Despite the skeptics, market indices continue to rise, and on Thursday the S&P 500 set its twentieth all-time record since the beginning of the year, up almost 10%. This is also the fifteenth best start to the year for the market since 1928. The upward trend has been sustained, and the Fed has confirmed its rate and future forecasts, which has had a positive impact on the markets. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

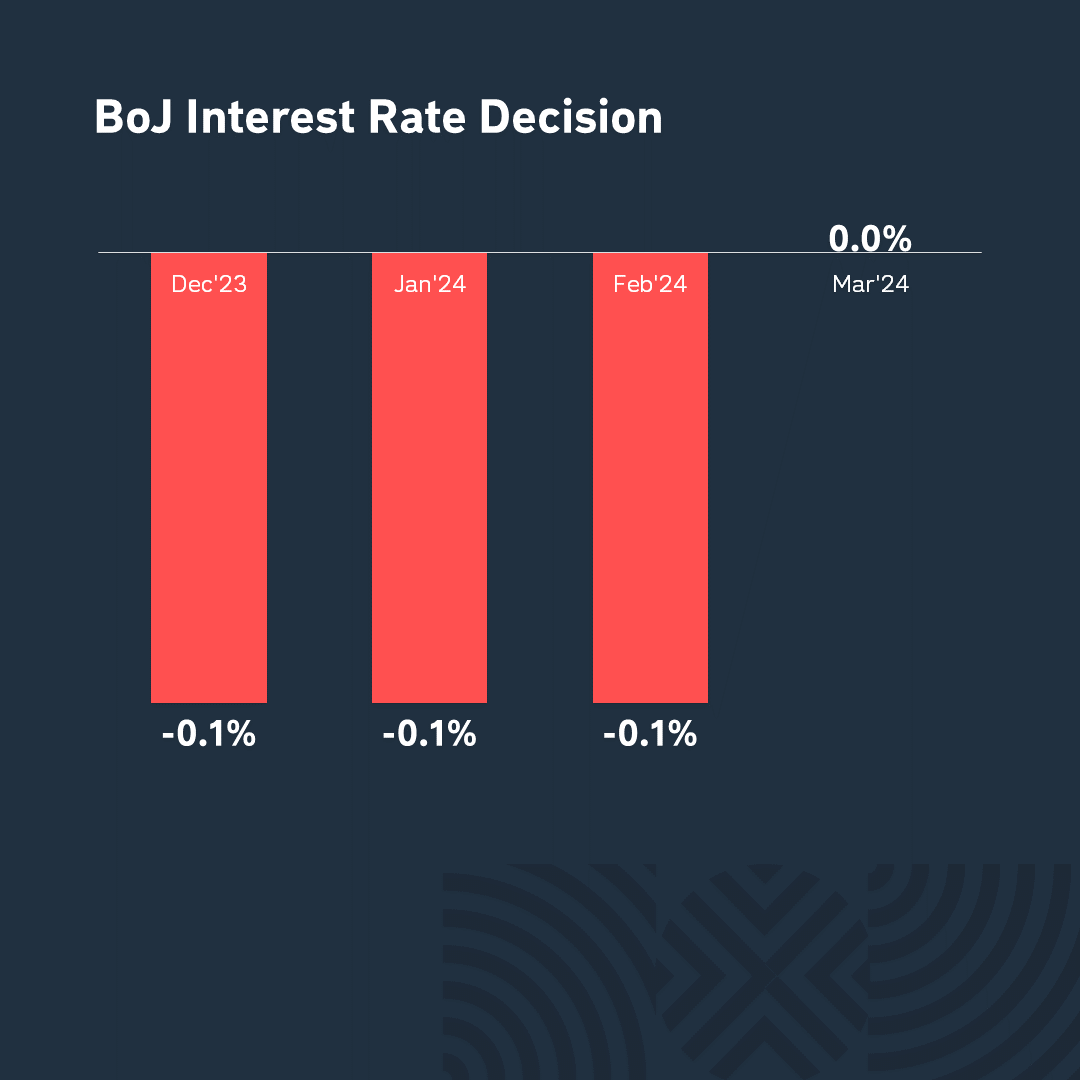

The Central Bank of Japan ended the twelve-year era of negative interest rates by raising the discount rate from -0.1% to 0.0-0.1%. It was also decided to cancel the buyback of Japanese companies’ shares and to stop setting a target for the long-term yield of government bonds. It is difficult to decide whether these measures were successful, but the Japanese economy is showing some positive trends, with wages and prices rising.

Katie Wood expressed an optimistic outlook for the global economy, predicting that new technologies will increase the annual GDP growth rate from the usual 3% to 6-8% over the next 20-25 years. She recommends investing in her ARK Innovation ETF, a fund focused on advanced technologies, which has suffered a 3.5% loss in value this year, although markets have risen by 10%.

At the GTC Annual Conference on Monday, Nvidia CEO Jensen Huang unveiled the Blackwell GPU, which he called the most powerful microprocessor to date. Investors’ reaction, however, was muted, and the company’s share prices remained virtually unchanged after the presentation. Tesla also announced an increase in prices for the Model Y in Europe and the United States from April 1, which may raise questions about the company’s strategy in the face of declining demand and competition in the electric vehicle market.

According to Bloomberg, Apple and Google are negotiating cooperation in the field of artificial intelligence (AI), hoping for the success of such a tandem. However, the situation is not going well for Apple: The U.S. Department of Justice and representatives of 17 separate states have filed a massive lawsuit against the company, accusing it of abusing its monopoly position in the smartphone market. This is a significant problem for Apple.

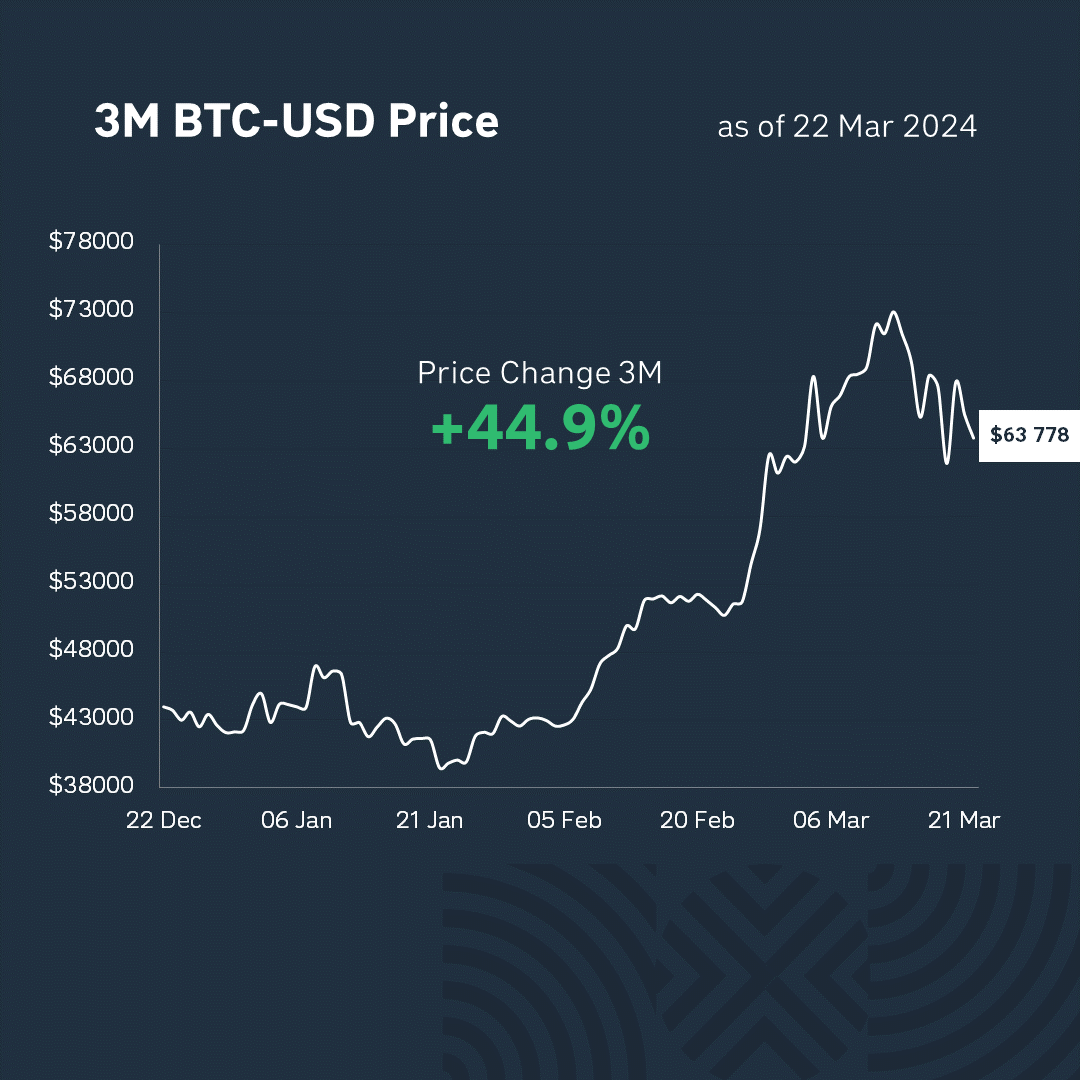

This week was a tough one for bitcoin. After a large-scale growth at the beginning of the year, spot Bitcoin ETFs experienced an outflow of investments, which caused the price of bitcoin to drop by more than 10% to $73,798. According to JPMorgan, it is likely that the price will fall further as it remains too high, traders are taking profits before halving, it is likely that the price could drop to $45K-50K.

What is the bottom line? Very simple: the stock market is trending upward, and as another popular wisdom says: “Don’t fight the trend!”. And it’s true, because such a war can be expensive. Although, I would like to say: “The bubble is still inflating!”

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.