The corporate reporting period has started.

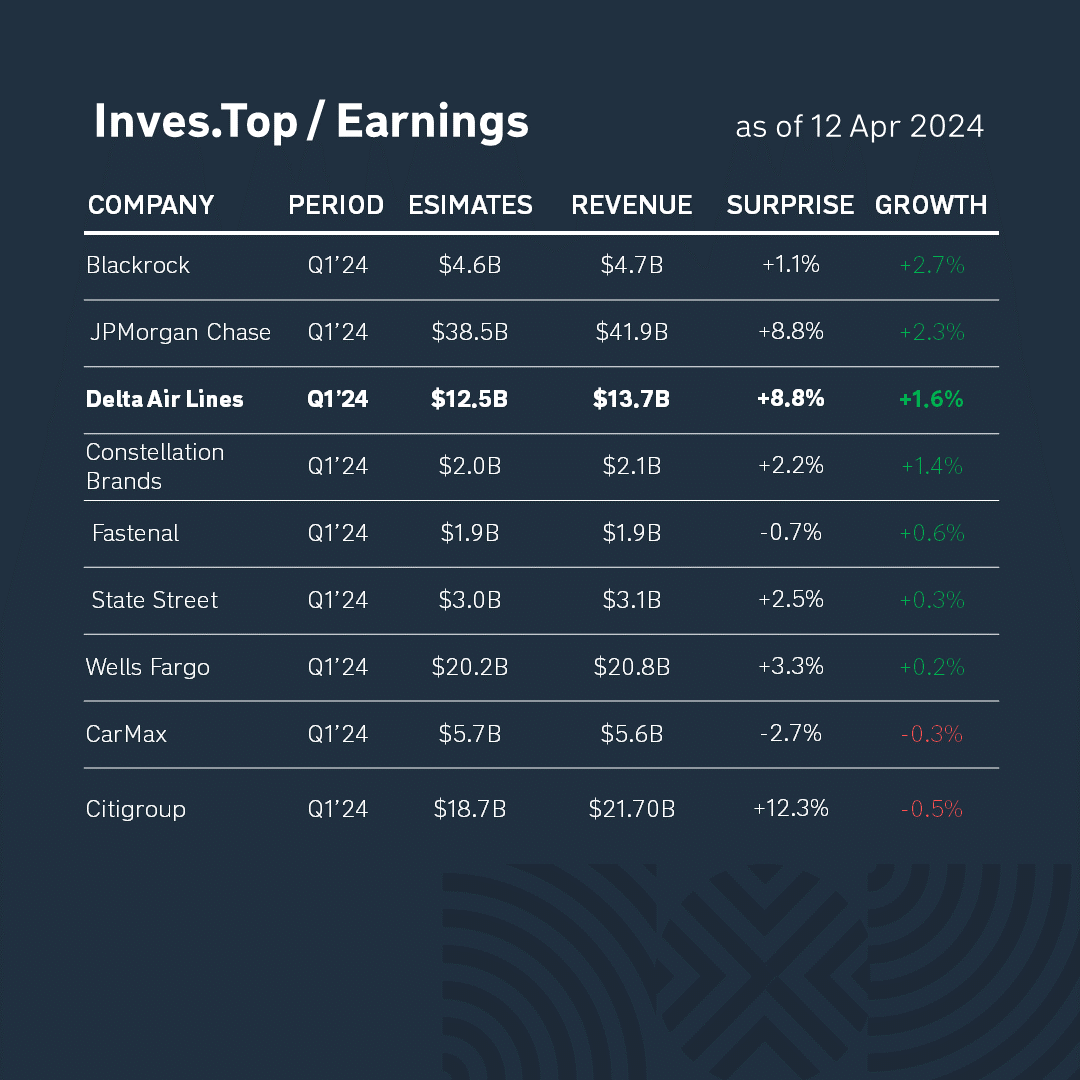

In the past week, 9 companies from the S&P 500 index reported for Q1 2024.

Today we will analyze Delta Air Lines. Its revenue is $13.7B. It grew by +1.6% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by 8.8%. Let’s analyze the company’s business in more detail.

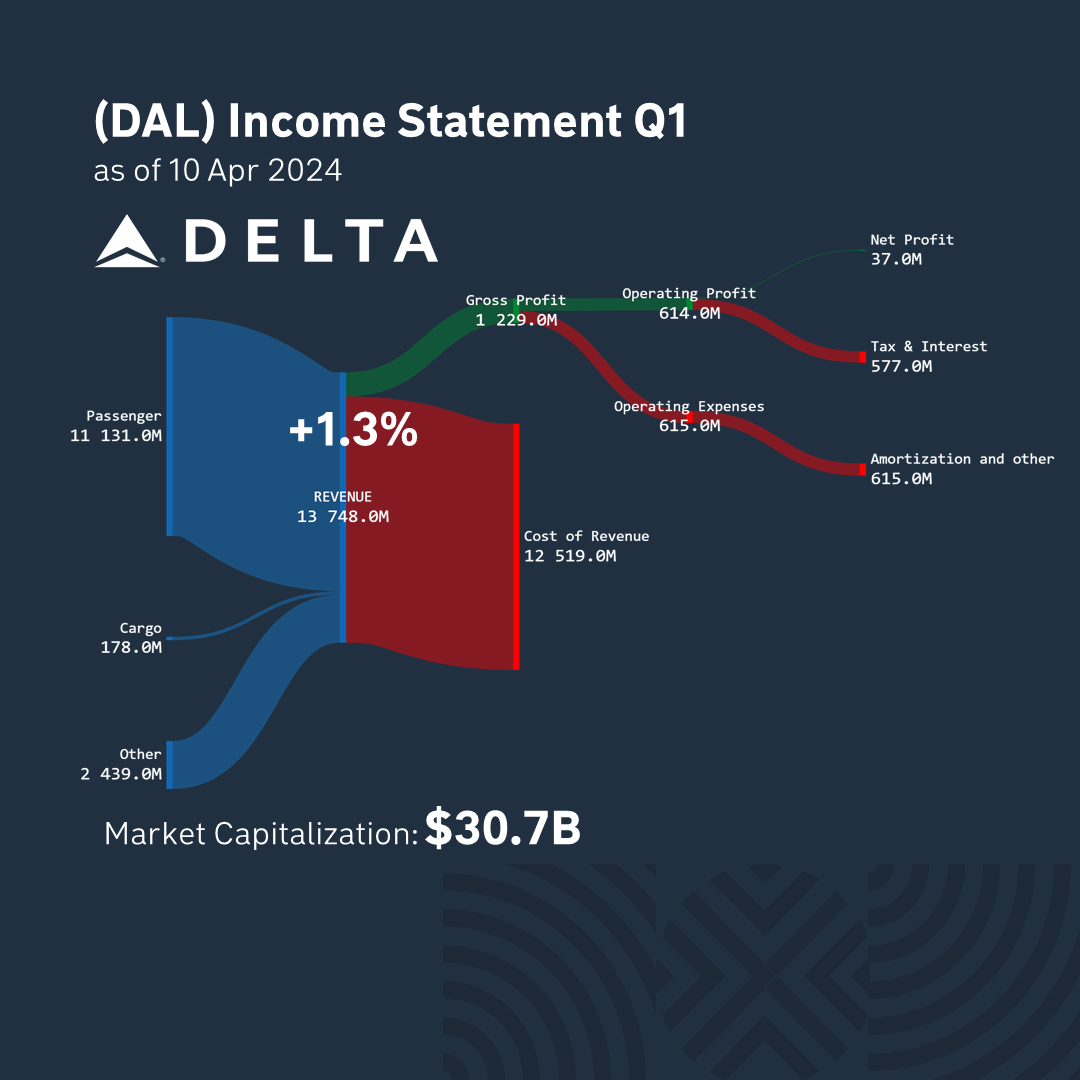

Delta Air Lines is one of the world’s largest airlines serving 300 destinations in 50 countries. Delta operates on the hub-and-spoke principle, using 5 of its hubs in the United States for transit. The company generates most of its revenue from passenger transportation across the Atlantic Ocean.

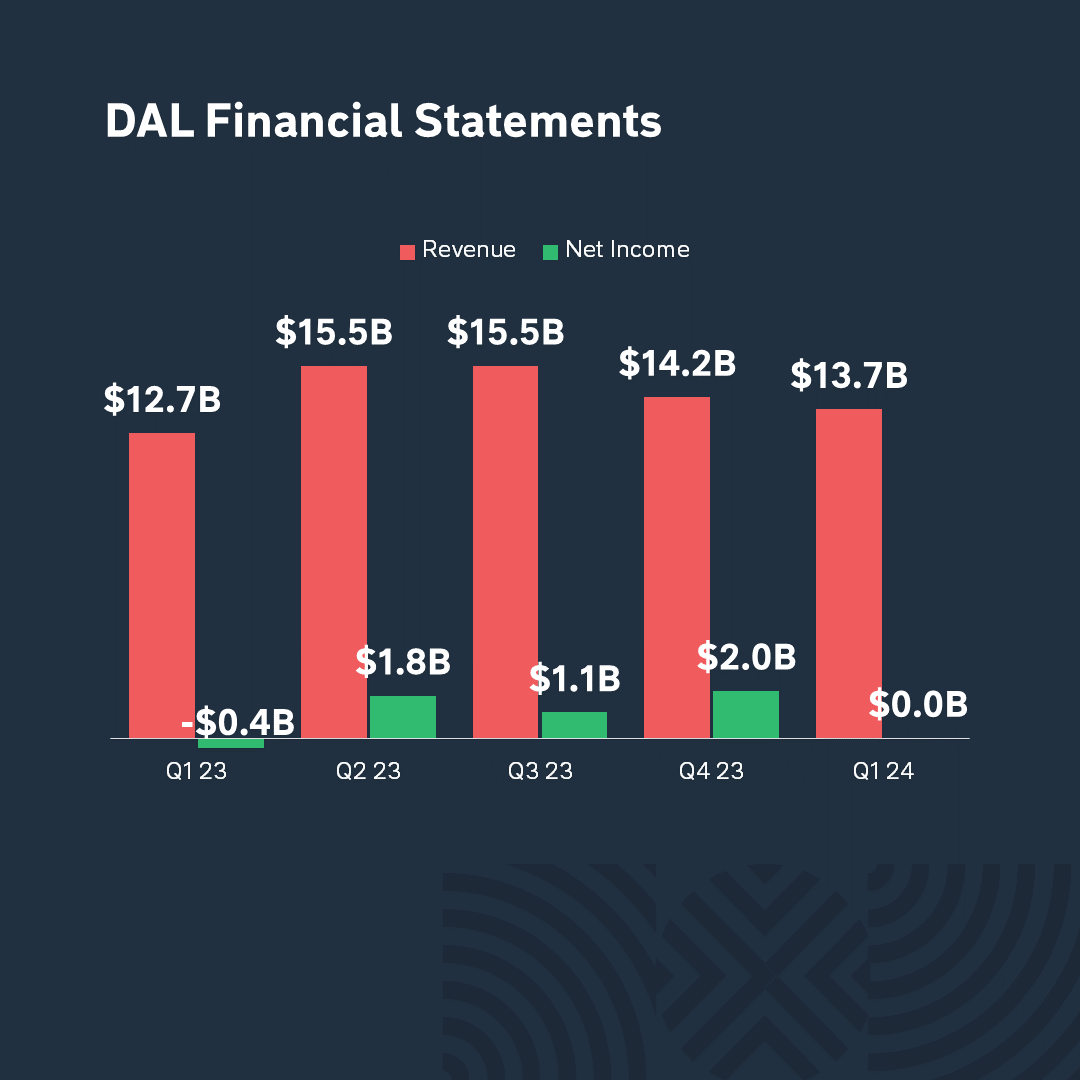

Delta Air Lines’ revenues increased by +7.8% year-on-year due to the growth in ticket sales before the holiday season. During the reporting period, the company’s aircraft had maximum occupancy as ticket growth was below the inflation rate – 1.0% compared to 3.5%.

Manufacturing costs make up 91% of the revenue structure, and gross profit is 9%. Over the past quarter, the company made a profit of $37M. Its market capitalization is $30B.

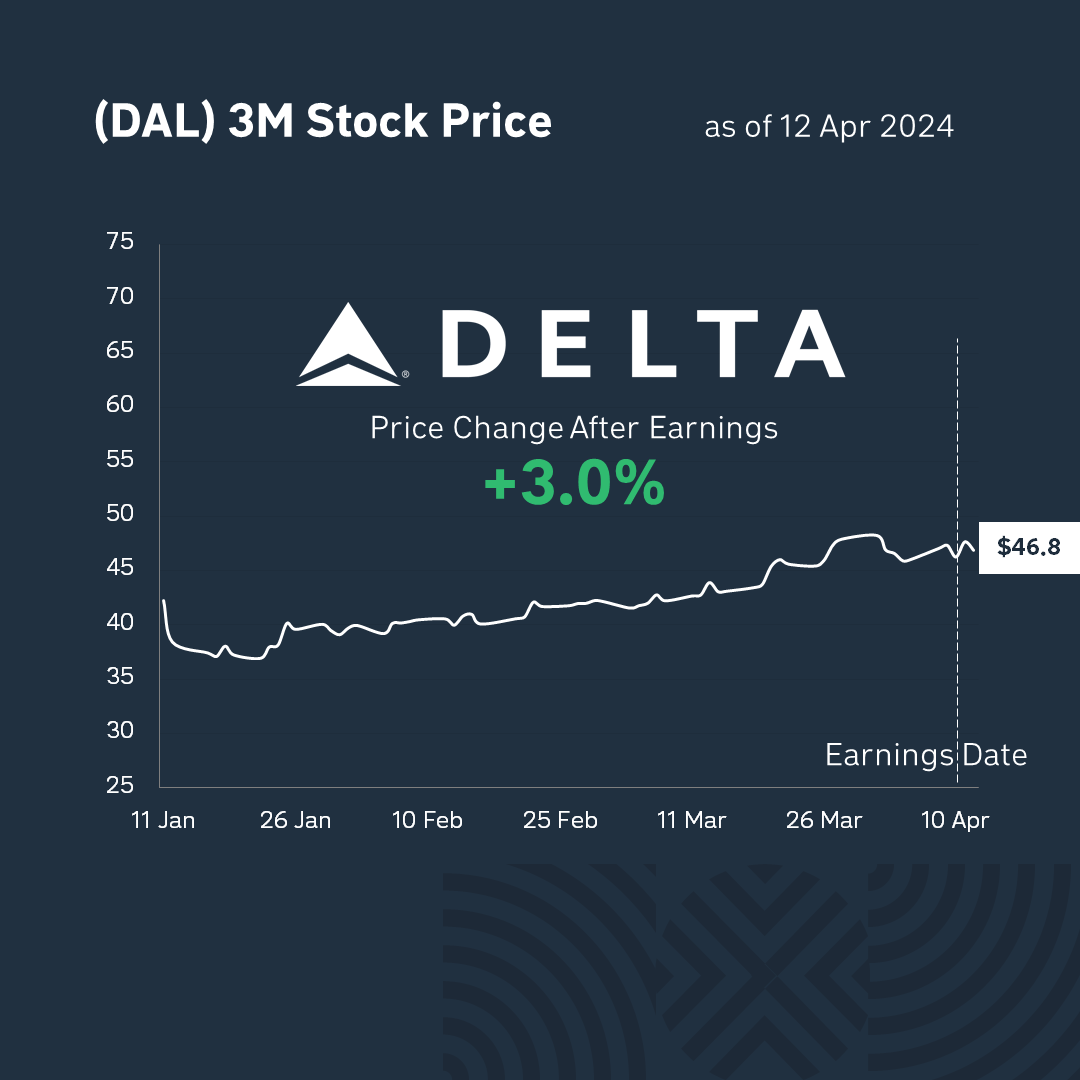

After the publication of the report, Delta Air Lines stock rose +3.0% to $46 per share. In general, market participants are satisfied with the company’s current financial results and reacted positively to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter