The week was short due to the US Independence Day, but that didn’t stop the S&P 500 and Nasdaq from setting new historical records. Despite the fact that all possible indicators are begging for a correction, the markets continue to rise – human greed really knows no bounds. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

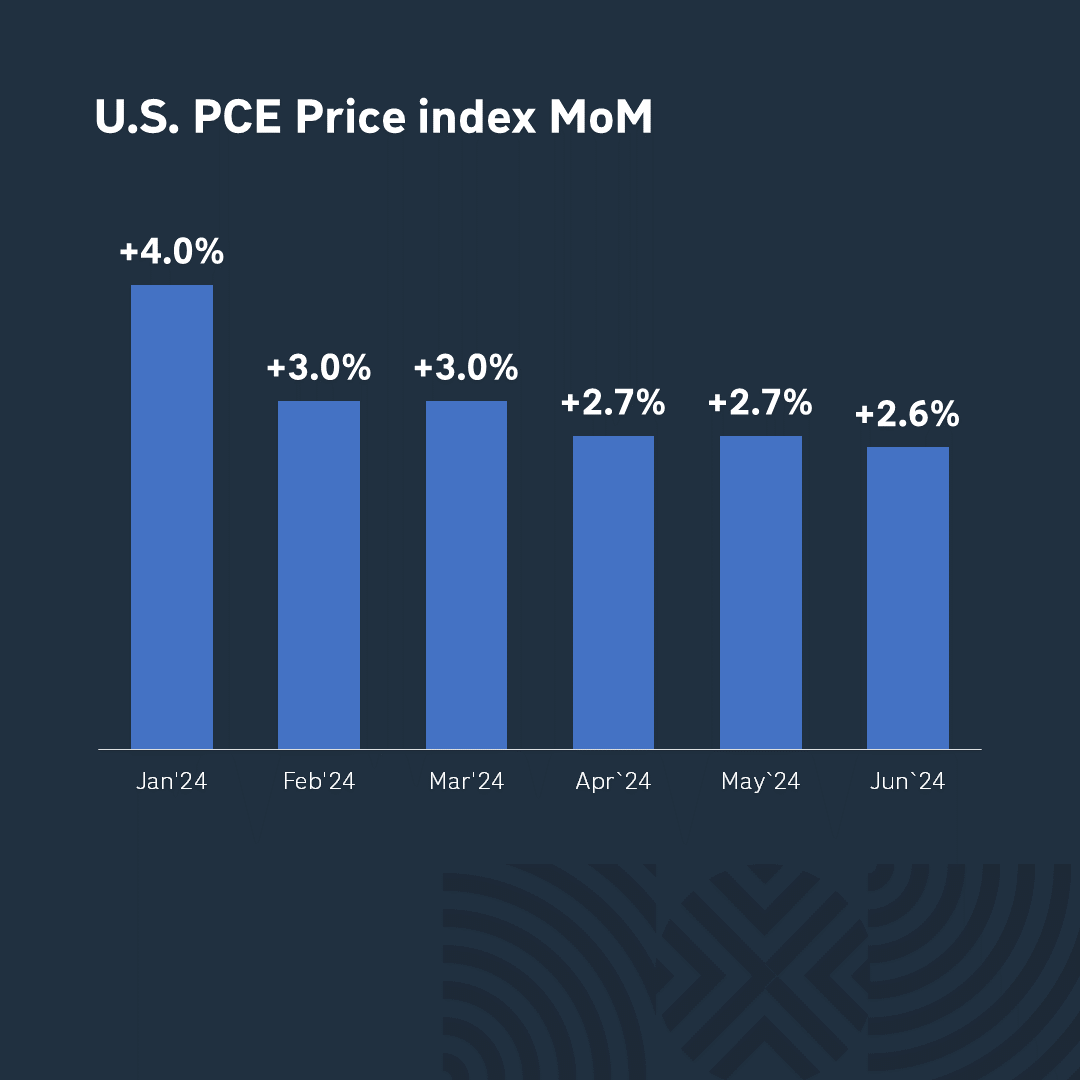

For almost a year now, the main discussion about the markets has been centered on inflation and interest rates, which the Fed is in no hurry to lower. This week, several important economic indicators showed a cooling labor market and a slowing economy. Even Powell acknowledged that the economy is moving toward lower inflation, but emphasized the need for more evidence to cut rates.

Last week, the markets were discussing the possibility of Biden’s withdrawal from the election. Bookmakers estimate the probability of this at more than 50%. This prompts investors to review their portfolios, focusing on a possible Trump victory, expecting tax cuts and increased protectionism. Accordingly, bets are rising on a stronger dollar, higher bond yields, and growth in shares of banks, energy, and pharmaceutical companies.

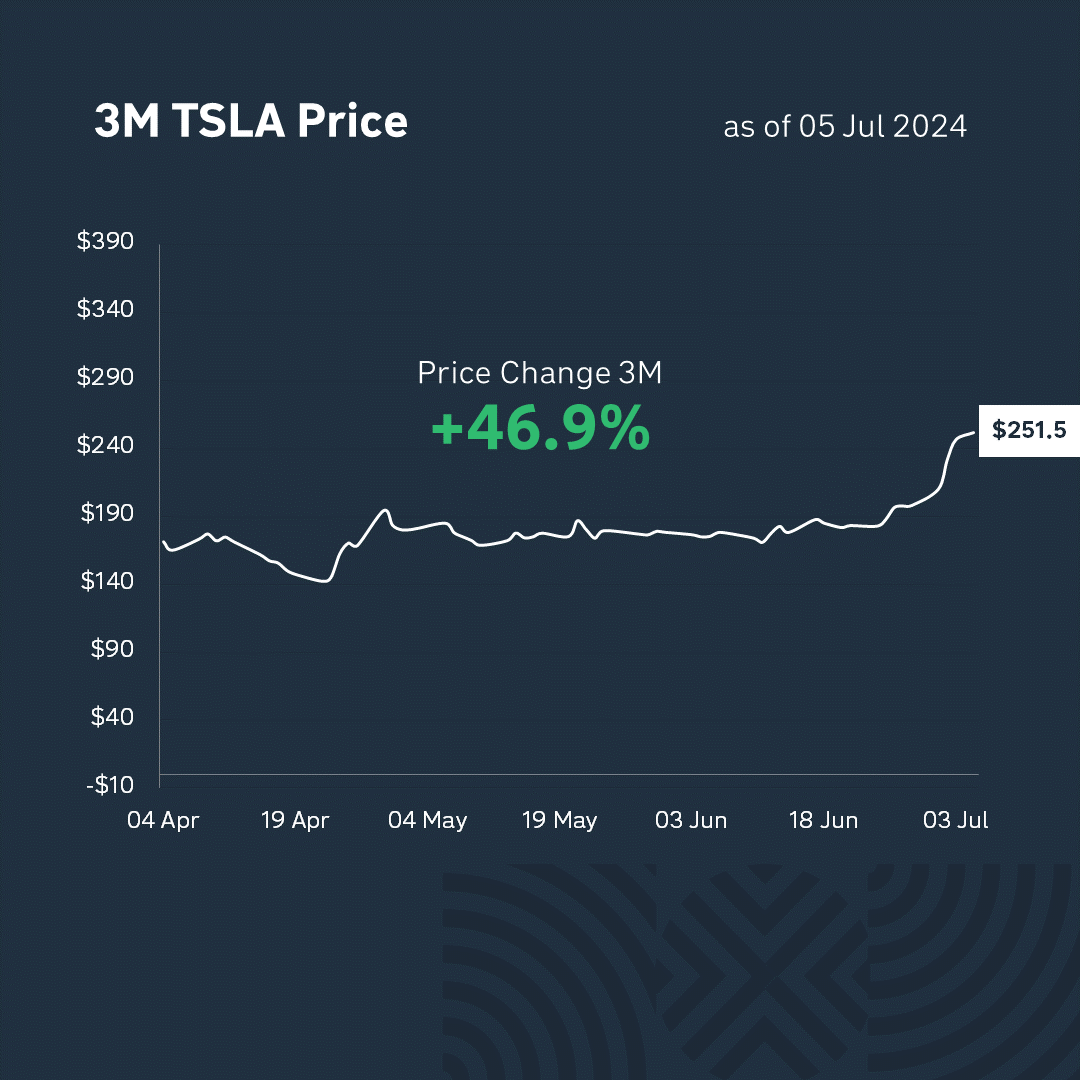

The season of quarterly financial results has not yet begun, but there is already some data for forecasts. This week, investors learned about Tesla’s car deliveries for the last quarter. The results were worse than last year, but better than analysts expected. This encouraged investors who believe that the worst times for Tesla are over. As a result, Tesla shares rose by more than 20% in three days, confirming that the market is always ready to buy hope.

At the end of the week, investors received data on the labor market, which would have been considered the main event if not for the news about Biden. The number of jobs created exceeded expectations, but was lower than a month earlier, and unemployment rose. This indicates a cooling in the labor market and increases the chances of a Fed rate cut, possibly as early as September, as the futures market predicts.

What’s the bottom line? The markets are rising, greed is winning, and a correction is becoming an increasingly logical prediction… Although, as we know, logic does not always work when emotions are involved.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.