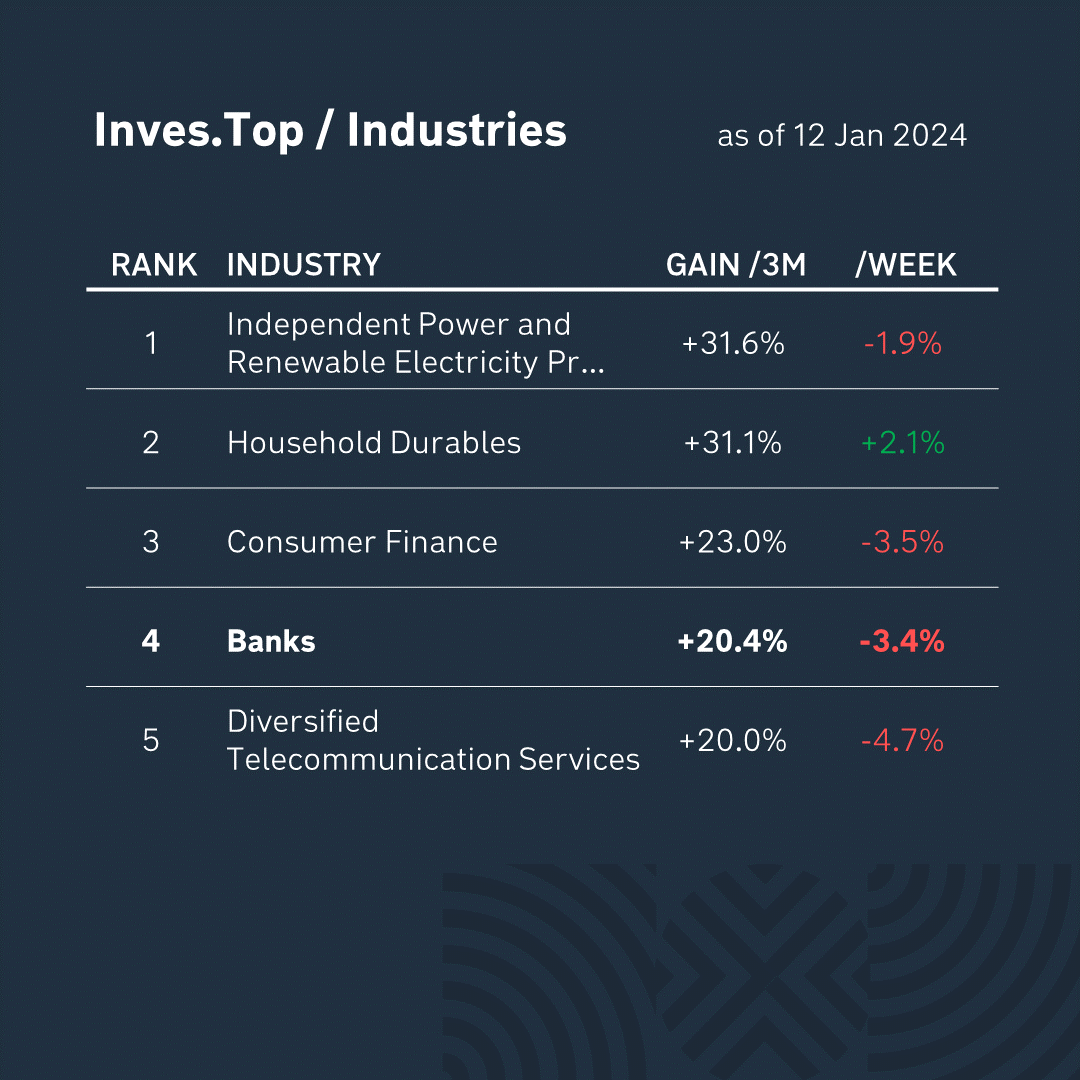

As we noted in last week’s issue, over the past three months, one of the leaders of growth in the S&P 500 index has been Banks Industry (+20.4%).

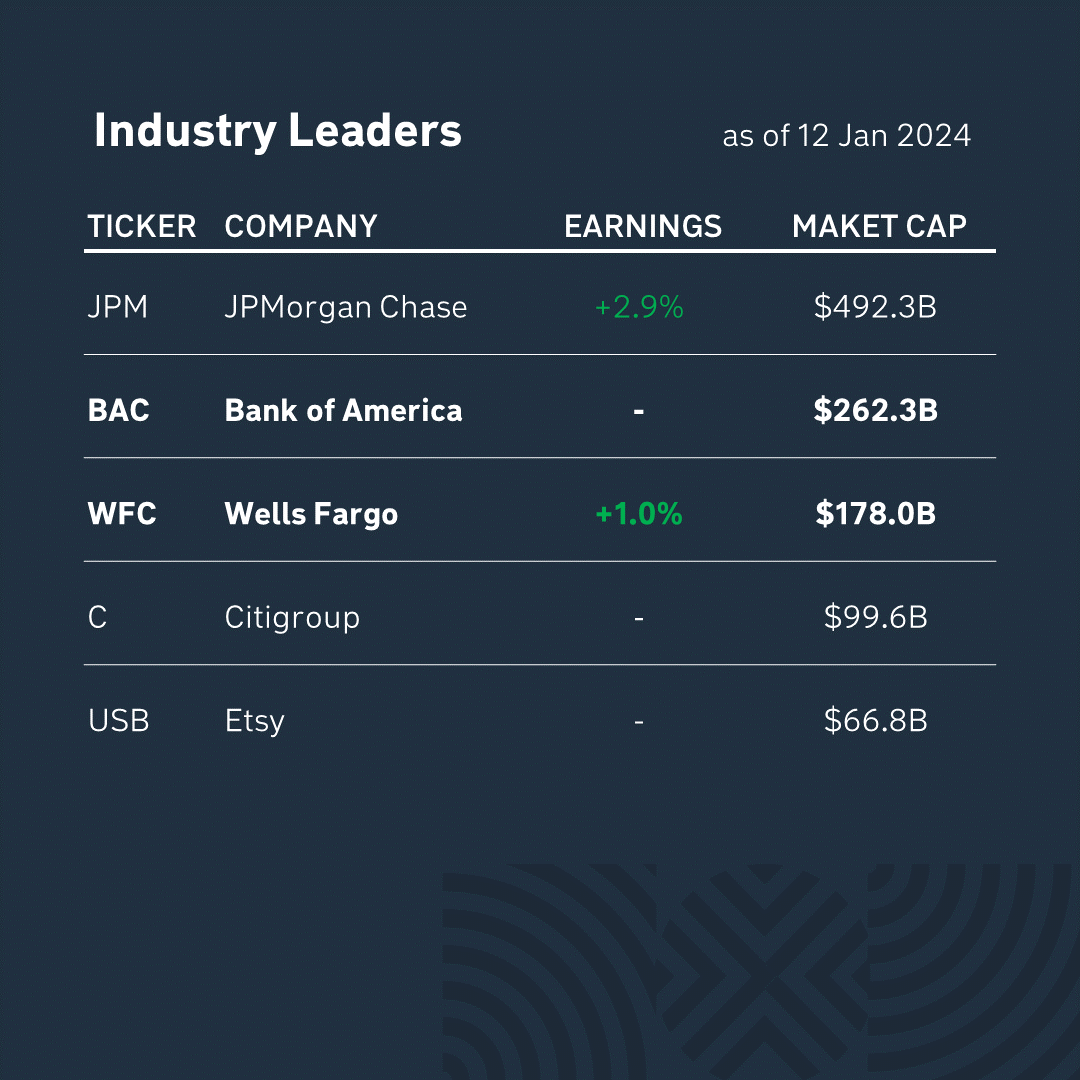

Some of the largest companies in this industry (by market capitalization) are Bank of America ($262.3B) and Wells Fargo ($178.0B). They have $2.5T and $1.9T under management, respectively.

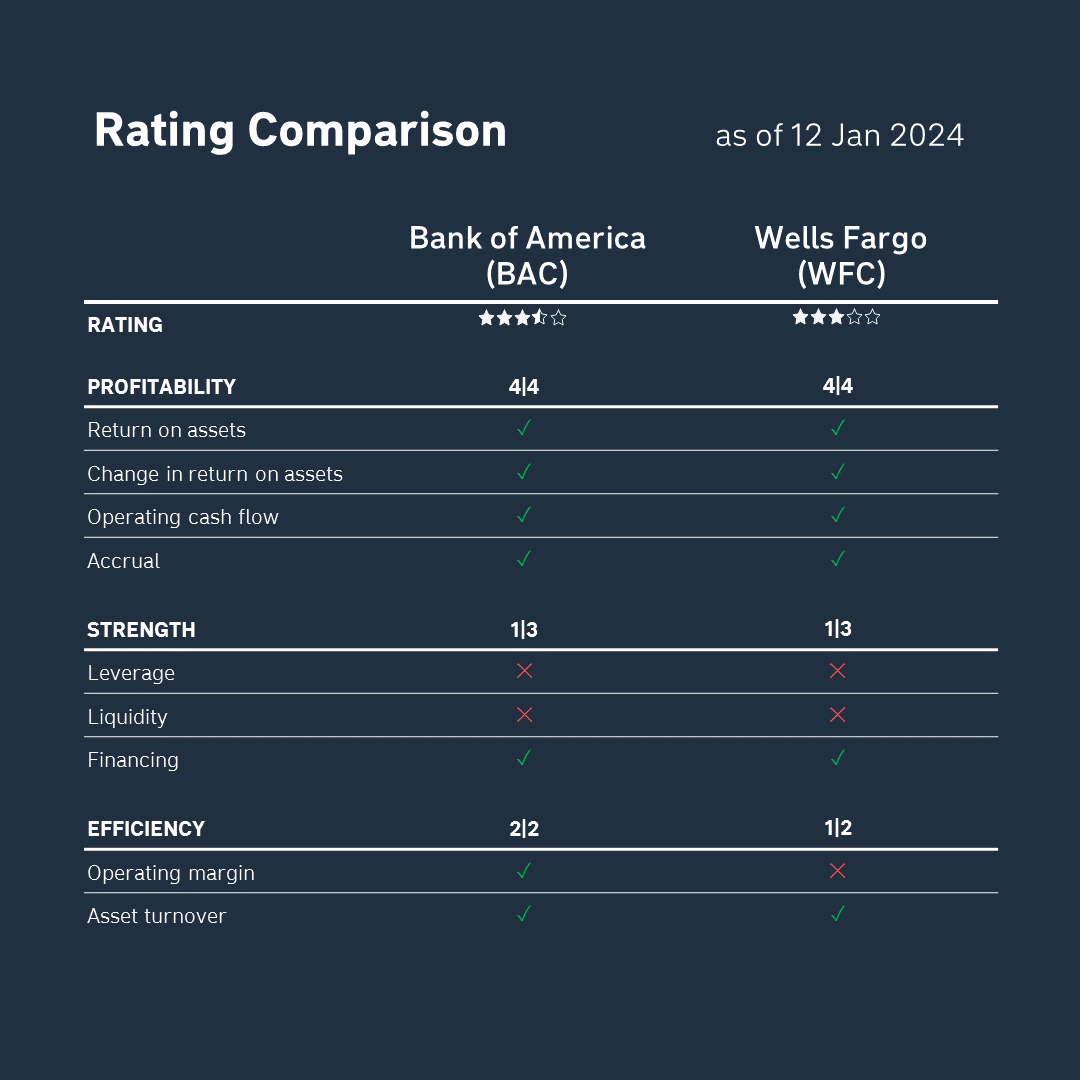

According to the latest quarterly reporting data, we analyzed each company’s profitability, strength, and efficiency criteria using the methodology of Stanford University professor Joseph Piotroski.

As you can see, in terms of fundamentals, both companies are currently performing similarly in the profitability and sustainability categories. However, Bank of America outperforms Wells Fargo in terms of efficiency. Therefore, it looks more attractive for medium- and long-term investments.

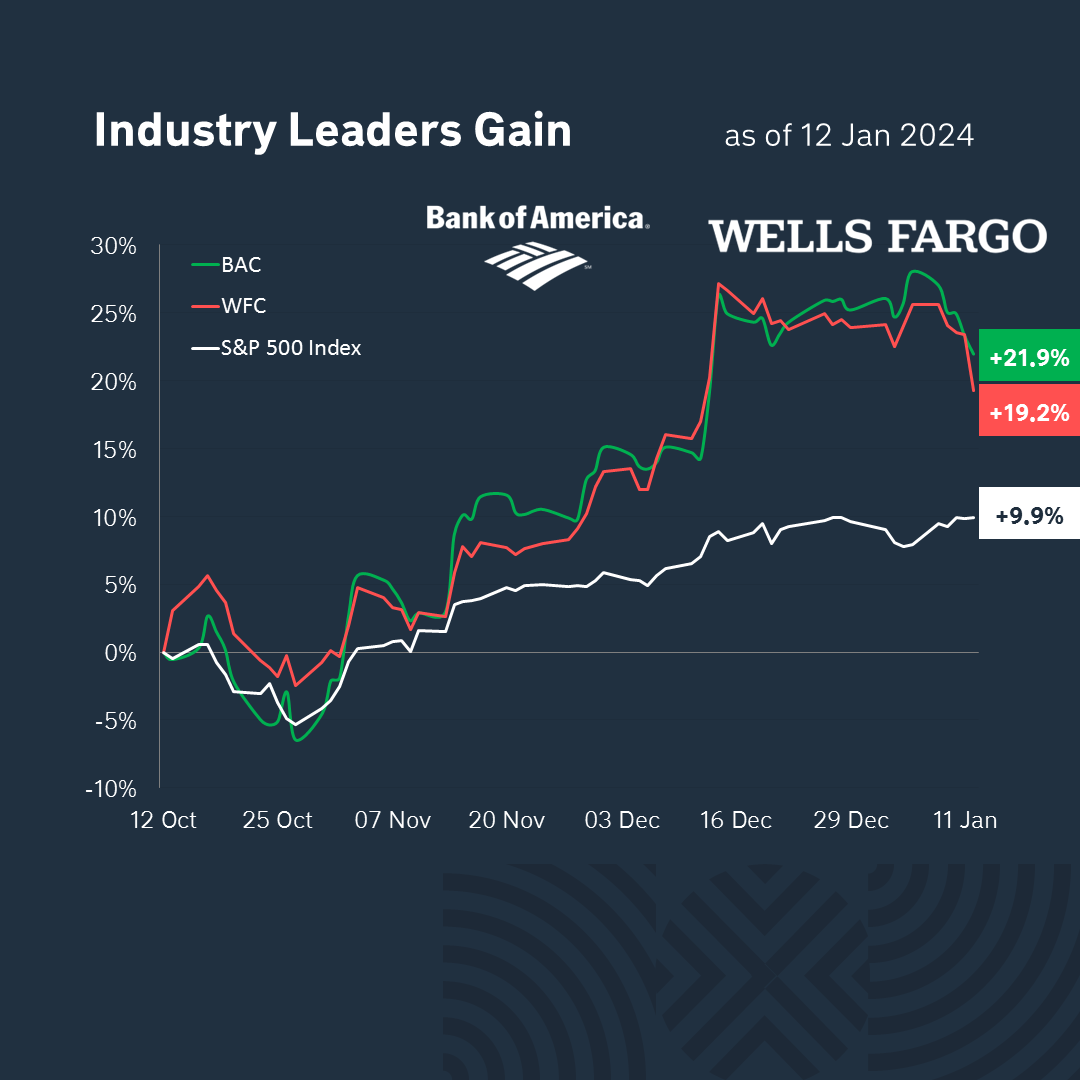

Over the past 3 months, Bank of America shares have risen by +21% and Wells Fargo by +19% (the S&P 500 index is up +9.9%). Bank of America has not only outperformed its closest competitor, but also demonstrated twice the yield of the index.

So, the winner in today’s battle is Bank of America (BAC). The company’s business looks healthier in terms of operating margin, and its shares show better dynamics..