The past week has reminded us of some concepts that have been in the spotlight of the investor community for a while now, and have been filling the analytical materials of leading financial publications. I mean “Higher and Longer” on the macroeconomic front and the G7 on the corporate front. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

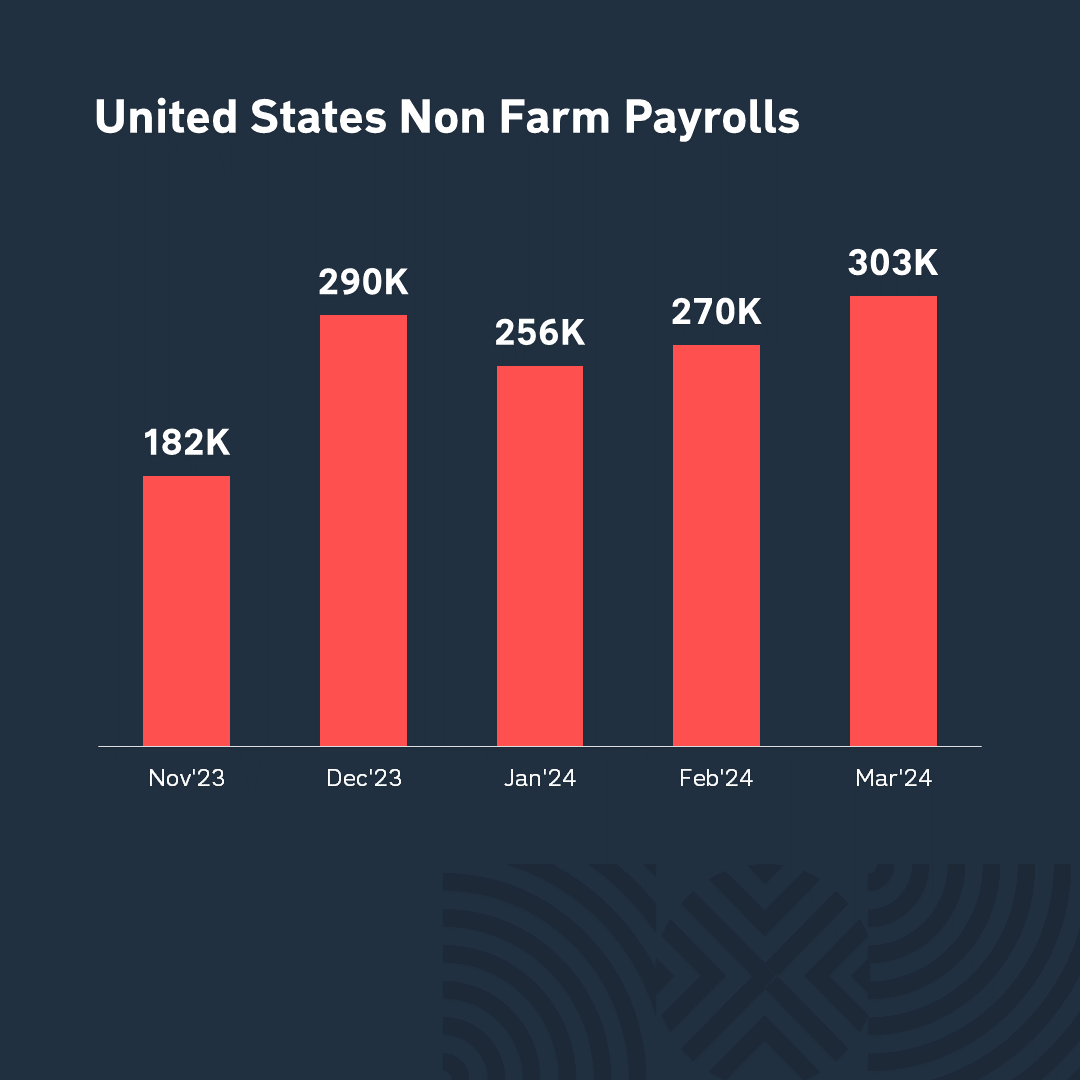

The US consumer inflation data (CPI) released on Wednesday was higher than expected, sparking concerns. Despite Fed Chairman Powell’s characterization of inflation as “bumpy,” it remains above the desired 2%. Additionally, some Fed officials caution against dismissing the recent inflation rise as a statistical anomaly. High inflation has raised concerns about the Fed’s “Higher and Longer” policy. Originally, investors anticipated interest rate cuts starting in spring, but recent data suggests this might not happen until November, coinciding with the US presidential election.

China faces a different challenge: sluggish inflation suggests an economic slowdown. Despite optimistic forecasts from Goldman Sachs and Morgan Stanley citing industrial production and exports growth, March saw a 7.5% year-on-year drop in exports, the largest since August. Despite efforts to boost growth, many companies are relocating to India, exacerbating China’s woes.

The “Magnificent Seven,” comprising the world’s seven largest tech firms, has been a pivotal concept over the past year. However, not all members have fared equally well recently: Apple faces challenges in the Chinese market, causing its stock price to plateau. Meanwhile, Tesla has been particularly hard hit, grappling with increasing competition and declining prices in the electric car sector. Ford’s price cuts for its electric pickup truck have intensified this pressure, affecting competitors like Rivian and Lucid. While Musk’s announcement of RoboCar helped stabilize Tesla’s shares momentarily, challenges persist. Since the year began, Tesla’s stock price has dropped by 21%, prompting concerns of prolonged decline. Additionally, Musk’s personal wealth has suffered, with Mark Zuckerberg surpassing him due to Meta’s stock surge.

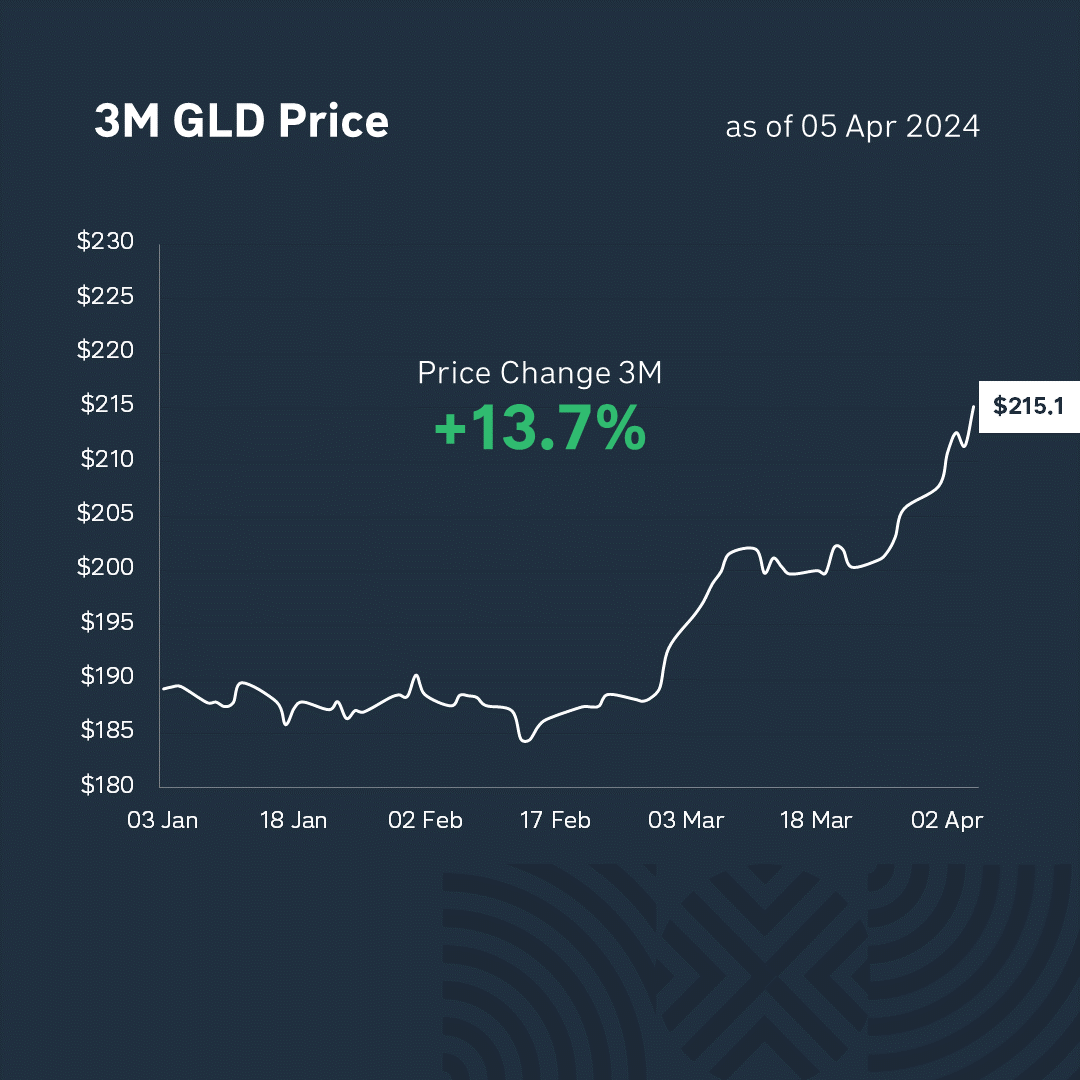

The quarterly results season kicked off on Friday, with banks and financial firms leading the charge. BlackRock reported growth in assets under management and profitability, buoyed by the strong performance of equity, cryptocurrency, and commodity markets in the first quarter. Conversely, Wells Fargo’s earnings were lower, but the company remains hopeful about prolonged high interest rates and improved earning prospects. As the season progresses, the reports from major corporations will continue to shape market trends in the coming weeks.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.