This week, the indices have fallen for five consecutive days, with the probability of another drop on the sixth day. The S&P 500 lost -4.6%, falling below its twenty- and fifty-day averages. Doubts among traders and investors about the continued growth of the market have increased, especially against the backdrop of rising US government bond yields, which led to a decline in the Fear and Greed Index. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Fear among investors has been exacerbated by the unstable situation in the world. Iran’s bombing of Israel has indeed caused some tension. And although Israel responded by avoiding a full-fledged war, investors remain tense, although oil prices, after an initial rise, have already begun to decline.

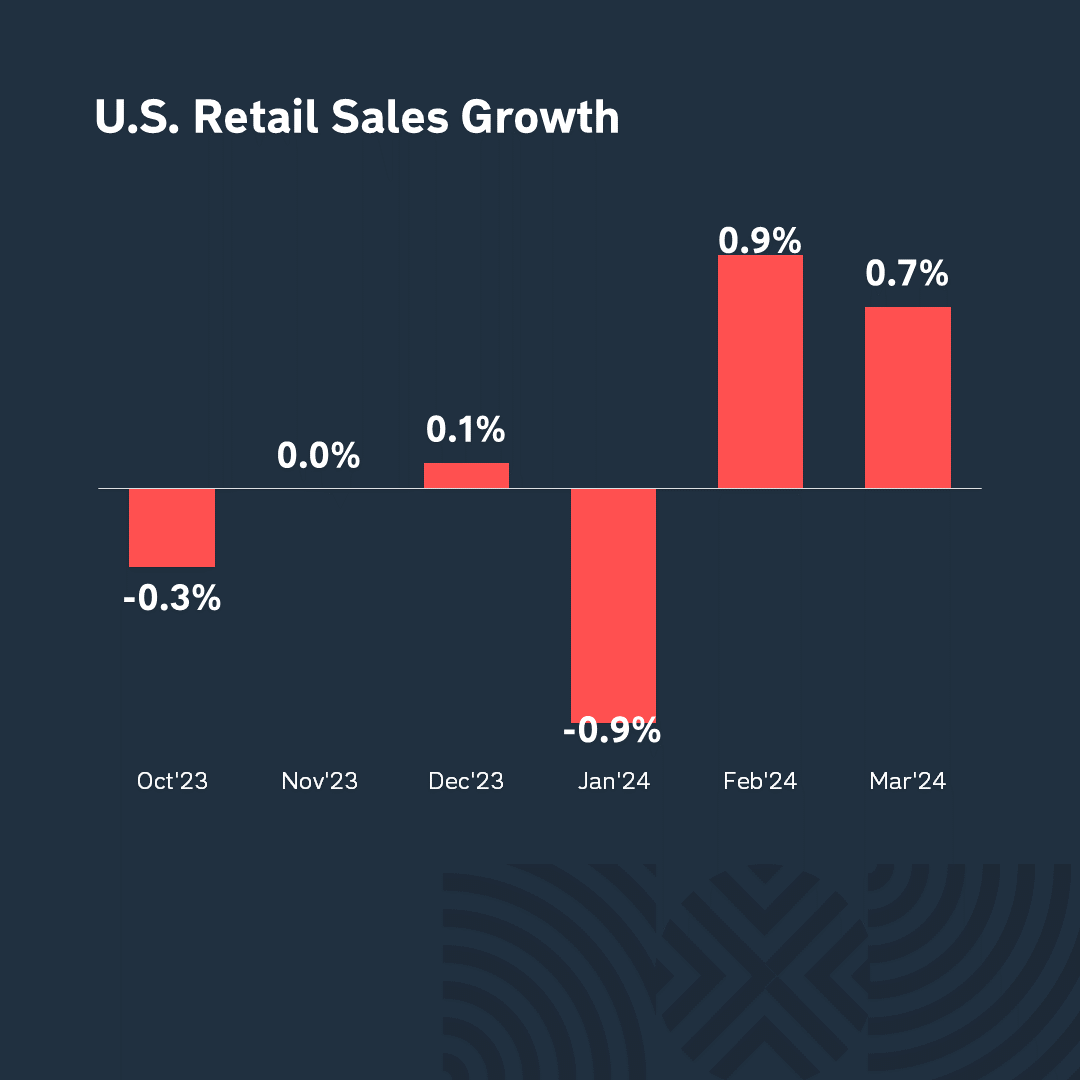

The initial optimistic expectations of investors for the Fed to cut interest rates were dashed by Chairman Powell’s statement about the expediency of maintaining a restrictive policy due to the state of the labor market and inflation. Forecasts were revised due to the prolonged persistence of high inflation, which could reach 4.8% by November, as noted by Bank of America analysts. This situation may even force the Fed to raise interest rates, according to former Treasury Secretary Larry Summers.

In the mixed atmosphere of the markets, the corporate sector may act as a support as the quarterly results season unfolds. What was previously perceived as negative news due to the expected decline in interest rates may now be a boost for companies as the strong economy helps boost their profits.. Although tech companies remain the main players in the market, it is difficult for them to surprise investors and attract them to new purchases, especially in the context of high expectations and prices at their highs.

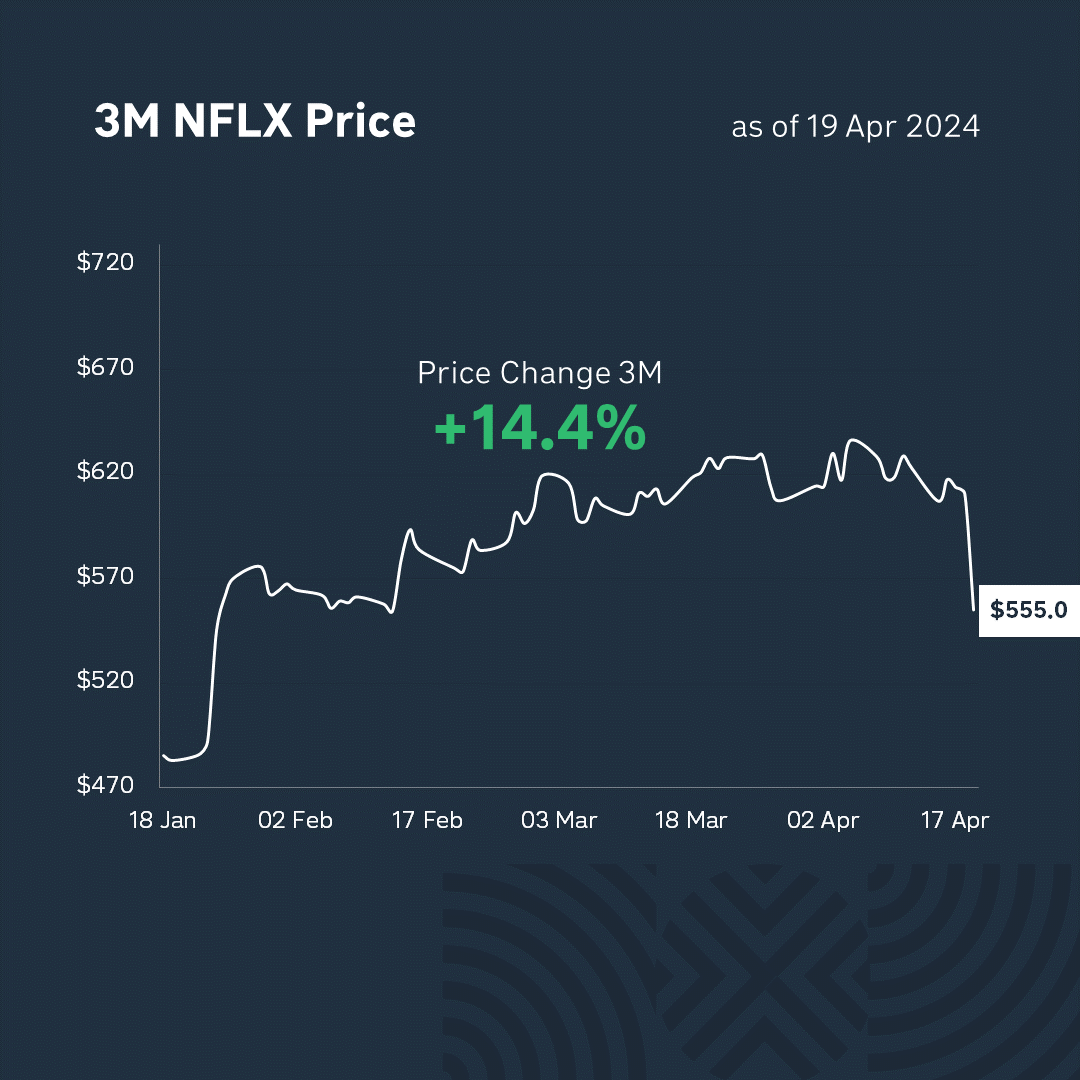

This week, Netflix shared its first quarter results. The company exceeded expectations in terms of revenue, net profit, and the number of subscribers. It would seem that there is nothing more to be desired! But the problem is that the forecast for the second quarter was not as optimistic as investors would have liked. As a result, the price of Netflix shares fell by more than 6% in over-the-counter trading before the stock exchange opened on Friday.

The situation looks unfavorable for the bulls, as all the positive news has already been priced in, and no new gains are expected. Even the next few weeks, when tech giants will present their reports, may not be as stimulating. Given the results of the quarterly reporting season, the situation is perceived as one that will not contribute to further growth. It seems that bears have the upper hand in the market at the moment.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.