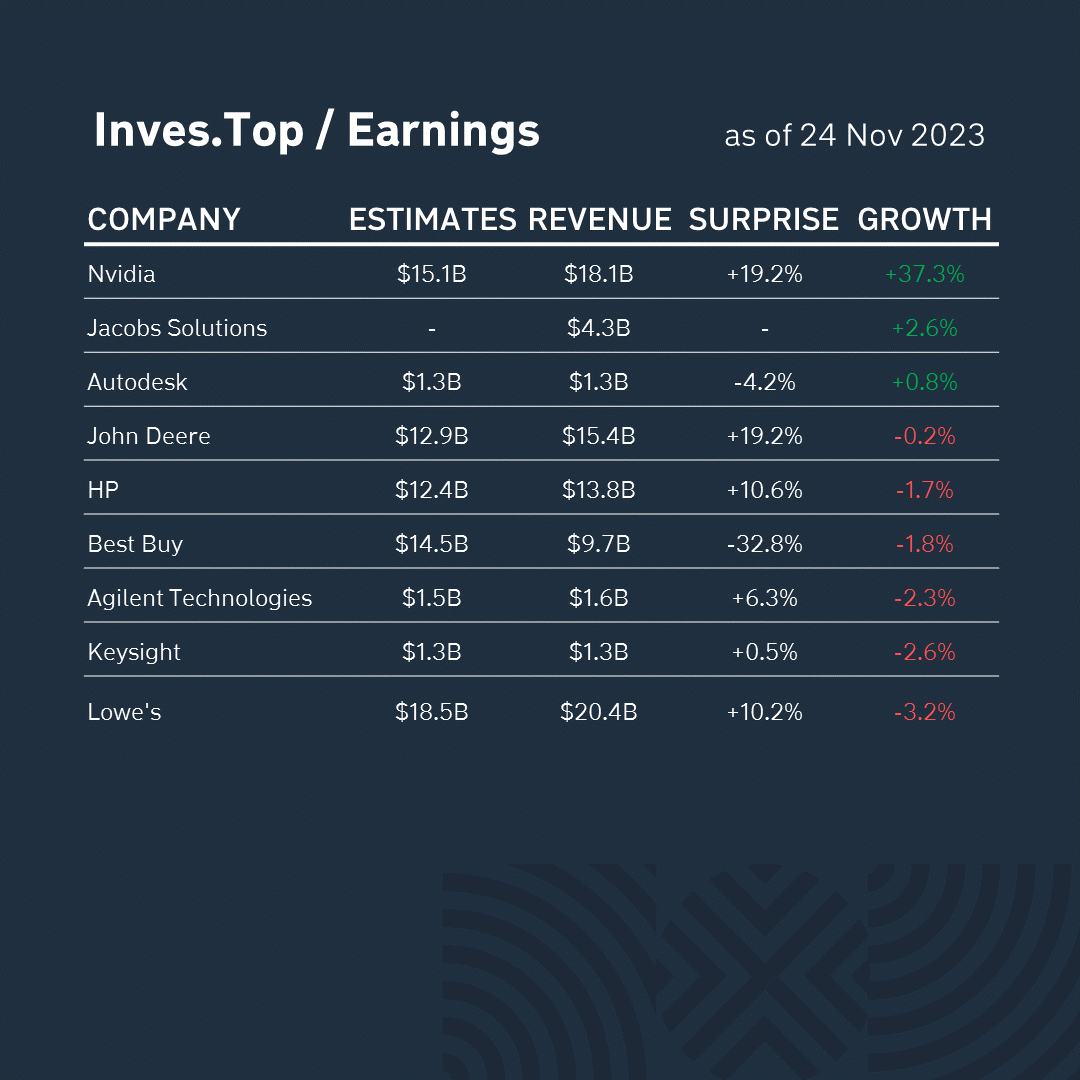

The corporate reporting period for Q3 2023 is coming to the end. Over the past week, 9 companies from the S&P 500 index have already reported for the third financial quarter.

Nvidia was the best performer. Its revenue grew by +37.3% compared to the corresponding value for the previous quarter and was +19.2% higher than analysts’ expectations. Let’s analyze the company’s business in more detail.

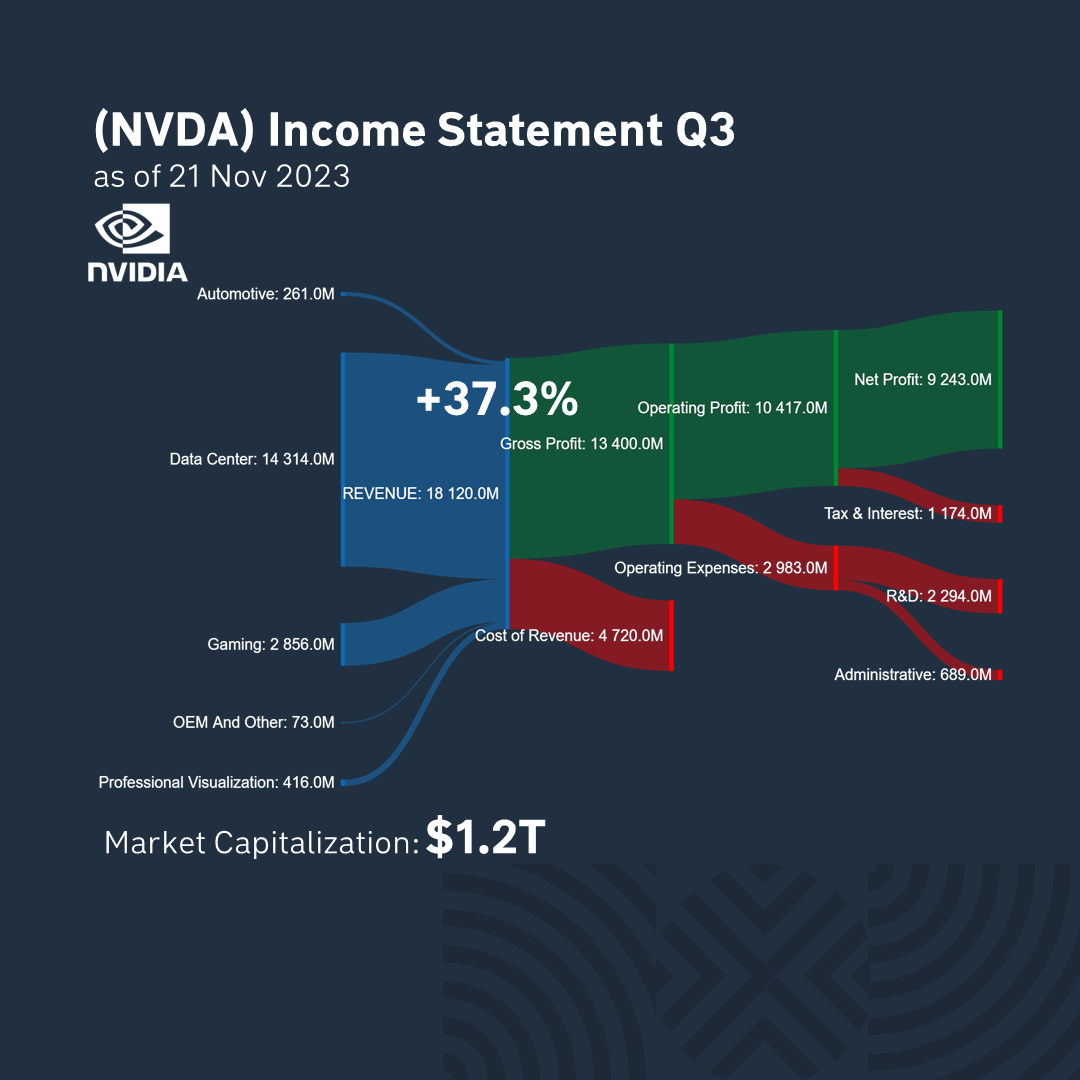

Due to the excitement around artificial intelligence, Nvidia achieved a record quarterly revenue of $18.2B. First of all, the catalyst was the data center segment, which accounted for $14.5B, or more than 80% of the company’s revenue. Data center revenues grew by +40.6% quarter-on-quarter and by +278.6% quarter-on-quarter. For the next quarter, the company’s management expects continued growth in demand for AI cloud computing products, and therefore forecasts revenue of $20B.

The company’s revenue for Q3 2023 is $18.1B. Of this volume, 27% of the revenue structure is accounted for by manufacturing costs and 73% by gross profit. Over the past quarter, the company made a profit of $9.2B. And its market capitalisation is now $1.2T.

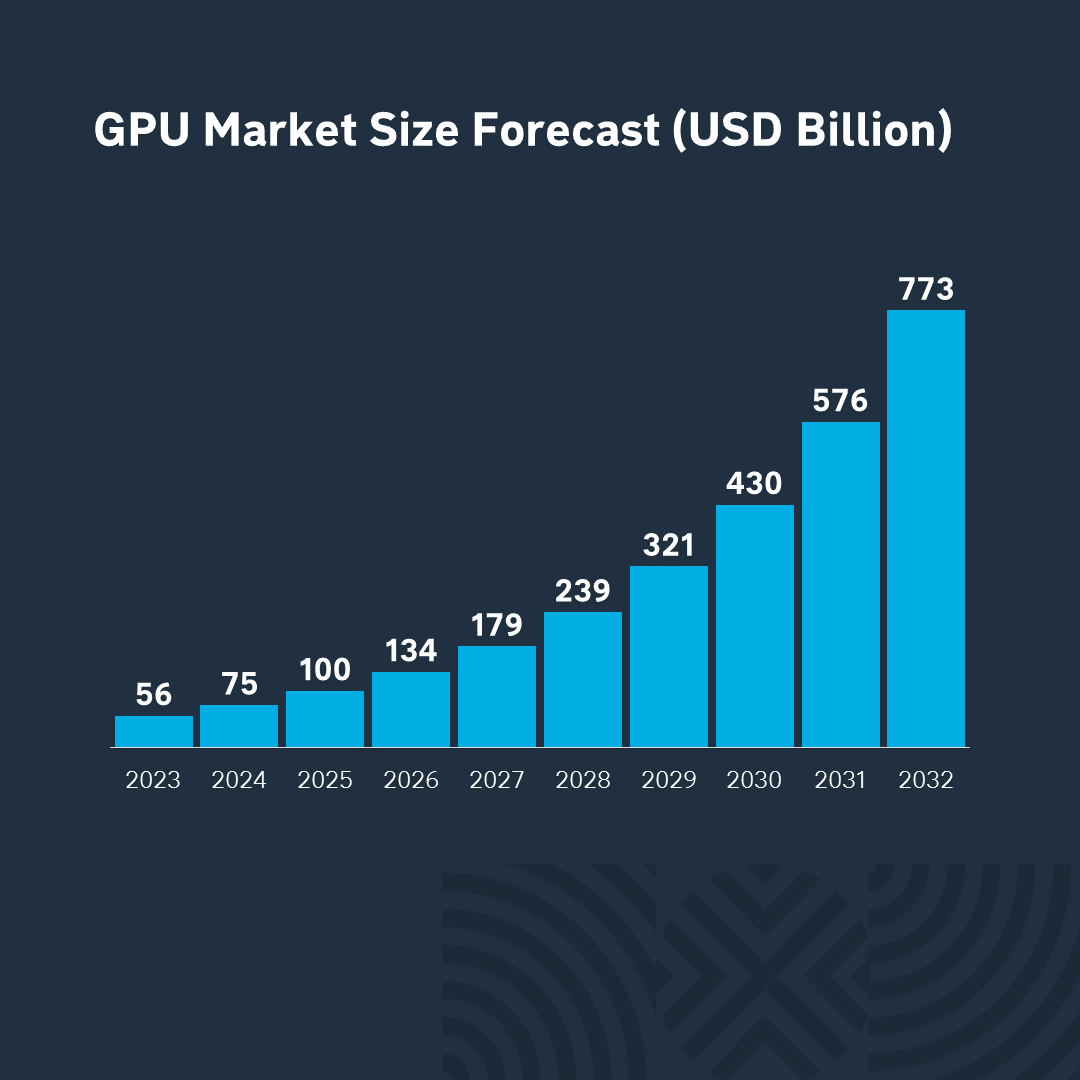

In 2006, scientists at Stanford University discovered that GPUs have another special property – they can accelerate mathematical operations. Thus, Nvidia has become one of the key figures in the artificial intelligence revolution. The company owns about 95% of the machine learning GPU market. For example, 10K Nvidia processors combined in a Microsoft supercomputer were used to train ChatGPT. According to forecasts, the global graphics processing unit (GPU) market is expected to exceed $56B in 2023 and reach $773B by 2032.

The day before the report was published, the company’s shares reached a record high of $504/share. However, after the financial results were released, its value dropped by -2.4%. Although the company surpassed the previous quarter’s revenue and forecasts, this was not enough for investors. The market probably priced in an even bigger difference between the expected and actual results. However, Nvidia shares have already shown a threefold increase since the beginning of the year, and therefore such episodes look like a small correction in the overall bullish trend.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter