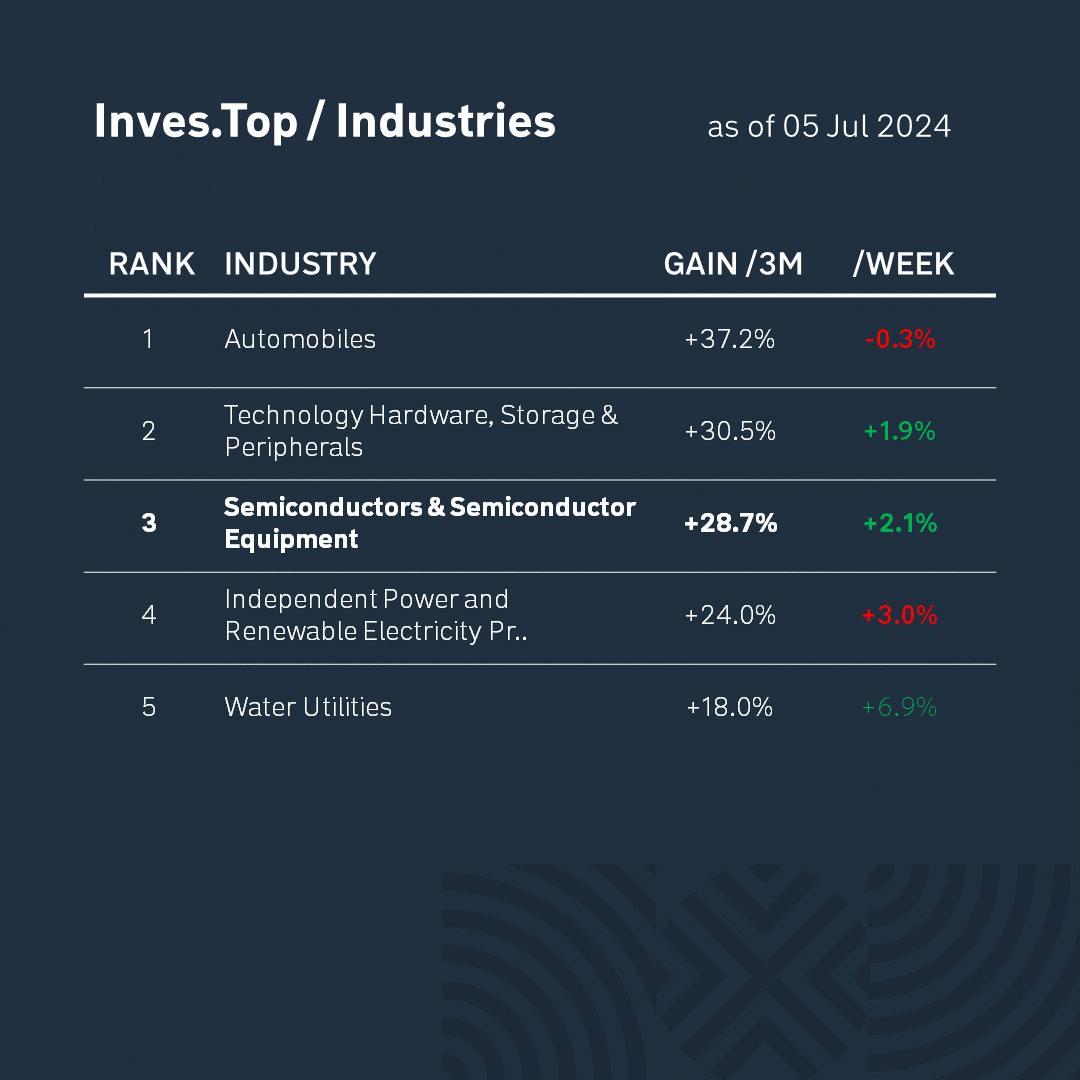

Over the past three months, one of the leaders of growth in the S&P 500 index has been the computer hardware industry (Technology Hardware, Storage & Peripherals) +32.8%.

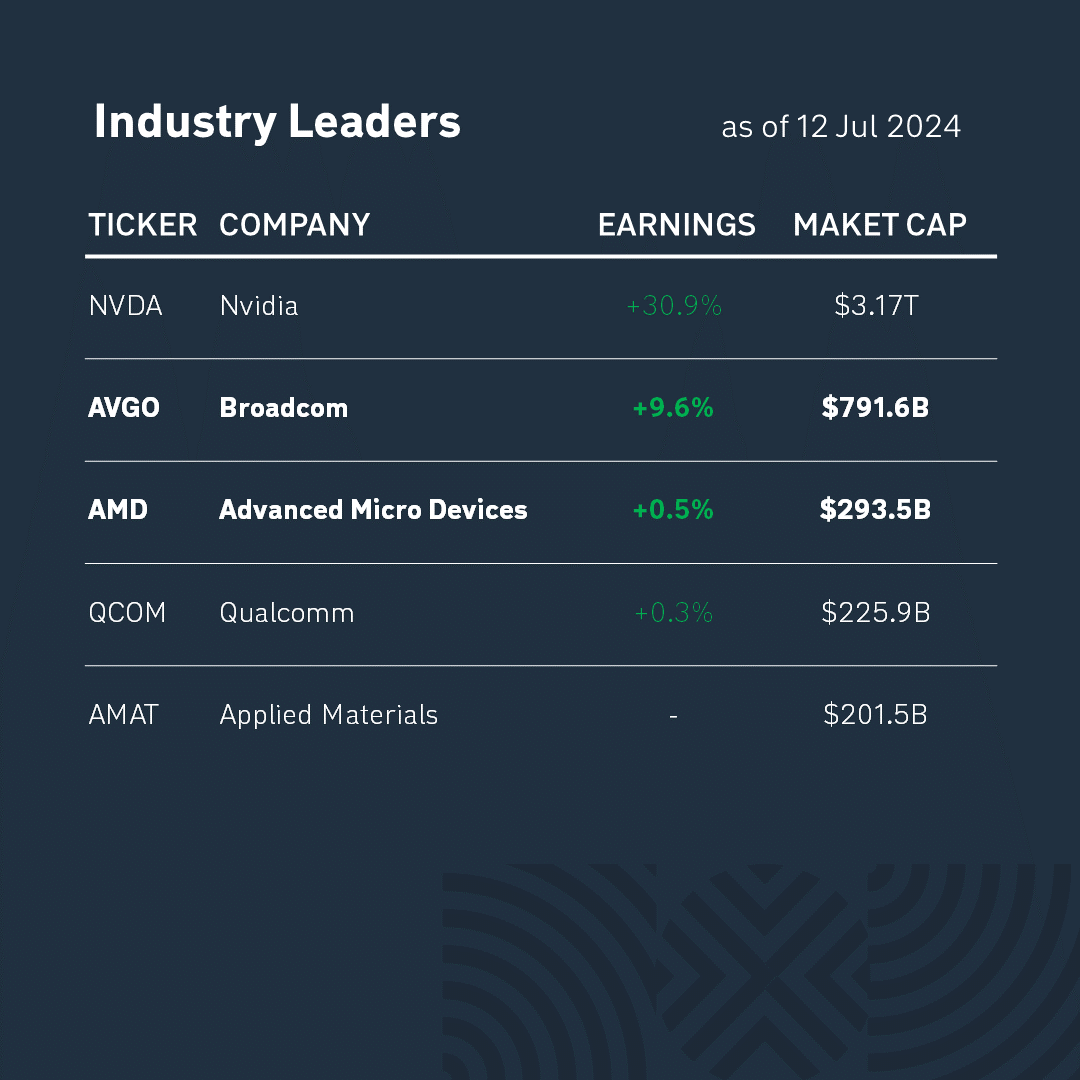

Some of the largest (by market capitalization) companies in this industry: HP ($36.4B), which develops computer and printing products for corporate clients, and Hewlett Packard Enterprise ($26.7B), which develops computer servers, storage devices and network equipment. Until 2015, both companies were divisions of Hewlett-Packard.

According to the latest quarterly reporting data, we analyzed each company’s profitability, strength, and efficiency criteria according to the methodology of Stanford University professor Joseph Piotroski.

As you can see, in terms of fundamental data, HP is performing better and outperforming Hewlett Packard Enterprise in terms of sustainability and efficiency.

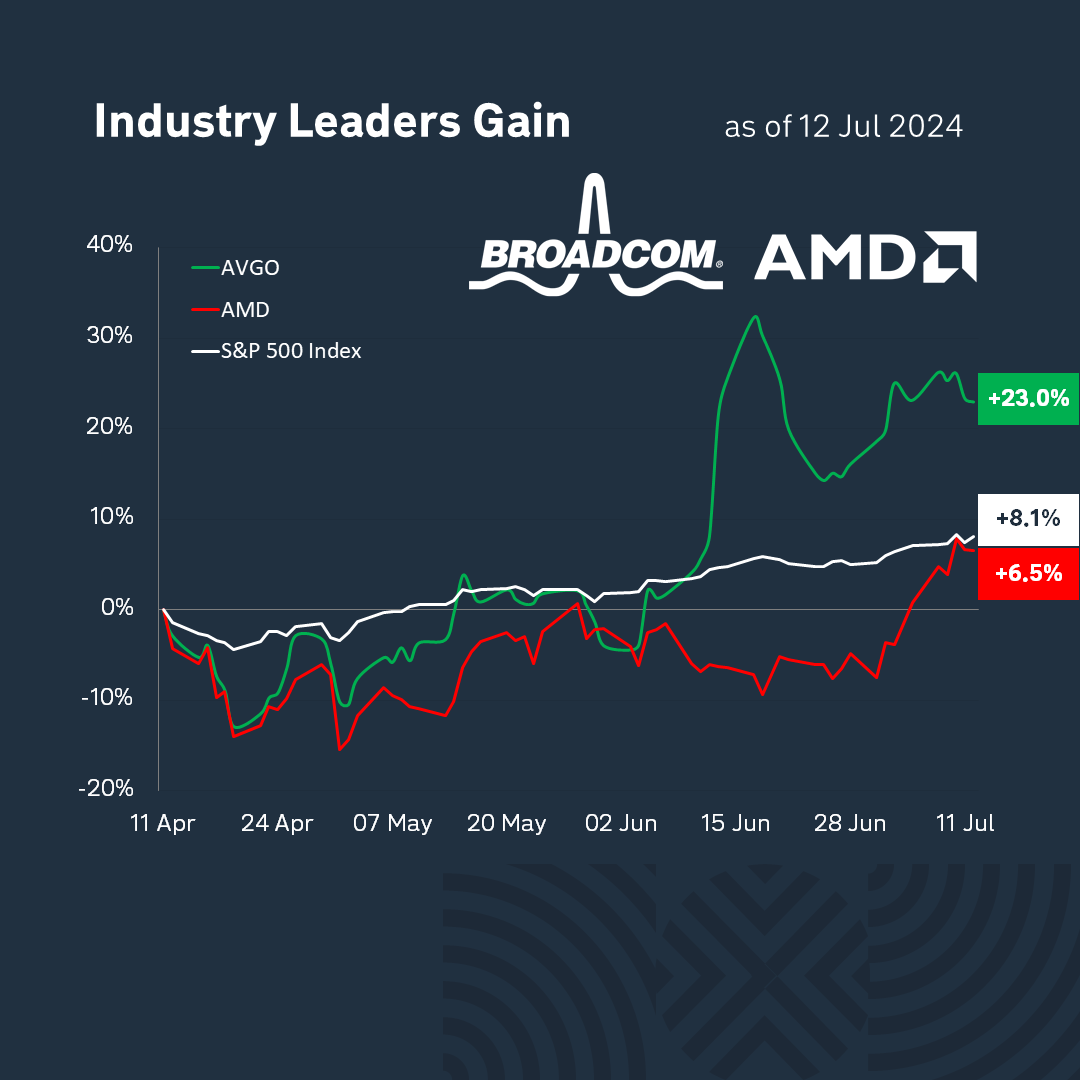

Over the past 3 months, HP shares have risen by +23.0%, while Hewlett Packard Enterprise has increased by +6.5% (the S&P 500 index has risen by +8.1%). Broadcom outperformed its closest competitor and showed better results compared to the index.

So, the winner in today’s battle is HP HPQ). HP shares show better profitability and the company’s business looks healthier in terms of financing and asset turnover.

* This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.