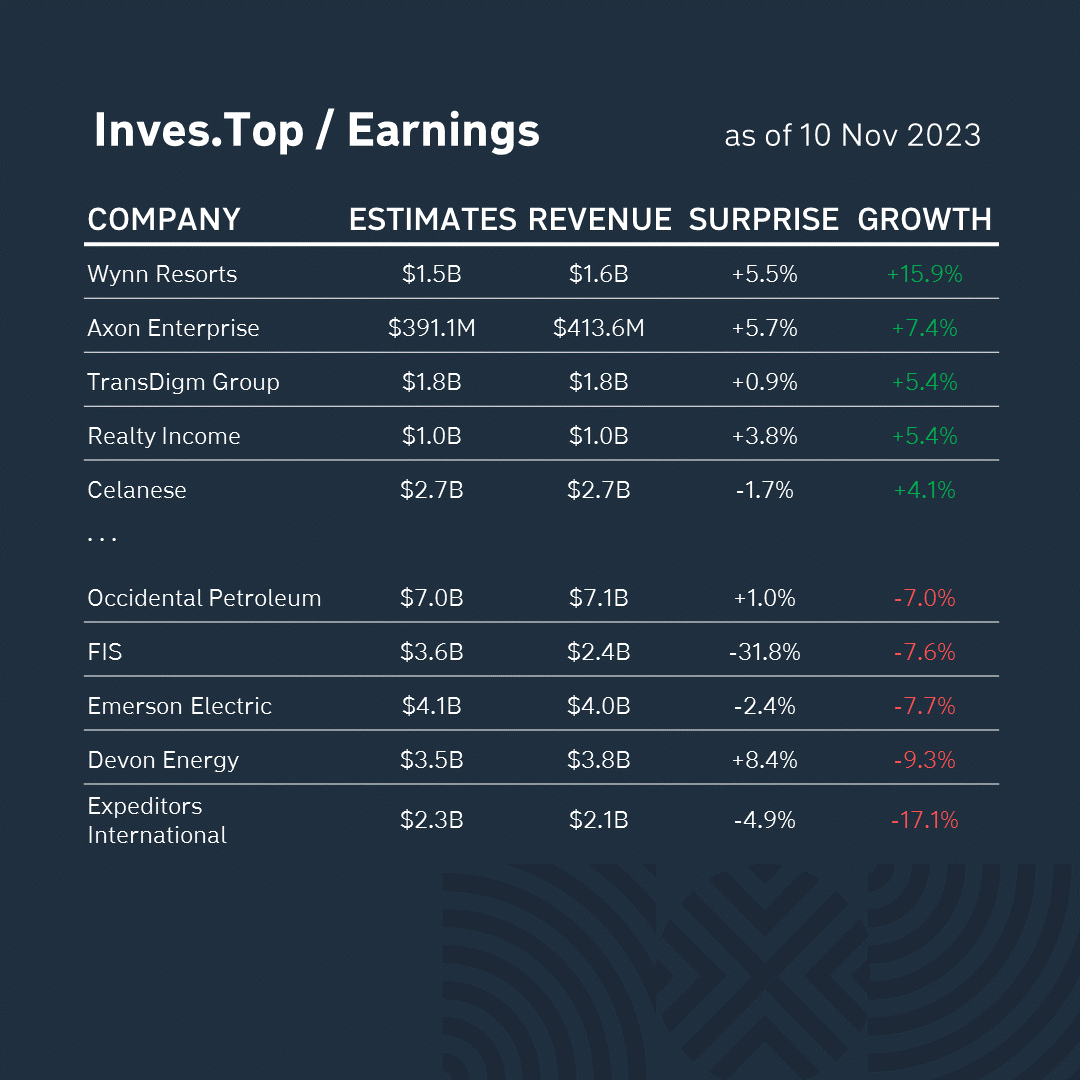

The corporate reporting period for Q3 2023 goes on. Over the past week, 37 companies from the S&P 500 Index have reported their third quarter results.

Over the past week, 37 companies from the S&P 500 index have already reported for the third financial quarter.

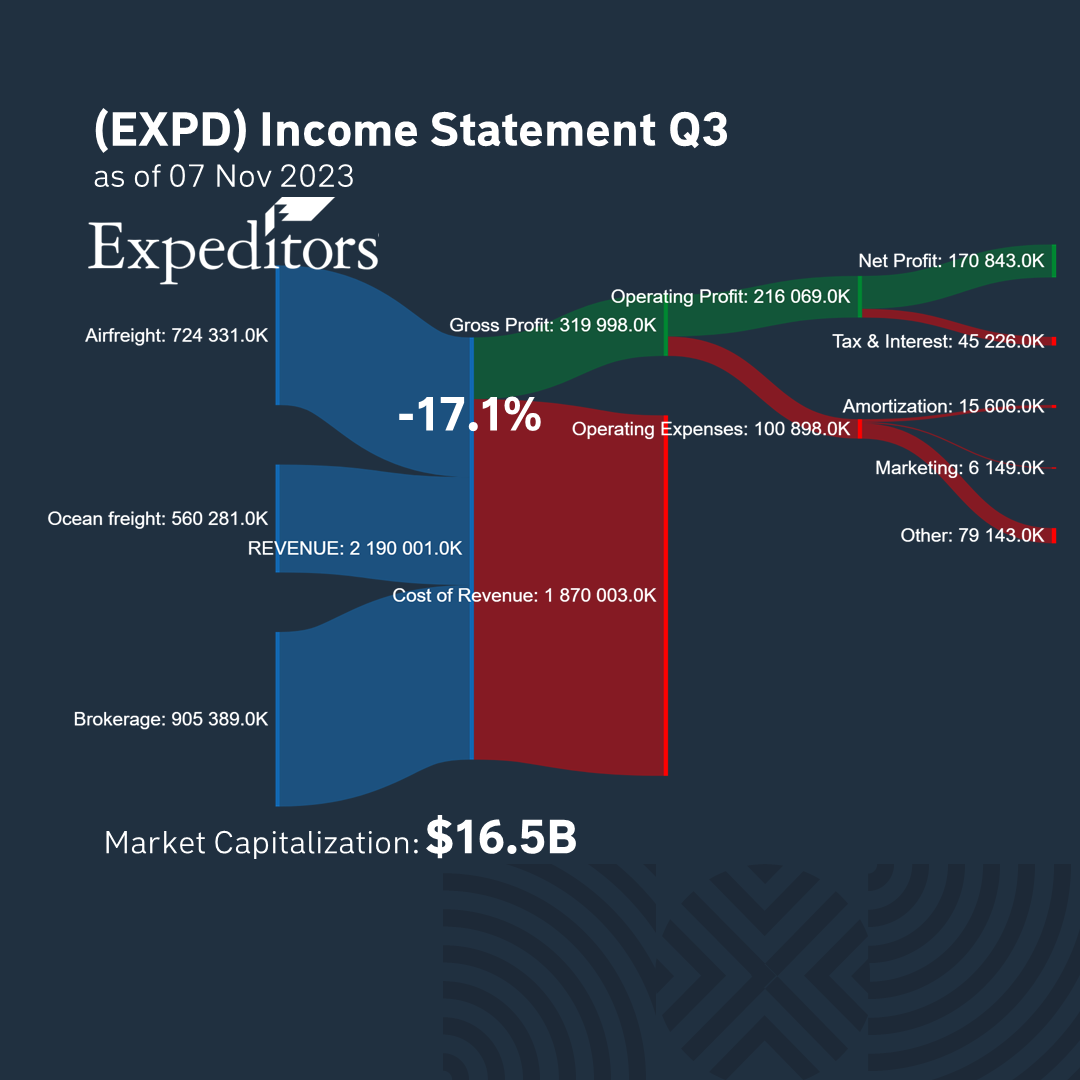

Expeditors International was the worst performer. Its revenue reached $2.1B and decreased by -17.1%. It is also below analysts’ expectations by -4.9%. Let’s analyse Expeditors International’s business in more detail.

Expeditors International’s core business is focused on logistics. The company’s revenue for Q3 2023 is $2.1B, and its main sources are air freight ($724.3M), ocean freight ($560.2M), and customs brokerage ($905.3M).

According to the latest financial report, Expeditors International lost the most money in ocean freight. In this business segment, revenue decreased by 5.6% quarter-on-quarter and by 66.7% compared to the same quarter last year. In the air cargo segment, revenue decreased by 3.5% quarter-on-quarter and by 51.0% quarter-on-quarter. The customs brokerage services segment was the most resilient among the others. Revenue in this segment increased by 1.1% quarter-on-quarter and decreased by 24.3% quarter-on-quarter.

89% of the revenue structure is made up of manufacturing costs and 11% of gross profit. The company earned a profit of $170.8M in the last quarter. And its market capitalisation now stands at $16.5B.

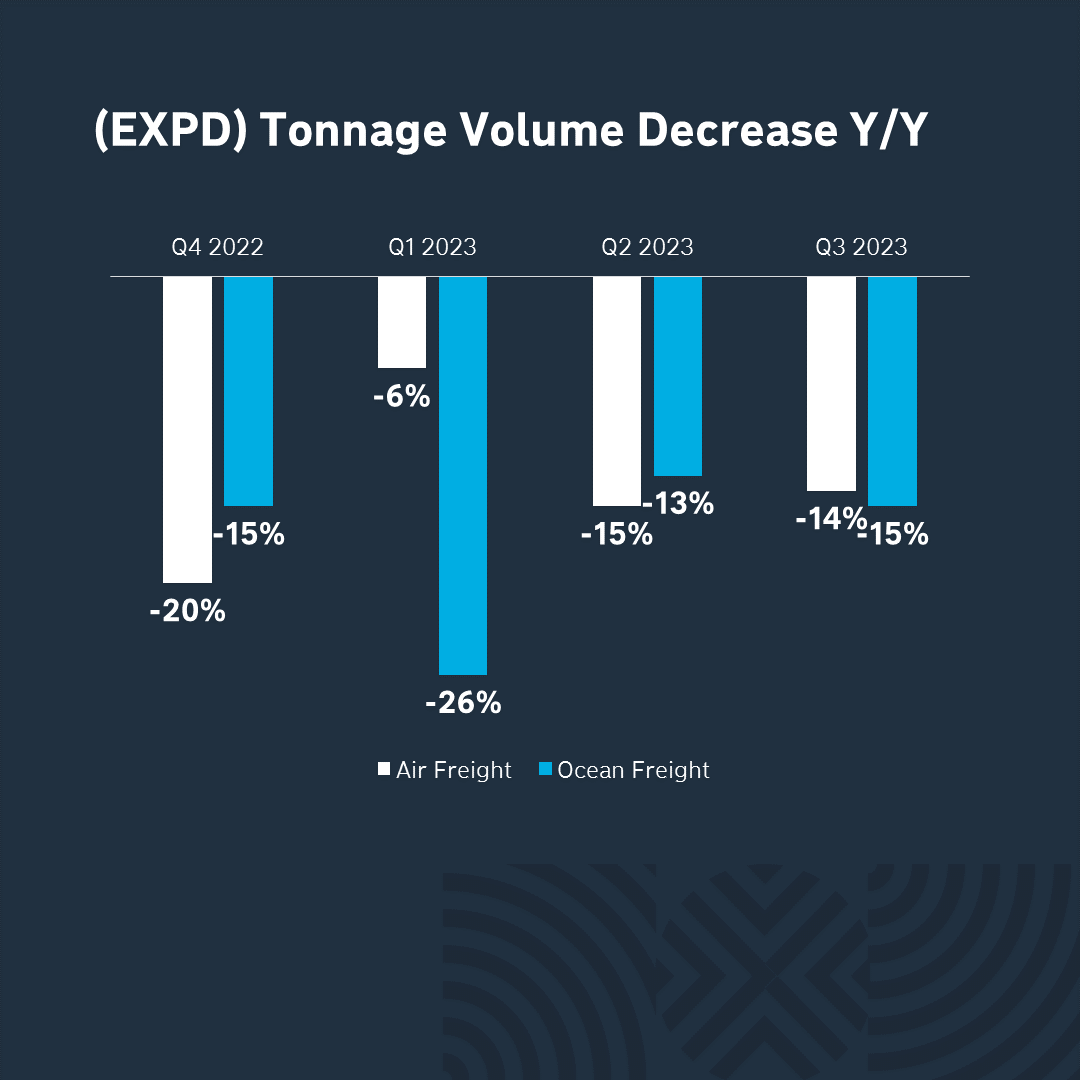

Immediately following the publication of the report, Expeditors International’s shares fell by -4.0%. This reaction was due to the fact that air freight and ocean container volumes fell by 14% and 15% respectively over the year. Jeffrey S. Musser, the company’s CEO, explained that such a difficult period was due to the low demand for logistics services observed since the beginning of the pandemic.

During the trading session, however, the fall was almost reversed and the market closed down by -0.9%. This may be due to Expeditors International’s decision to optimise its business while the economic environment remains uncertain. Over the past 12 months, costs have fallen by 56%. This is mainly due to an 11% reduction in salaries and other operating expenses as a result of an 8% reduction in staff. In addition, the company has returned more than $2 billion to shareholders through share buybacks and dividends over the past 12 months. Expeditors International can therefore be seen as a good example of how a company should respond to adverse external factors and behave under conditions of high uncertainty.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter