The financial world continues to revolve around the Magnificent Seven, although Tesla doesn’t look so great anymore. Other companies, like Nvidia, are pulling the market onward and upward. This week, Nvidia released its first quarter results, attracting investors’ attention. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

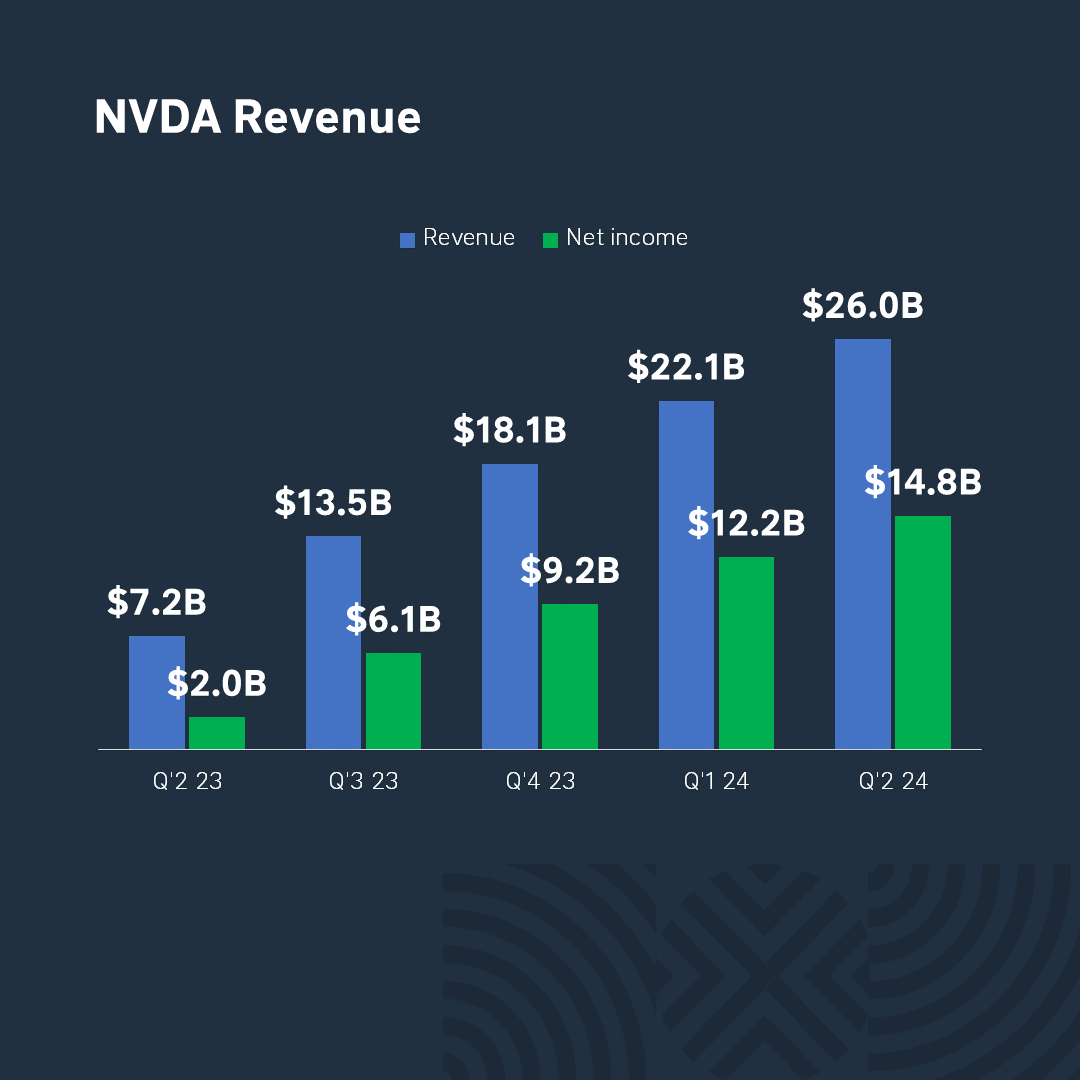

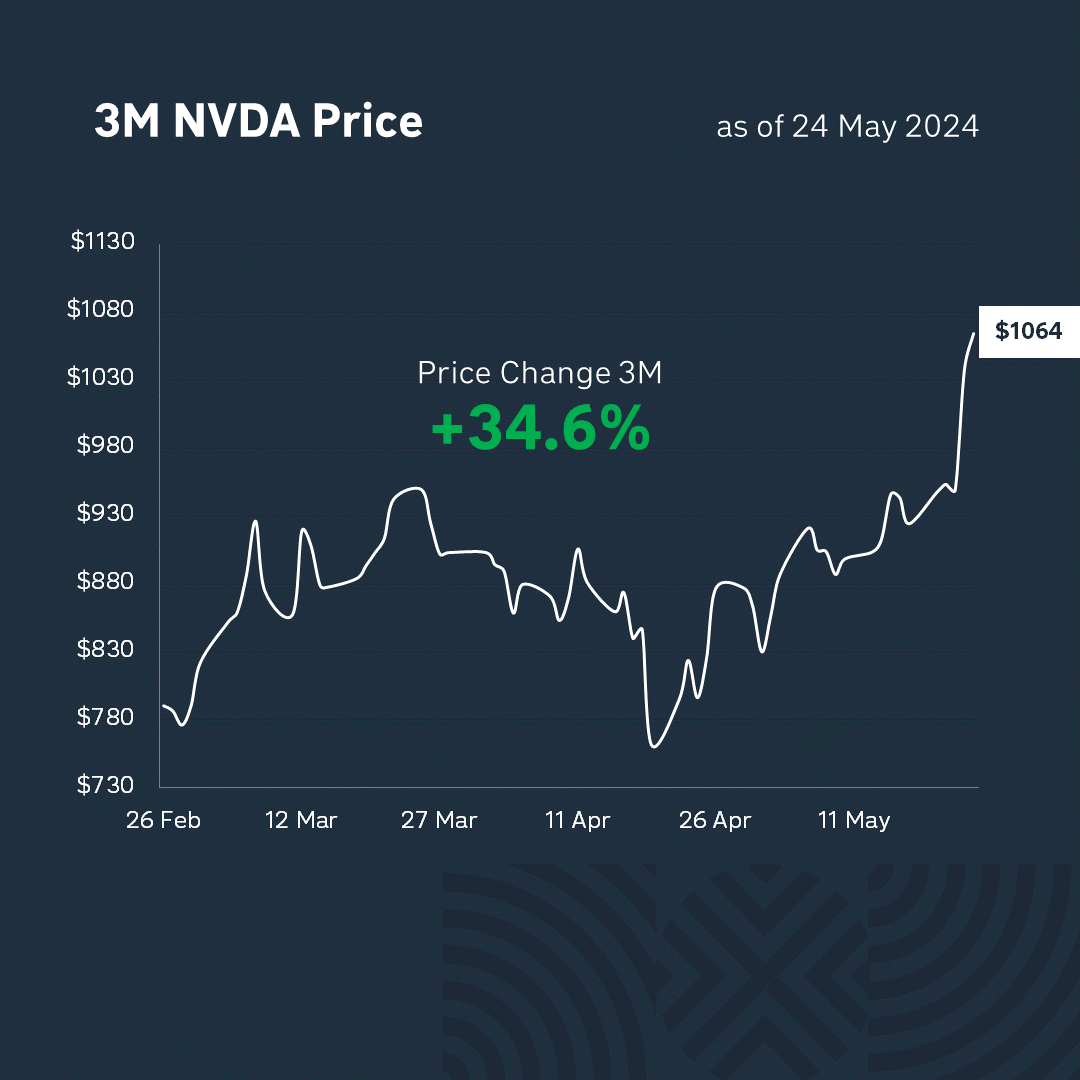

Nvidia’s results were once again stunning: the company significantly exceeded forecasts and showed significant growth. The mania for artificial intelligence continues to drive demand for microprocessors, increasing Nvidia’s capitalization by $200 billion a day. Since the beginning of the year, the company’s market value has doubled to $2.5 trillion. Amazon, Microsoft, and Google, with their cloud businesses, are Nvidia’s largest customers, demonstrating “remarkable” solidarity. Nvidia’s CEO, Jensen Huang, predicts that the boom in artificial intelligence will remain a “gigantic market opportunity.” In June, the company plans to make a 1:10 share split, which traditionally has a positive effect on the price.

Still, there was not enough optimism for the entire market. In the second half of the week, investors decided to take a short break, after a series of records set by each of the three major indices in the previous days. Even Nvidia’s achievements and forecasts were not enough to trigger a new upswing. And the news from the macroeconomic fronts this week, to be honest, was not very conducive to new records.

The minutes of the last Fed meeting, released on Wednesday, brought less joy than Nvidia’s results. The “higher for longer” strategy remains dominant, and some committee members are ready to raise rates if inflation risks increase. Such views do not please investors, who are now revising their forecasts. Whereas a week ago, two 25 basis point rate cuts were expected by the end of the year, only one cut is now the most likely.

The crypto industry continues to make gains, winning the hearts and wallets of investors. During the week, cryptocurrencies grew in value, awaiting the SEC’s approval to list the first ETF investing in Ethereum. The expectations were met: now you can invest in Ethereum through the BlackRock fund, which will be traded under the ETHA ticker symbol.

What should we expect next? I’m afraid that no one has an exact answer to this question, except that we can say with certainty that in the long run, quality companies will grow in value. So, don’t waste your time and money trying to guess where the market wind will blow next minute, but rather spend it looking for fundamentally high-quality companies.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.