During this week, investors have been paying attention to the economic situation in the US and hoping to predict the reaction of the Federal Reserve. Fed Chairman Powell held two days of consultations with lawmakers on Wednesday, concluding them on Friday with the release of the Labor Market Report. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Powell was expected to have a difficult time speaking to lawmakers this week. He had to avoid political controversy, taking into account the short-term and long-term interests of the parties, while not scaring the markets or emphasizing inflationary risks too much. Powell mentioned the possibility of a rate cut in 2024, which lifted the mood on the markets. His confirmation on Thursday also emphasized this possibility. Hence, we will continue to monitor macroeconomic news as it will be an important factor for the Fed’s future actions.

Investors did not have to wait long for important data – on Friday, they had the opportunity to get acquainted with the latest Labor Market Report, which is one of the most important documents that affect the central bank’s policy. The labor market continues to maintain a tense situation – unemployment remains at historically low levels, and wages continue to rise, keeping inflation high. Even Powell noted that this situation was a surprise for the Fed when inflation was falling.

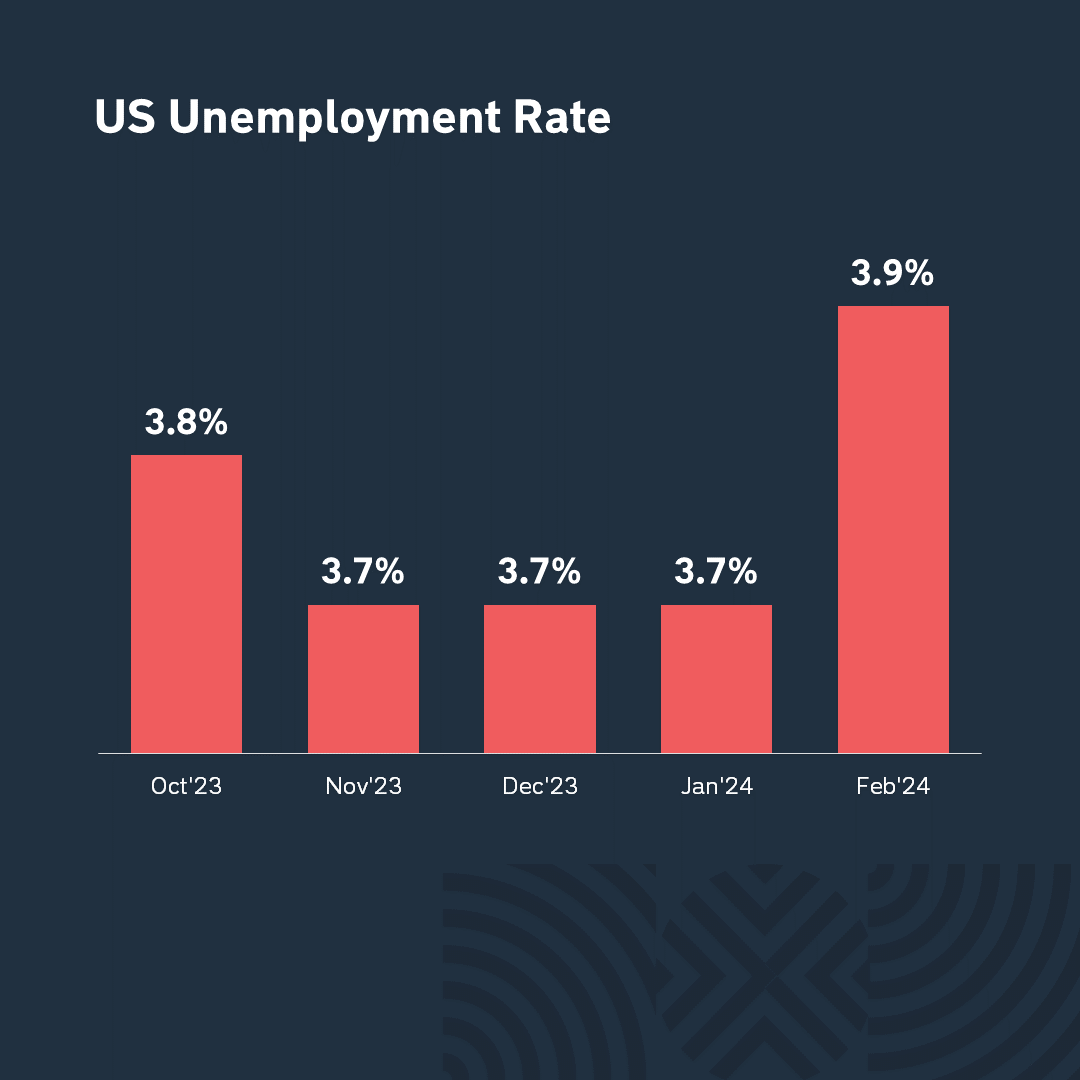

The latest labor market data showed that some surprises are still relevant. In February, the US economy created 275 thousand new jobs, which exceeded the expected 200 thousand. However, the unemployment rate, which worries Powell, rose for the first time in four months, to 3.9%, while the level of 3.7% was expected. Average hourly earnings rose by 4.3%, which was the expected result. Overall, the Labor Market Report was unlikely to affect investor optimism, as indices continued to climb on Friday morning after its release on the belief of a “soft landing” and lower rates.

The markets fluctuated throughout the week, according to the news, but Nvidia shares continued to rise, while Alphabet, Apple, and Tesla experienced difficulties The representatives of the Magnificent Seven did not have an easy time last week. Alphabet continued to fall, while the problems of the Chinese economy are beginning to affect Apple and Tesla, whose sales in China are falling significantly. It’s impossible to justify the advances that investors gave to companies in the form of sky-high valuations without the Chinese market, and it’s far from being in the best condition right now.

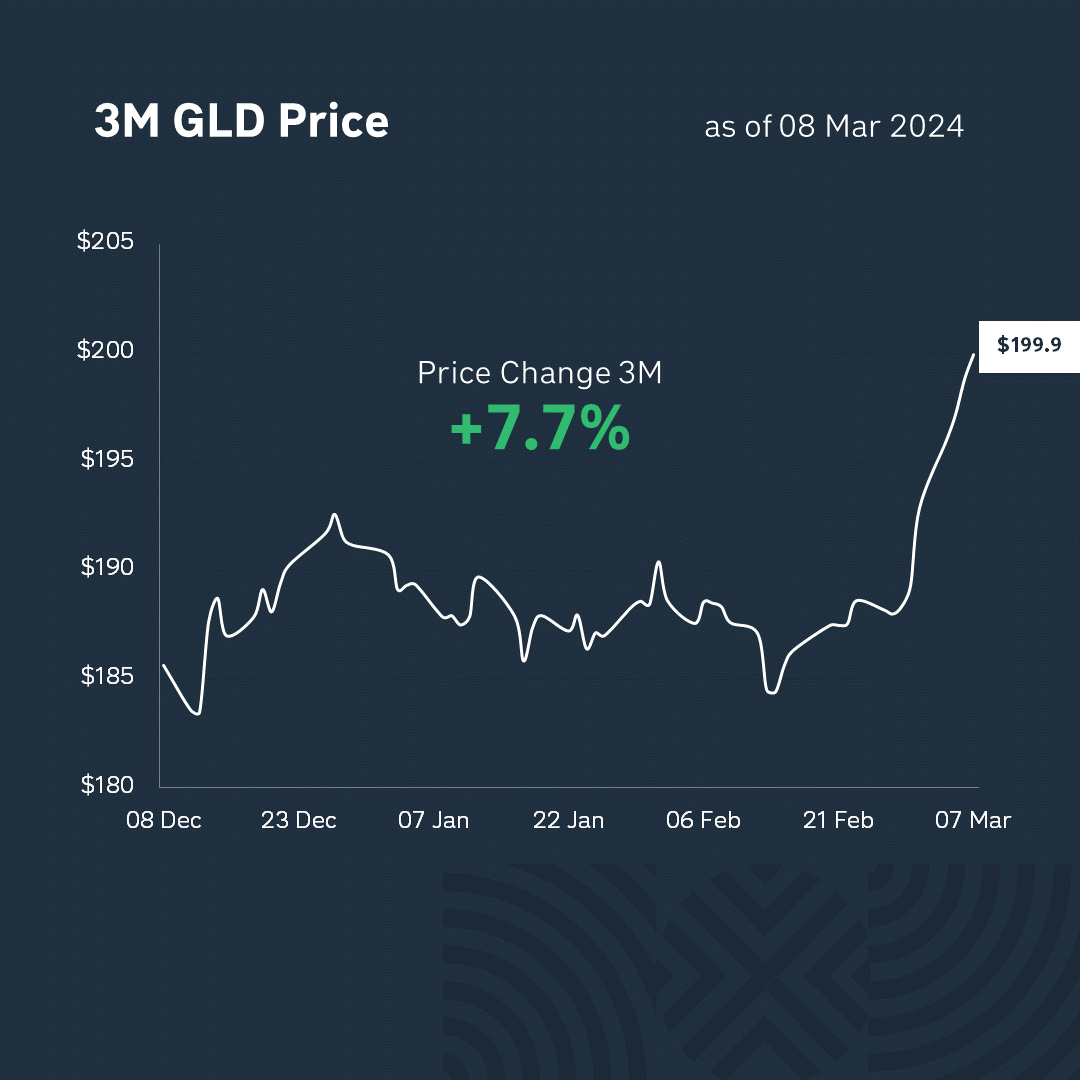

The price of gold continues to move steadily upward, with a new historical high every day, but the “crypto world” is fluctuating: during the week, bitcoin rose and fell with considerable amplitude, ranging from $61K to $69K per coin, as did other cryptocurrencies. But this is their fate, and crypto investors are no strangers to it!

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.