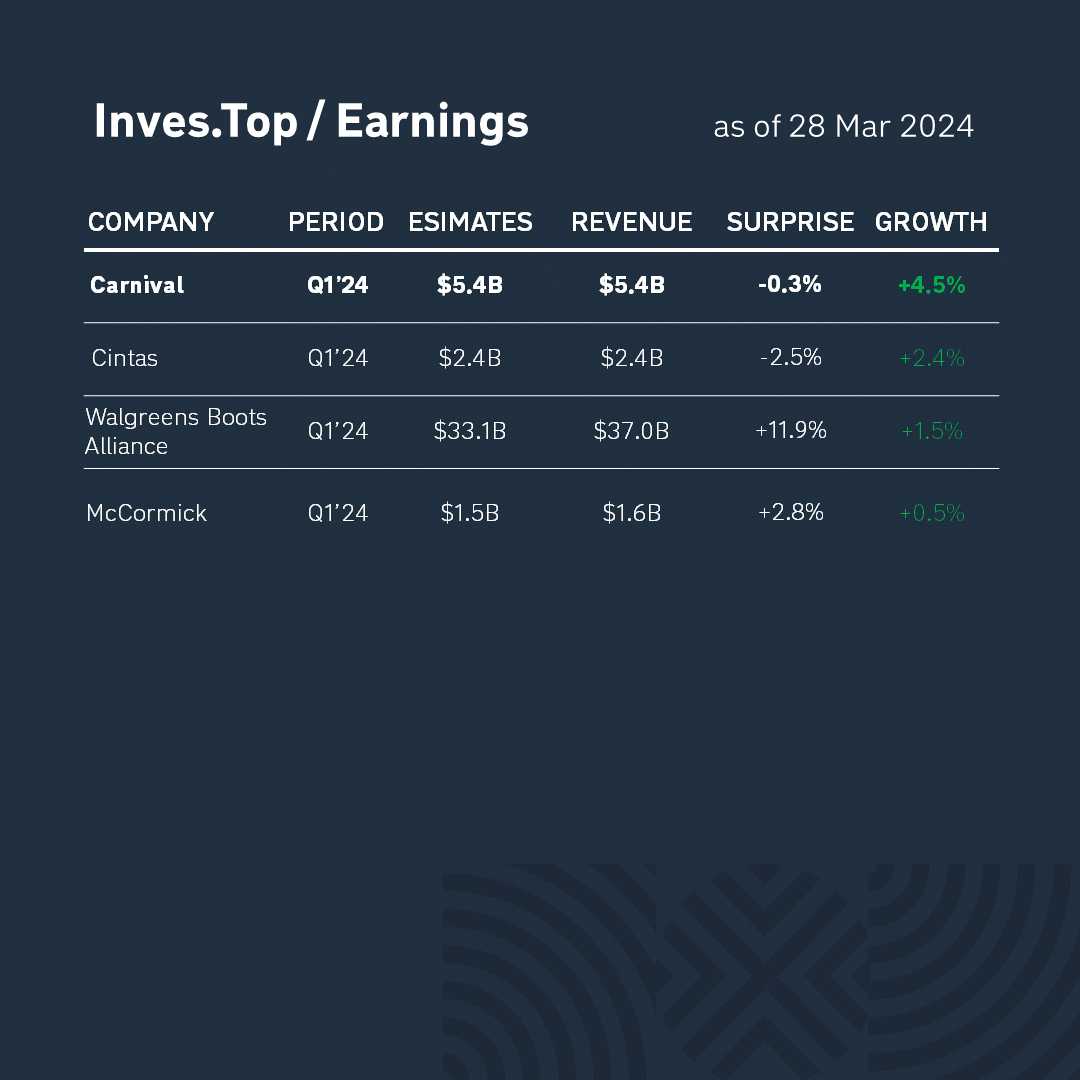

The corporate reporting period has started.

In the past week, 4companies from the S&P 500 index reported for Q1 2024.

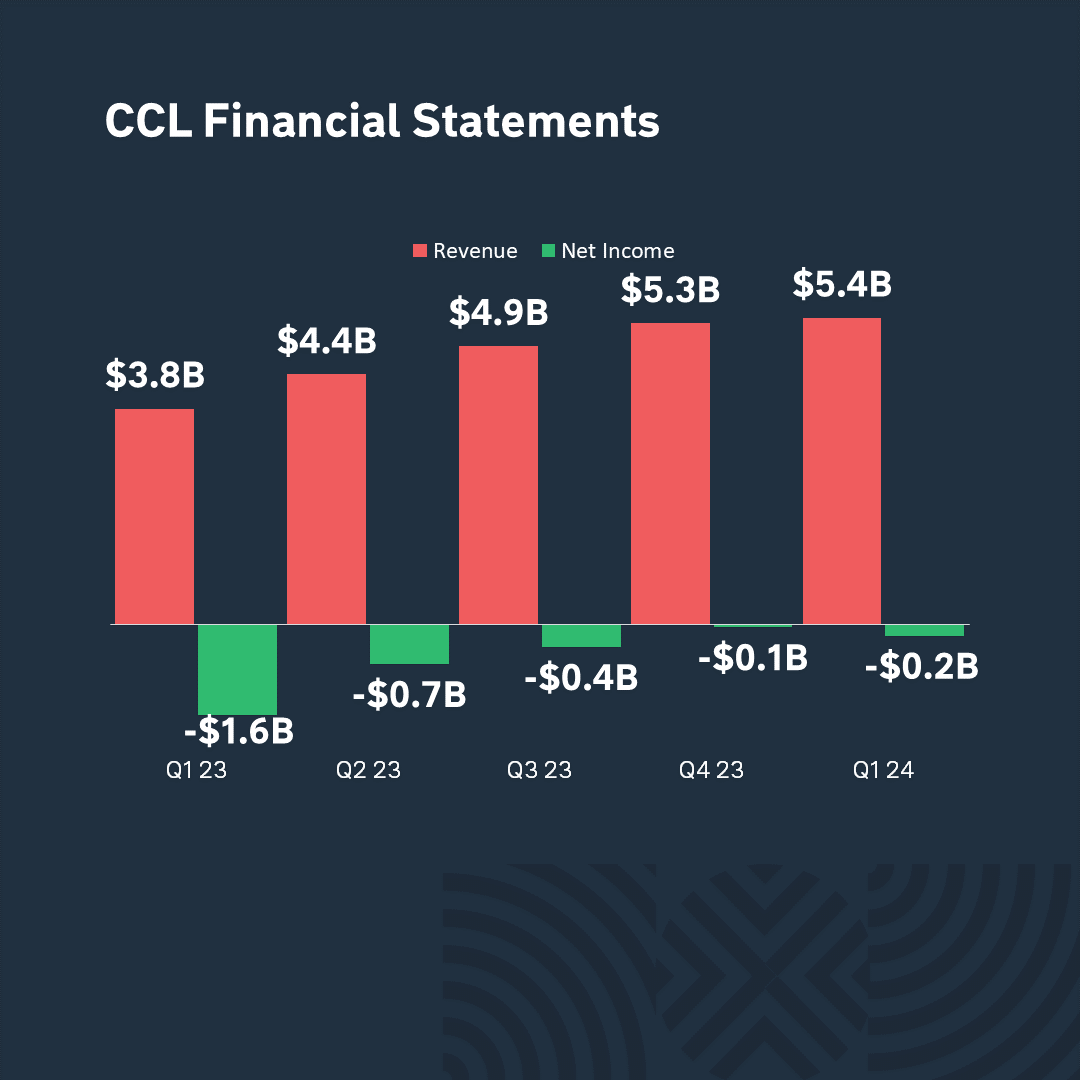

Carnival showed the best result. Its revenue amounted to $5.4B. It increased by +4.5% compared to the corresponding value for the previous quarter. Let’s analyze the company’s business in more detail.

Carnival is the world’s largest cruise line with a fleet of 92 ships and 9 sub-brands. The company also owns real estate in port areas, hotels, and logistics bases in the United States. In 2023, the company attracted 13 million new customers.

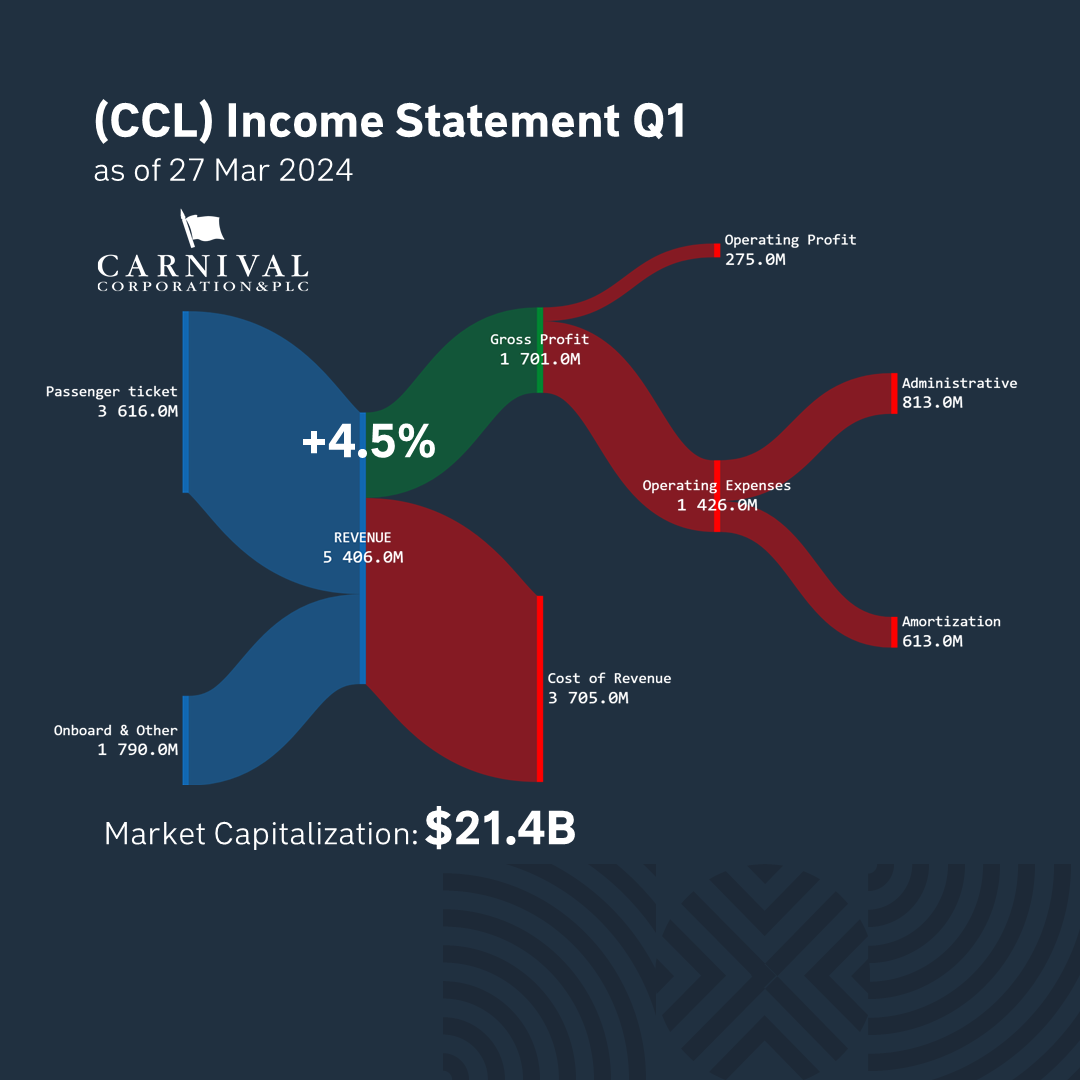

Carnival’s revenue increased by +42% compared to the same quarter last year and reached $5.4B due to a record number of bookings in the last 3 months. The total volume of customer deposits is $7.0B, and their annual growth is +$1.3B. The company has also ordered 5 new cruise ships, which are planned to be produced in 2027-2028.

68% of the revenue structure is made up of manufacturing costs, and 32% is gross revenue. Over the past quarter, the company suffered a loss of $214M. Its market capitalization is $21B.

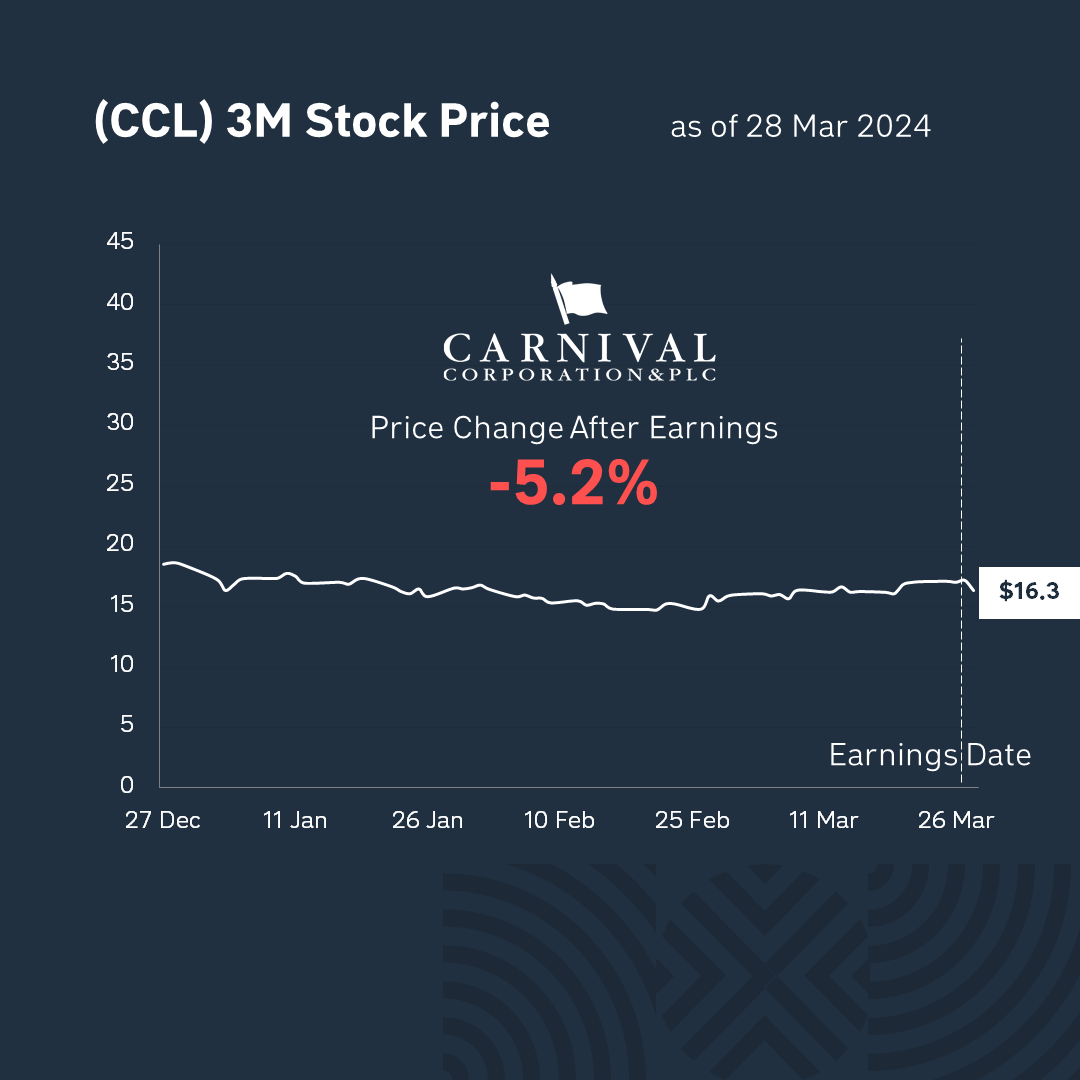

After the publication of the report, Carnival’s shares fell by -5.2% to $16 per share. In general, market participants are not satisfied with the company’s current financial results and reacted rather cautiously to forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter