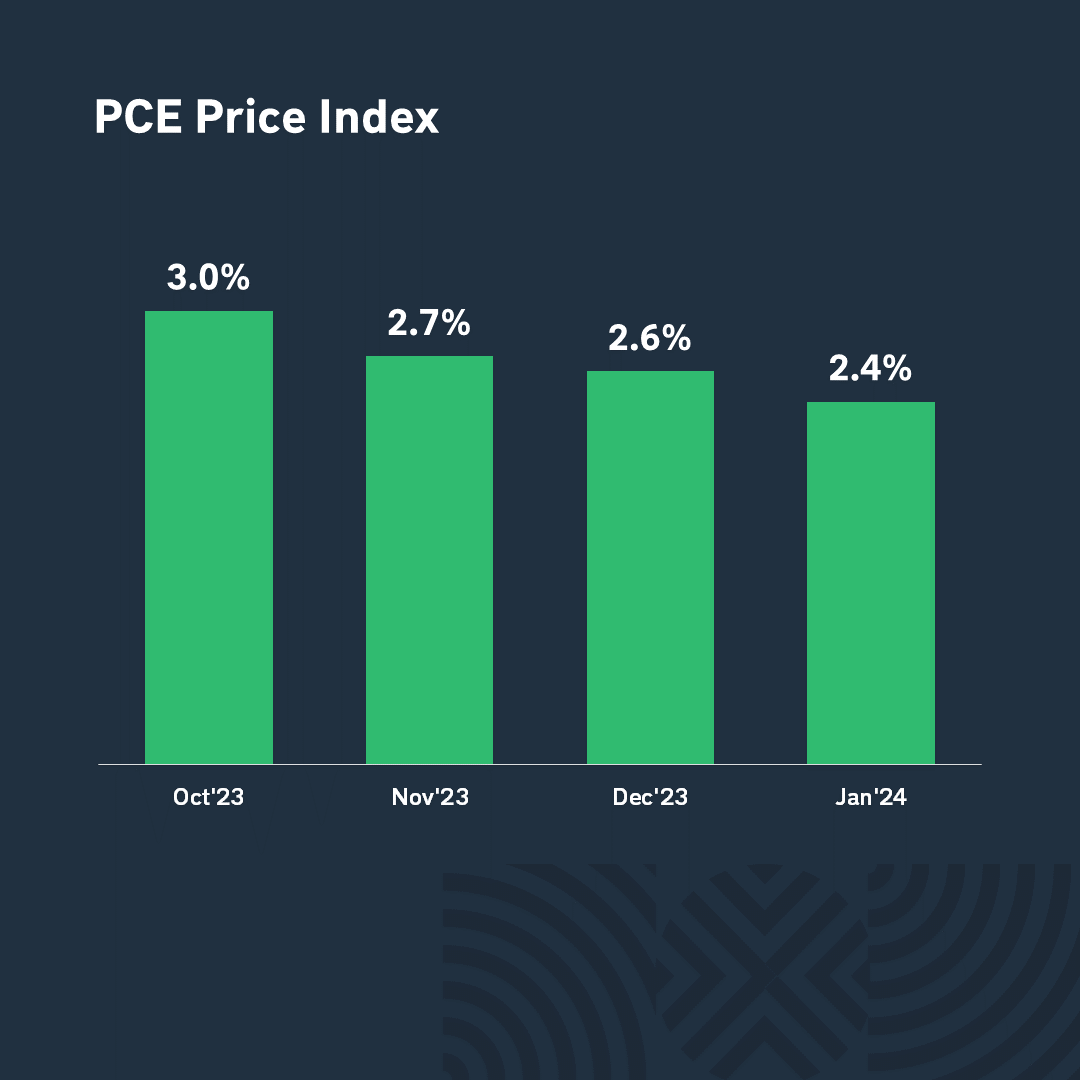

The main event of the week was the release of the PCE Index, a consumer spending index that measures inflation by the Federal Reserve. This data will determine the Fed’s future monetary policy under the “Higher for Longer” framework, which involves delayed interest rate cuts. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

The previous year confirmed the importance of this strategy for financial markets, and it is likely to remain relevant in the future. The PCE results were in line with the forecast, which mitigated initial investor concerns about unexpectedly high consumer inflation. This reinforced expectations of a Fed rate cut, which led to a green rally in the markets and the S&P 500 and Nasdaq reaching historic highs.

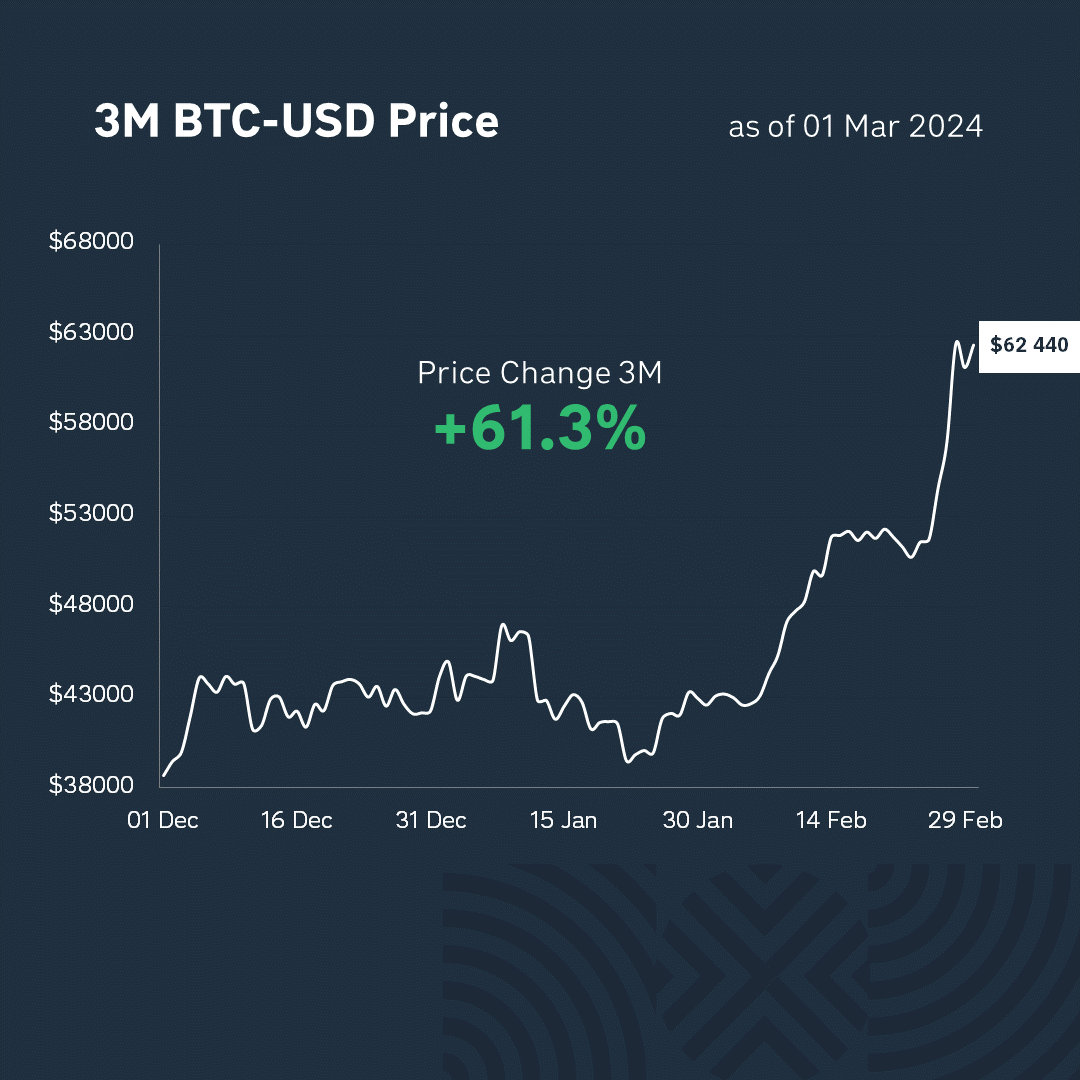

The main surprise of the week was Bitcoin’s significant surge in price, as predicted by cryptocurrency experts. It’s anticipated that Bitcoin’s price may surpass even the highest expectations, potentially reaching $1 million per coin. Over the past week, its price rose by 18%, by 46% over the month, and by 169% over the year. This growth is primarily attributed to a significant demand exceeding supply, driven by various factors:

(1) The introduction of ETFs has simplified bitcoin investment, increasing demand among those who prefer a hassle-free approach. Buying bitcoin is now as straightforward as purchasing a stock, removing the complexities of wallets and passwords. The fixed supply remains a crucial characteristic of cryptocurrency.

(2) Halving, a programmed event occurring every four years, reduces the daily production of bitcoins. With the upcoming halving in two months, daily production will decrease, prompting anticipation and stocking up.

(3) Governments, including the US, hold a significant portion of bitcoins seized from lawbreakers, reducing circulation. Technical reasons prevail as the fundamental value of bitcoin remains uncertain, leading markets into speculative tendencies known as the “Fool’s Game.”

What’s next? Given that the quarterly results season is virtually over, the economic situation will be a major factor influencing the markets in the next few months. We will be eagerly awaiting data on inflation, unemployment, GDP and other important statistics, and once we have them, we will analyze, discuss and try to guess when the Fed will finally start cutting rates, recognizing inflation as overcome. Let’s hope we’re right!

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.