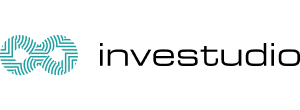

Over the past week, 24 companies from the S&P 500 index have already reported for the quarter ended December 31, 2023.

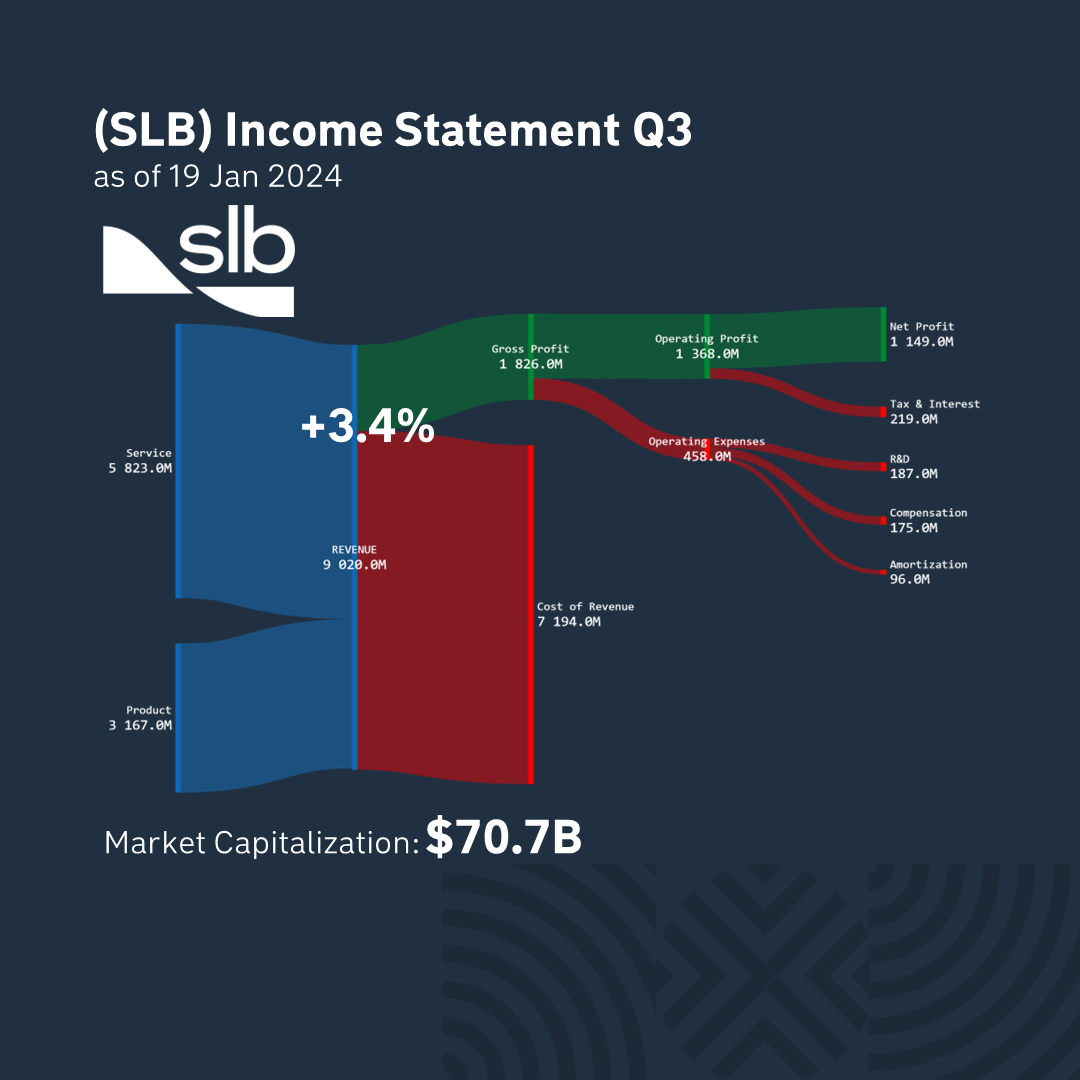

Schlumberger showed the best results. Its revenue reached $8.9B. It increased by +3.4% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by +0.3%. Let’s analyze the company’s business in more detail.

Schlumberger is one of the world’s largest oil well development companies. The company has been on the market for almost 100 years and therefore has a dominant share in the industry.

First of all, Schlumberger’s revenue exceeded analysts’ forecasts due to the production of subsea drilling equipment. This is a joint project with Aker Solutions, which accounted for 70% of the revenue growth for the quarter. In addition, the company raised its quarterly dividend by 10% and announced that it plans to increase its share buyback in 2024, which will return up to $2.5B to investors.

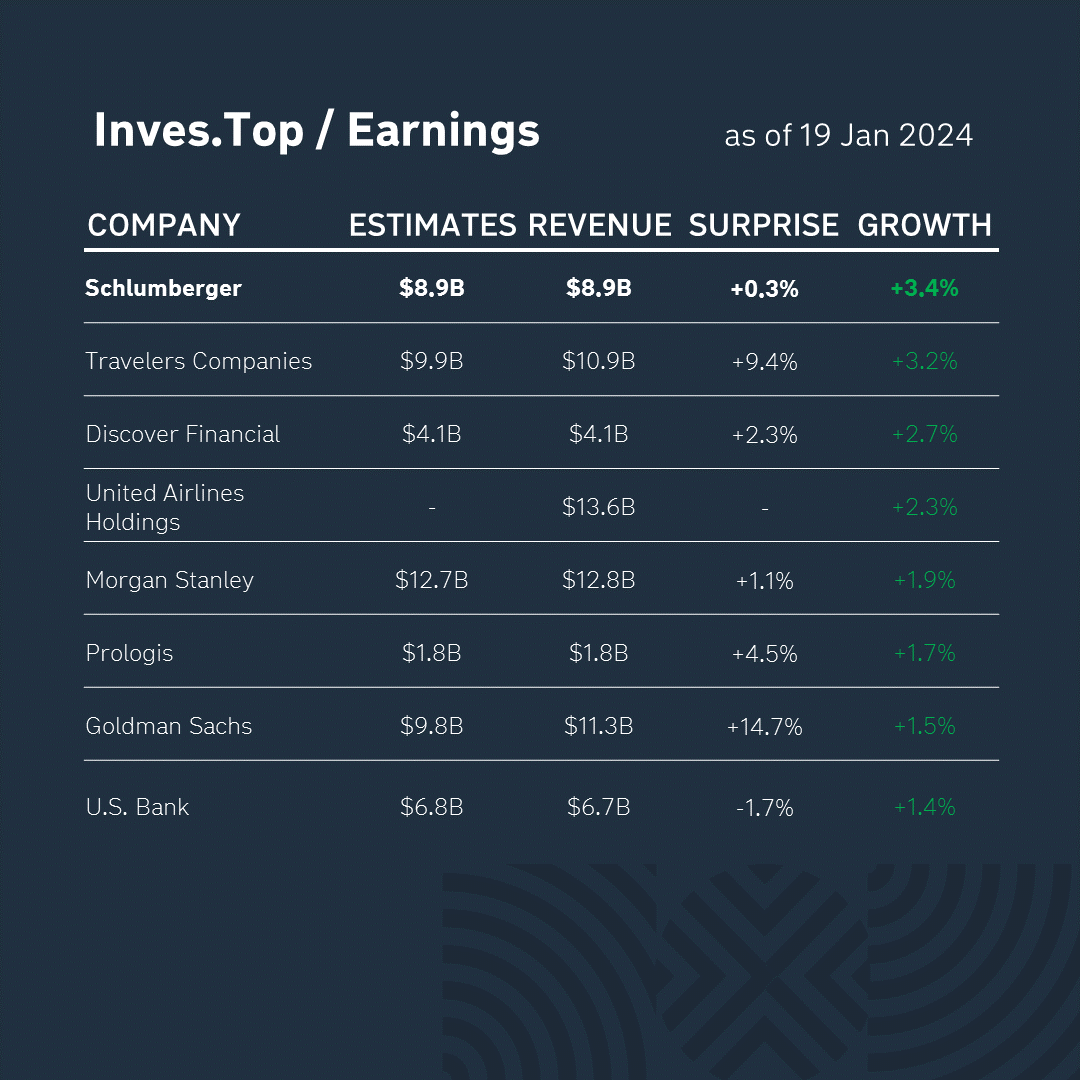

Manufacturing costs account for 88% of the revenue structure, and gross revenue for 12%. Over the past quarter, the company made a profit of $1.1B. And its market capitalization is now $70B.

After the publication of the report, Schlumberger stock rose by +2.2% to reach $49/share. In general, market participants are satisfied with the company’s current financial results and reacted positively to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter