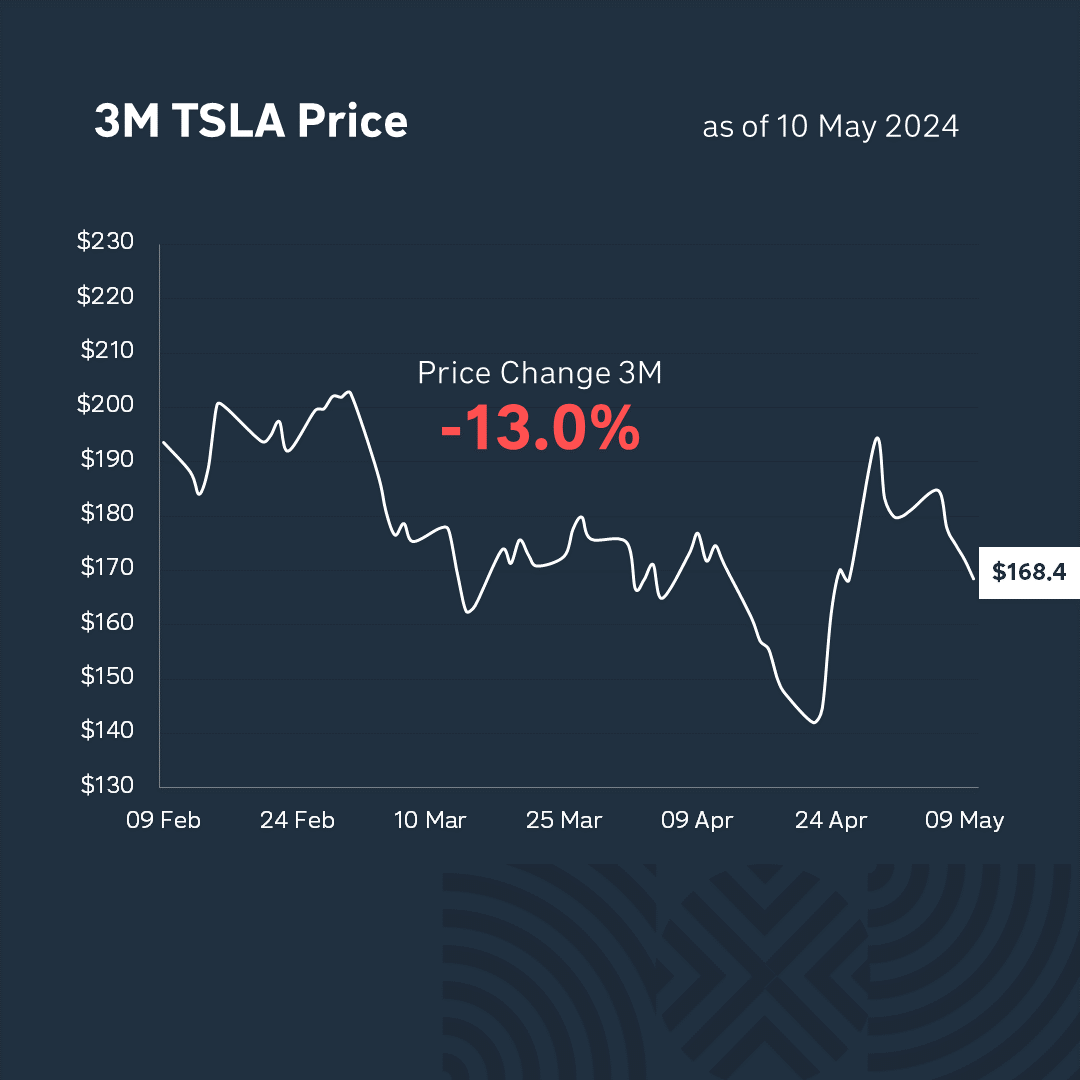

This week was a winning week for the markets, especially after news from Musk that he had reached an agreement with China on the use of Tesla’s autopilot technology. This agreement helped prevent the company’s shares from falling freely. Although the production of new models is lagging behind and the financial performance is not impressive, investors are responding positively to Musk’s promises, which is reflected in the growth of the share price. Nevertheless, a recovery in the company’s real valuation could lead to further share price declines in the future. At the end of Monday, Tesla’s share price rose by 15%, but later investors recovered and the price began to decline gradually. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Musk’s colleagues from the Magnificent Seven also impressed. Amazon exceeded expectations in revenue and profit, thanks to the successful Amazon Web Services business. Although the forecast for the second quarter was lower, the company’s shares rose slightly after the results were announced. The CEO promised active investment in AWS for future success.

Apple is not doing well: revenue and iPhone sales are declining, but the results were better than expected. There is an increase in revenue from services and a record buyback of $110 billion of its own shares. Despite investor fears, Apple continues to hold its ground, especially with the introduction of artificial intelligence, and shares are rising.

This week, Powell’s press conference after the Fed meeting was the main event for the markets. As expected, the rate remained unchanged, but Powell expressed concerns about inflation, noting that the data did not provide confidence in achieving the 2% target. This triggered talk of a possible rate hike, but Powell assured the markets that such a move was not planned.

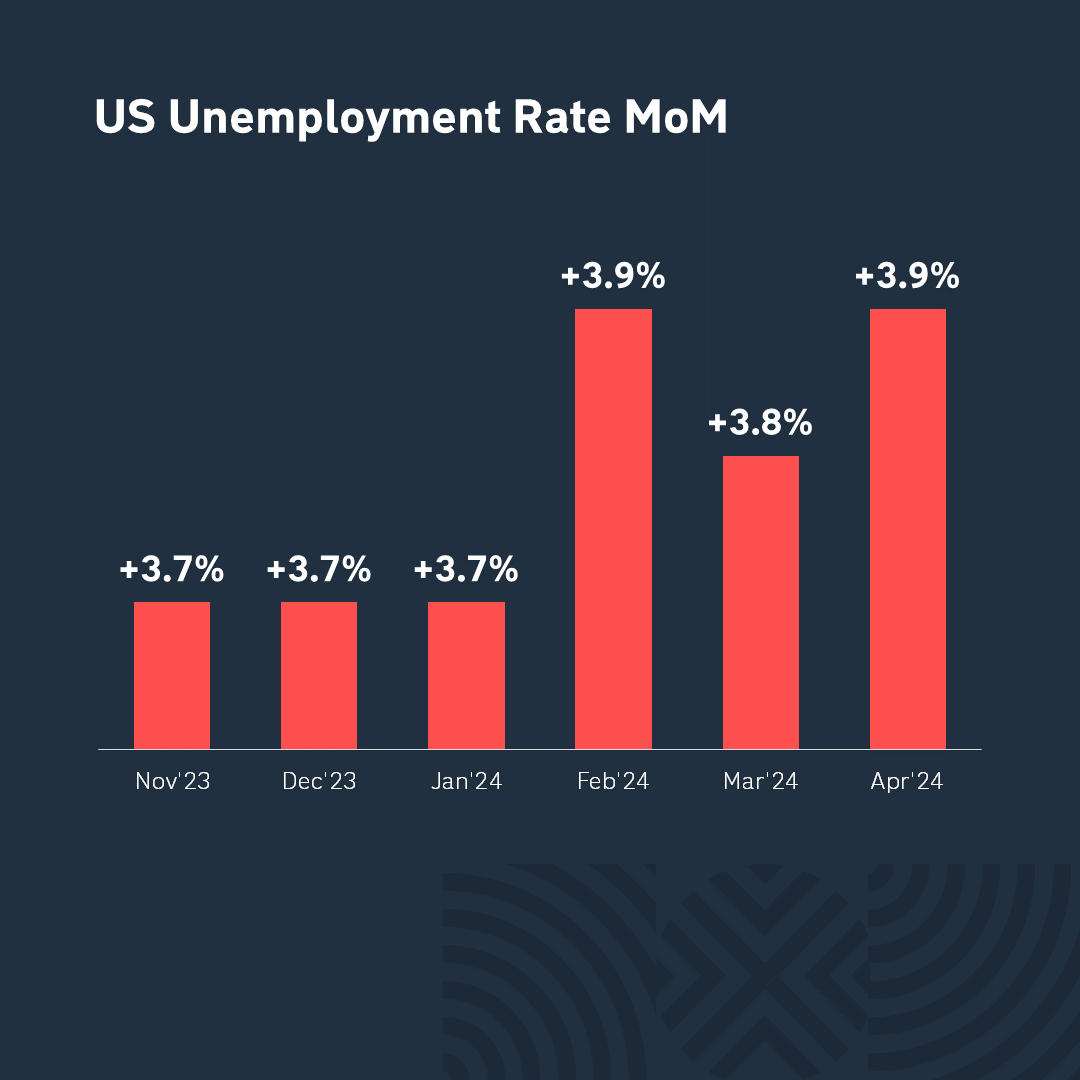

The icing on the cake was the labor market report, which unexpectedly showed some cooling: the number of jobs created in April was 175,000, against the expected 240,000. The unemployment rate rose to 3.9%, which is 3.8% higher than forecast. Wage growth slowed to 0.2%, while the forecast was for 0.3%. So, the question of a possible rate hike seems to be closed for a while and a rate cut can be expected again. Well, all in all, a good week: macroeconomic data is positive, corporate results did not disappoint, the seven is still “Excellent”, and optimism is winning!

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.