The markets started to get nervous last week. It’s understandable, because even the most ardent optimists must realize that growth cannot last forever. Moreover, when the valuation of companies is based only on incredibly optimistic and often unlikely scenarios and an irresistible desire of investors to make money, it only takes one event to turn everything upside down. This week’s event was the reports of Tesla and Alphabet on their achievements in the second quarter.This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

The companies’ reports were mixed: Alphabet exceeded forecasts, Tesla did not. This is not enough for the market – it needs records, and there are none. Tesla warned of difficult times without new models and low profitability, and Alphabet did not answer when investments in artificial intelligence (AI) would pay off. Doubts about AI are becoming more and more relevant.

The issue of AI requires more attention. The energy required for its operation may exceed the planet’s capacity. Investors have begun to question the payback of multibillion-dollar investments in AI, which has led to the loss of more than a trillion dollars in market capitalization. The results of Alphabet and Tesla did not provide a positive answer to these questions, which caused a massive “flight” of investors from the technology sector to more stable financial and pharmaceutical companies.

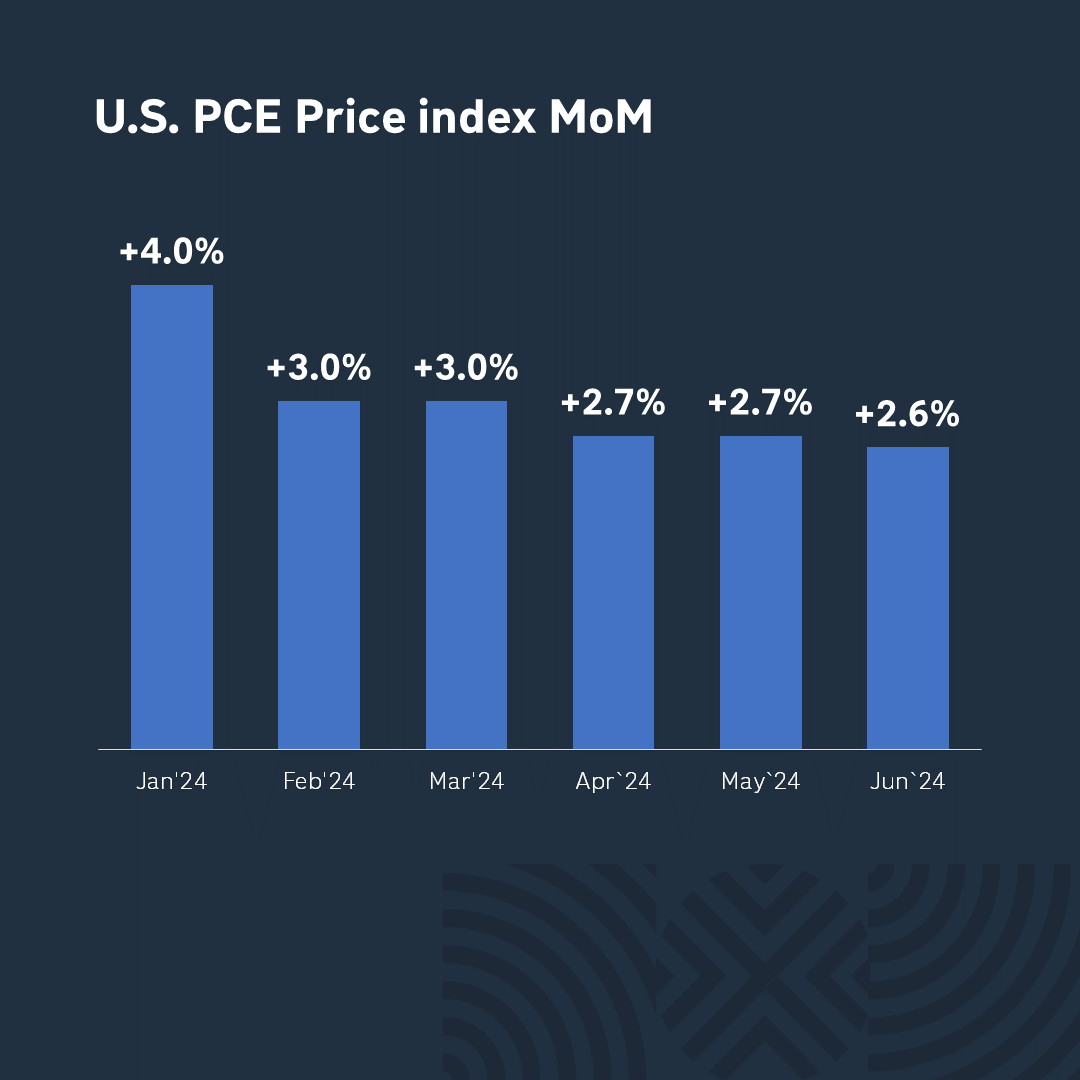

This scare overshadowed the macroeconomic events of the week: The US GDP in the first quarter exceeded forecasts and last quarter’s achievements, indicating that the economy is resilient. The labor market continues to cool, and inflation is heading towards the Fed’s target. This gives hope for the predictability of rate cuts. According to a Bloomberg poll, most economists believe that the Fed may signal a September rate cut at its meeting next week.

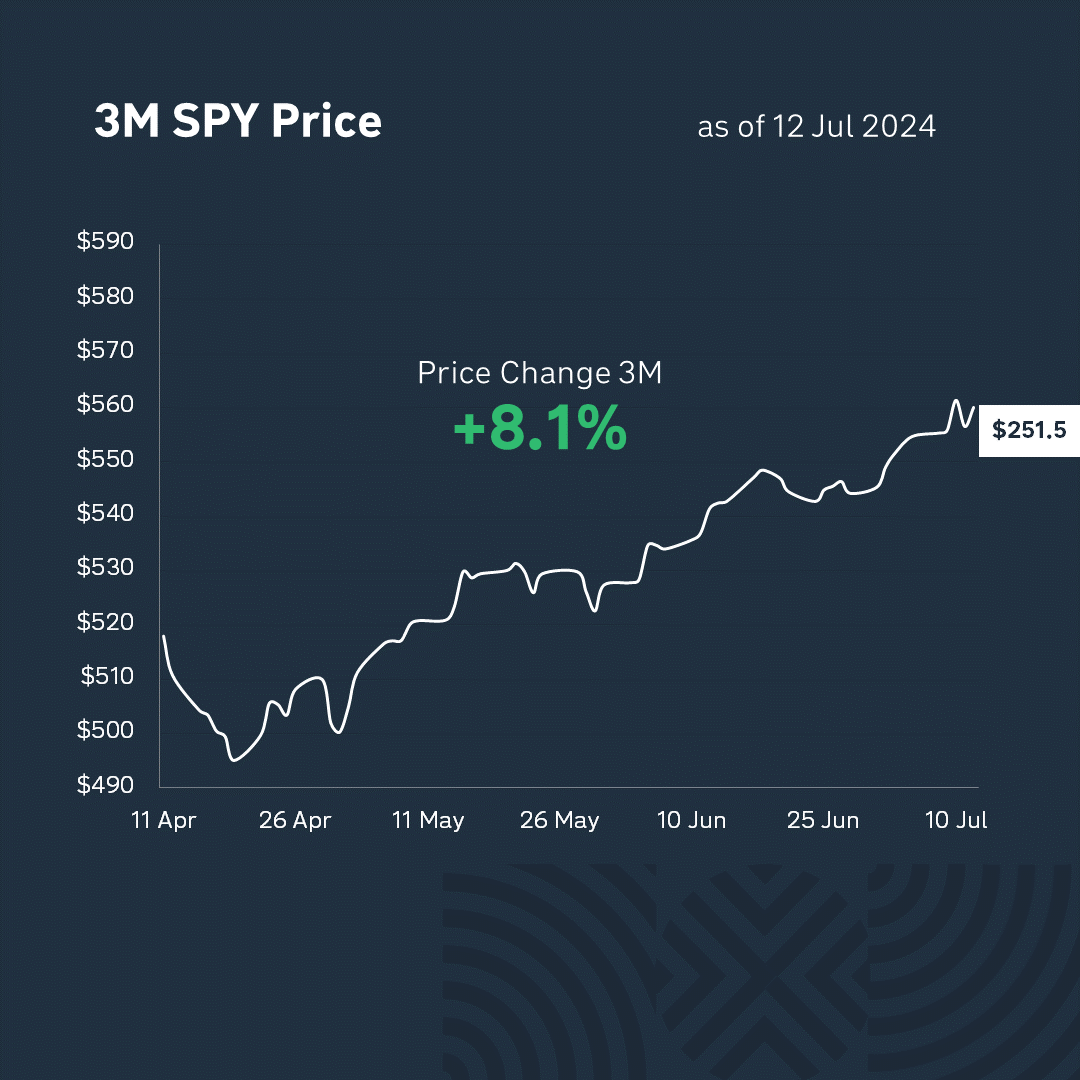

The next week may provide an answer to the question: is the recent drop, the largest since 2022, accidental or are we witnessing the beginning of a deeper correction? It’s pointless to make predictions, but a decline in rates seems more or less predictable. The markets’ reaction to the results of Meta, Amazon, Microsoft, and Apple next week could be violent. “The Magnificent Seven created this market, and it can destroy it. It won’t be different this time – it will be business as usual.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.