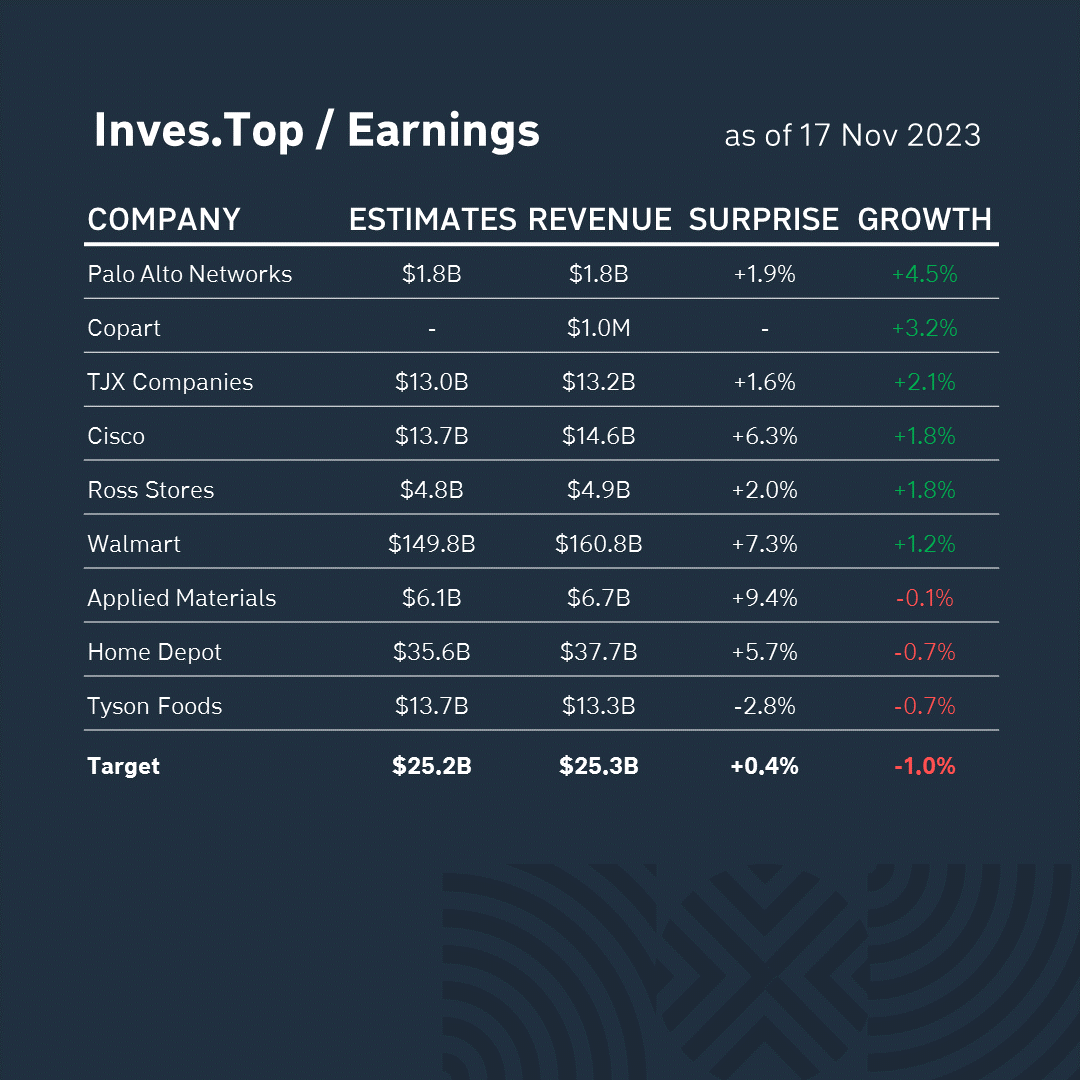

The corporate reporting period for Q3 2023 goes on. Over the past week, 37 companies from the S&P 500 Index have reported their third quarter results.

Target was the worst performer. Its revenue decreased by -1.0% compared to the same value for the previous quarter, but was higher than analysts’ expectations by +0.4%. Let’s analyze the company’s business in more detail.

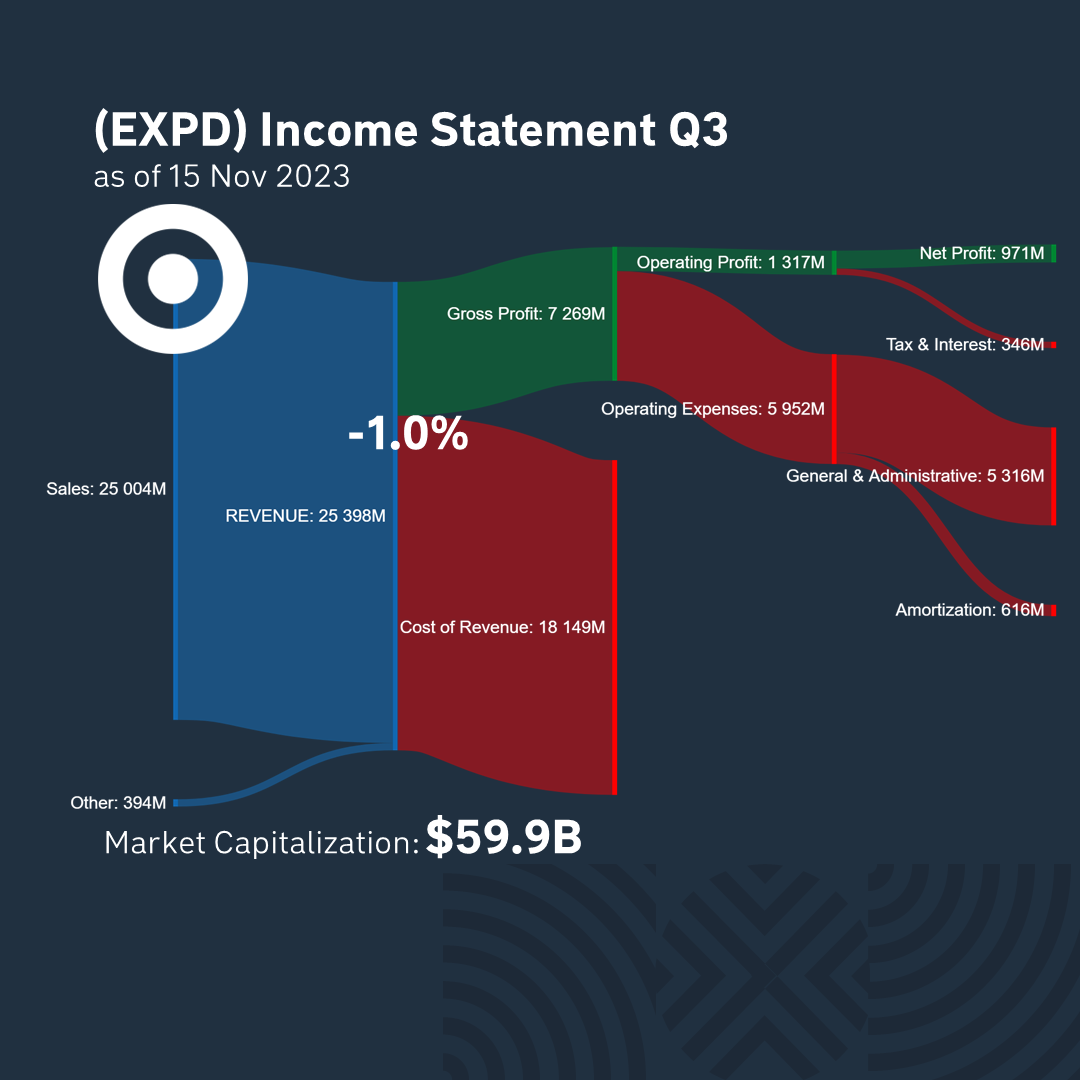

As one of the largest retailers in the US, Target’s revenue (98.4%) is driven by retail sales. Interestingly, Covid19 has prompted Target to review its business strategy. With the onset of the pandemic, the company was forced to move some of its services online. Thus, over the past 5 years, the share of sales through a mobile app or website has increased from 7.1% in 2018 to 17.1% in 2023. The company’s revenue for Q3 2023 is $25.2B. Of this volume, 71% of the revenue structure is accounted for by manufacturing costs and 29% by gross profit. Over the past quarter, the company made a net profit of $971M. And its market capitalization now stands at $59B.

Target’s strategy combines online and offline shopping. The integration of digital and brick-and-mortar retail improves efficiency by reducing delivery times and costs. A particularly successful service is Drive Up, which offers contactless delivery from the store to your car in the car park. This approach not only reflects Target’s adaptability in a dynamic environment but also points to its future potential.

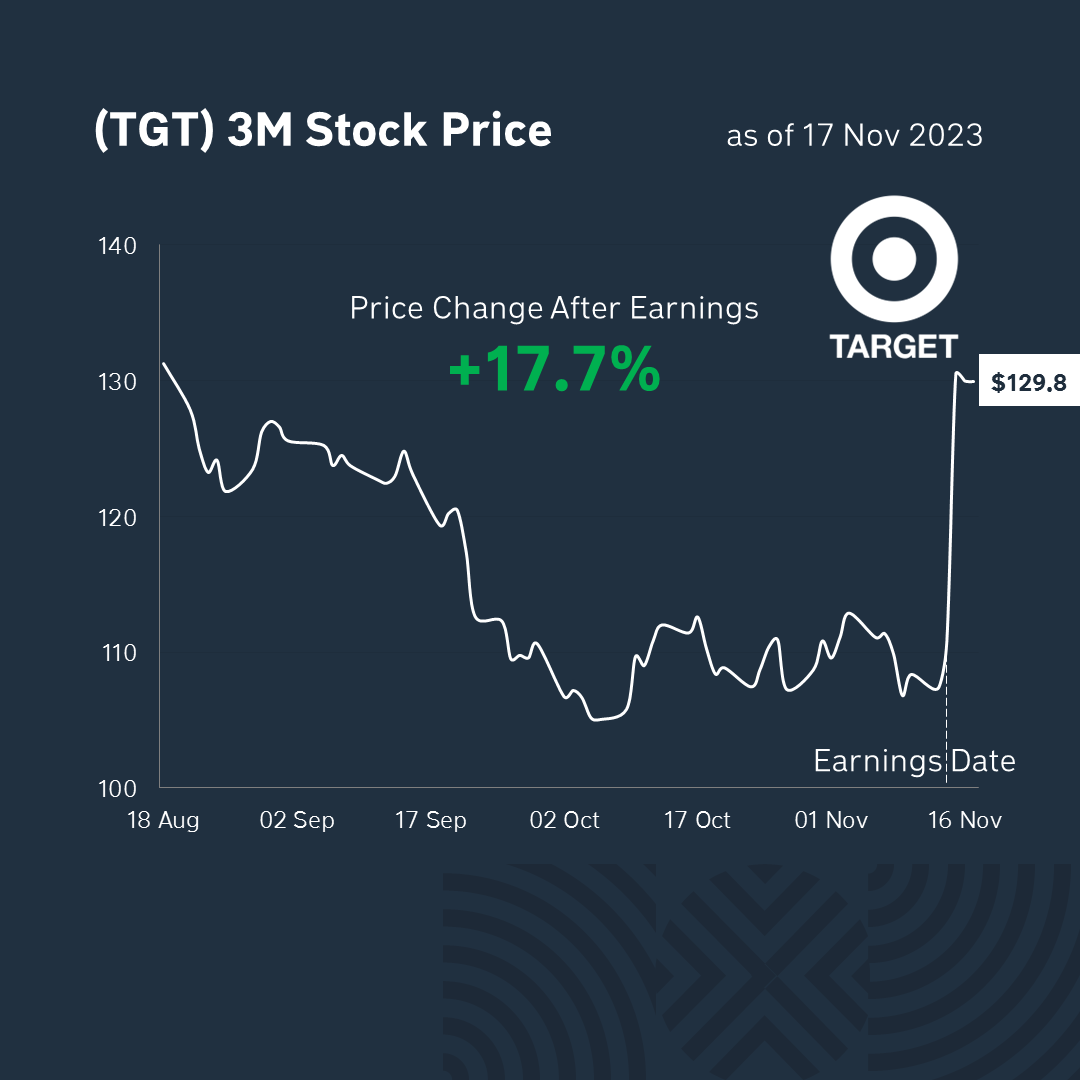

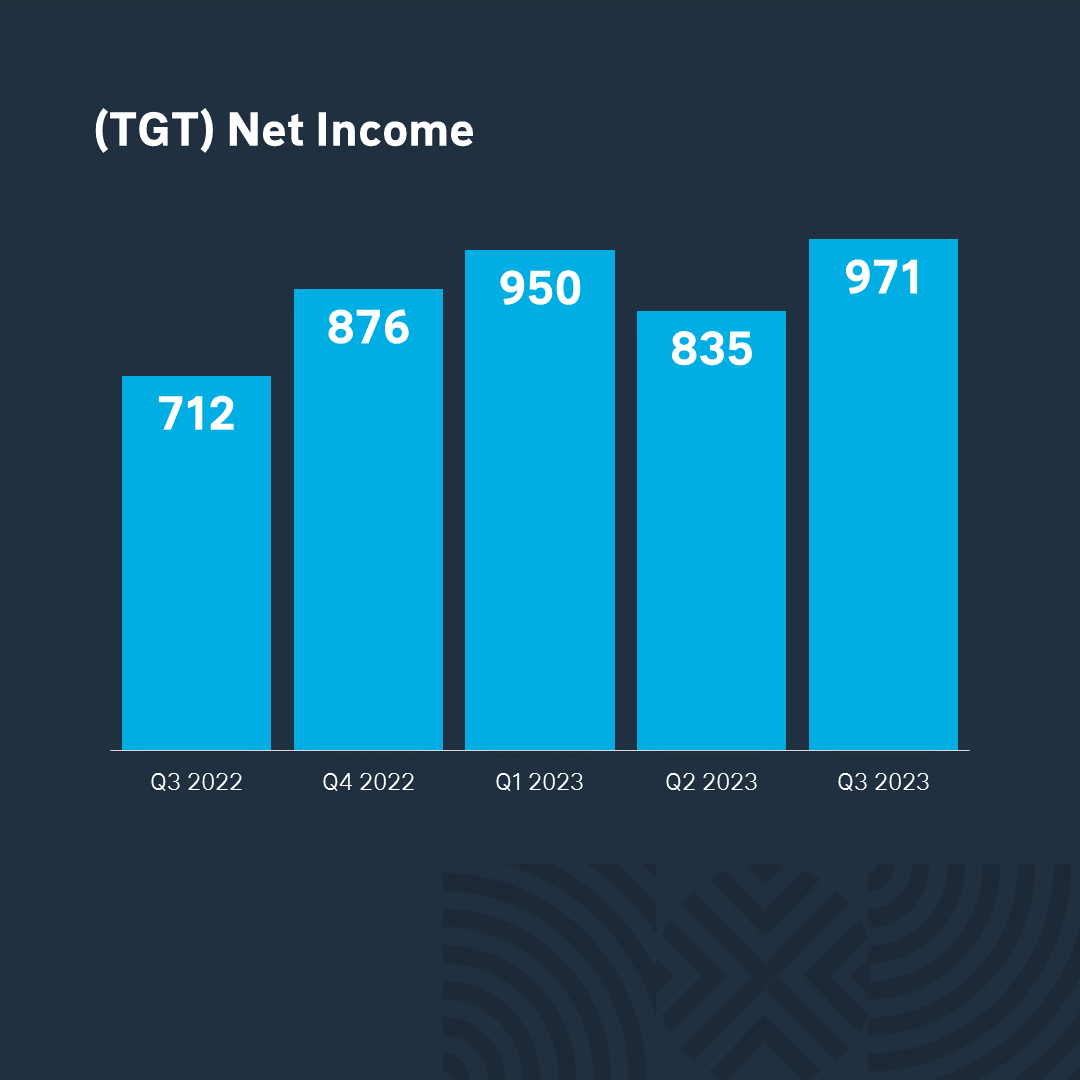

After the report was published, Target shares rose by 17%. Although the company reported a decline in revenue, it was offset by a +16% increase in net profit compared to the previous quarter and +36% compared to the same quarter last year. This effect was primarily achieved by reducing costs related to markdowns, inventory and supply chain. Therefore, investors highly appreciated the company’s ability to solve economic problems in the face of high-interest rates, expensive loans and consequently low demand for goods.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter