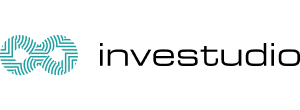

The corporate reporting period has started.

In the past week, 37 companies from the S&P 500 index reported for Q1 2024.

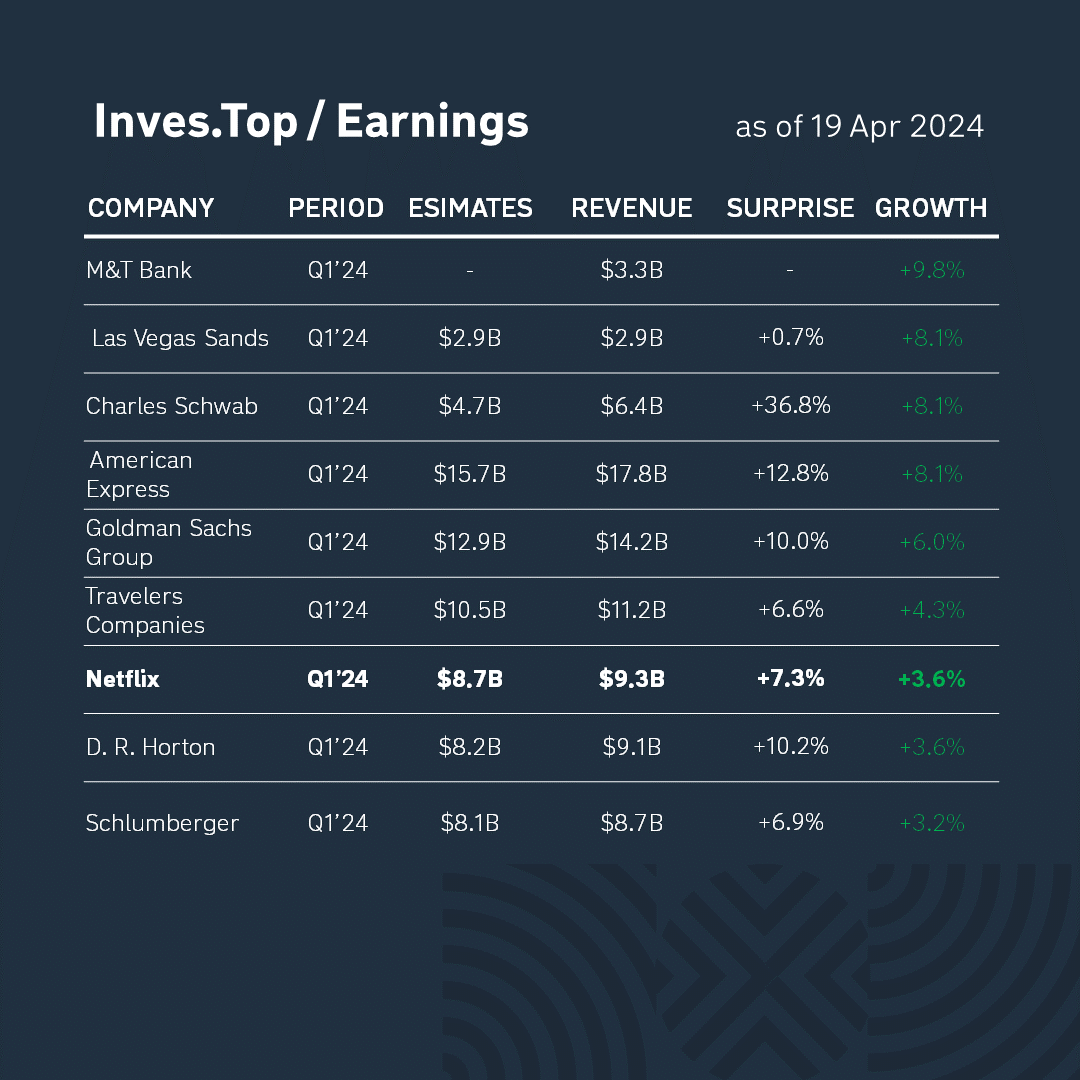

Today we will consider Netflix. Its revenue is $9.3B. It grew by +3.6% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by +7.3%. Let’s analyze the company’s business in more detail.

Netflix is one of the largest streaming companies in the world with a subscriber base of over 250M users from 190 countries. The company creates most of its content independently. The company also introduces paid subscriptions to video games and advertising integrations.

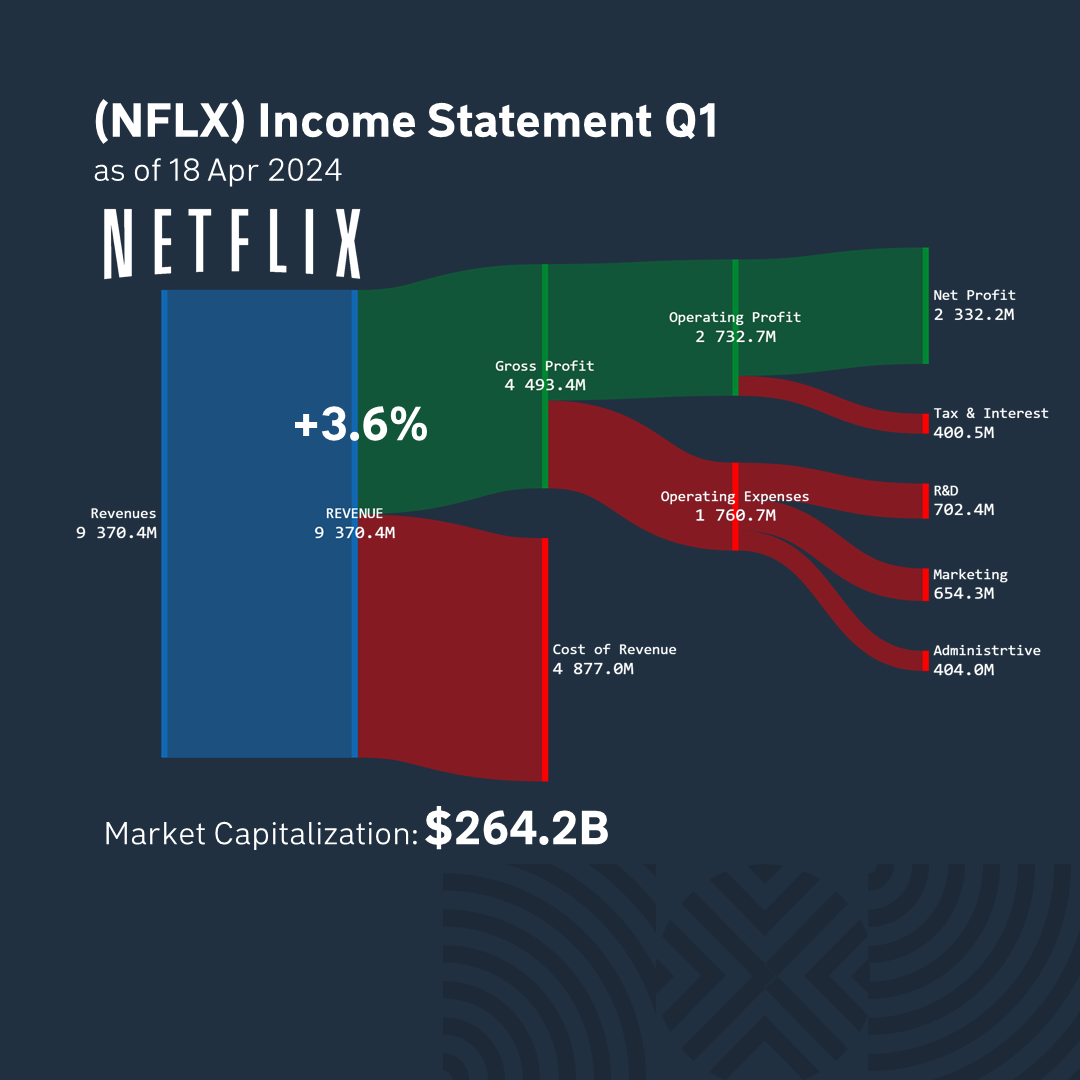

Netflix’s revenue increased by +5.6% compared to the corresponding quarter of last year due to the growth of new subscribers, namely +9.3M for the last quarter and +37M for the whole of last year. This increase in subscribers was due to a decrease in the likelihood of passing a password to third-party users.

Manufacturing costs make up52% of the revenue structure, and gross profit is 48%. Over the past quarter, the company made a profit of $2.3B. Its market capitalization is $262B.

After the publication of the report, Netflix stock fell by -9.0% to $555 per share. In general, market participants are dissatisfied with the company’s current financial results and reacted negatively to forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter