The corporate reporting period has is ending.

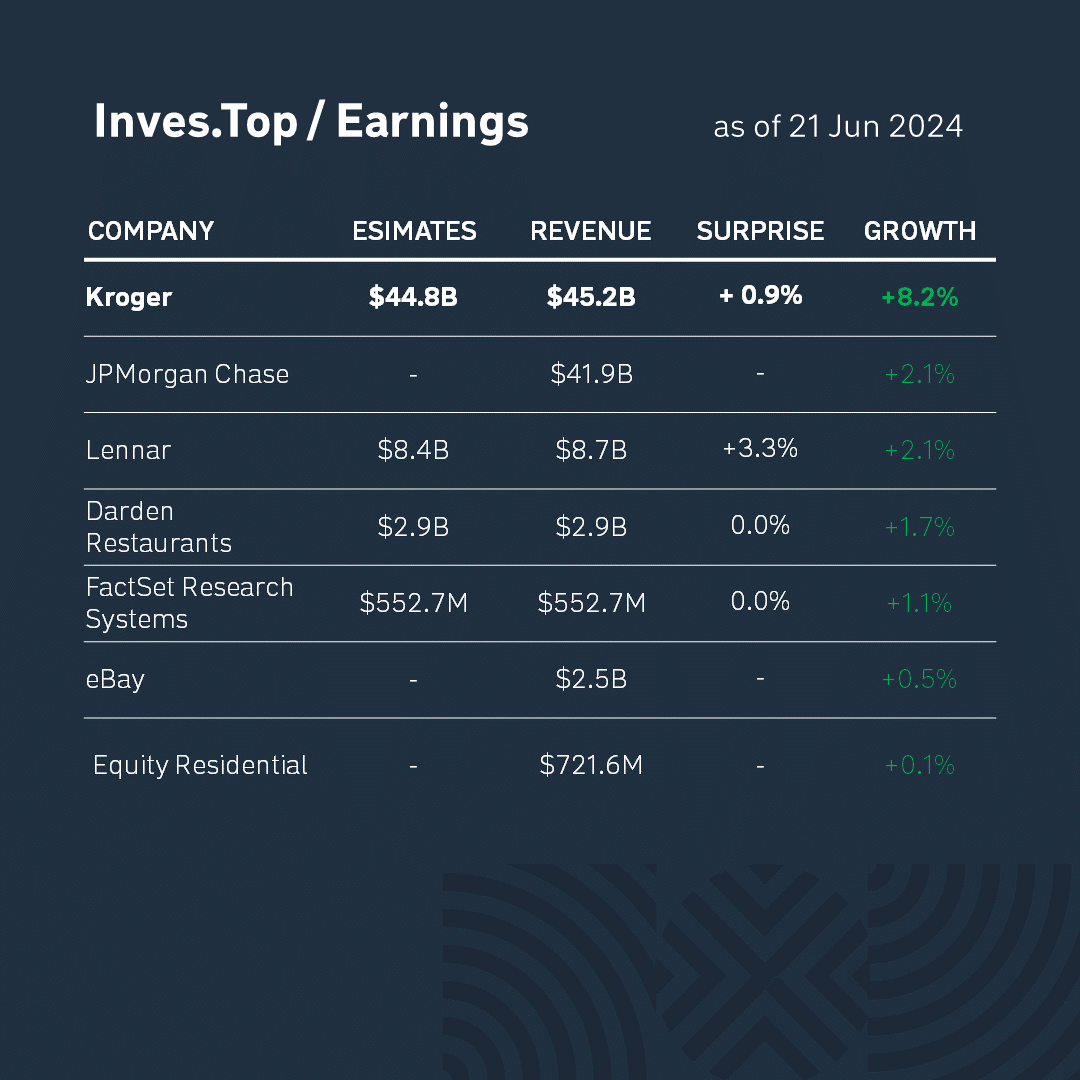

Last week, 11 companies from the S&P 500 index reported.

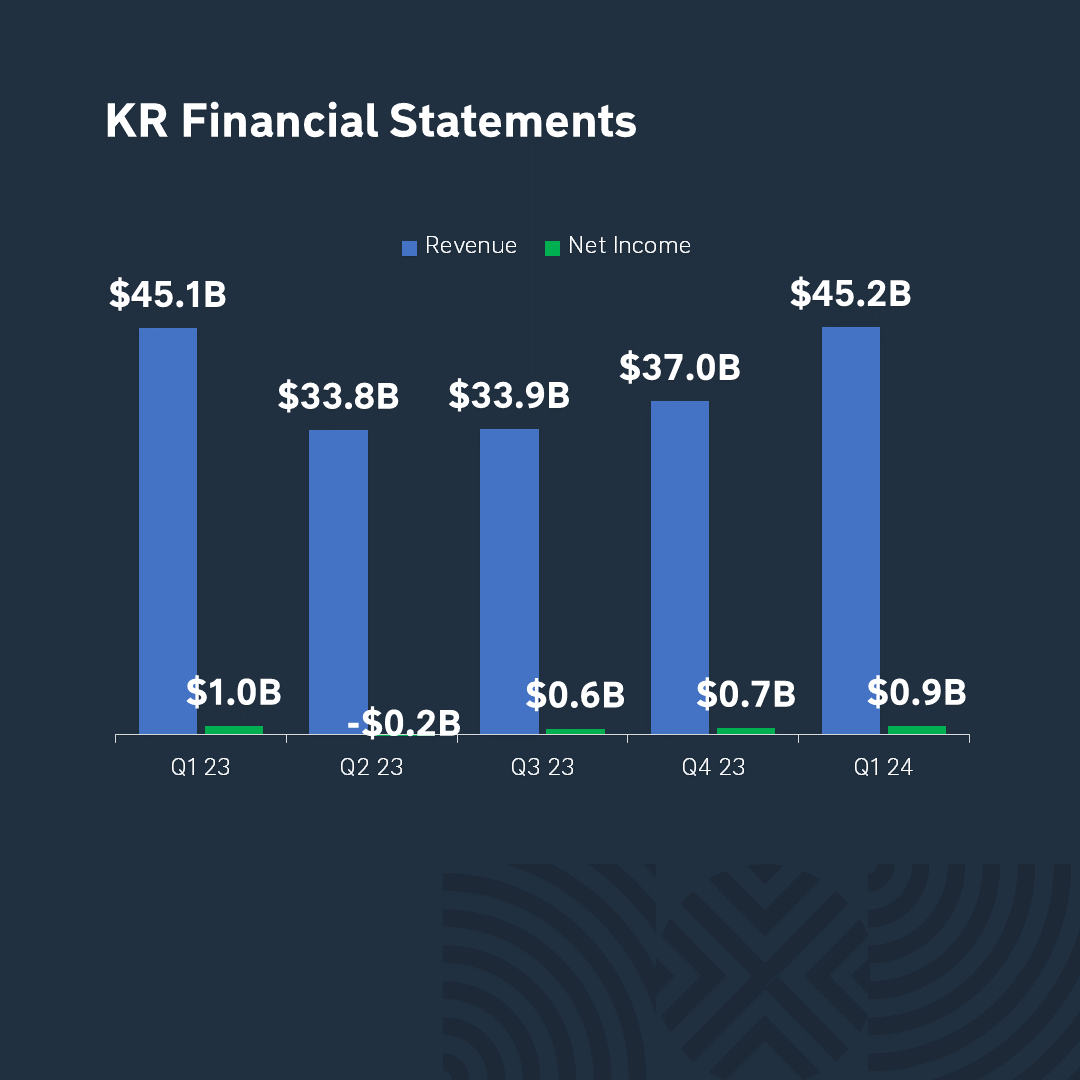

Today, we are going to look at Kroger’s results. Its revenue is $45.2B. It grew by +8.2% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by +0.9%. Let’s analyze the company’s business in more detail.

Kroger is one of the largest grocery retailers in the United States, operating more than 2,700 stores and 20 supermarkets. The company produces about 27% of its food products at its own 33 factories. The company also owns pharmacies and gas stations.

The company’s revenues increased by +0.2% quarter-on-quarter and by +22.1% month-on-month. The company is diversifying its product categories to attract customers and has 20 times more items than its competitor Costco. The company is also developing its e-commerce segment, which involves 2,200 stores. Kroger has a long-term strategy of buying back its own shares – $12B has been allocated since 2014.

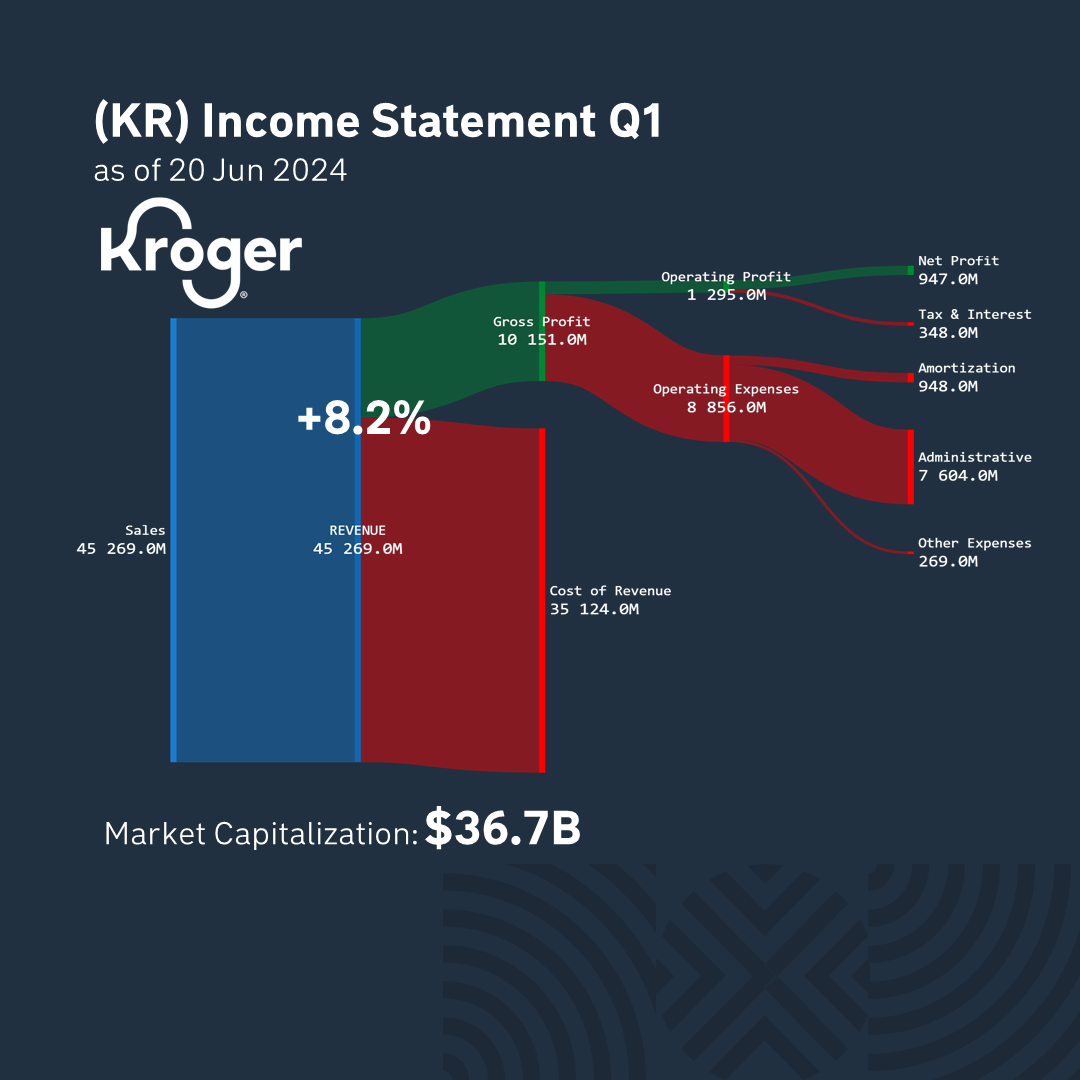

77% of the revenue structure is made up of manufacturing costs, and 23% is gross revenue. For the last quarter, the company earned a profit of $947M. And its market capitalization is $36B.

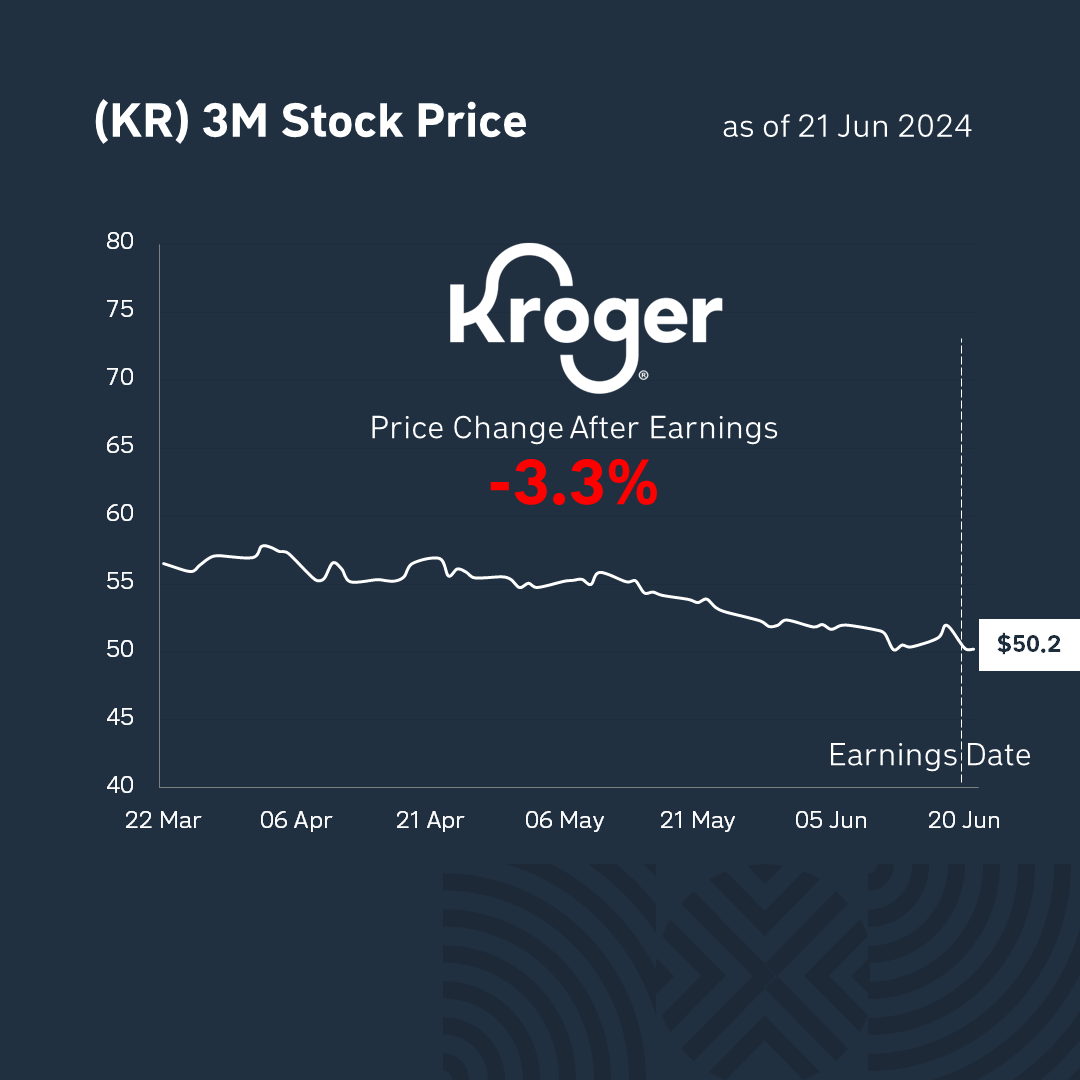

After the publication of the report, Kroger’s shares fell by -3.3% to $50.2 per share. Market participants are dissatisfied with the company’s financial results and reacted negatively to the company’s development prospects.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter