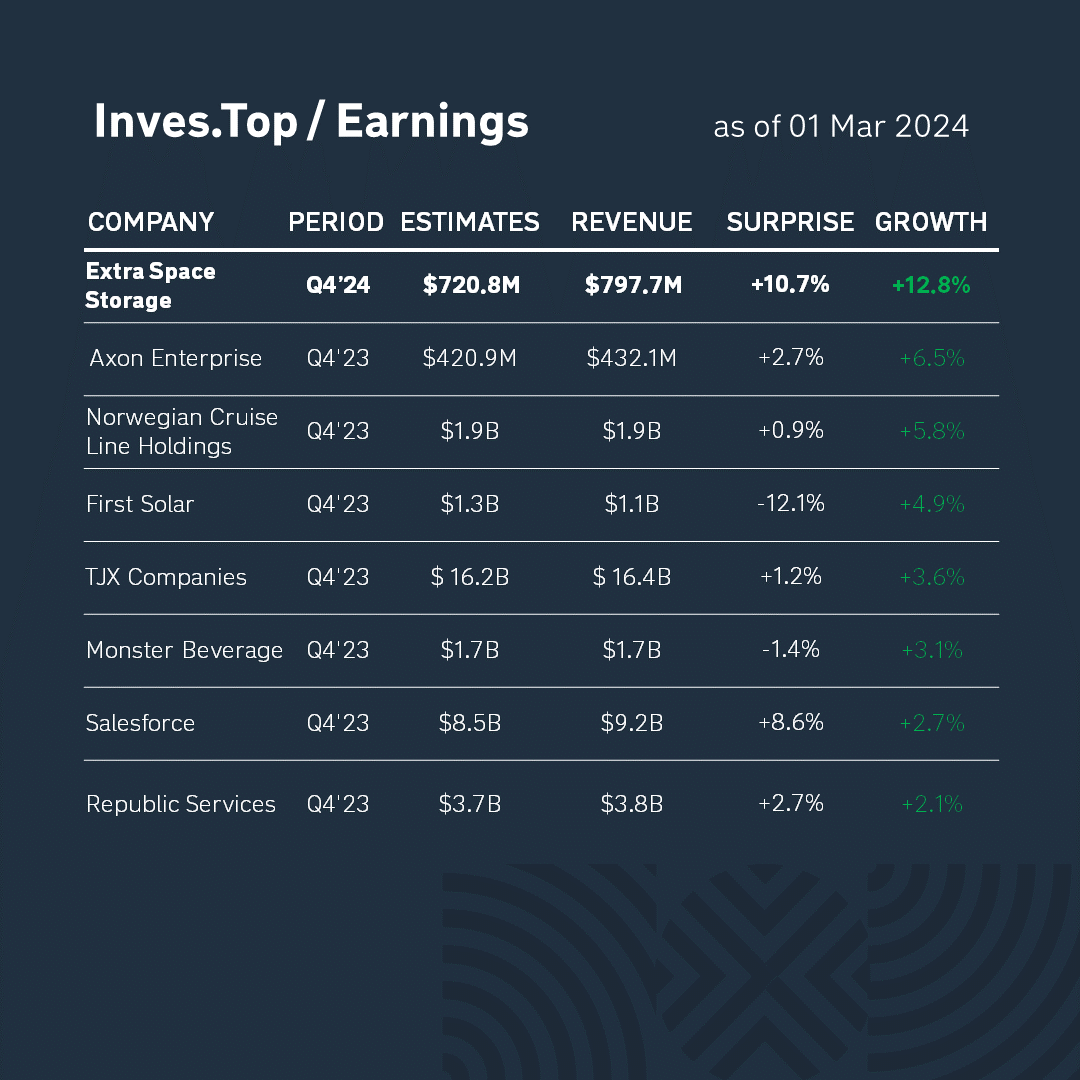

Last week, 41 companies from the S&P 500 index reported for Q4 2023.

Extra Space Storage showed the best results. Its revenue amounted to $797M. It grew by +12.8% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by 10.7%. Let’s analyze the company’s business in more detail.

Extra Space Storage is a real estate investment trust (REIT) that owns more than 3.5K stores and warehouses in 42 states.

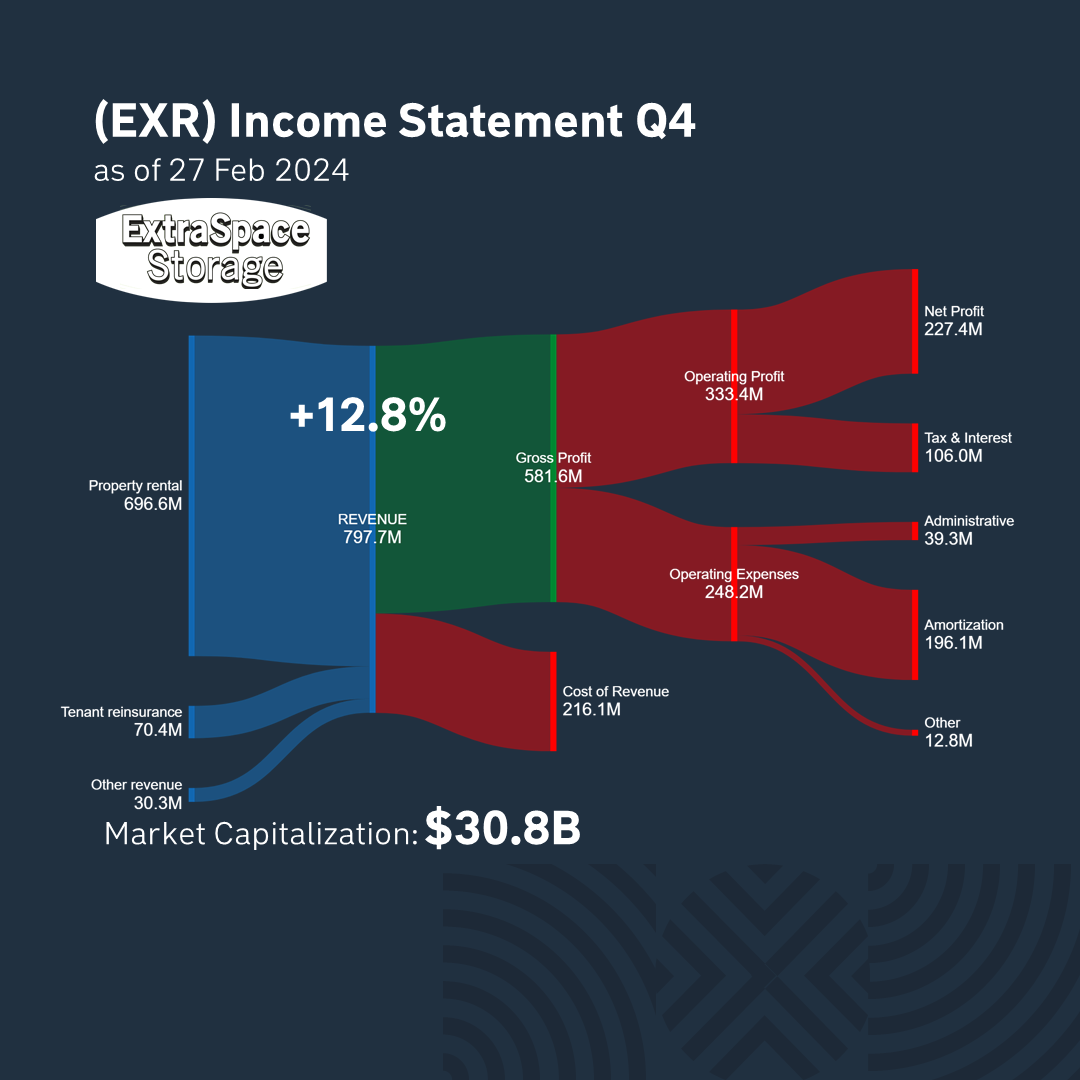

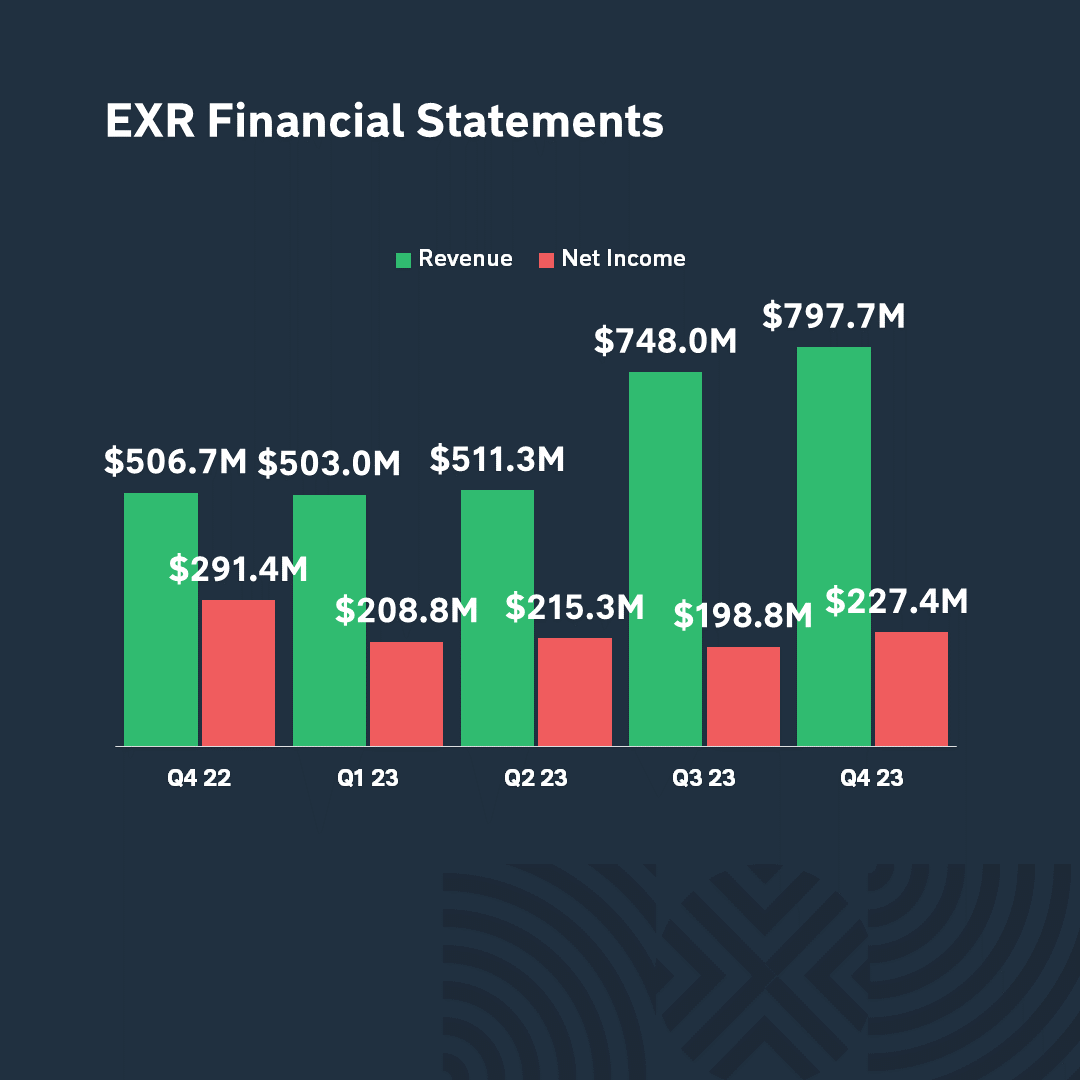

The company’s revenues increased by +57% and net income decreased by -22% compared to the same quarter last year. In the reporting quarter, the company acquired 7 warehouses and stores for $82.7M and invested $1.0M in a partnership development project. The company’s financial position was also strengthened by the high occupancy rate of 93.0% as of the end of 2023.

27% of the revenue structure is made up of manufacturing costs, and 73% is gross revenue. The company made a profit of $227M in the last quarter. Its market capitalization is $30B.

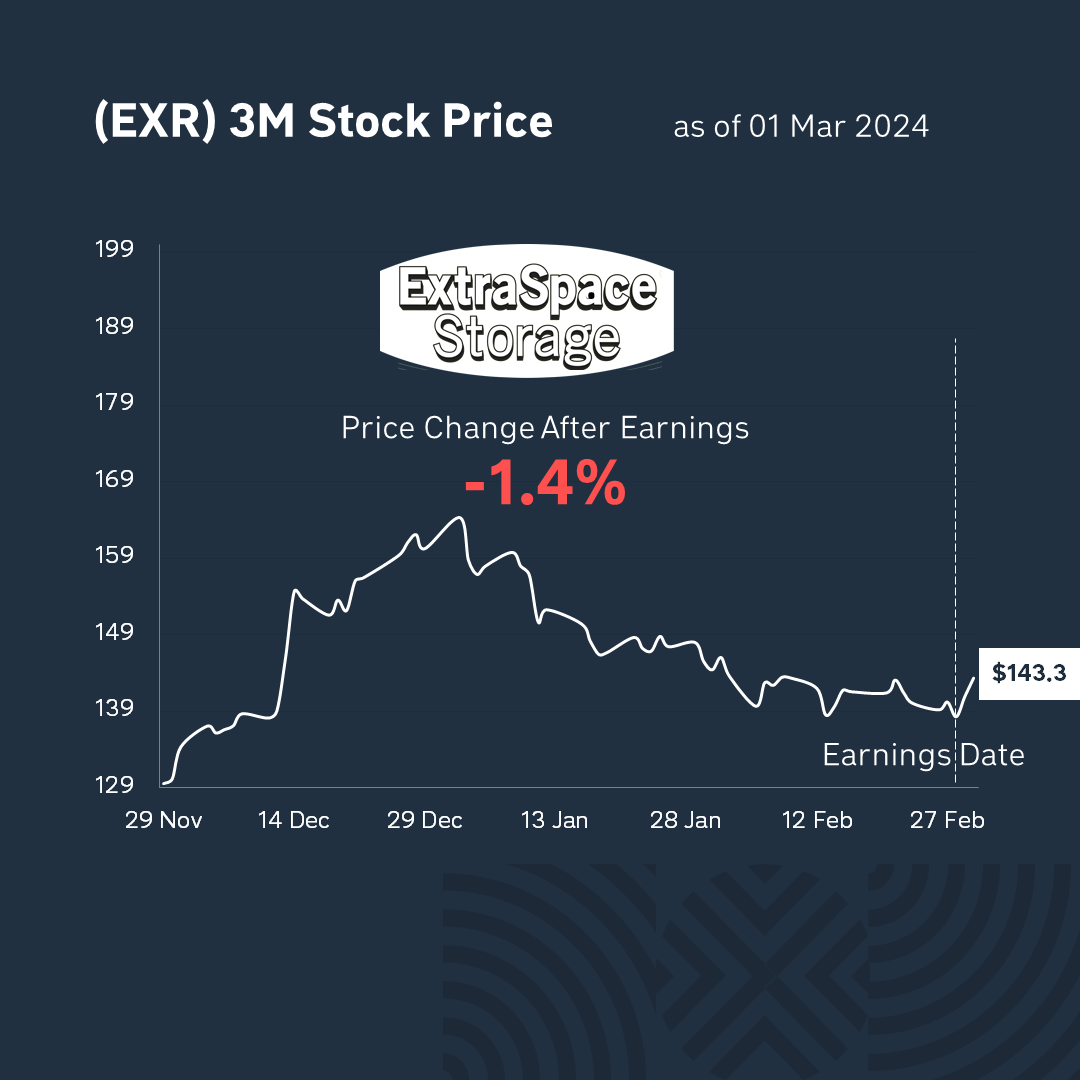

After the publication of the report, Extra Space Storage’s stock fell by -1.4% to $143 per stock. In general, market participants are satisfied with the company’s current financial results, but reacted rather cautiously to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter