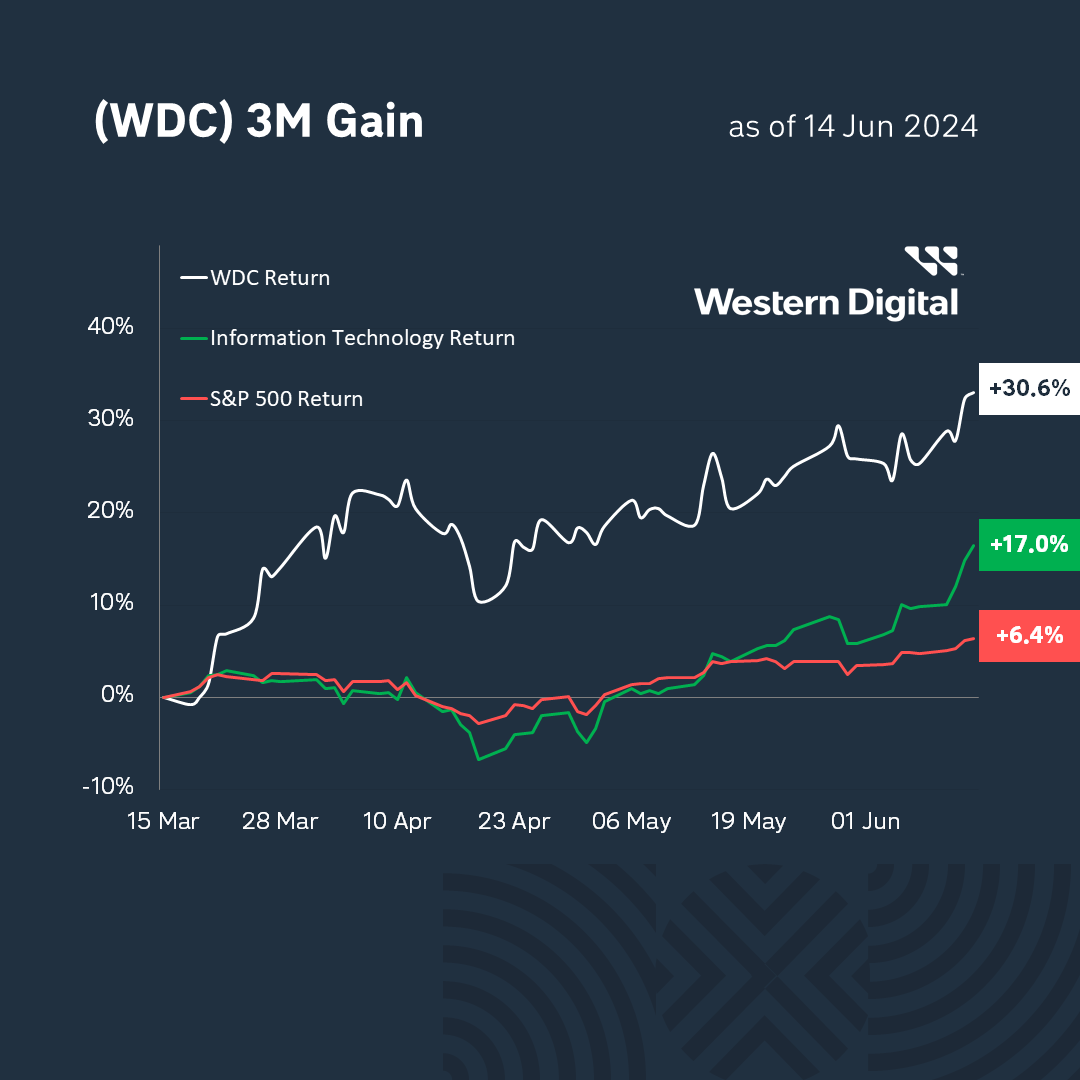

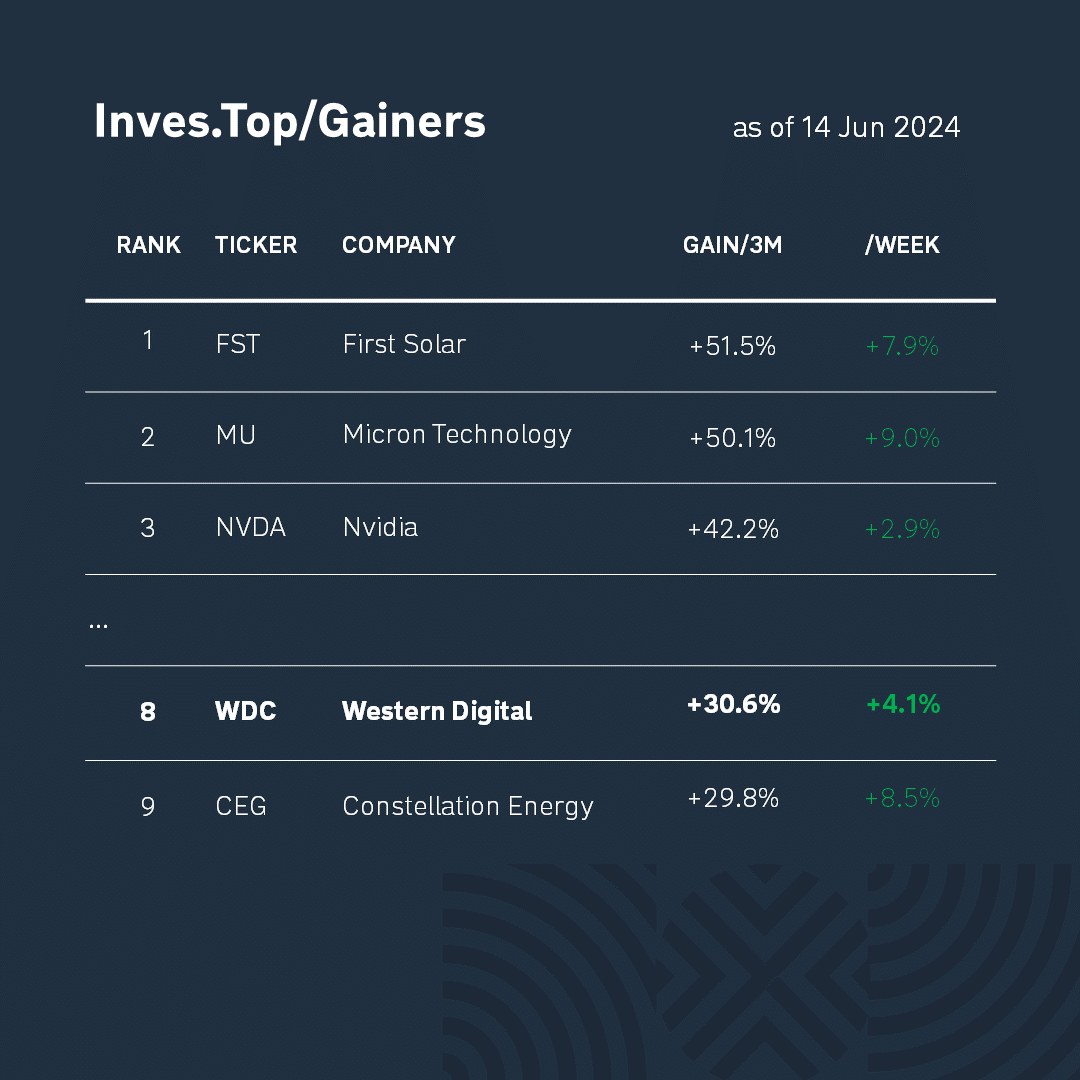

Today, we’ll talk about Western Digital (WDC), which has been one of the top growth stocks over the past 3 months.

Over the past three months, Western Digital shares have risen by +30.6%. At the same time, the technology sector, to which the company belongs, grew by +17.0%, and the S&P 500 index grew by +6.4%. As you can see, Western Digital shares show better returns than the sector average.

Western Digital is one of the world’s leading manufacturers of storage media: hard disk drives (HDDs) and NAND flash memory. The company’s most famous brands are SanDisk and WD. The company controls about 40% of the hard disk drive market and has products with capacities up to 18TB.

The company operates in the computer hardware industry. It was founded in 1970, listed on the NASDAQ stock exchange in 1978, and in 2009 was included in the S&P 500 index. For the past 3 years, the company has been led by David Goeckeler and a team of experienced managers.

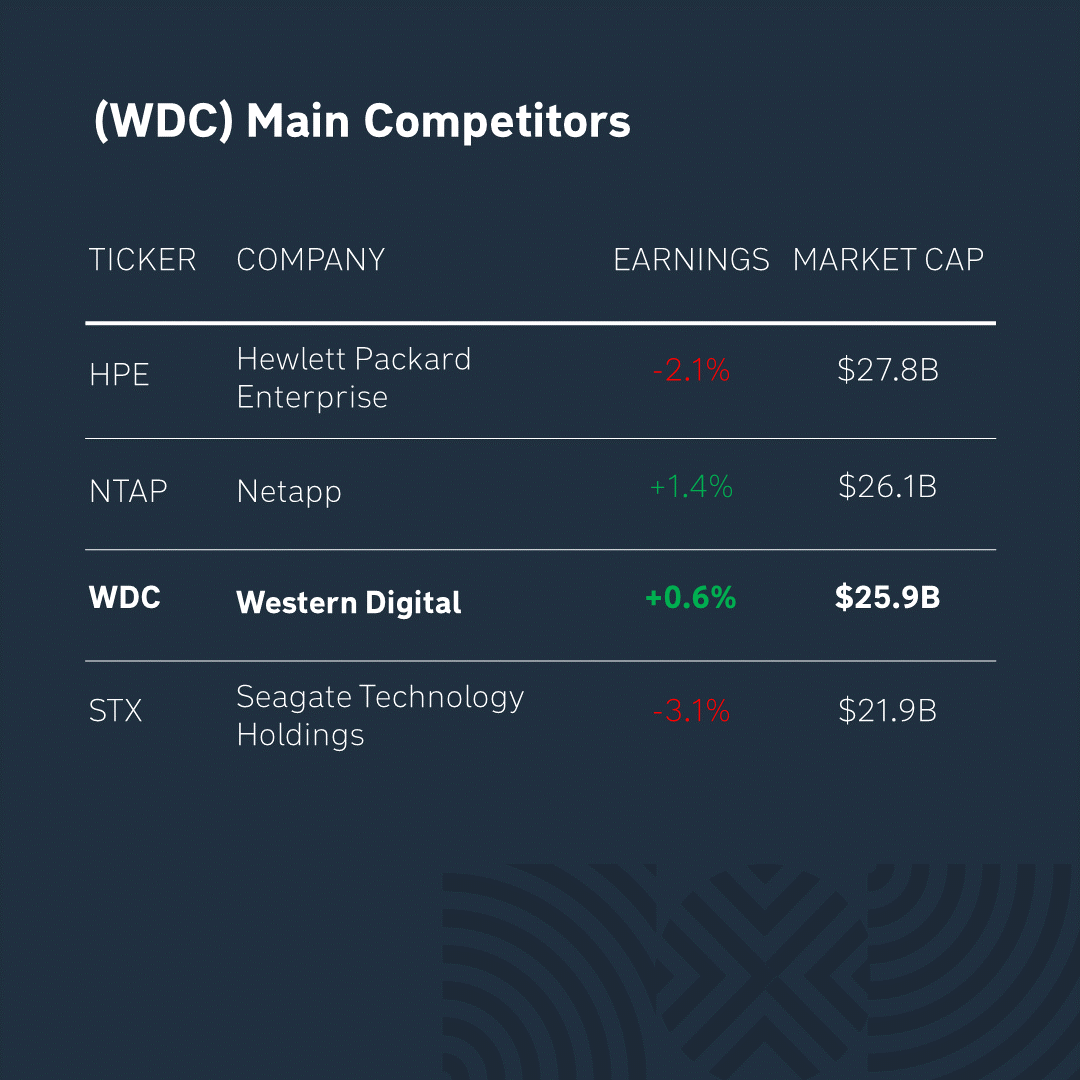

Western Digital’s main competitors are Hewlett Packard Enterprise, Netapp, and Seagate Technology Holdings. As you can see from the table above, some of them are ahead of the company in terms of capitalization, but it has a number of competitive advantages.

Western Digital’s strengths are based on its leading position in the HDD market. Western Digital and its direct competitor Seagate each control about 40% of the market, while Toshiba has a 20% share. The company invests about $1.0B in new product development annually, making it increasingly difficult for new players to enter the market. In addition, Western Digital announced the development of new 30TB storage projects.

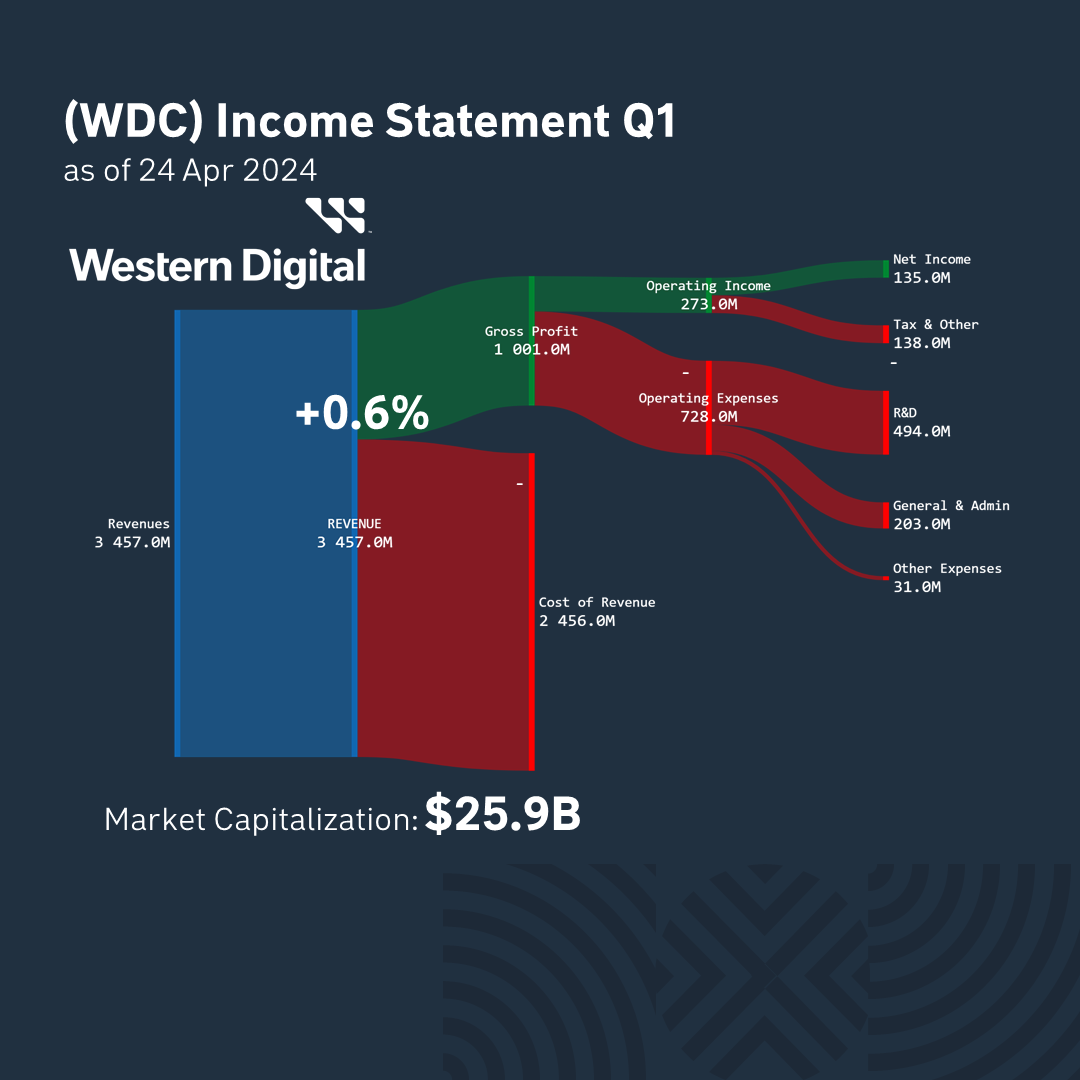

The latest report was published by Western Digital on April 24. 71% of the revenue structure is made up of manufacturing costs, and 29% is gross revenue. Over the past quarter, the company earned a profit of $135M. And its market capitalization is now $25.9B.

*This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.