Recently, the market has lacked catalysts for further growth. The topic of artificial intelligence has exhausted itself, quarterly results have not yet been released, so traders are left with speculation about the Fed’s interest rate cut, reacting to the speeches of its leaders. This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Initially, Powell emphasized in a speech at Stanford that inflation is headed for 2%, but the Fed’s leadership expects a possible rate cut this year. Atlanta Fed President Bostic agreed with this, pointing to a possible one-time cut. This lifted the mood of traders, but the speech of the President of the Minneapolis Fed, Kashkari, about the possible termination of rate cuts in case of unimproved inflation, caused a significant decline in the indices. But forecasts are one thing, and reality can be surprising. “The ‘last mile’ is always the most difficult” – at the end of last week, the PCE index showed that inflation is not willing to return to the 2% target.

The OPEC+ decision and tensions in the Middle East are pushing up oil prices, prompting a return of inflation. The cartel on Wednesday maintained its current supply policy and called on some members to cut production. The conflict between Israel and Iran threatens stability, which could limit oil supplies, raising prices and creating problems for the Fed and other central banks. On Friday, Brent crude futures reached $91 per barrel, the highest level since last fall.

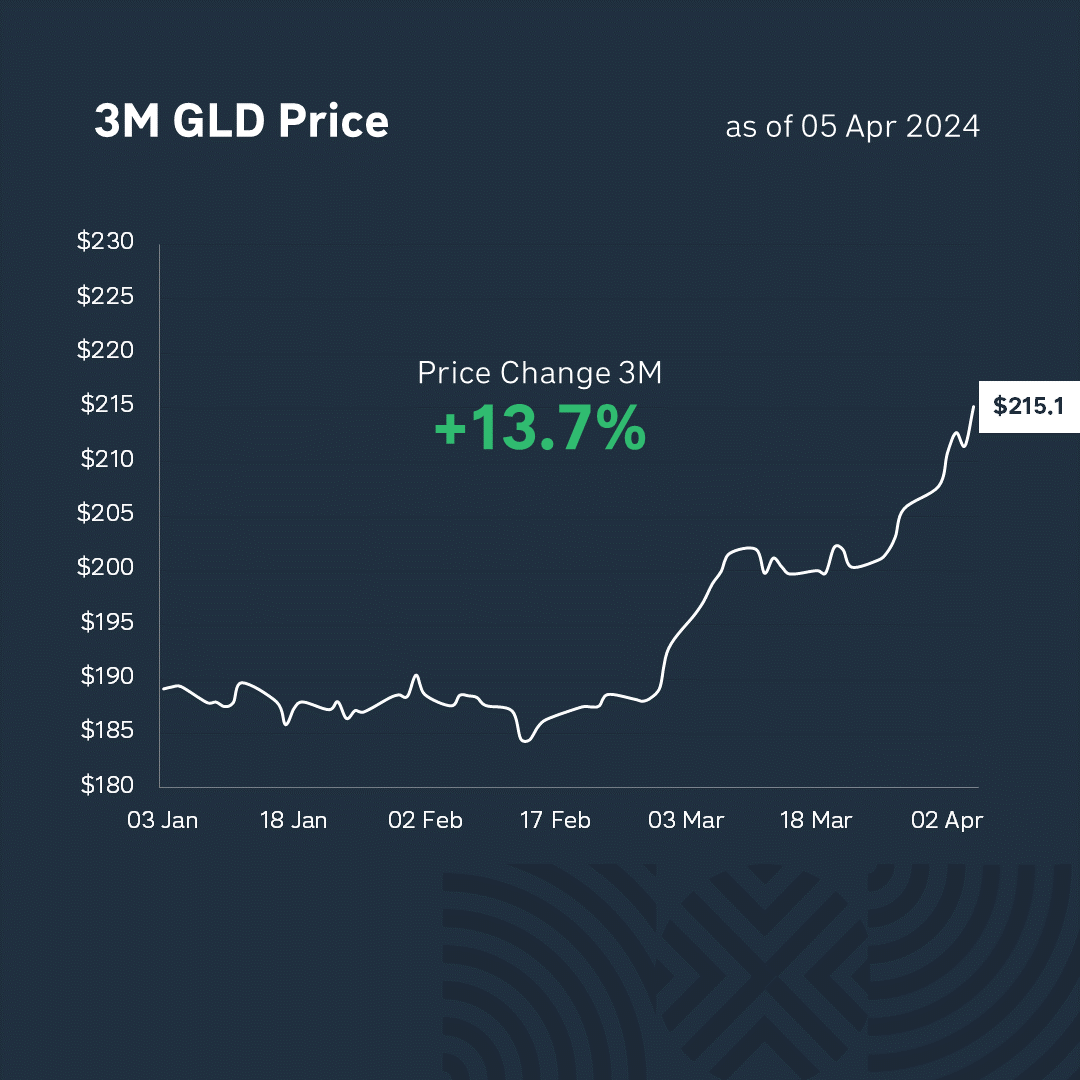

We cannot but say a few words about gold, whose price has already risen by 12% this year, confidently outperforming the S&P 500 and Nasdaq. The prospect of lower interest rates and geopolitical instability are driving both investors and the world’s leading central banks to actively buy gold. And it doesn’t look like these arguments have exhausted themselves.

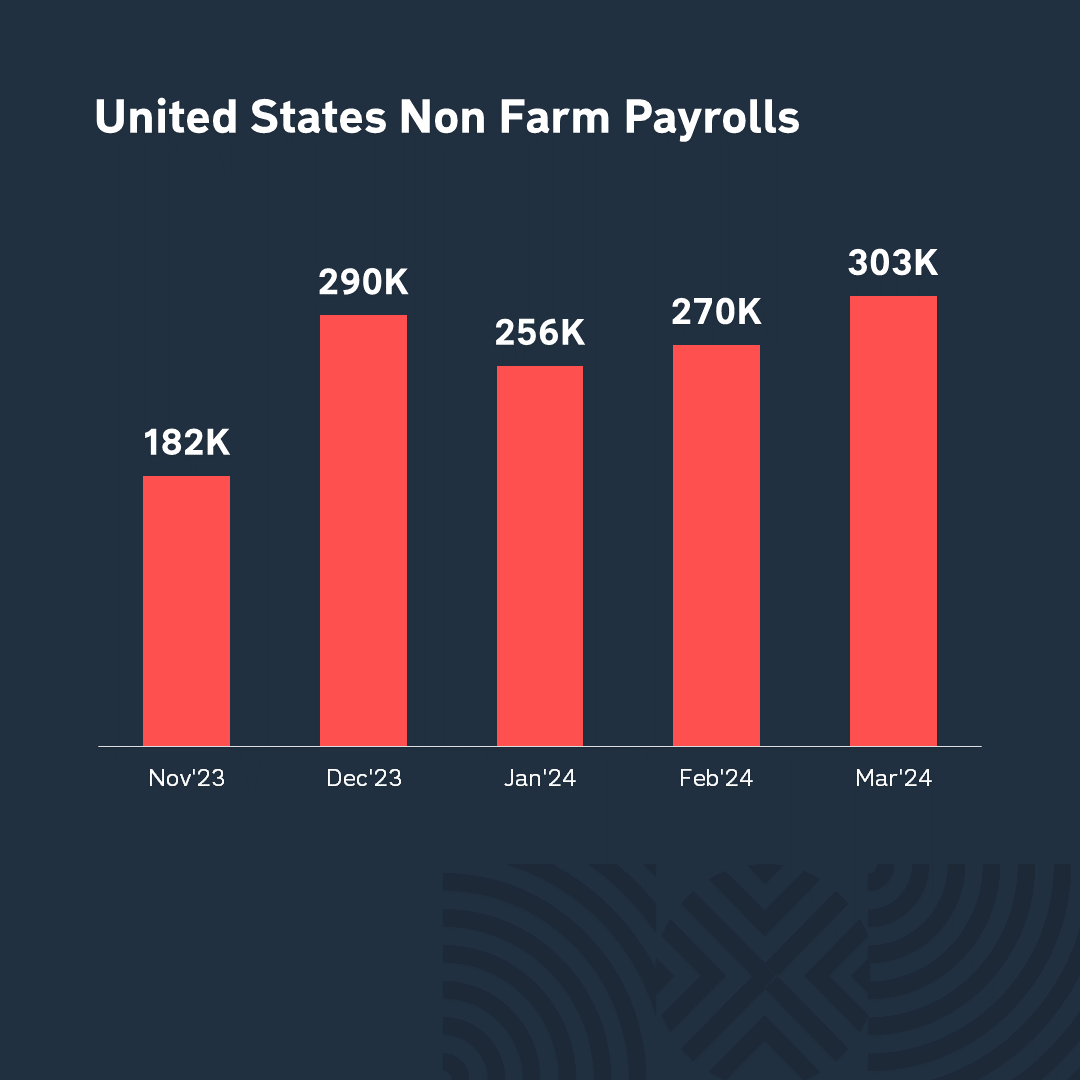

The main event of the week, as expected, was the Labor Market Report, which is an important part of the foundation for the Fed’s decisions. In March, 303,000 jobs were created in the US economy, which is significantly more than the 214,000 forecasted. The unemployment rate fell to 3.8%, from 3.9% in February. Wages grew by 4.1%. As you can see, the labor market is in great shape and thus a potential source of inflation and again making investors and traders worried.

It doesn’t look like investors have discovered any new factors this week that will make markets rise further. The situation is not easy: the likelihood of a central bank rate cut this year is decreasing, bond yields are rising, stock prices are too high, and so if the quarterly results of companies that start coming in next week do not impress investors, we may be in for a correction.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.