The battle between the “bulls” and the “bears” that some, including me, had predicted for this week did not take place – the “bears” were not supplied with shells, but the bulls had as many as they wanted, of any caliber, power and killing force.This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

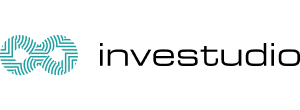

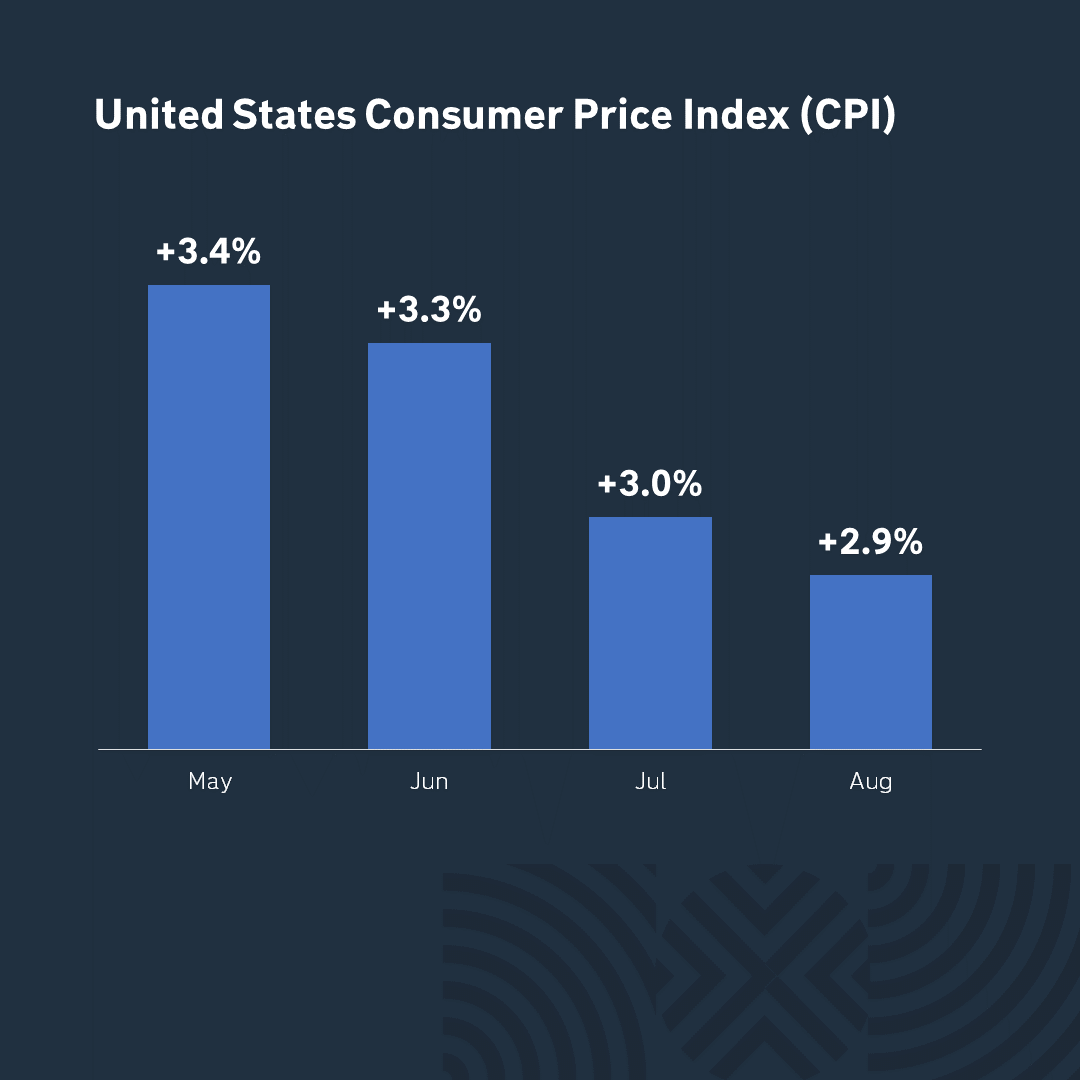

Inflation is falling. On Monday, the markets were rocking, recalling the dramatic events of the previous week and looking for direction, but on Tuesday and Wednesday they were rewarded for their resilience. The inflation data, first on producer inflation (PPI) and then on consumer inflation (CPI), proved to be a real roadmap that paved the way for the Fed to cut rates at its next meeting in September and for markets to rise further. The fourth consecutive decline in the consumer price index, to 2.9% in July, was better than the expected 3% and the smallest since March 2021. So, it seems that the Fed’s fight against rising prices and Powell’s consistency have paid off. However, there is a small fly in the ointment: inflation is still significantly above the 2% target. But this spoonful is so small that when the markets heard about the decline in inflation, they didn’t even feel the taste of bitterness and rushed forward as fast as they could.

The economy is holding up. The Fed’s success in controlling inflation is clear, but markets are concerned about the cost of keeping rates above 5% for so long. Many investors fear this could lead to an economic crisis, contributing to the sharp drop on Monday, August 5. However, the Fed continues to push for a “soft landing.” Economic data released Thursday—retail sales and initial jobless claims—indicate no immediate crisis. Jobless claims were lower than the previous week and below forecasts, suggesting the labor market is stable, people are spending, and economic growth continues. Great news for the market!

The bears did not find a worthy response to the bulls’ armor-piercing arguments: as a result, over the four days of the week, as of Friday morning, when I was writing this, the major indices rose in the range of 2.7% to 5.0%, fully recovering the fall of the Monday before last, when it seemed that the crisis was already at the doorstep and knocking.

What’s next? Predicting the future is both intriguing and often futile. Market behavior is driven not just by fundamentals but by investor sentiment. The latest Bank of America survey, involving 189 respondents managing $508 billion, offers insights into this sentiment. In early August, 47% of respondents believed the economy would weaken—20 percentage points less than a month ago. Meanwhile, 76% expect a “soft landing” or continued economic growth, fueled by the expectation that interest rates will decline, with 93% predicting lower rates in a year. Despite this optimism, cash holdings have increased, and equity investments have decreased. Investors remain cautious, holding back on stock purchases, anticipating future price drops.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.