It was a week of relentless records and crazy temptation, when you want to take another step, even a small one, forward, to a new peak, but you can’t help but think that in an instant everything can turn into a rapid fall, when you will have neither the strength nor the time to jump out of the stream of the same record holders flying sideways at a great speed. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

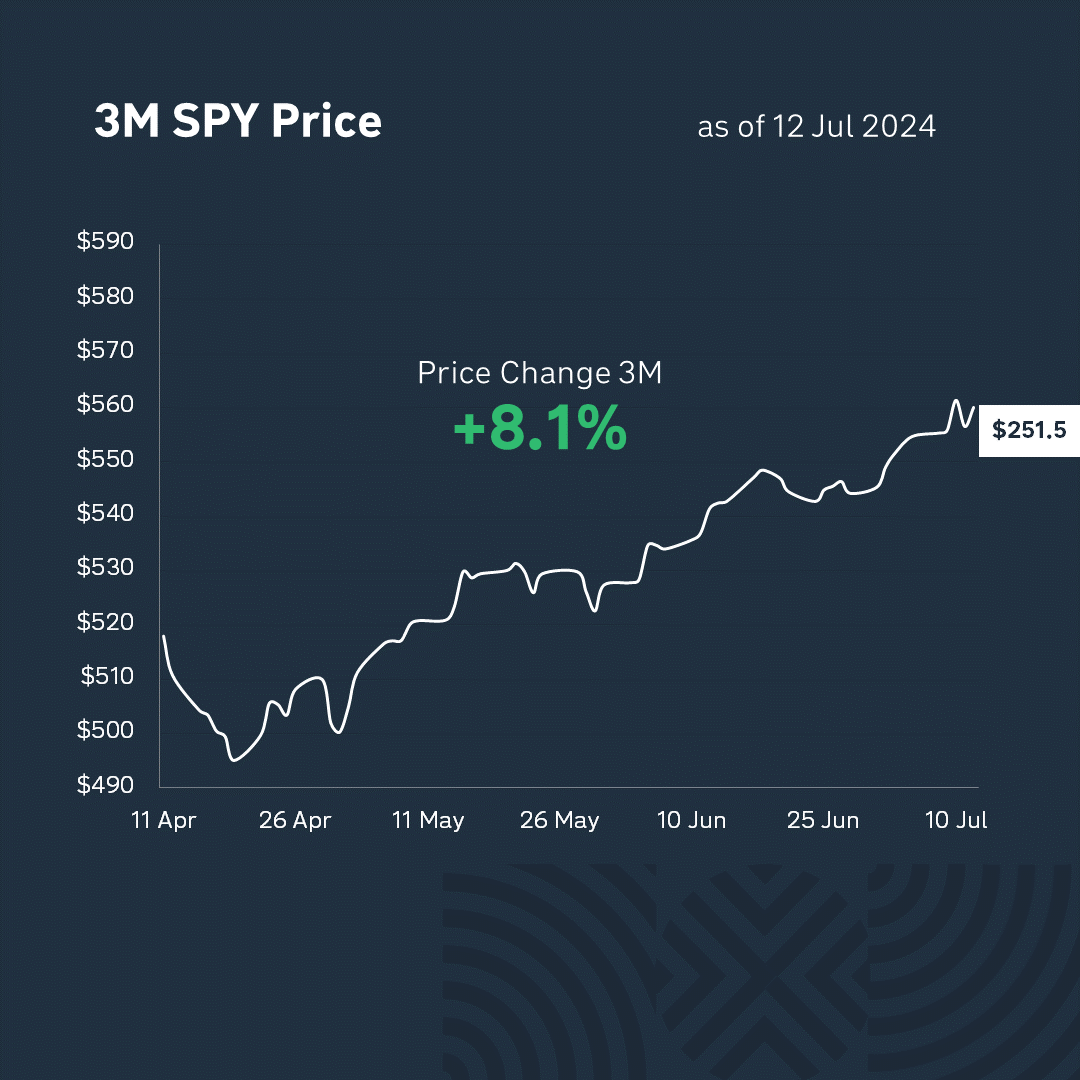

Between Monday and Wednesday, the S&P 500 and Nasdaq set six records, exceeding most forecasts and dashing bears’ hopes for a correction. “The Buffett Indicator exceeded the levels of the dot-com crisis and the Great Recession. The concentration of market gains in a few tech giants is worrisome. The latest forecast from Mike Wilson of Morgan Stanley predicts a 10% correction by the end of the year due to political uncertainty. The correction is inevitable, but when exactly is unknown.

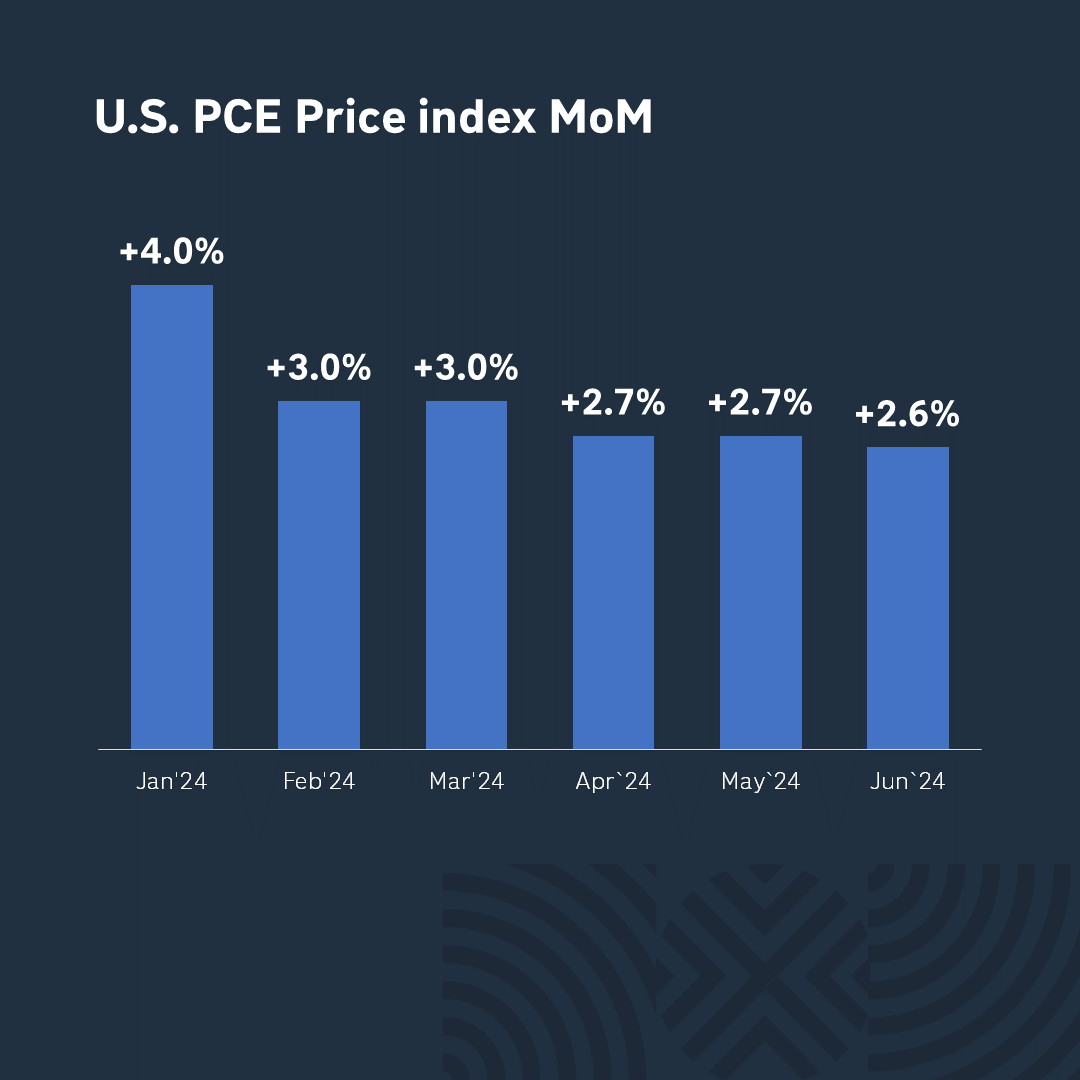

On the macroeconomic front, the main events of the week were Fed Chairman Powell’s speech to lawmakers and the announcement of June inflation data. Powell assured that “we are moving in the right direction,” but noted that “we need more data to cut rates.” New inflation data showed a decline to 3% per annum, the first since 2020. This exceeded expectations and gives hope for a rate cut in September. The probability of such a scenario is 86.4%.

On the corporate front, Tesla was the hero of the week. Although the company’s sales and profitability have been declining, emotions have pushed the stock up for eleven consecutive trading sessions, increasing its price by 53%. On Thursday, UBS recommended that clients sell the stock, saying that the growth was “too big and too fast.” Tesla announced the postponement of the robotaxi demonstration from August to October, which also affected the market. Unfulfilled promises are not uncommon for Tesla, but the market continues to support the company.

According to Goldman Sachs, investors are increasingly concerned about the spending of American tech giants on artificial intelligence. Amazon, Meta, Microsoft, and Alphabet spent about $357 billion last year on capital investments and research in this area. Analysts emphasize that companies must prove the profitability of these investments. If this does not happen, the advances received in the form of rising stock prices will have to be quickly returned, as happened during the dot-com crisis in 2000-01, when the Nasdaq lost 87%. And while it is said that this time it will be different, concerns remain.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.