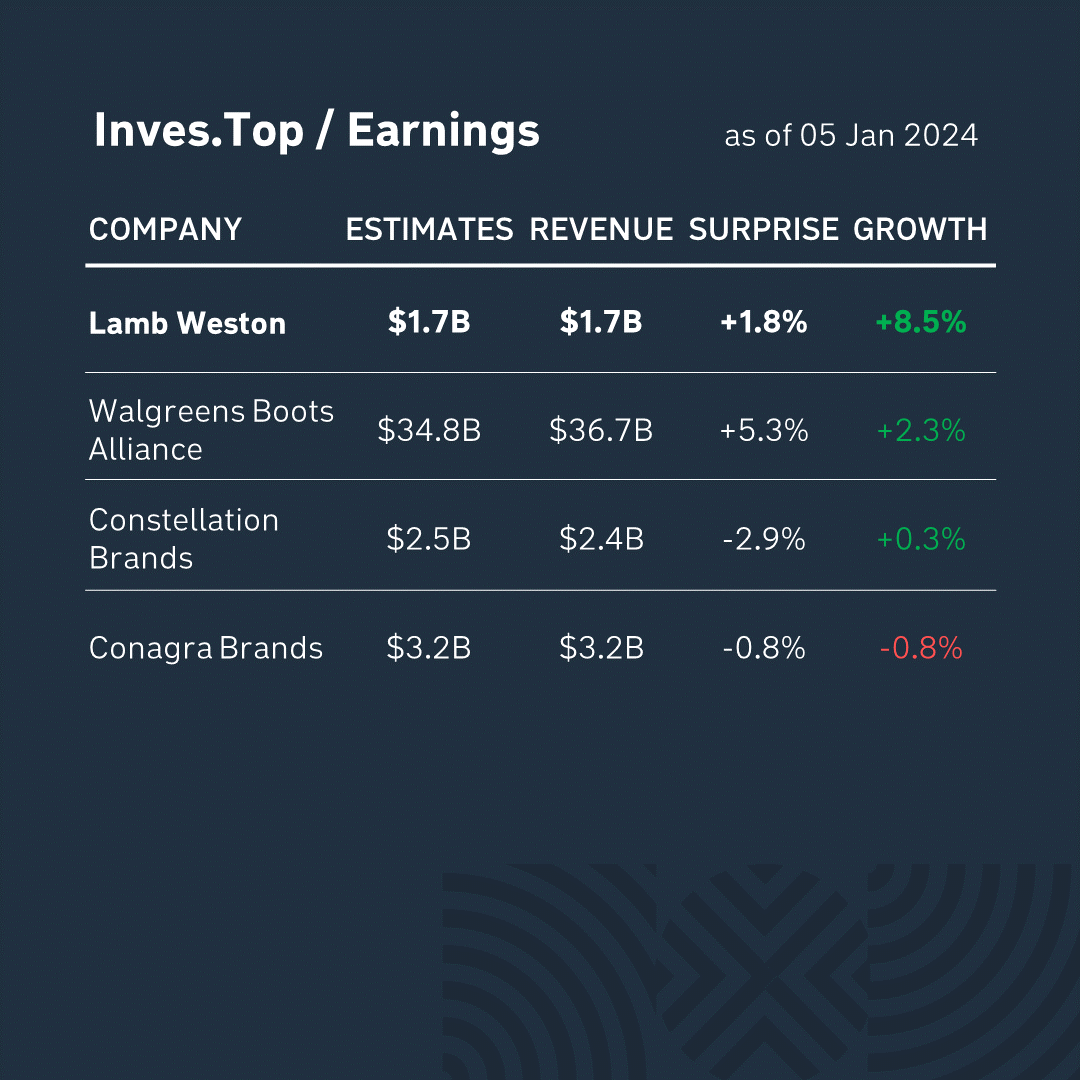

The corporate reporting period for Q4 2023 has begun. Over the past week, 4 companies from the S&P 500 index have already reported for the fourth fiscal quarter.

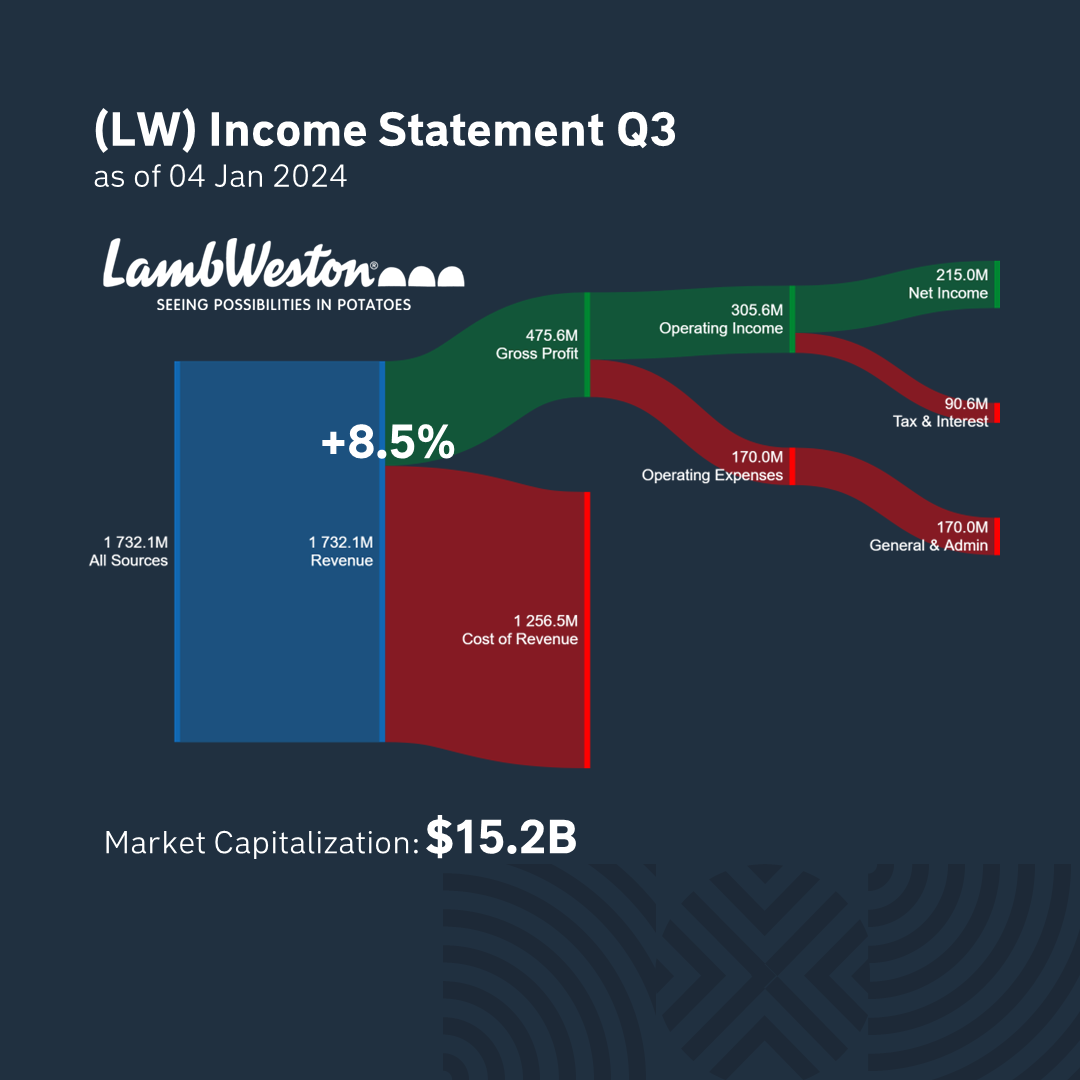

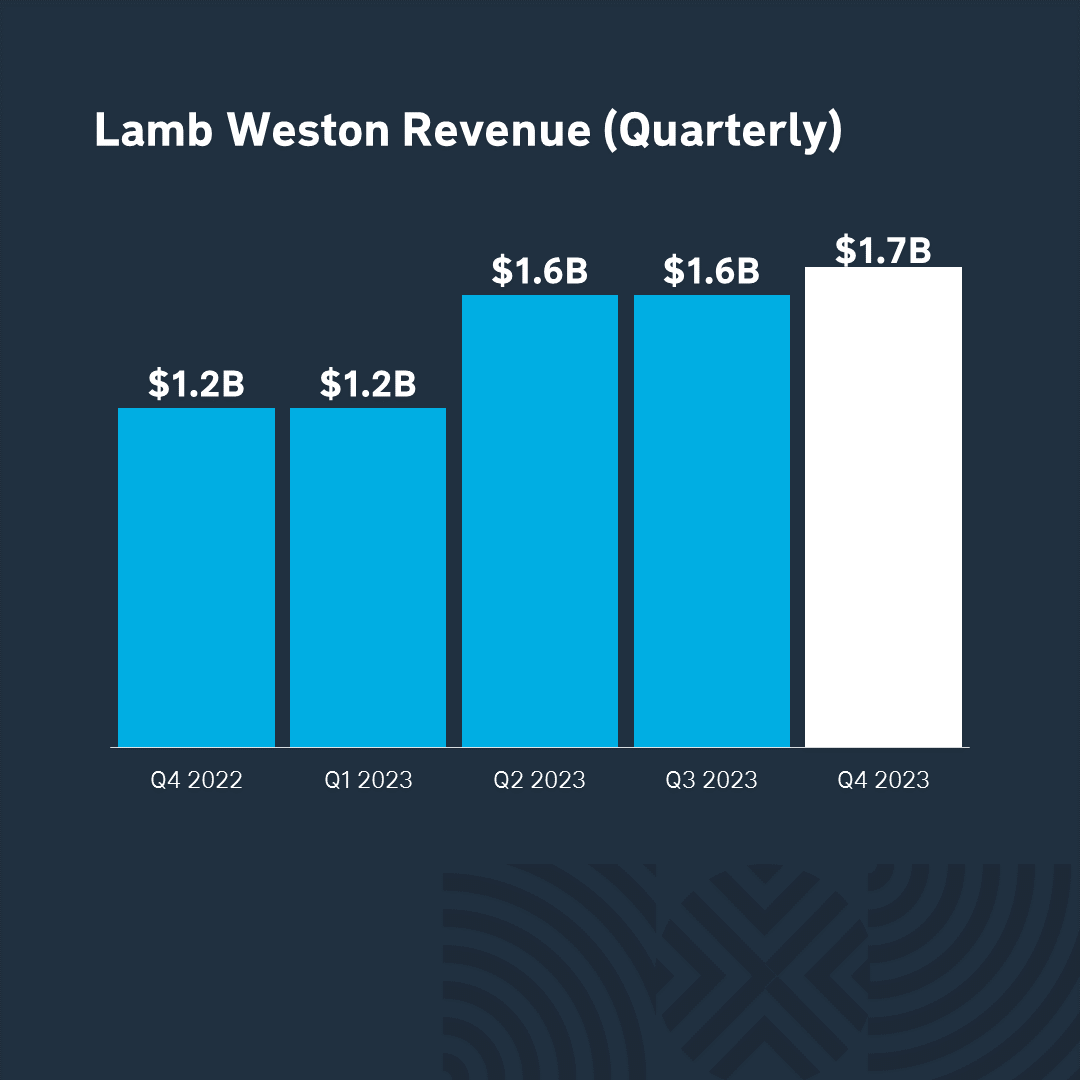

The best results were demonstrated by Lamb Weston, which reported $1.7B in revenue. It grew by +8.5% compared to the previous quarter and outperformed analysts’ expectations by +1.8%. Let’s analyze the company’s business in more detail.

Lamb Weston is the largest North American and 2nd largest producer of frozen potato products, including French fries. The company has been on the market since 1950 (74 years), has more than 7K employees in more than 100 countries. And its largest customer is McDonald’s.

Net profit grew by +109%, revenue by +36%, and dividends by +29% compared to the same quarter last year. Also, during this period, the company’s total debt decreased by -26%. The company’s positive financial results reflect the correctness of management decisions in difficult economic conditions, such as the write-off of surplus raw potatoes in North America.

Manufacturing costs make up 72% of the company’s revenue structure, and gross profit is 28%. Over the past quarter, the company earned a profit of $215M. And its market capitalization is now $15B.

After the publication of the report, Lamb Weston stock has risen by +0.3% to $105 per share. In general, market participants are satisfied with the company’s current financial results, but reacted rather cautiously to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter