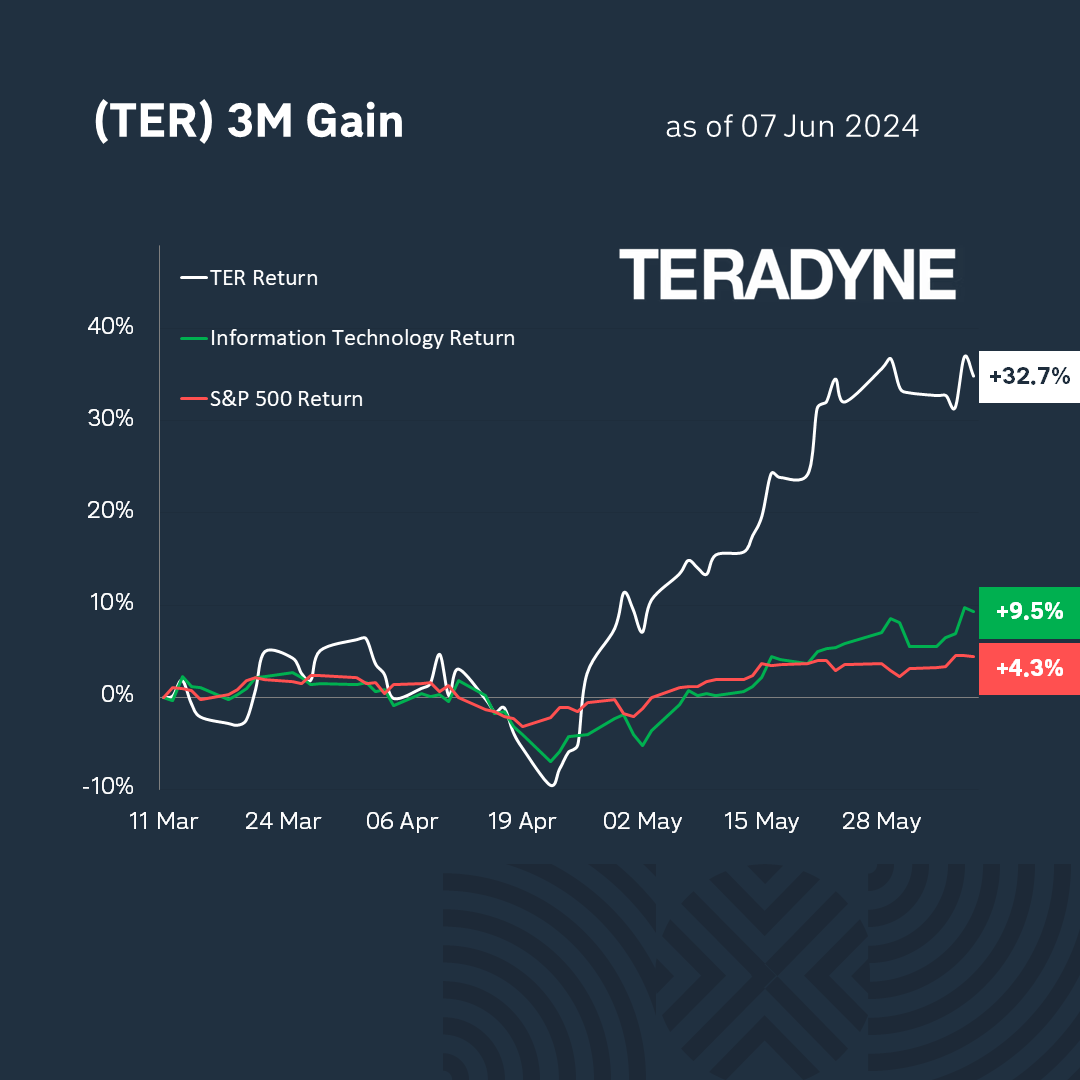

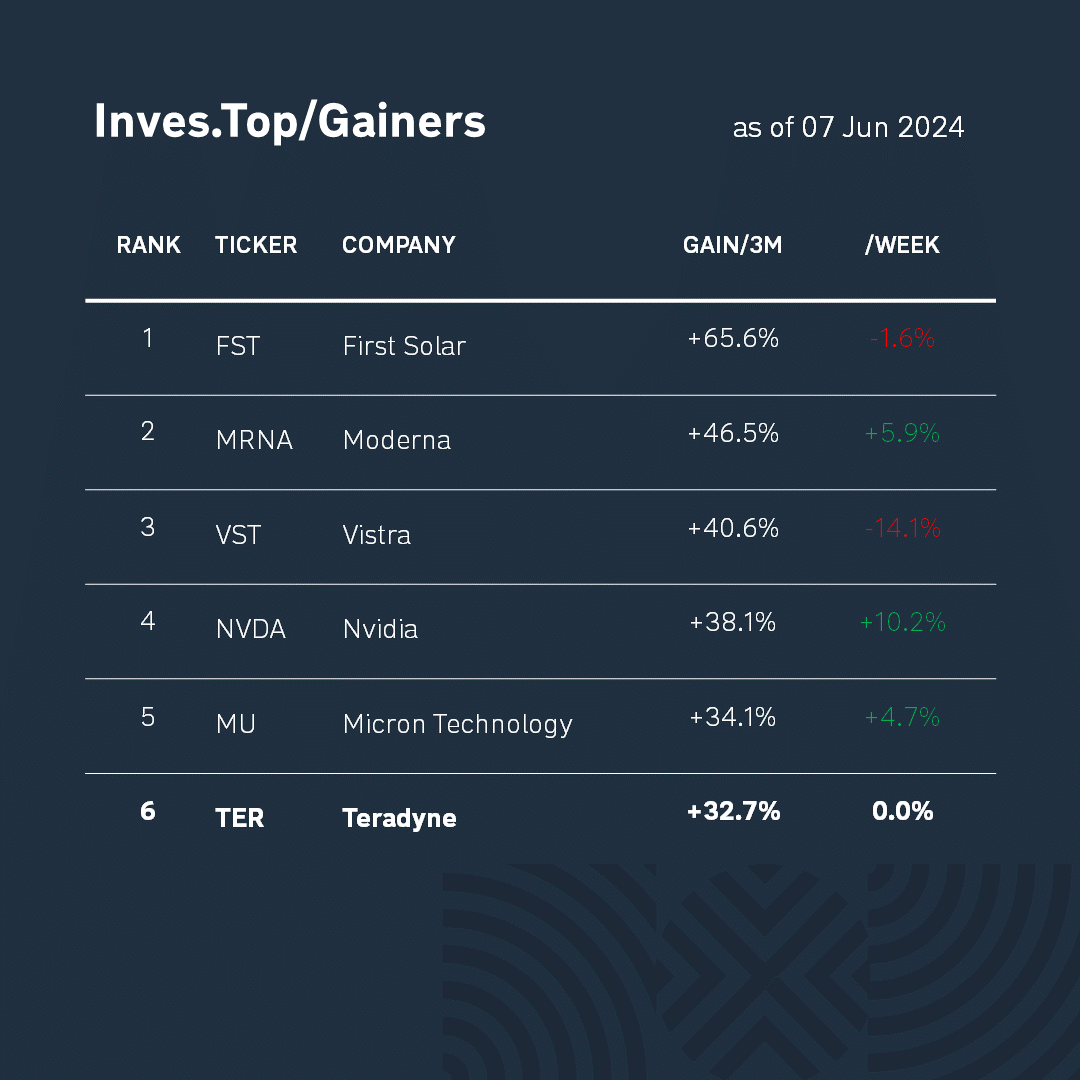

Today, we will talk about Teradyne (TER), which has been one of the top growth stocks over the past 3 months.

Over the past three months, Teradyne shares have risen by +32.7%. At the same time, the technology sector, to which the company belongs, grew by +9.5%, and the S&P 500 index grew by +4.3%. As you can see, Teradyne shares show better returns than the sector average.

Teradyne is an American developer of automatic test equipment (ATE). Teradyne’s well-known customers include Samsung, Qualcomm, Intel, Analog Devices, Texas Instruments, and IBM.

The company operates in the semiconductor industry. It was founded in 1960, went public on the NASDAQ stock exchange in 1970, and was included in the S&P 500 index in 2020. For the past 10 years, the company has been led by Greg Smith and a team of experienced managers.

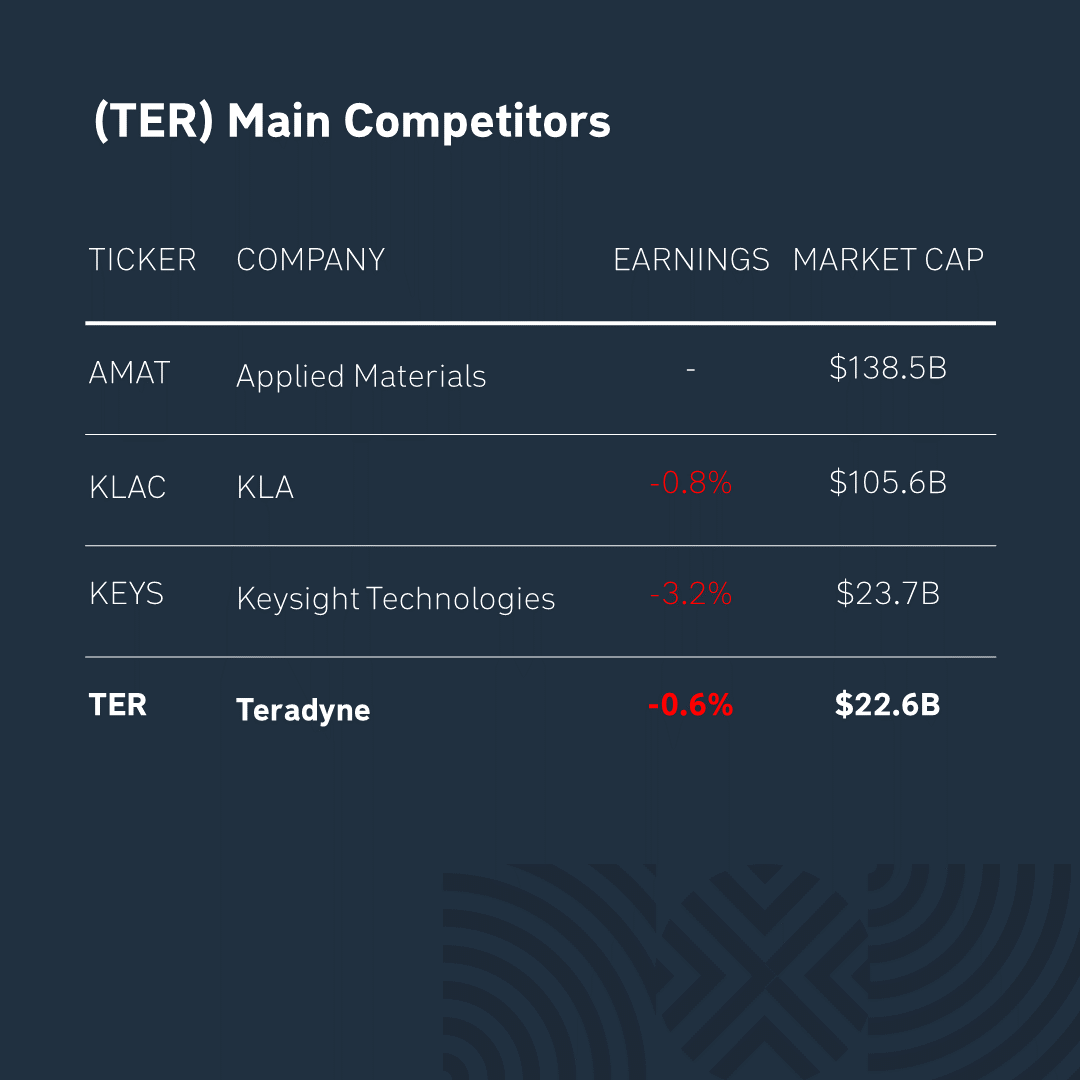

Teradyne’s main competitors are Applied Materials, KLA, and Keysight Technologies. As you can see from the table above, they are ahead of the company in terms of capitalization, but it has a number of competitive advantages.

Teradyne’s strengths are based on its niche market positioning. Due to the rapid development of the semiconductor industry, testing is becoming increasingly complex. Chips and semiconductors are usually tested at different temperatures, and Teradyne devices can pinpoint the specific production step that caused the defect. Therefore, the company serves only market leaders, for example, all Apple NAND products are tested exclusively on Teradyne equipment. The company invests heavily in new products, for example, $500M was spent on the latest chip testing product and 600 engineers from the R&D team were involved.

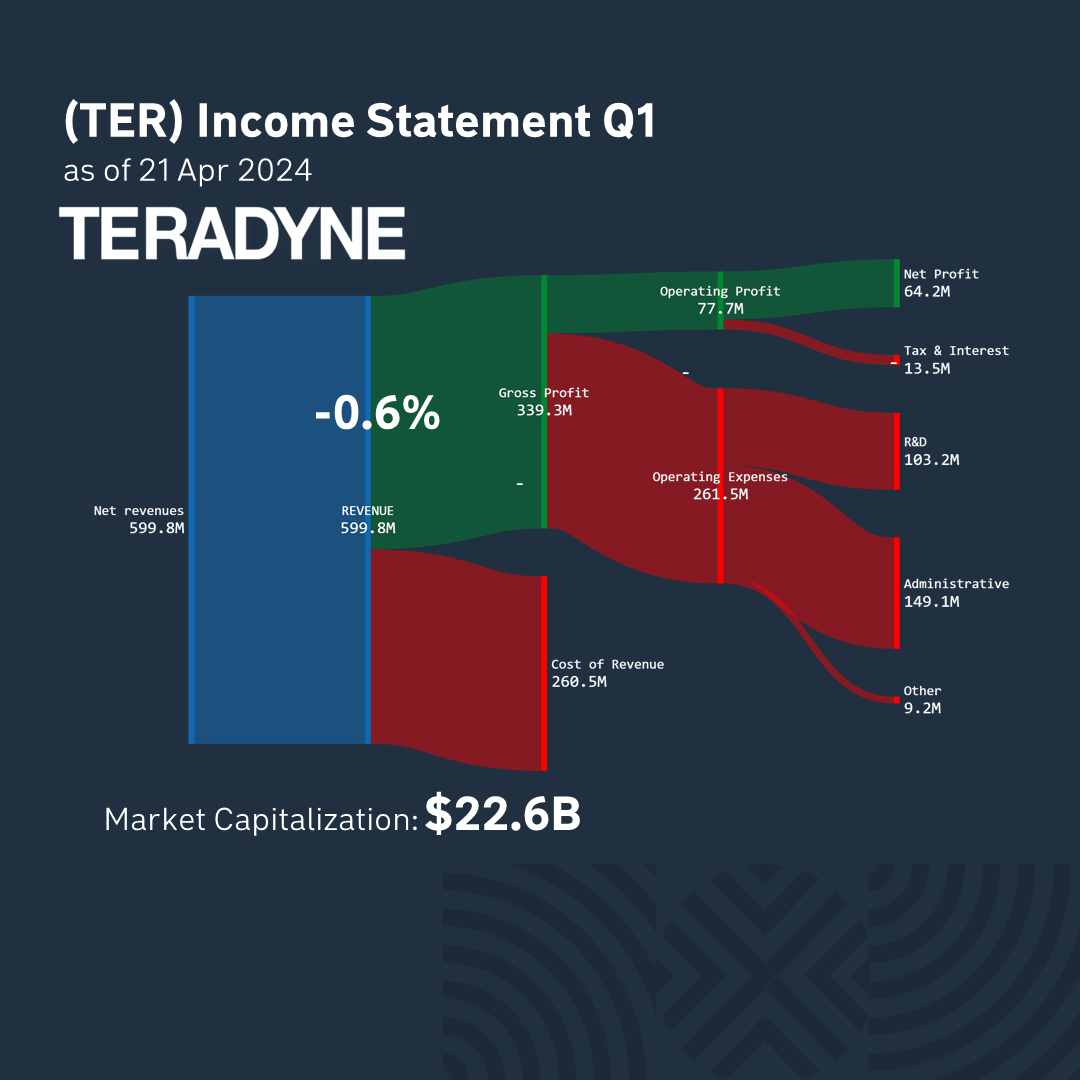

Teradyne published its latest report on June 21. 43% of the revenue structure is made up of manufacturing costs, and 57% is gross revenue. Over the past quarter, the company made a profit of $64M. And its market capitalization is now $22.6B.

*This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.