The corporate reporting period has is going.

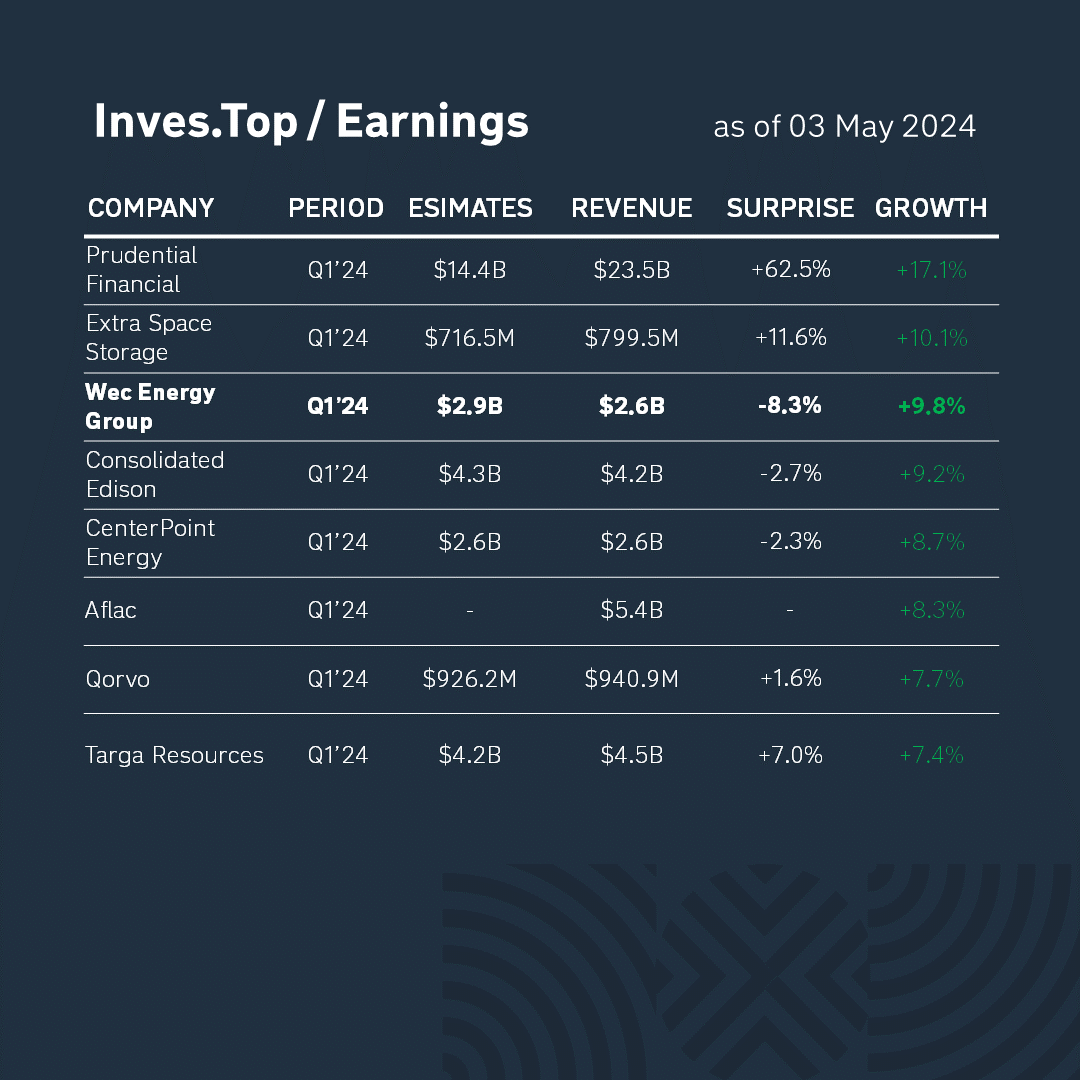

In the past week, 173 companies from the S&P 500 index reported for Q1 2024.

Today, we will analyze the results of Wec Energy Group. Its revenue is $2.6B. It grew by +9.8% compared to the corresponding value for the previous quarter, but did not exceed analysts’ expectations by -8.3%. Let’s analyze the company’s business in more detail.

WEC Energy Group is an American utility company that supplies electricity and natural gas to 4.4M customers in 4 US states. The company also owns a 60% stake in American Transmission, which manufactures electrical equipment.

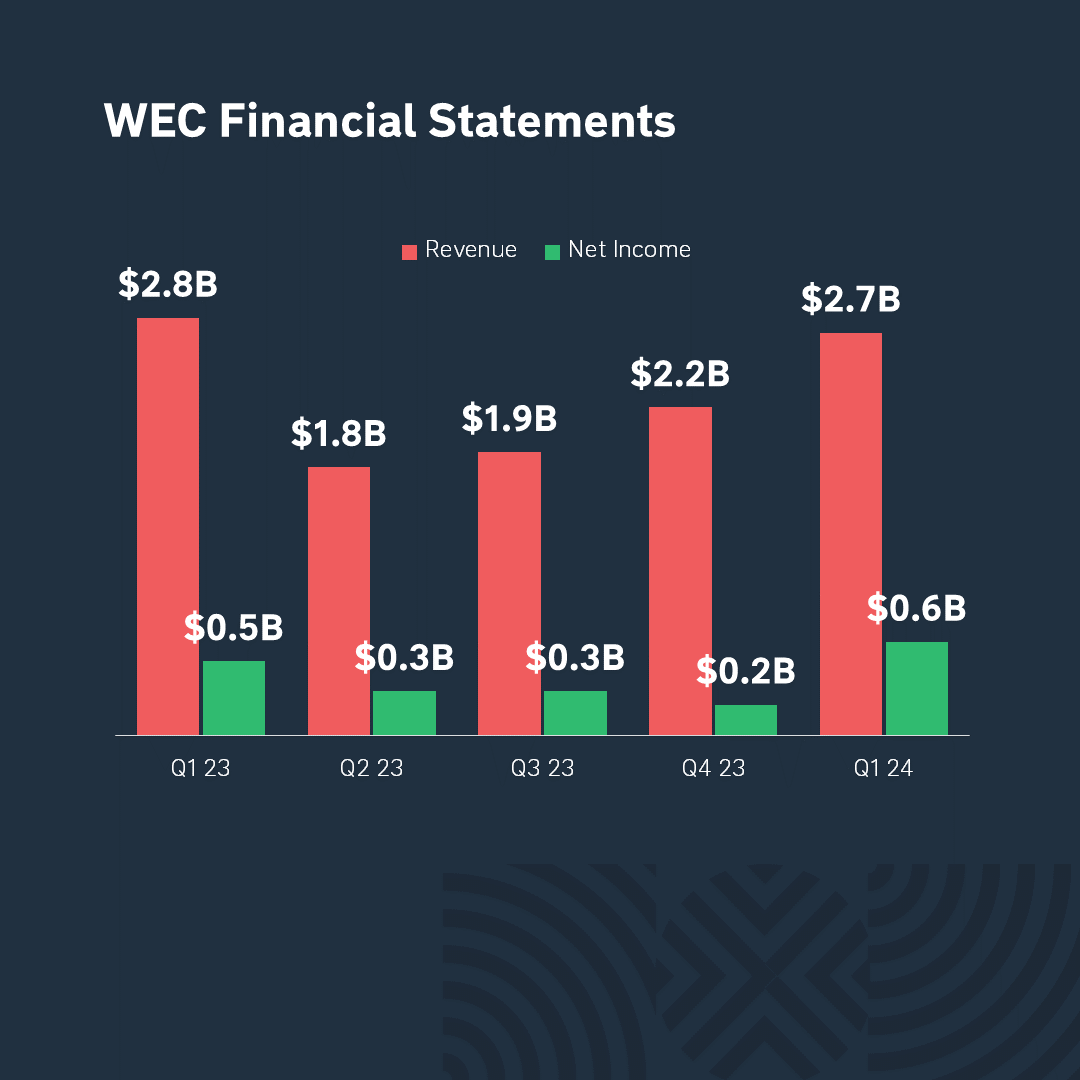

Wec Energy Group Platforms’ revenue for Q1’24 decreased by -4.6% compared to Q1’23, but increased by +22.7% compared to the previous quarter Q4’23. The company increased its revenue 3 times due to cost optimization and a new tariff structure in the Peoples Gas offer. Wec Energy Group expects an increase in electricity demand by 4.5-5.0% in the next 4 years due to new data centers in the company’s region of operation.

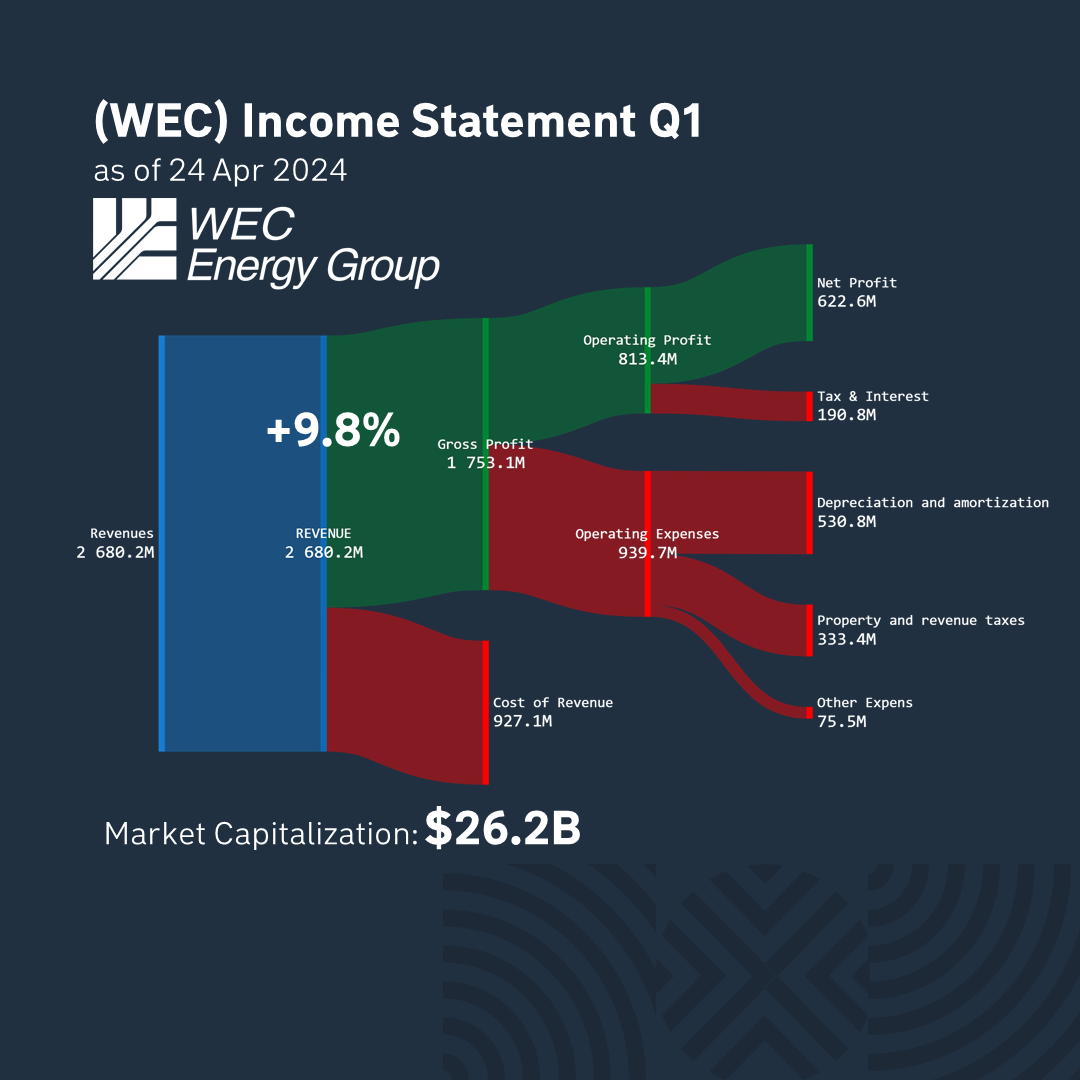

Manufacturing costs make up 34% of the revenue structure, and gross profit accounts for 66%. Over the past quarter, the company earned a profit of $622M. And its market capitalization is $26.2B.

After the publication of the report, stocks of Wec Energy Group increased by +0.5% and reached $83 per share. In general, market participants are satisfied with the company’s current financial results and reacted positively to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter