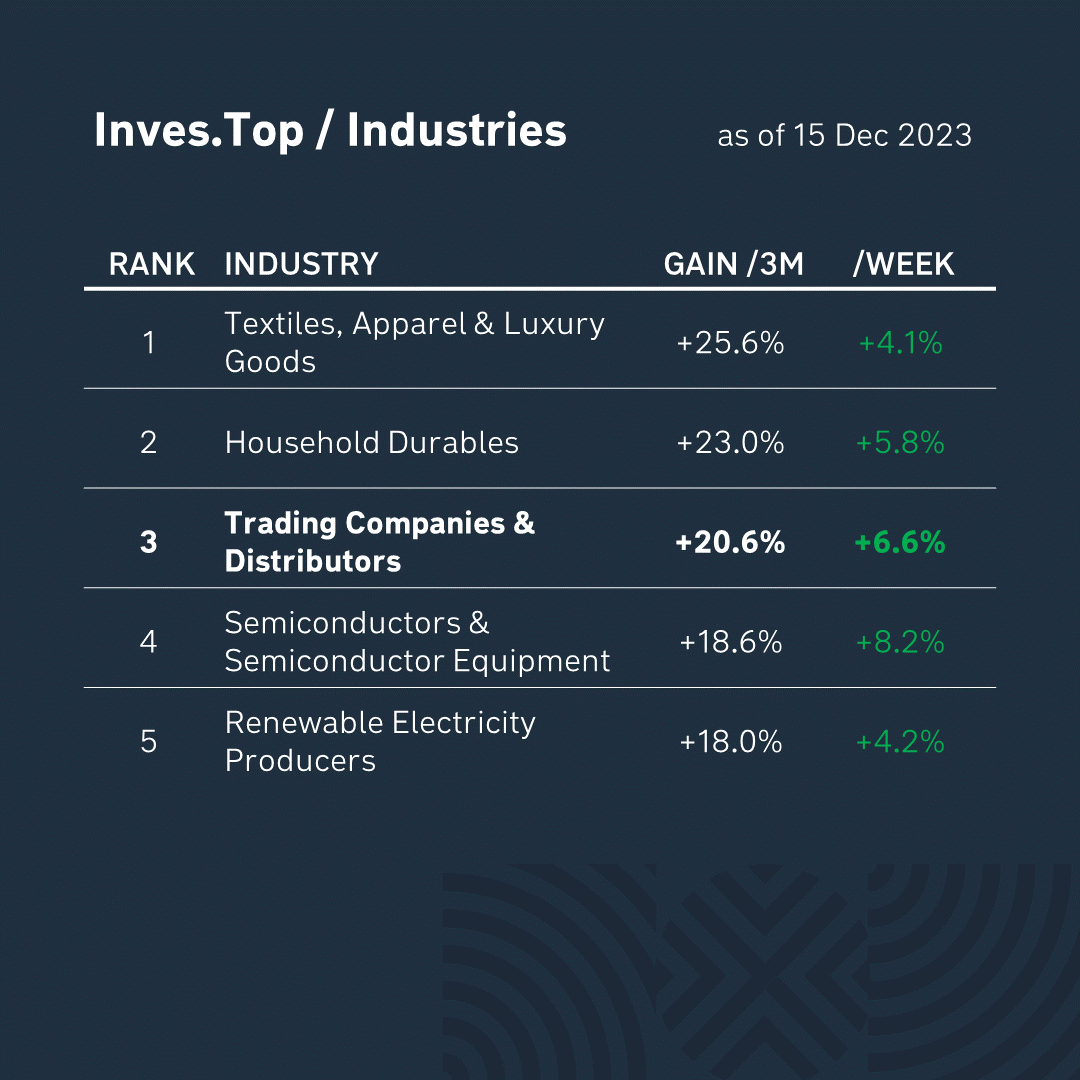

As we noted in last week’s issue, over the past three months, one of the top growth industries in the S&P 500 has been Trading Companies & Distributors (+20.6%).

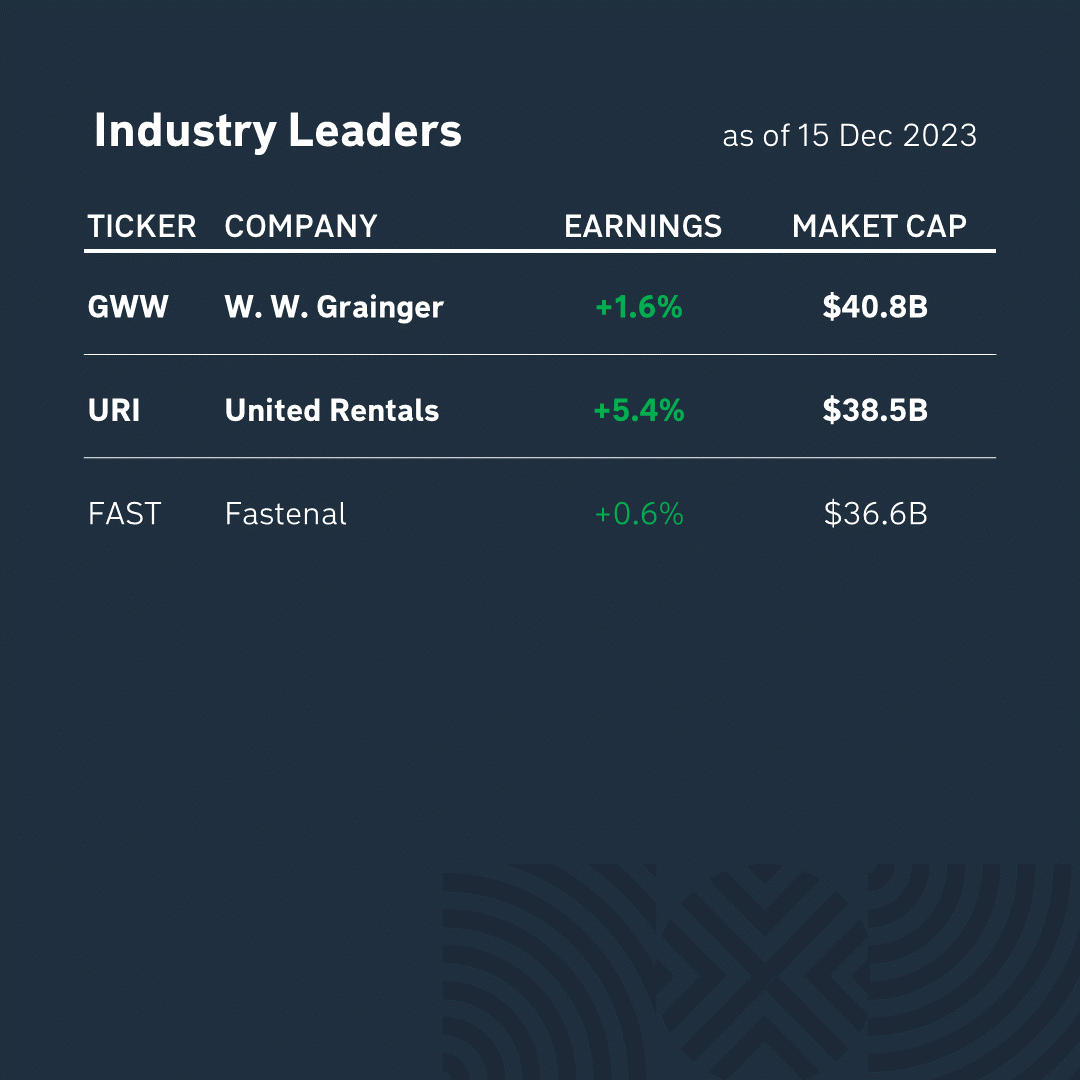

The largest (by market capitalization) companies in this industry: W.W. Grainger ($40.8B), which distributes industrial goods, and United Rentals ($38.5B), the world’s largest industrial equipment rental company.

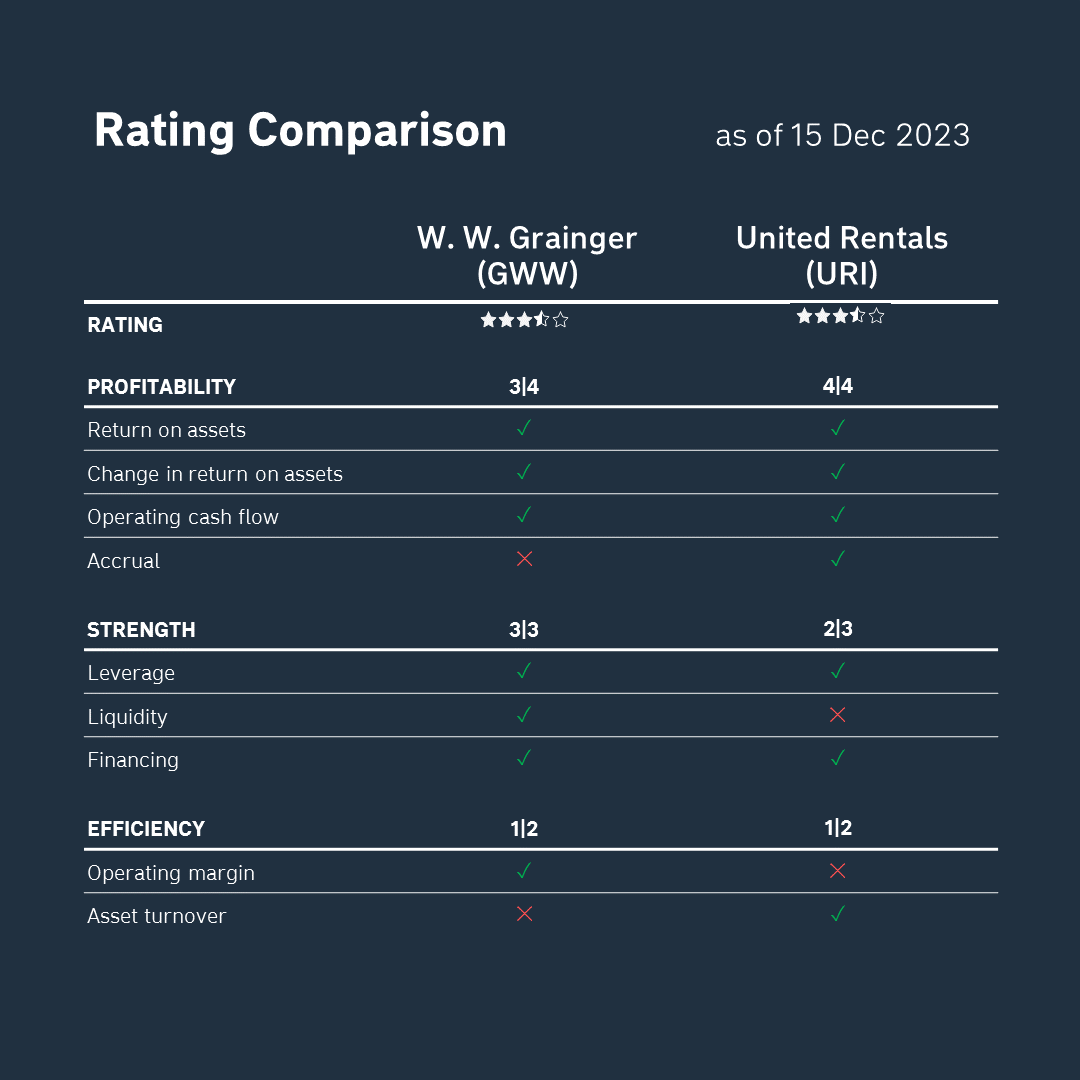

Based on the latest quarterly reporting data, we analyzed the profitability, strength, and efficiency criteria for each company using the methodology of Stanford University professor Joseph Piotroski.

As you can see, from the point of fundamental valuation, both companies are currently performing quite strongly. Both W.W. Grainger and United Rentals look attractive for medium- and long-term investments.

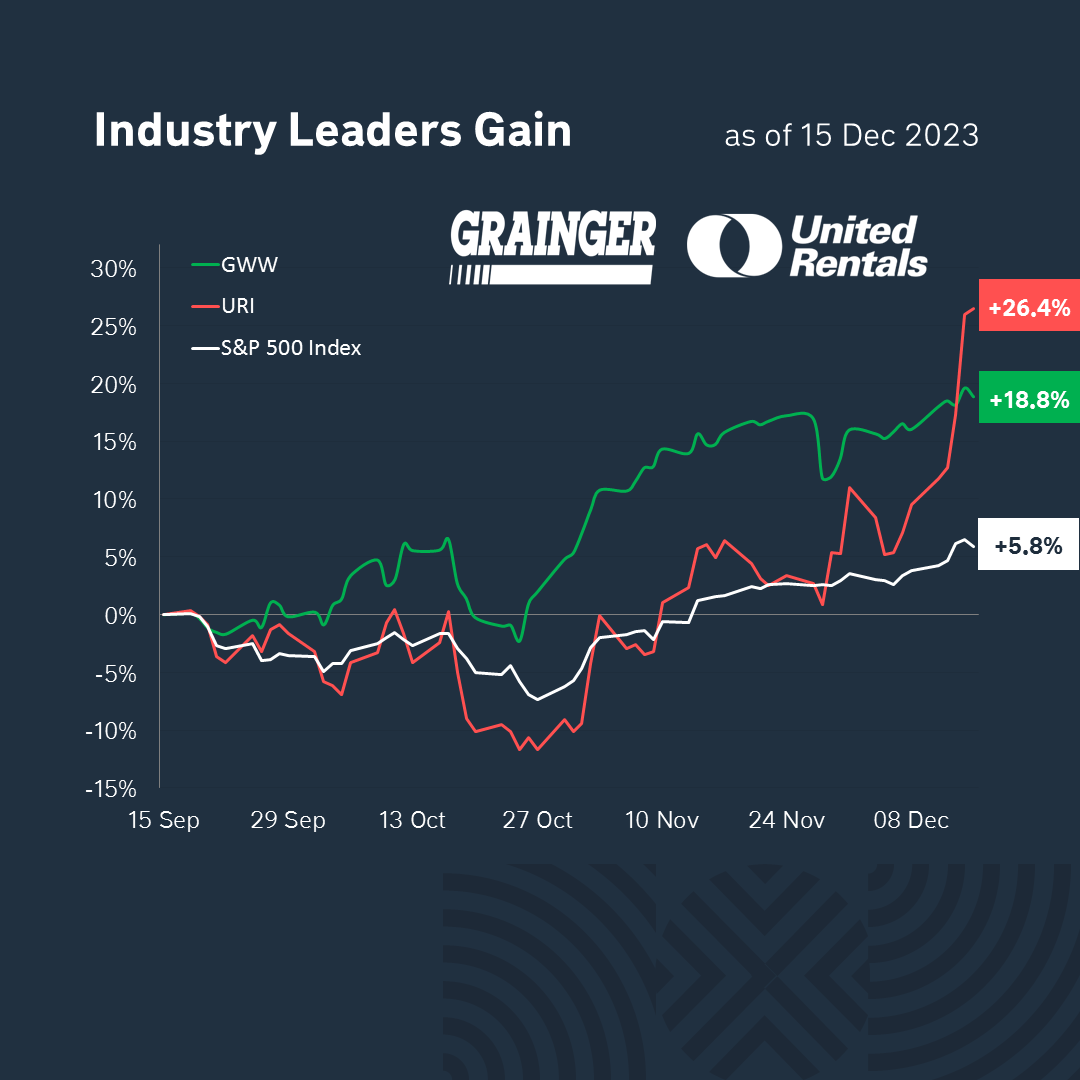

In addition, over the past 3 months, United Rentals shares have risen by +26.4% and W.W. Grainger by +18.8% (the S&P500 index is up +5.8%). United Rentals not only outperformed its closest competitor, but also showed better results compared to the index. However, the dynamics of its stock was more volatile, while the yield curve of W.W. Grainger stock was smoother.

So, there is no single winner in today’s battle. Therefore, it is up to each individual to decide which criteria to give preference to when making an investment decision, taking into account their goals and individual risk tolerance.