It was a very interesting week, which was an almost perfect illustration of what investors value and how their emotions and psychological state affect the market. And while the first half of the week was dominated by corporate news, macroeconomic factors came to the fore at the end. Now, let’s talk about everything in turn. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Tesla disappointed in its first-quarter results, posting declines in revenue, net income, and gross margin. With no new models and growing competition, the situation looks disappointing. However, Elon Musk’s announcement of accelerating the release of new models and robotaxis sent the stock up by 12%, showing that the market reacts to expectations, even if they are not confirmed.

Meta reported impressive results: the increase in profit and revenue for the year exceeded forecasts. But during the forecasts for the next quarter, Zuckerberg faced reality: he admitted that revenue could be lower and the cost of developing artificial intelligence would increase. This led to a 15% drop in Meta shares, which shows that the market does not always appreciate honesty.

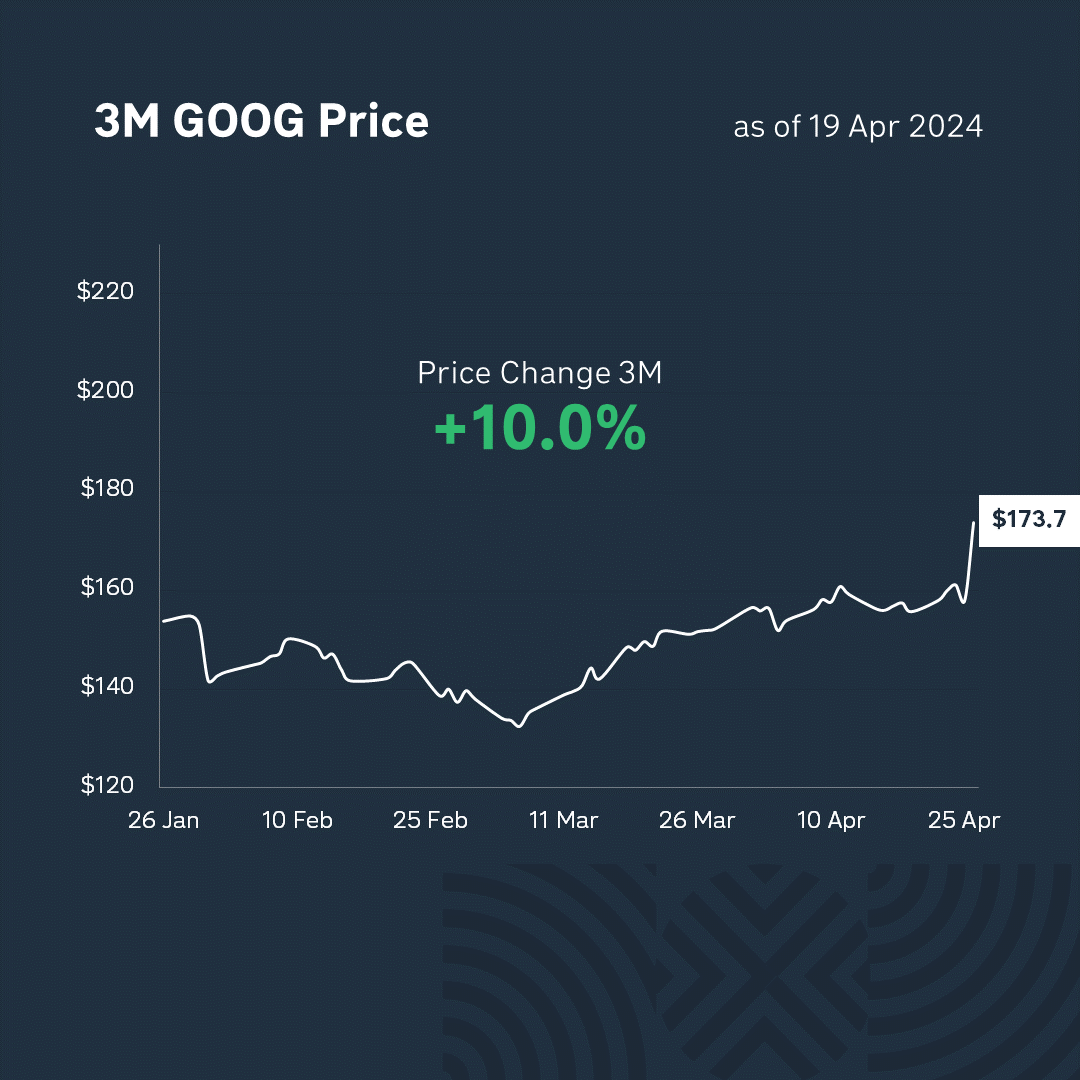

The market was quite upset when it heard about the low US GDP figures for the first quarter, but by the end of the day, the situation was almost rectified. On Thursday evening, Google and Microsoft had a real celebration, with Alphabet exceeding expectations and announcing the first dividend in its history. Compared to its peers, Microsoft looked a bit more modest, but the company’s cloud business contributed to the fact that its actual results, revenue and profit, were better than forecasts.

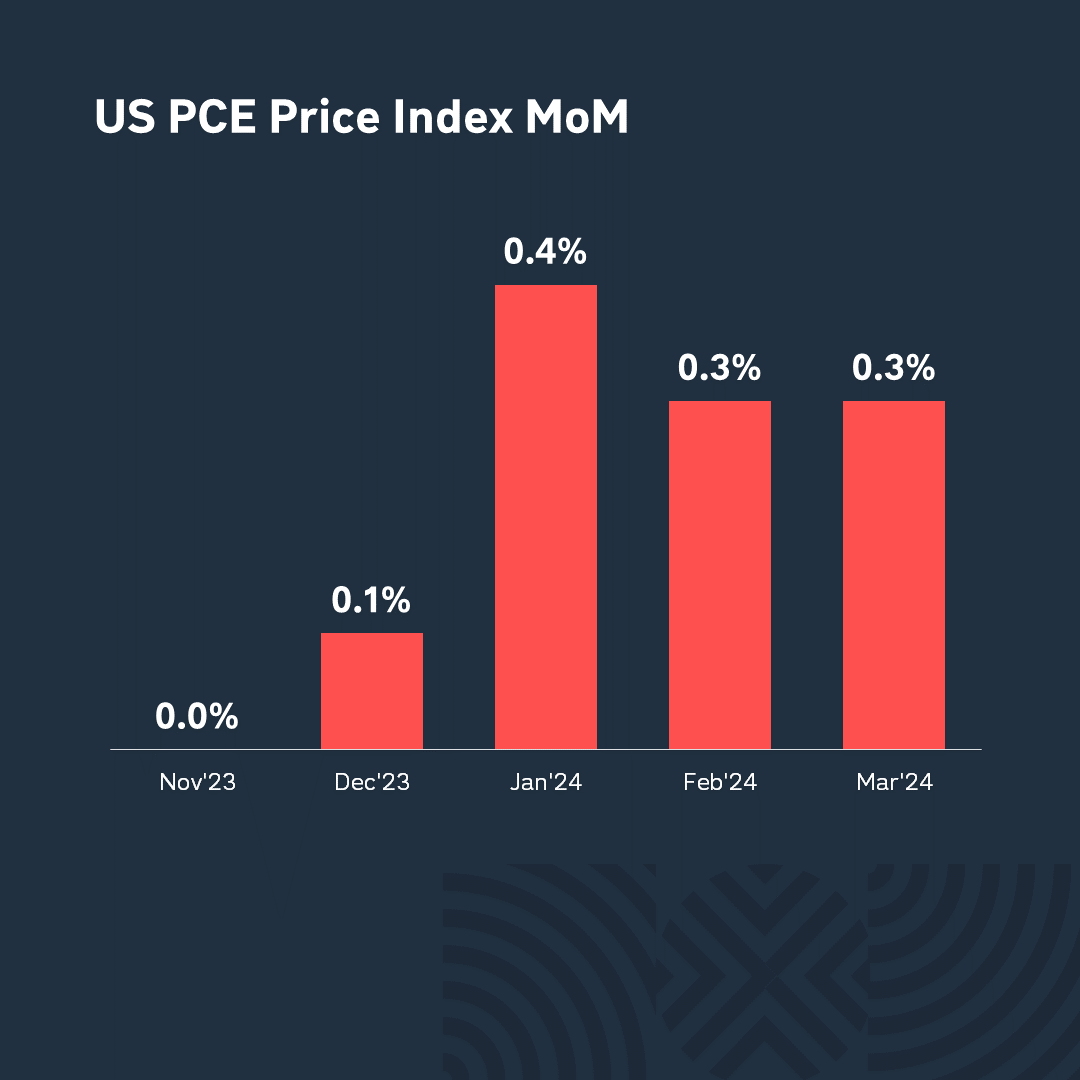

At the end of the week, on Friday, the US Bureau of Economic Analysis announced the value of the PCE (Consumer Expenditure Index), which is used by the Fed to measure inflation. In March, the PCE Index grew by 0.3%, the same as in February, and fully in line with the forecast. On an annualized basis, the result was slightly above expectations and higher than in the previous month.

It seems that despite the excellent corporate results of almost all of the G7, which continues to push markets up, we have a problem. And the problem is a decline in GDP with inflation still quite high. What should the Fed do in this situation? What should the Fed do in such a situation? It seems that different market segments have answered this question in different ways. The casino, which the stock market is gradually turning into, is flying forward without restrictions, while the “smart money” that dominates the bond market is being cautious and selling a little bit. So you decide with whom you feel more comfortable.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.