The folk wisdom is worthy of attention, especially the Wall Street saying: “Sell everything in May and go on vacation,” implying that summer is not the best time for capital markets. It’s not a law, but historical data shows that many summers have been bad for investors. This summer could have been different: markets were overwhelmingly optimistic, indices were rising, bond yields were falling, and bulls were dominating bears. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

But nothing lasts forever, and even greed needs fuel. Investors need catalysts for optimism, like Nvidia’s quarterly report. The company’s stellar results and exciting forecasts led to a 33% rise in shares for the month and 132% since the start of the year. However, Nvidia, though fantastic, couldn’t lead the entire market. Experienced investors note the market’s unusual behavior of falling even when its leader grows. The anticipated growth stage hasn’t begun, and indices remain red with no signs of upward movement.

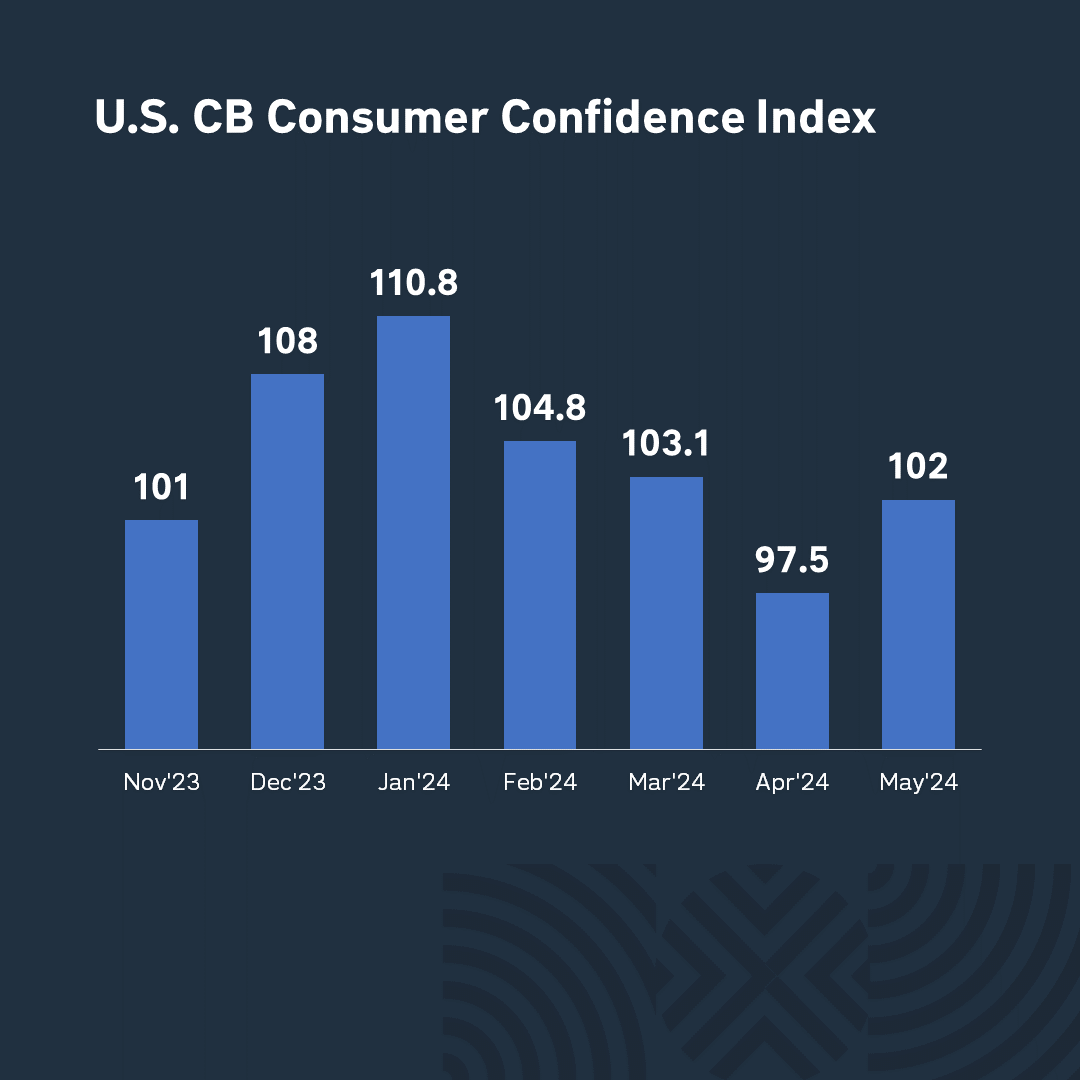

The main reason for the slowdown is the macroeconomy and Fed policy. The second estimate of the US GDP in the first quarter showed an increase of 1.3%, while in the fourth quarter of last year this figure was 3.4%. Economists at Bank of America believe that “the economy slowed down a bit in the first quarter, but overall it remains stable.” Consumer confidence in the future does not look strong: inflation has reduced savings, high interest rates are increasing borrowing costs, and there is less money left for shopping and entertainment. Retail sales growth in April was only 0.2%. The Conference Board consumer confidence index rose to 102.0 in May from 97.5 in April. The current situation index rose to 143.1 in May from 140.6 in April, and the expectations index rose to 74.6 from 68.8 last month. This is an improvement, but the Expectations Index was below 80 for the fourth month in a row, signaling a possible recession.

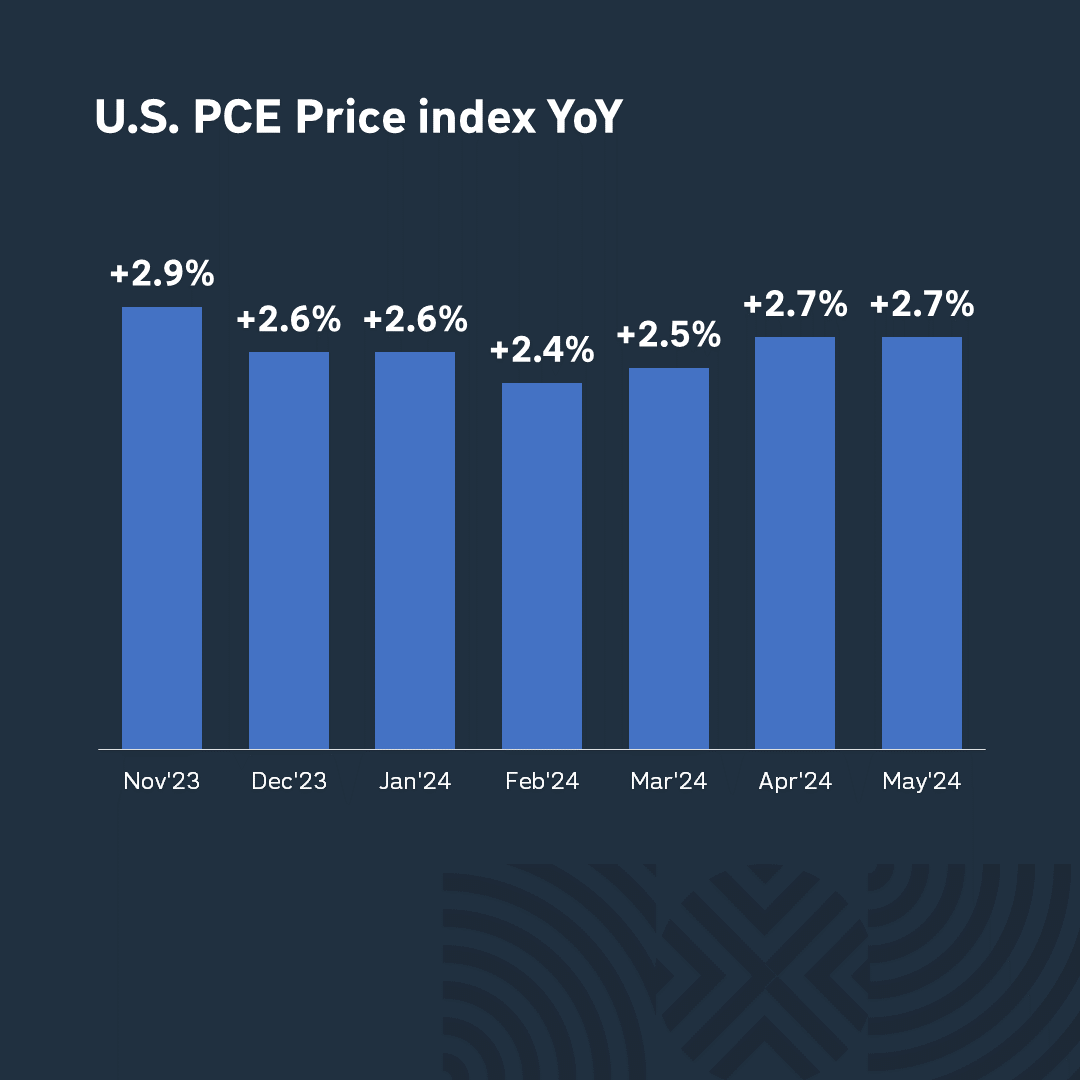

The last chance to “save the week” could have been the release of data on the PCE Index, which is the Fed’s measure of inflation. It was expected that the index would grow by 0.3%, and by 2.7% on an annualized basis. The actual results were fully in line with the forecasts, showing no convincing downward movement. Core PCE, excluding food and fuel prices, rose by 0.2%, slightly better than expectations of 0.3%, and 2.8% year-on-year. All in all, it doesn’t look like these figures are exactly what the Fed wants to see before deciding to cut rates, and the market before jumping further up.

So, given all of the above, we’re going to have to admit that we really should listen to folk wisdom, and that the best strategy may indeed be “Sell in May and go away!”

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.