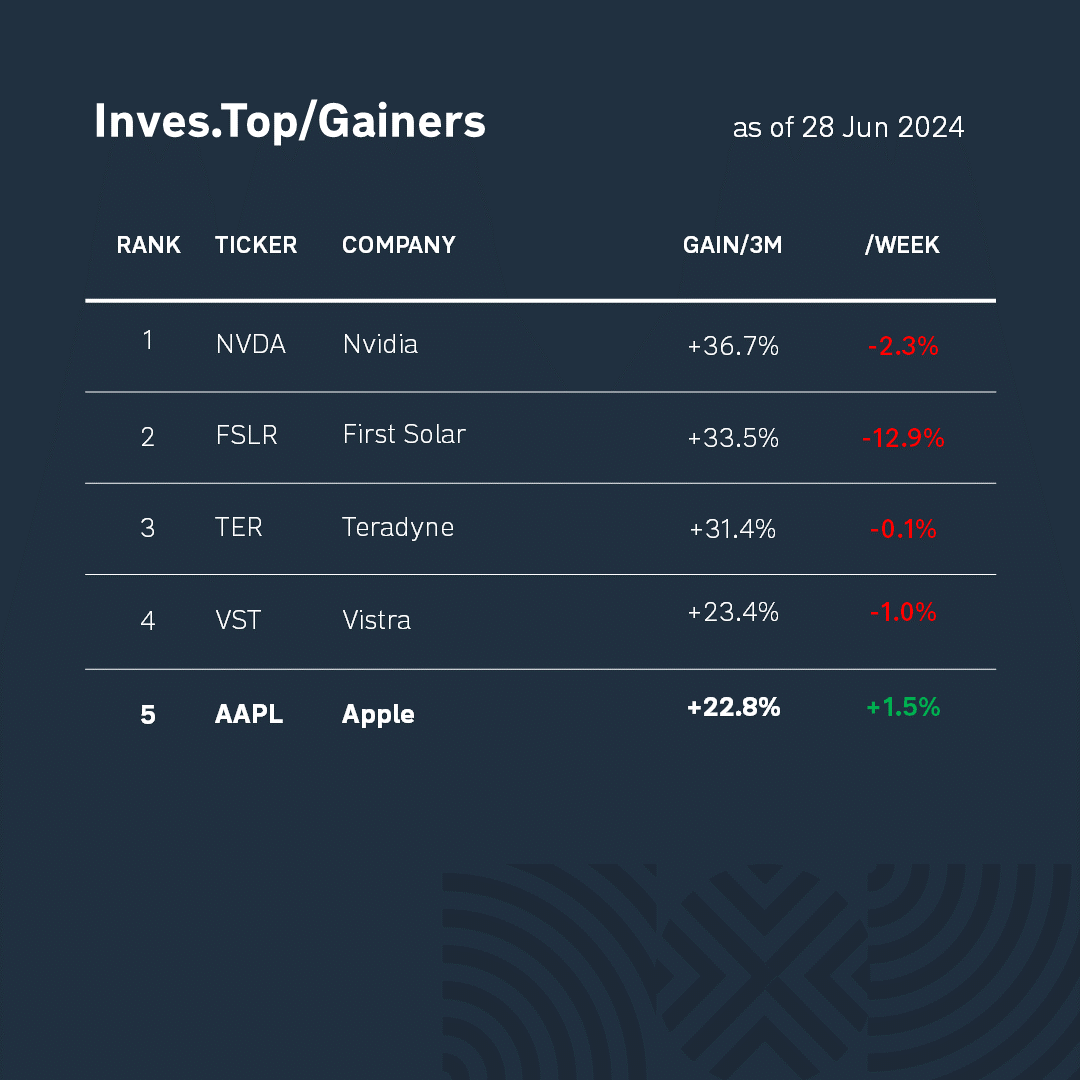

Today, we will talk about Apple (AAPL), which is one of the top growth stocks over the past 3 months.

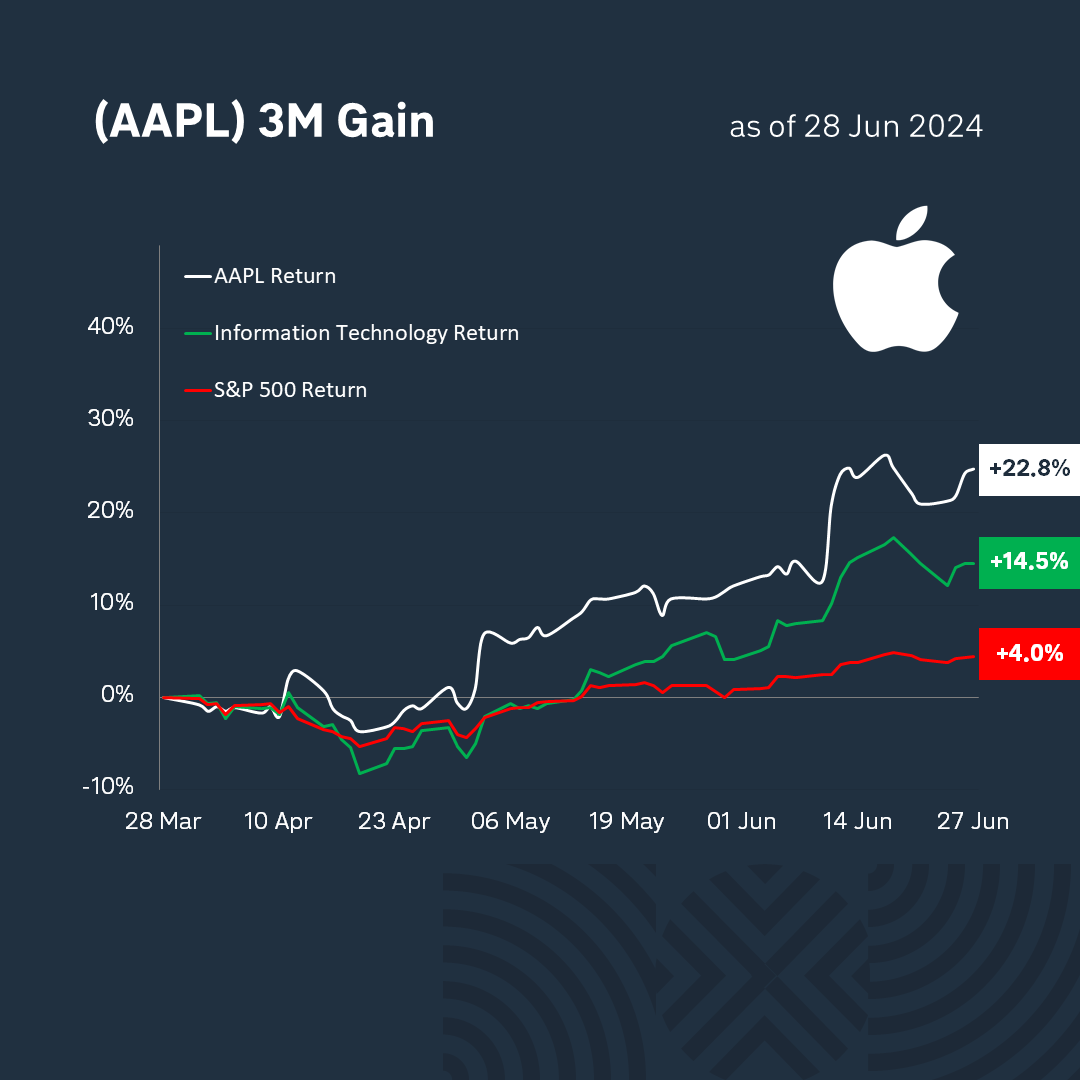

Over the past three months, Apple shares have risen by +22.3%. At the same time, the technology sector, to which the company belongs, grew by +14.0%, and the S&P 500 index grew by +4.0%. As you can see, Apple shares show better returns than the sector average.

Apple is an American multinational technology company that has revolutionized the technology sector. Apple created the first commercially successful personal computer and was the first to introduce a graphical user interface (GUI) to the public. The company also became the first publicly traded American company to exceed $1T in 2018, $2T in 2020, and $3T in 2022.

The company operates in the computer hardware industry. It was founded in 1976, listed on the NASDAQ stock exchange in 1980, and was included in the S&P 500 index in 1982. For the past 13 years, the company has been led by Tim Cook and a team of experienced managers.

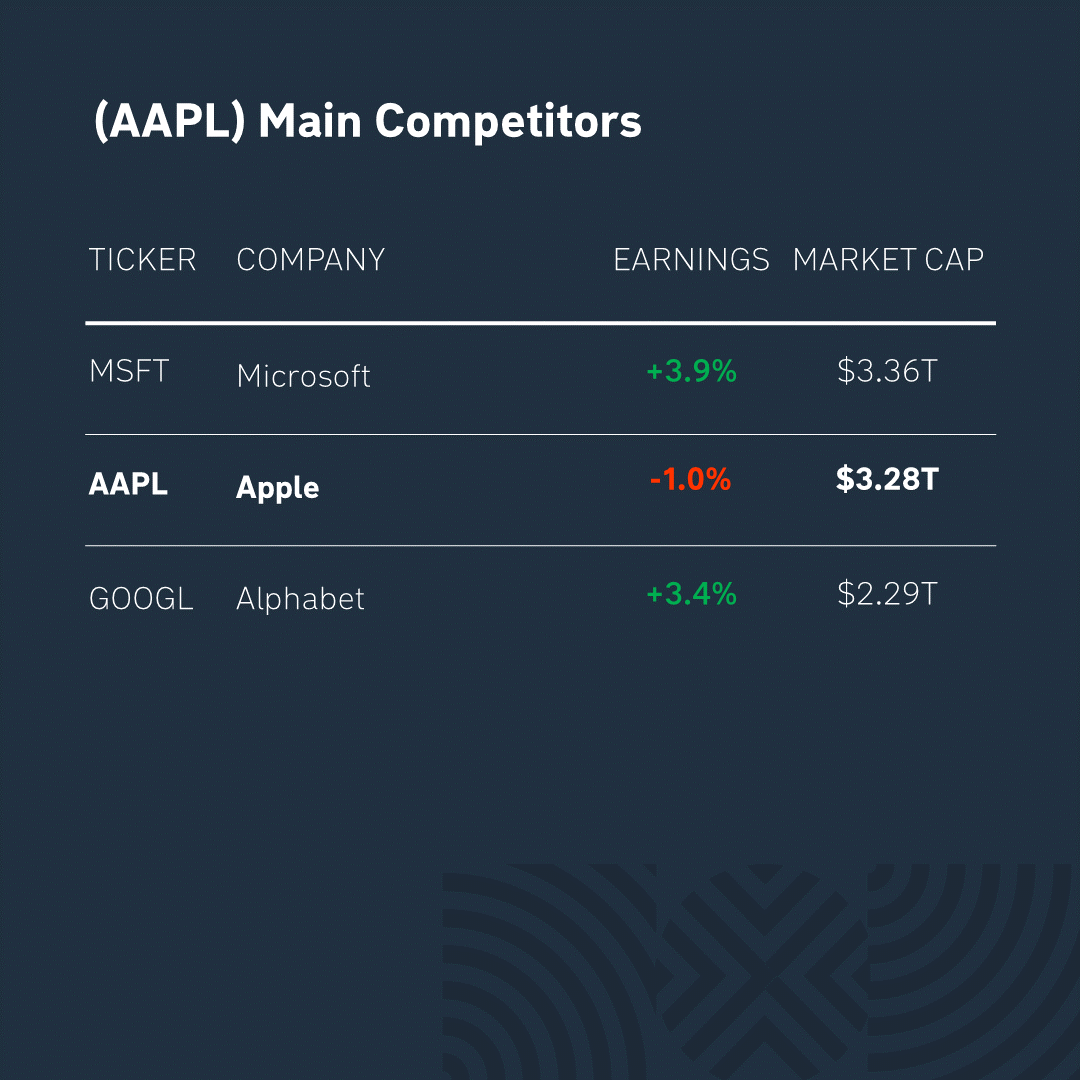

Apple’s main competitors in the S&P 500 index are Microsoft and Alphabet. As you can see from the table above, some of them are ahead of the company in terms of capitalization, but Apple has a number of competitive advantages.

Apple’s strengths are based on its ecosystem of software and computer hardware. The company develops chips for its own software, and this approach is qualitatively different from Apple’s main competitor in the smartphone market, Samsung, which produces its own smartphones but buys chips from Qualcomm and software from Google (Android). The company focuses on the premium segment, offering best-in-class devices that it sells at a significant premium. Customers have demonstrated a consistent willingness to pay for this quality, which leads to an increase in market share for Apple even when its products are priced higher than its competitors.

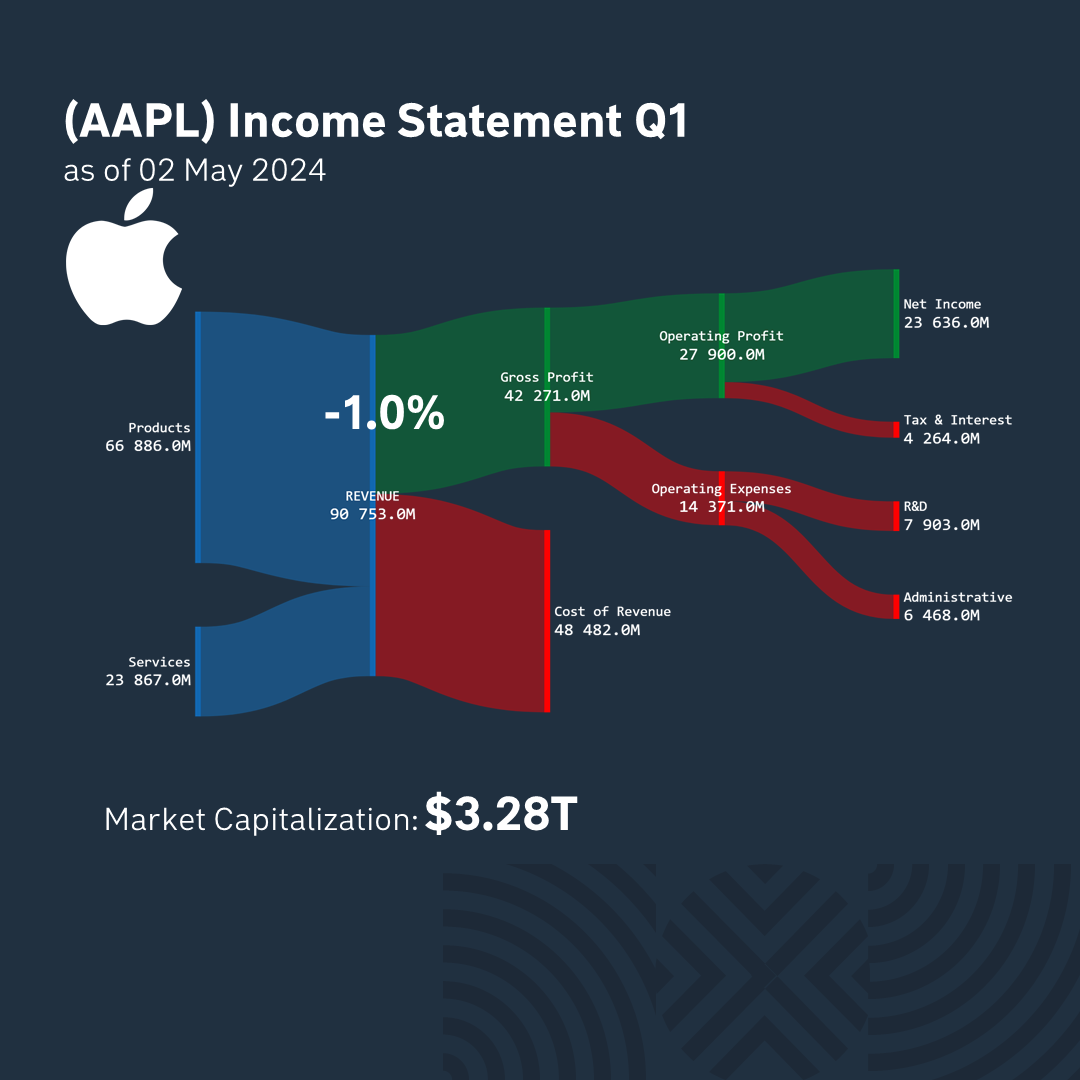

Apple published its latest report on May 2. 53% of the revenue structure is occupied by manufacturing costs, and 47% by gross income. For the last quarter, the company earned a profit of $23.6B. And its market capitalization is now $3.28T.

*This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.