The corporate reporting period has is going.

In the past week, 174 companies from the S&P 500 index reported for Q1 2024.

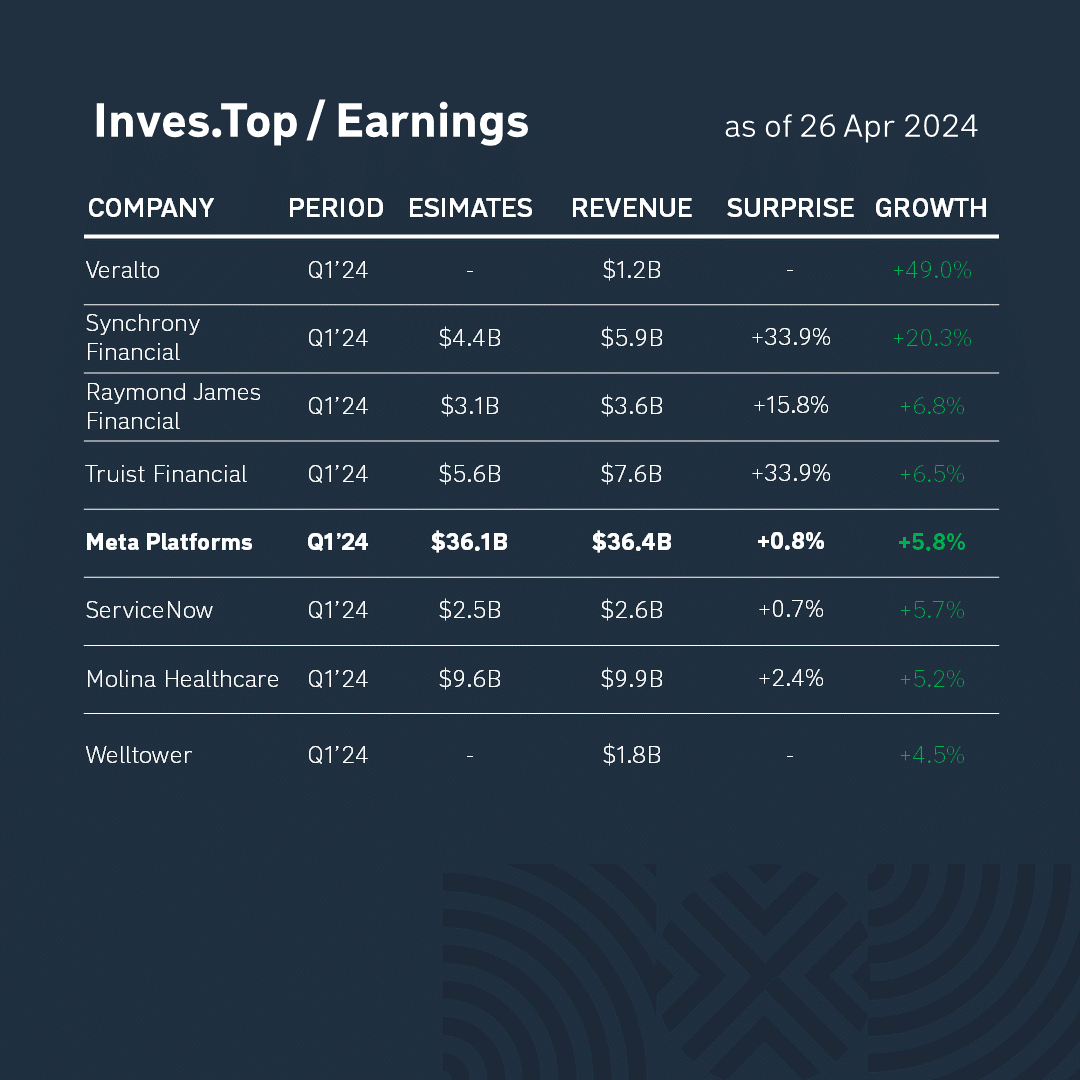

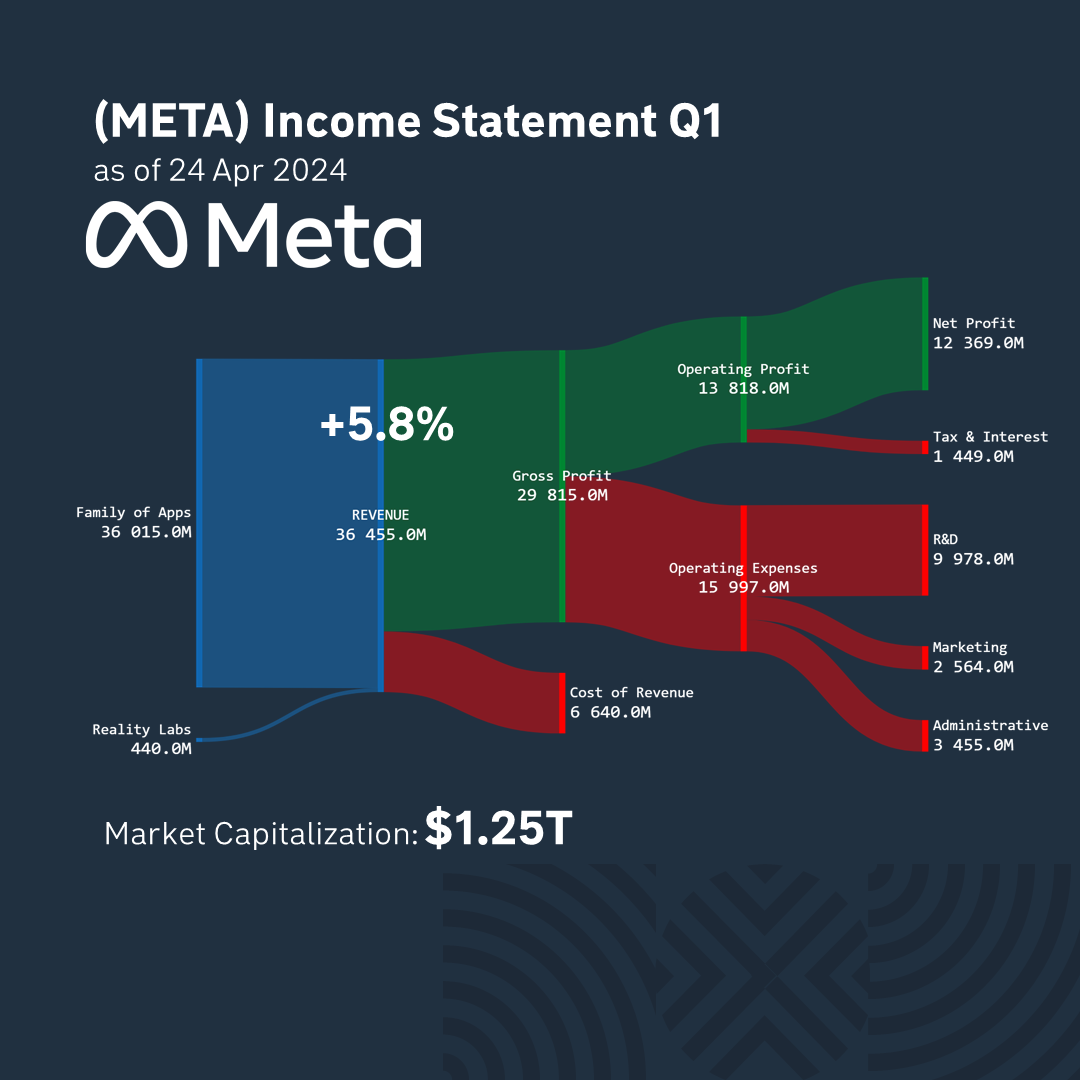

Today, let’s look at the results of Meta Platforms. Its revenue amounted to $36.4B. It grew by +5.8% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by 0.8%. Let’s analyze the company’s business in more detail.

Meta is the world’s largest social network with almost 4 billion active users. The company’s ecosystem consists mainly of Facebook, Instagram, Messenger, and WhatsApp applications. The company generates its main revenue from advertising (over 90%), of which over 45% comes from users in the US and Canada, and over 20% from Europe.

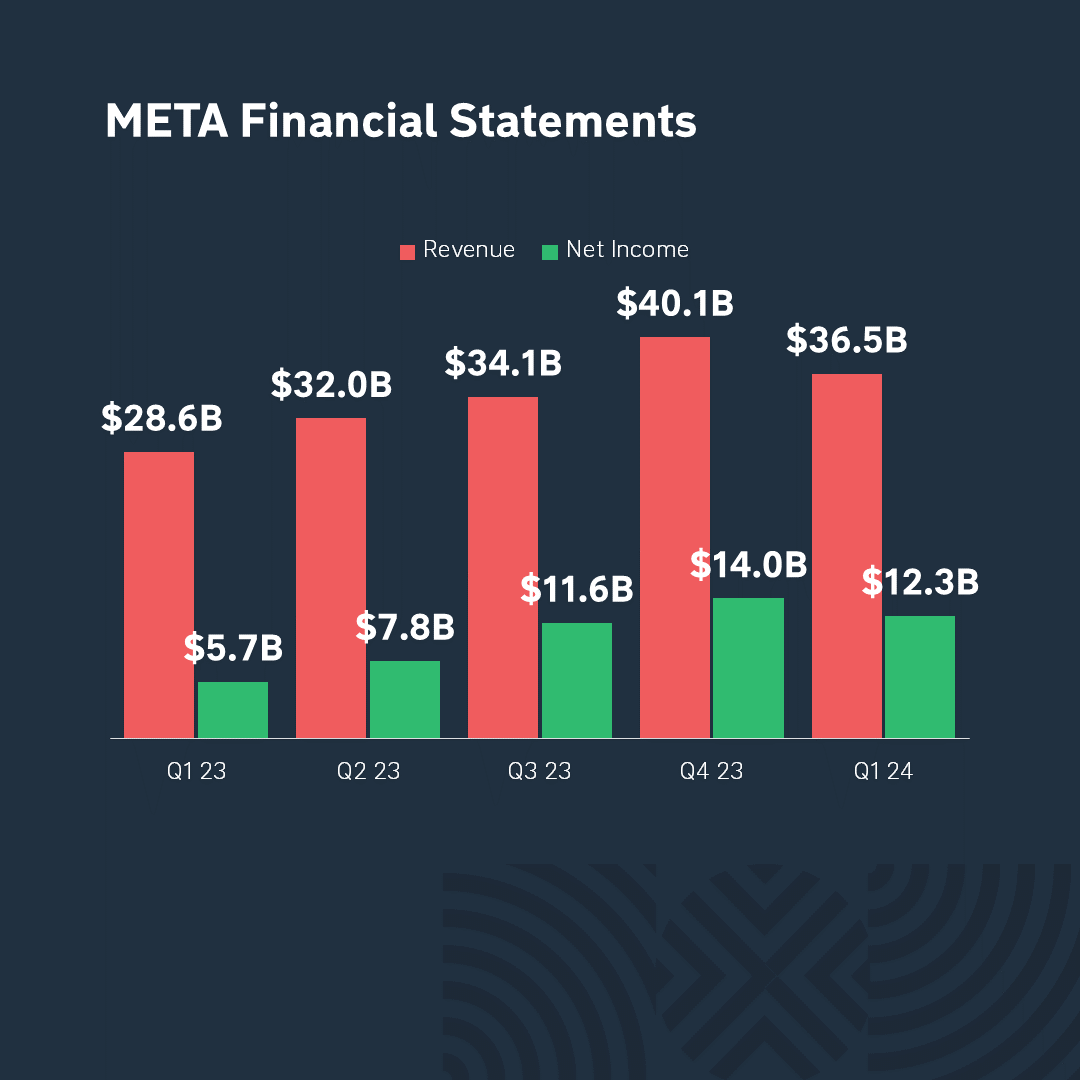

Meta Platforms’ revenue for Q1’24 increased by +27% compared to Q1’23, but decreased by -9.0% compared to the previous quarter Q4’23. The company announced a new free AI assistant Llama 3 that will help compete with rival apps ChatGPT and Gemini.

Manufacturing costs make up 18% of the revenue structure, and gross revenue is 82%. The company made a profit of $12.3B in the last quarter. Its market capitalization is $1.25T.

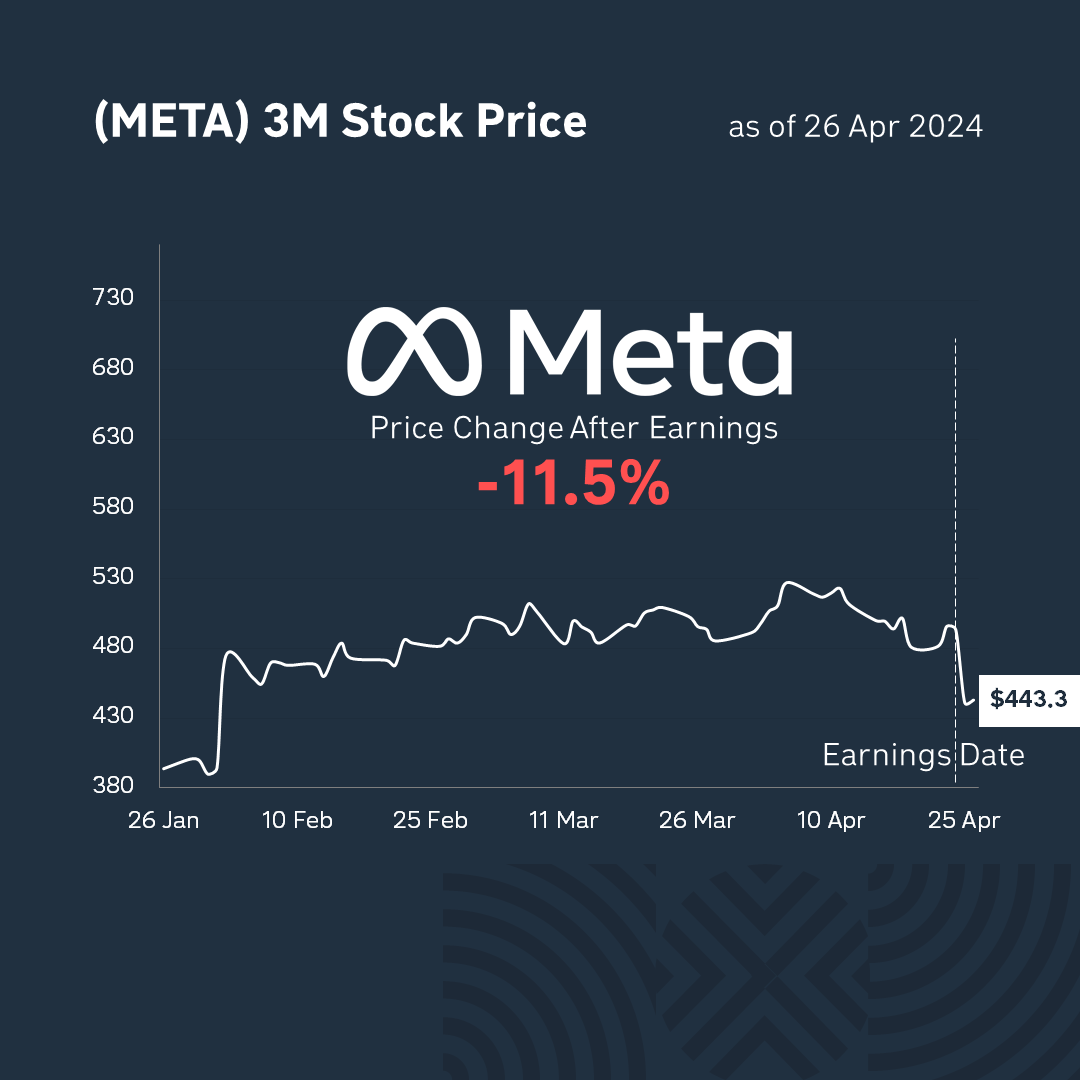

After the publication of the report, Meta Platforms stock fell by -11% to $443 per share. Meta published a revenue forecast in the range of $36.5B-$39B, while analysts are expecting $38.39B, which corresponds to the upper range of the company’s forecast. As a result, the company’s shares declined as market participants were dissatisfied with the company’s financial results and reacted negatively to the company’s revenue forecasts.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter