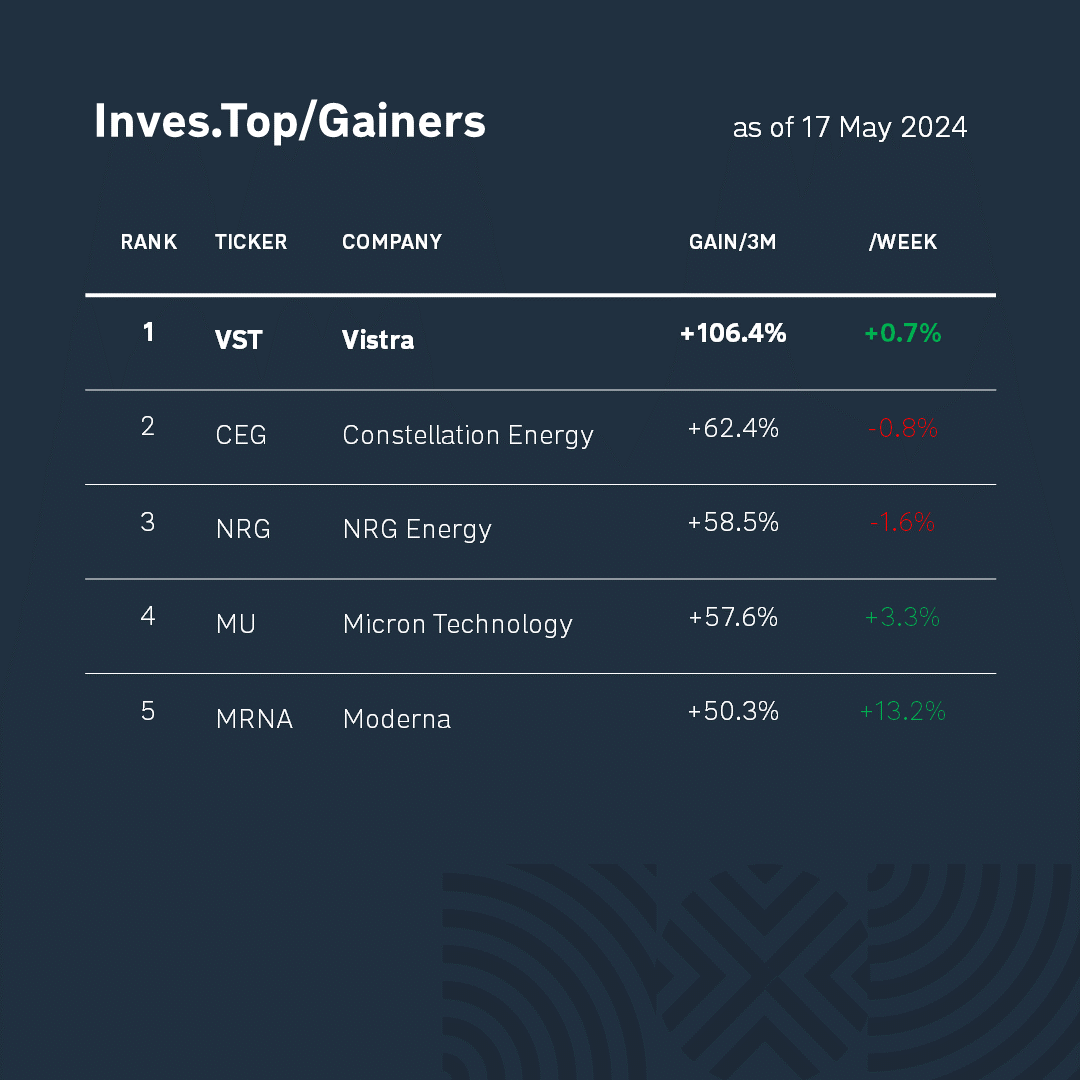

Today, we’ll talk about Vistra (VST), which has been a growth leader over the past 3 months.

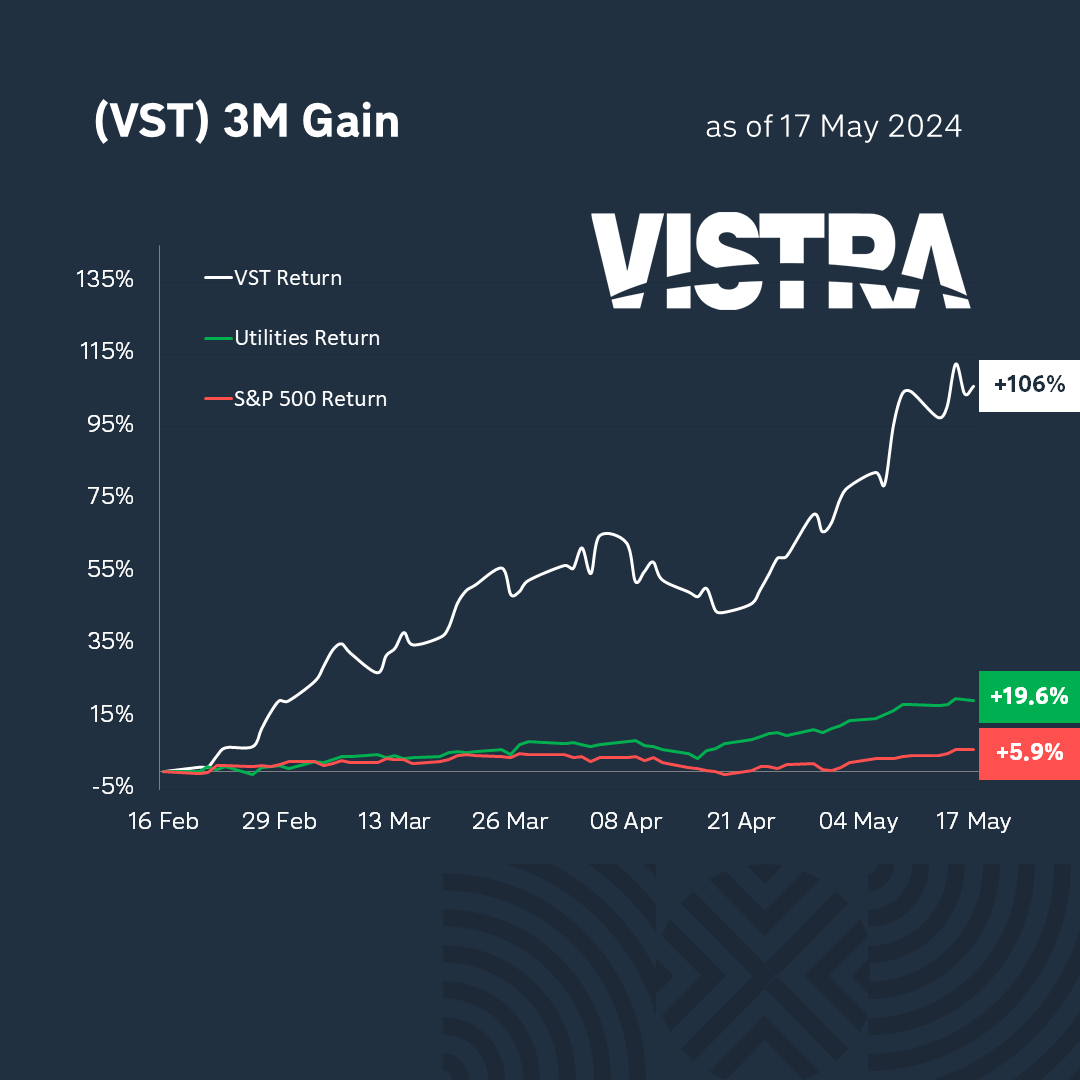

Over the past three months, Vistra stock has risen by +106.4%. At the same time, the utility sector, to which the company belongs, grew by +19.6%, and the S&P 500 index by +5.9%. As you can see, Vistra’s shares show better returns than the sector average.

Vistra is one of the largest electricity producers and suppliers in the United States. The company has 41 gigawatts of nuclear, coal, gas, and solar generation capacity. The utility segment serves 20 million customers in 20 US states.

The company operates in the alternative energy industry. It was founded in 2016 and listed on the NYSE in the same year, and in 2024 was included in the S&P 500 index. For the past 3 years, the company has been led by Jim Burke and a team of experienced managers.

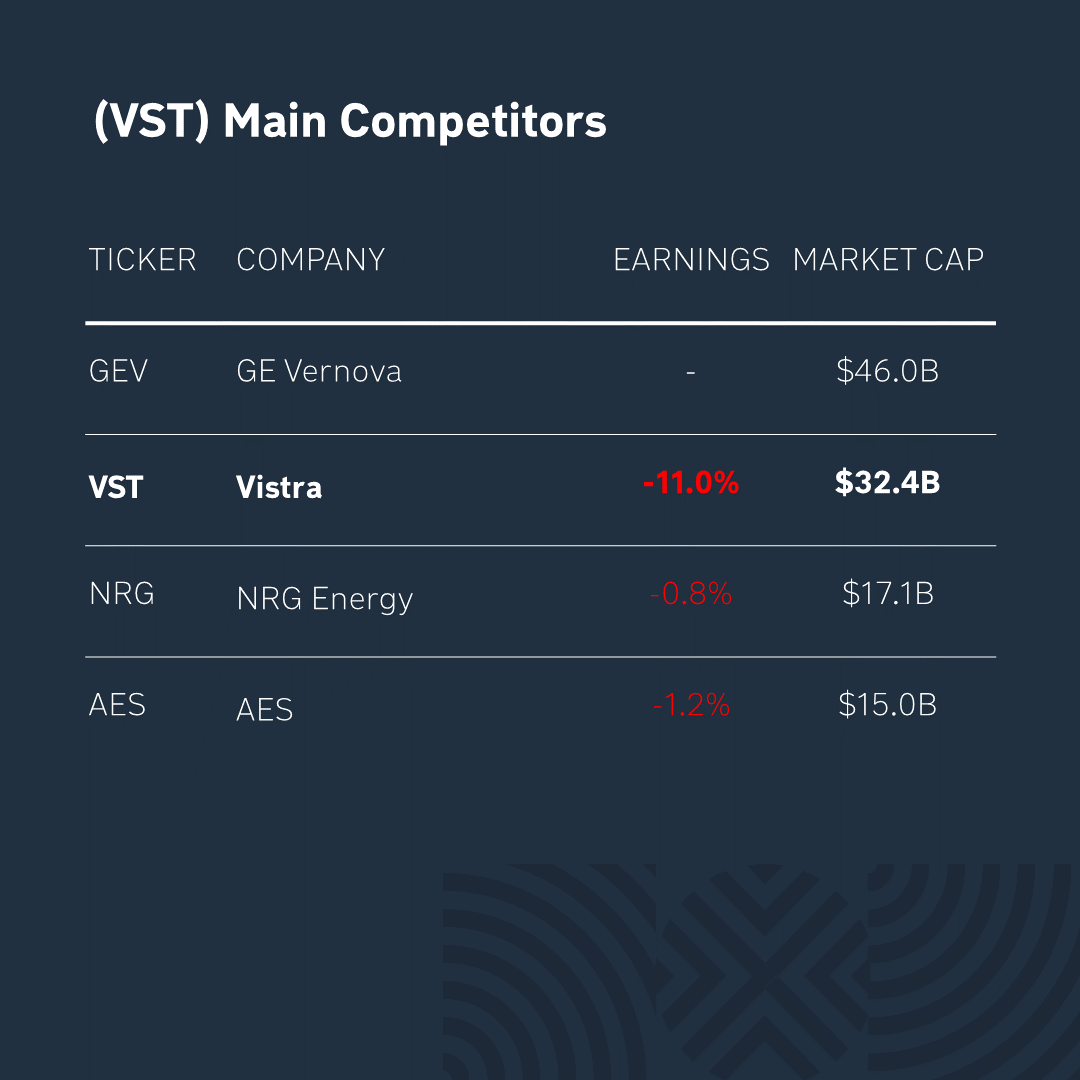

The main competitors of Vistra are GE Vernova, NRG Energy and AES. As you can see from the table above, some of them are ahead of the company in terms of capitalization, but it has a number of competitive advantages.

Vistra’s strengths are based on its unique market positioning strategy. The company generates electricity from 4 sources and sells it to consumers, while developing projects for the production and implementation of industrial batteries. Moss Landing’s main project is the world’s largest lithium battery energy storage system with a total capacity of 3 gigawatts. The company is also expanding its business by acquiring competitors, namely, Dynegy for $2.3B and Energy Harbor for $5.7B.

The latest report was published by Vistra on May 8. 72% of the revenue structure is occupied by manufacturing costs and 28% by gross revenue. Over the past quarter, the company earned a profit of $18M. And its market capitalization is now $32B.

*This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.