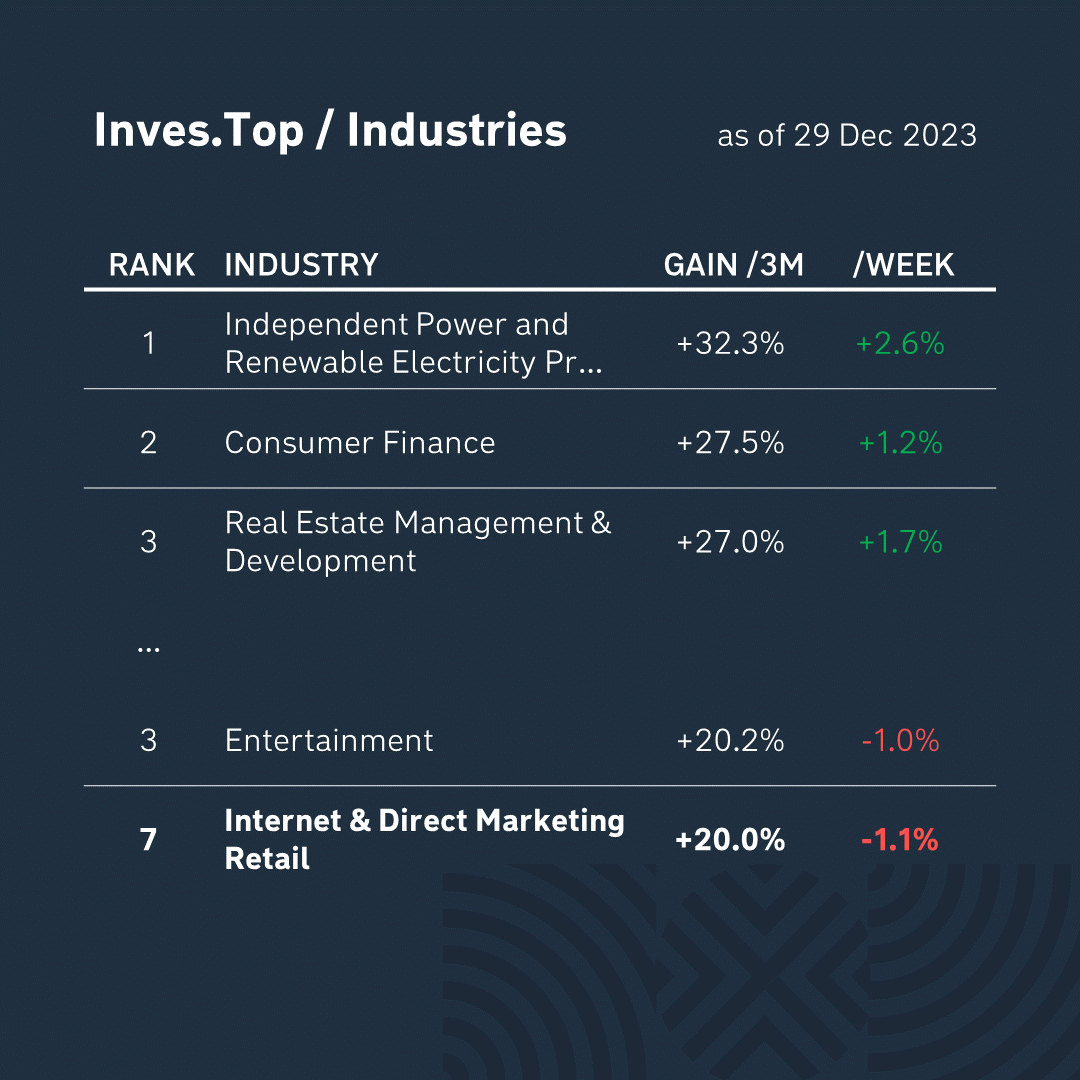

As we noted in last weekly review, over the past three months, one of the leaders of growth in the S&P 500 index has been the Internet & Direct Marketing Retail Industry (+20.0%).

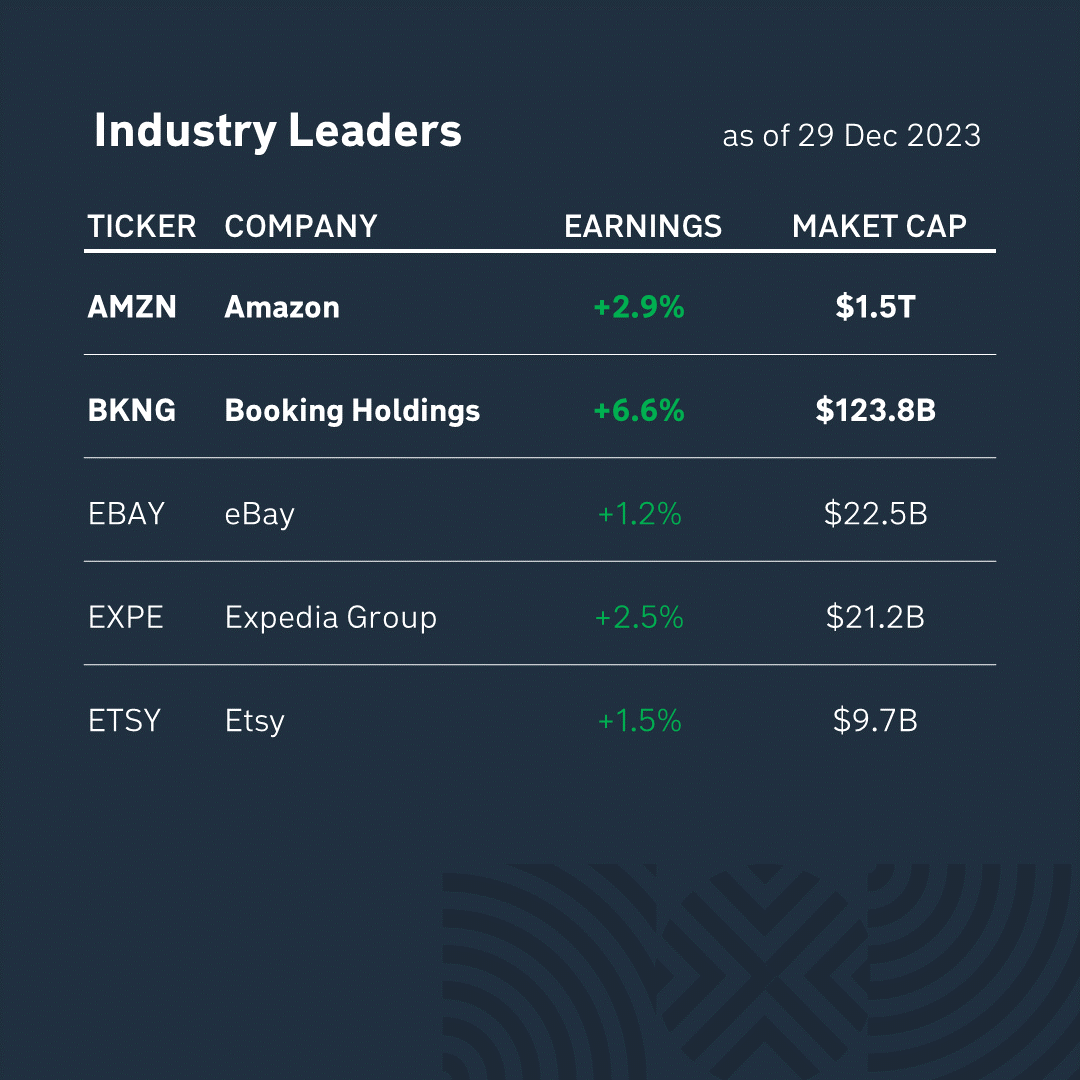

The largest (by market capitalization) companies in this industry: Amazon ($1.5T), a leader in e-commerce and cloud computing, and Booking Holdings ($123.8B), which provides online services for booking apartments, buying tickets and renting vehicles.

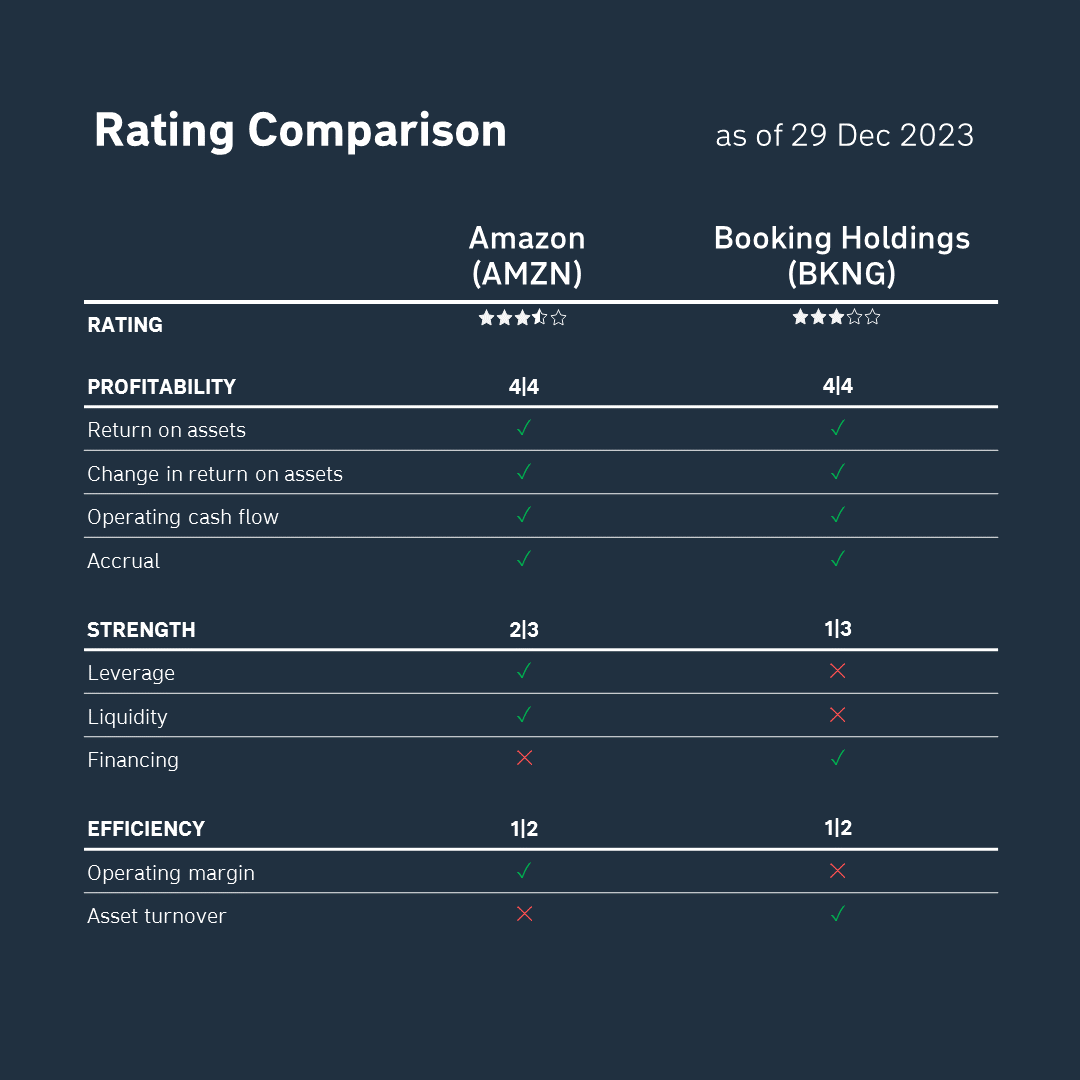

Based on the latest quarterly reports, we analyzed each company’s profitability, strength, and efficiency criteria according to the methodology of Stanford University professor Joseph Piotroski.

As you can see, in terms of fundamental data, both companies are currently performing similarly in the profitability and efficiency categories. However, Amazon is better than Booking Holdings in terms of strength. Therefore, Jeff Bezos’ company looks more preferred for mid- and long-term investments.

Over the past 3 months, Amazon shares have risen by +20% and Booking Holdings by +14% (the S&P 500 index is up +10%). Amazon has not only outperformed its closest competitor, but also demonstrated twice the yield compared to the index.

So, the winner in today’s battle is Amazon (AMZN). The company’s business looks healthier in terms of financial leverage and liquidity, and its shares show better dynamics.

* It is not an investment advisory. It is up to each investor to decide which criteria to prioritize when making an investment decision, taking into account their goals and individual risk tolerance.