Inflation is still a concern for the Fed and investors, despite attempts to reassure markets. Although it has repeatedly seemed that the Fed might cut rates to support the securities markets, this decision has been postponed to another meeting. A rate cut is expected no earlier than June, and the probability of its adoption, although high (55%), is still ambiguous. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

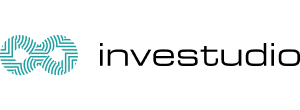

This week’s February inflation data did not provide investors with additional confidence. The annual growth in retail prices came in at 3.2%, exceeding forecasts and the previous month’s figures. Although core inflation declined slightly, it remains higher than expected (+3.8%). The situation with industrial inflation is similar, but the difference between the actual and forecasted results is even greater. The US Treasury Secretary acknowledged the error in previous estimates and suggested that interest rates will not return to pre-pandemic levels.

Higher inflation indicates the resilience of the US economy and the growth in retail sales in February confirms consumer activity. The labor market also demonstrates resilience, which postpones the crisis. The number of unemployment claims declined, indicating a continuation of positive trends.

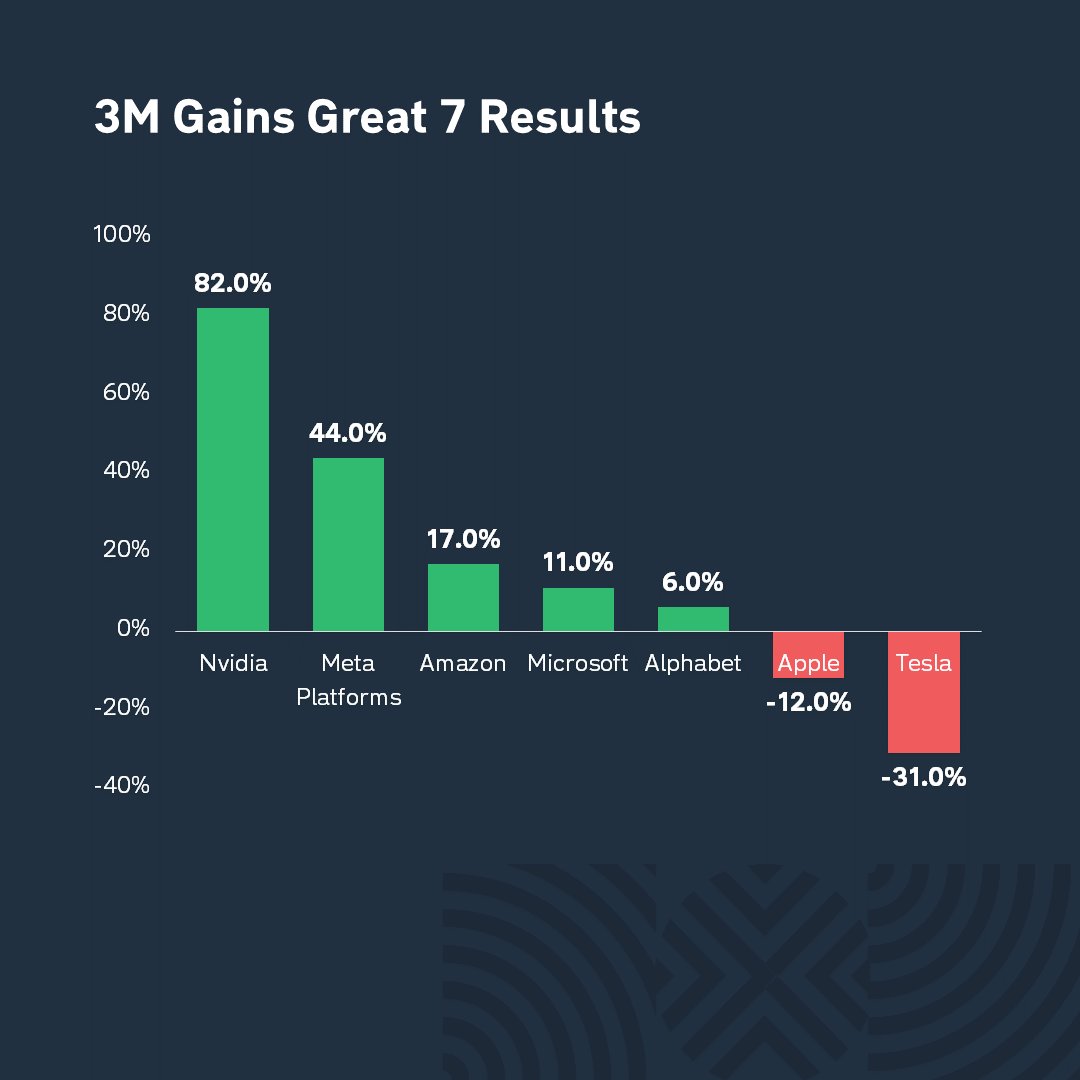

The market reacted calmly to this week’s macroeconomic news, paying more attention to corporate events. Among the “Great Seven” Tesla and Apple were the worst performers: Tesla lost 32% and Apple 11% of its share price. This happened in the context of economic difficulties in China and market stagnation. Some companies, such as Nvidia (82%), Meta (44%), Amazon (17%), and Microsoft (11%) and Alphabet (+6%, showed significant growth. But Tesla (-31%) and Apple (-12%) are in the red.

Well, how can we not mention bitcoin: this week, the value of the coin initially rose from $67,776 on Monday to $73,749 on Thursday, only to drop again to $68,694 on Friday. Why things are happening this way, and not otherwise, we need to ask the “believers”, because no one has yet come up with a mechanism to determine the “fair” value of cryptocurrencies.

The current situation on the markets looks somehow fragile, which leads investors to ask the question: “Who will pull the market further?”, especially when large companies are tired and small ones need money, which is still expensive, in addition to stories and dreams about AI.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.