The corporate reporting period has is going.

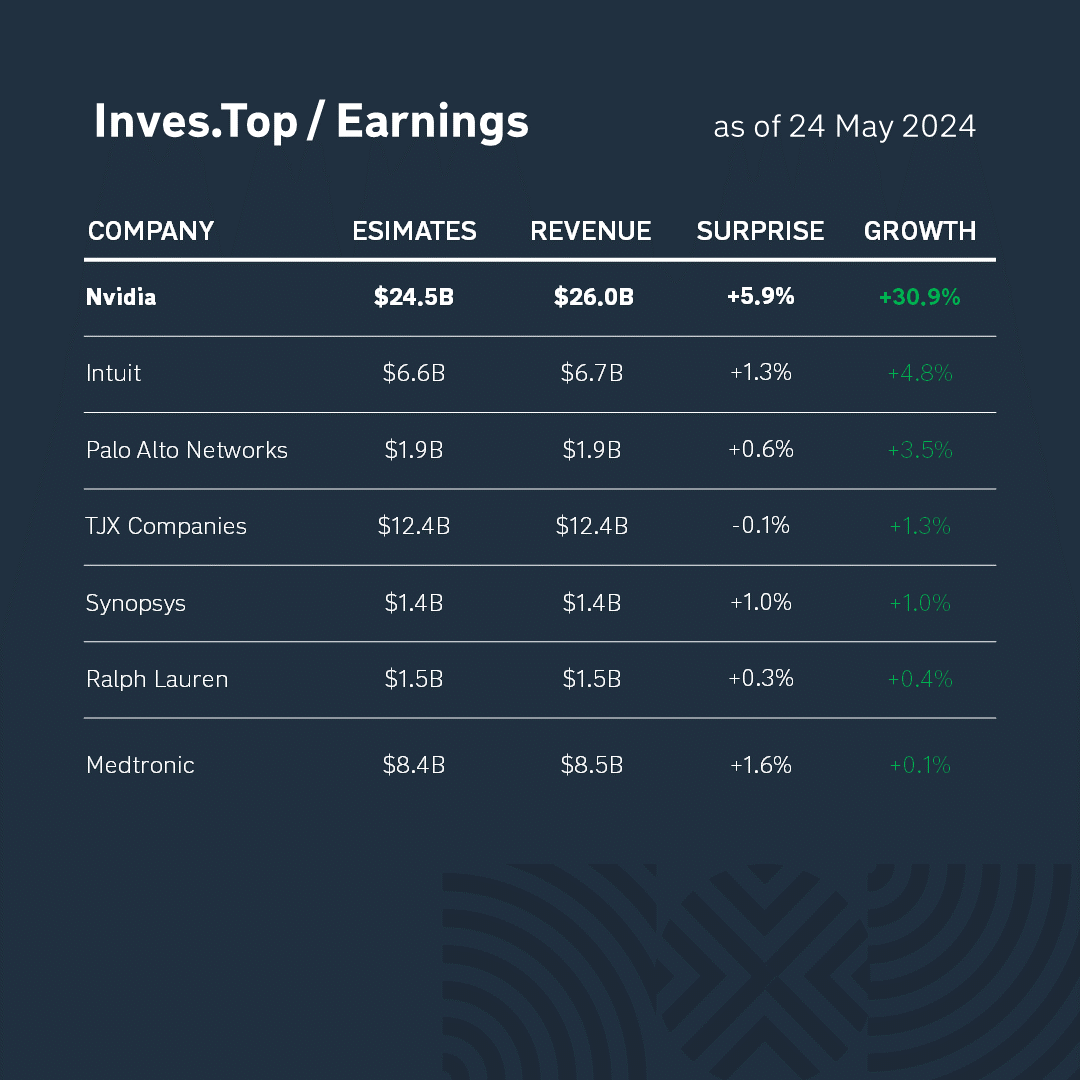

Last week, 13 companies from the S&P 500 index reported.

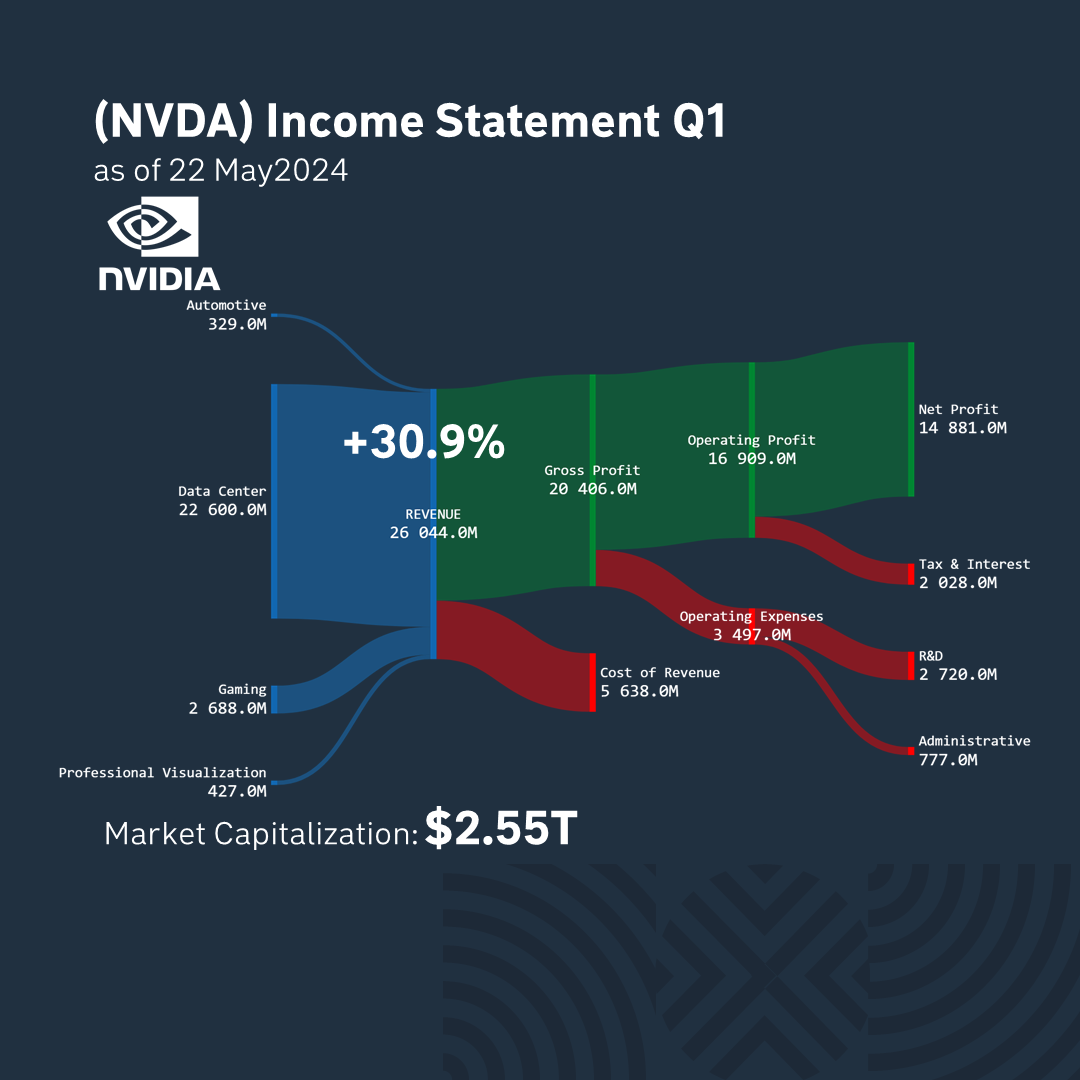

Today, we are going to analyze the results of Nvidia. Its revenue is $26.0B. It grew by +30.9% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by +5.9%. Let’s analyze the company’s business in more detail.

Nvidia is a leader in the market of graphics processors used for computer games, training artificial intelligence models, cryptocurrency mining, etc. For example, one of the most productive processors, Nvidia RTX, has already sold more than 100 million units.

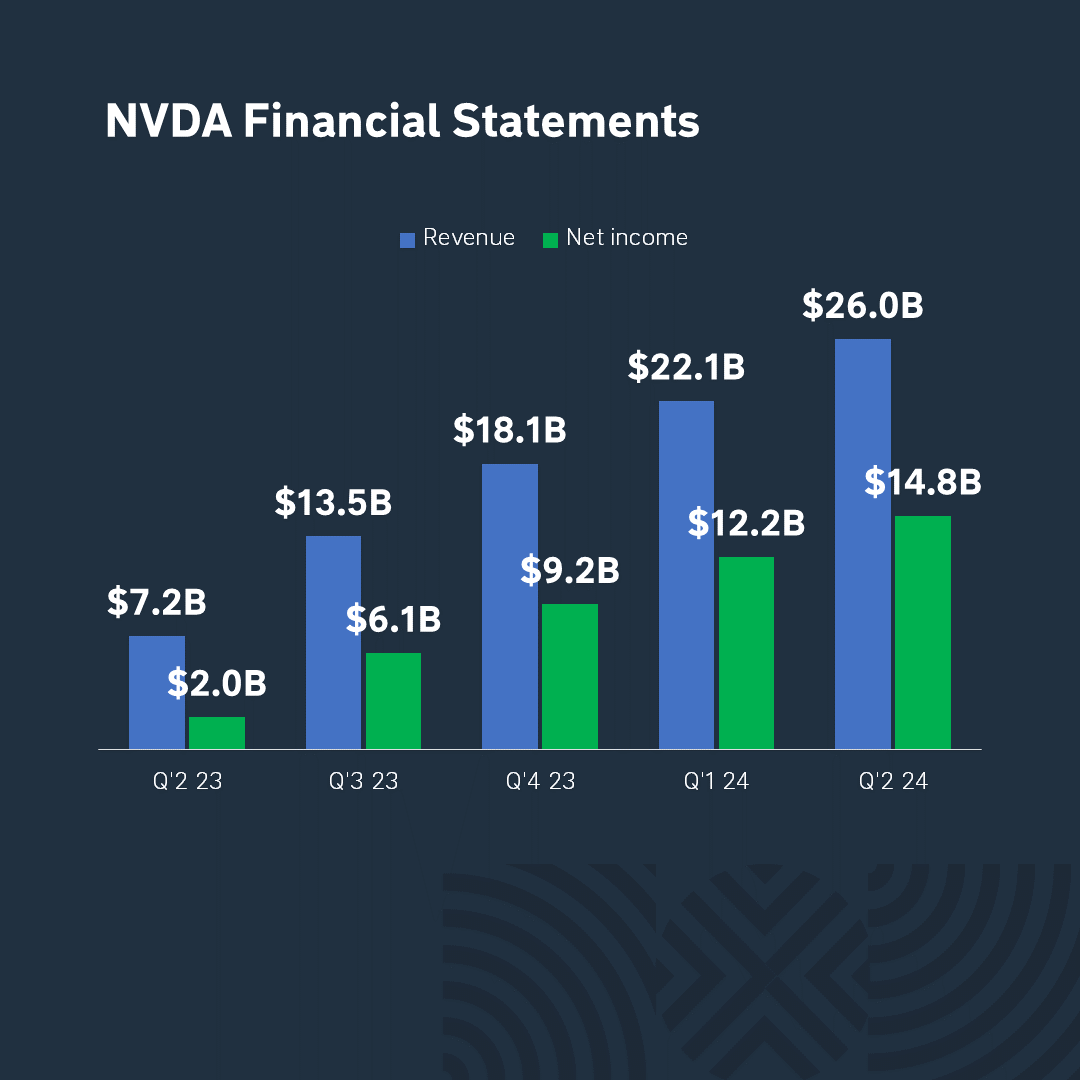

The company’s revenue increased by 3.6 times and net income by 7.4 times compared to the same quarter last year. This was driven by the growing demand for AI products worldwide. The company announced a 10:1 stock split after the market close on June 6 to make investing in the company more affordable. Nvidia has also increased its quarterly dividend payments by 150%, from $0.04 to $0.1, which it plans to pay on June 28.

Manufacturing costs make up 21% of the revenue structure, and gross profit accounts for 79%. Over the past quarter, the company earned a profit of $14.8B. Its market capitalization is $2.55T.

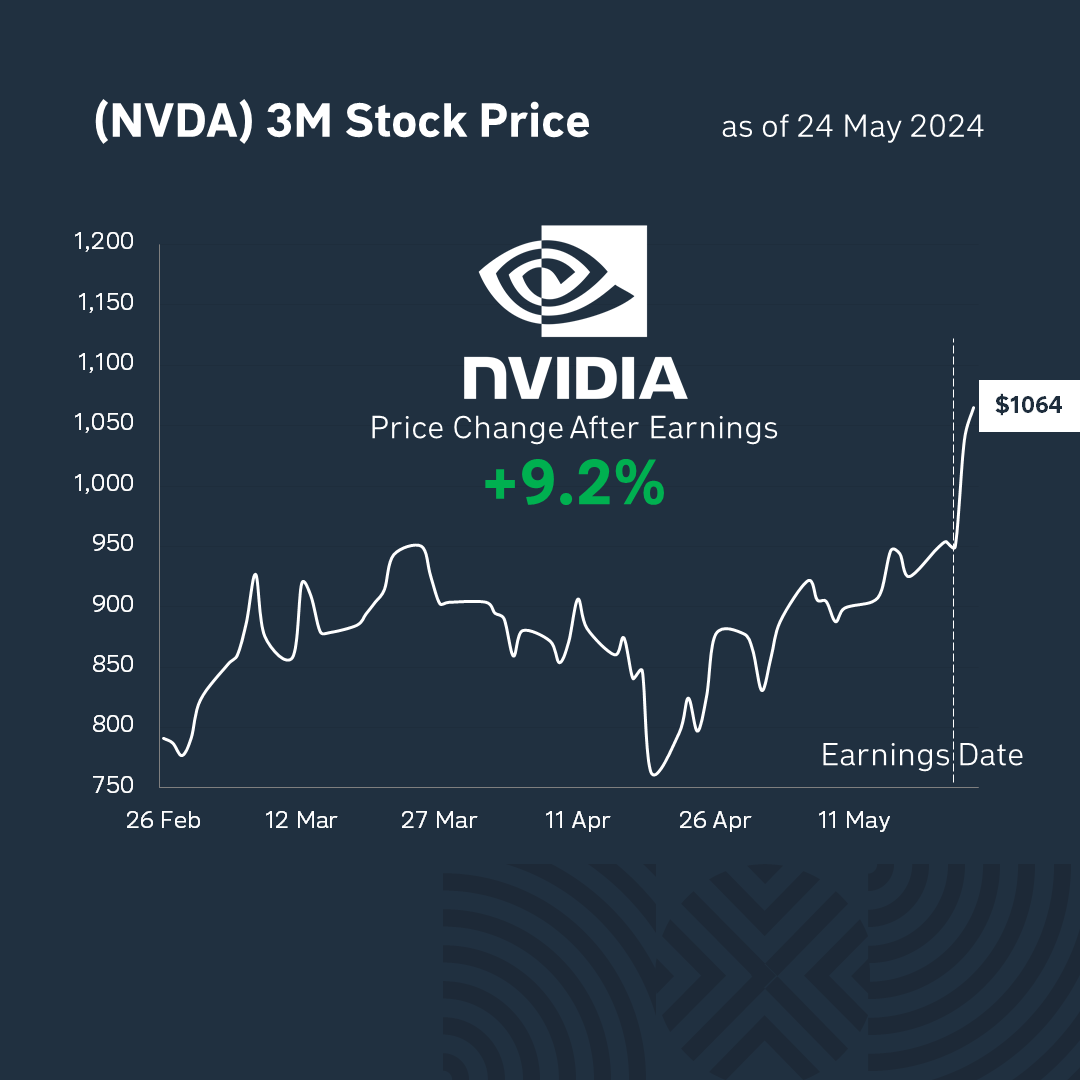

After the publication of the report, Nvidia stock rose by +9.2% to reach $1064 per share. Market participants are pleased with the company’s strong financial results and reacted positively to the company’s development prospects.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter