The US Federal Reserve’s “higher and longer” strategy, which involves keeping interest rates high, is showing results. Its goal is to make a “soft landing”, avoiding an economic crisis by raising rates to fight inflation. Data show a gradual cooling of the economy and a decline in inflation, although it remains high. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Personal spending by Americans declined in the first quarter. Business equipment orders and deliveries are also falling, the trade deficit is the largest in two years, the unemployment rate is rising, and home purchases are declining. As one Wall Street strategist put it, “the economy is running at low speed in the first half of 2024.” So, the economy is cooling enough to stop price increases, but a recession is likely to be avoided.

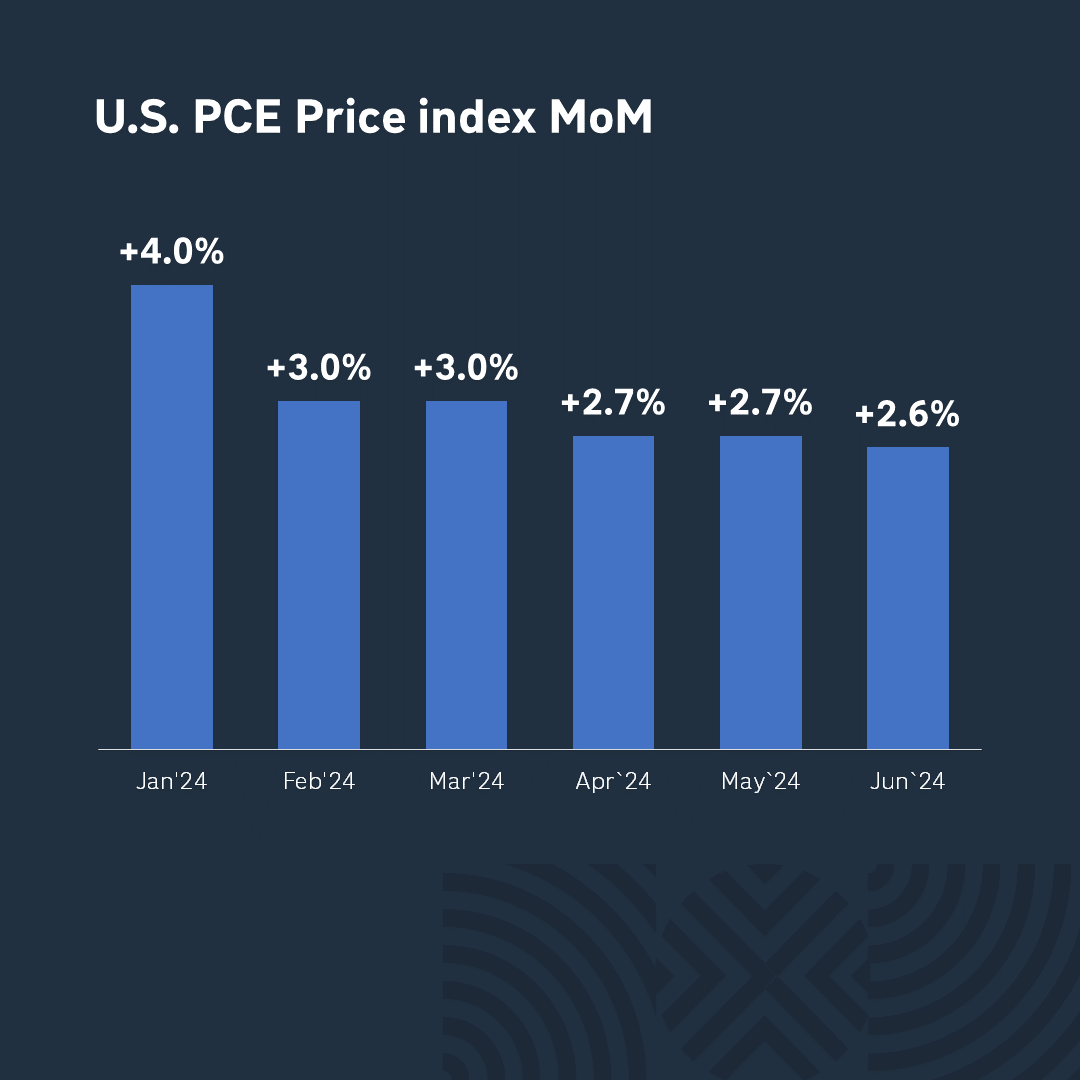

Inflation remains a major topic of economic debate and determines the monetary strategies of central banks. The latest personal consumption expenditure (PCE) data announced on Friday showed that inflation has stopped rising. In May, PCE remained at 0.3%, the same as in April, in line with forecasts. On an annualized basis, inflation is now 2.6%, still above the 2% target.

It is impossible not to mention the debate between the US presidential candidates that took place on Thursday. In four months, Americans will have to make a choice. The strategies of the candidates differ: Biden’s socially oriented plans versus Trump’s capitalist sentiments, from whom big business expects tax cuts and trade protectionism. Wall Street is largely on Trump’s side, as evidenced by the morning’s gains in futures and bond yields after the debate. However, it is too early to draw conclusions, as there is still a long way to go before the November 5 election, and the assessment of the chances of both candidates will change.

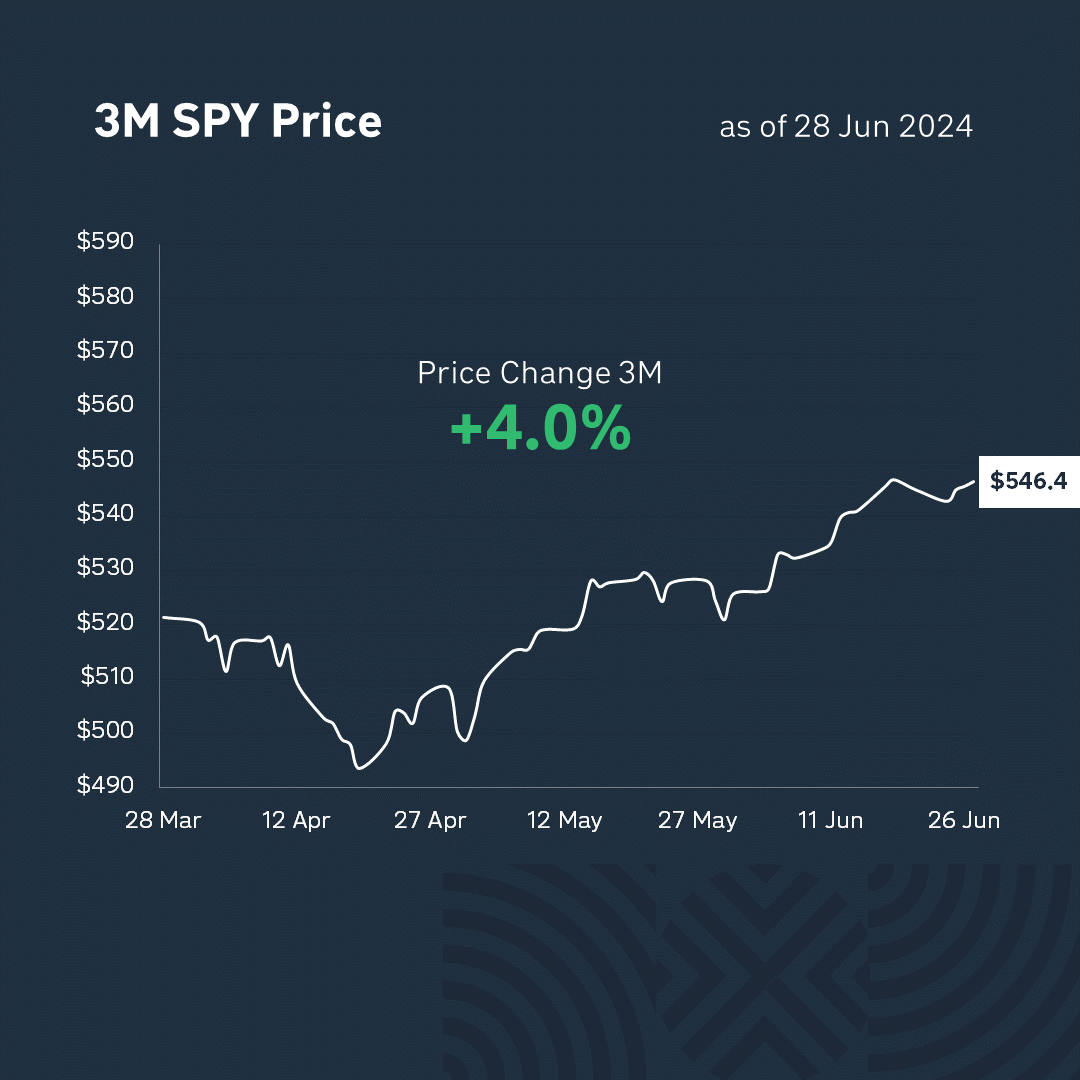

What’s the bottom line? The last week of the quarter saw a rise in indices, a stronger dollar, and higher bond yields. The S&P 500 rose by 4.3% for the quarter, often breaking historical records. The technology sector grew by 8.8% for the quarter. The value of the seven largest companies accounts for a third of the market and is the main driver of growth. Since the beginning of the year, the S&P 500 and Nasdaq are up 16% and 20%, respectively. The results are fantastic, and we hope that it will only get better.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.