The corporate reporting period has is going.

Last week, 138 companies from the S&P 500 index reported.

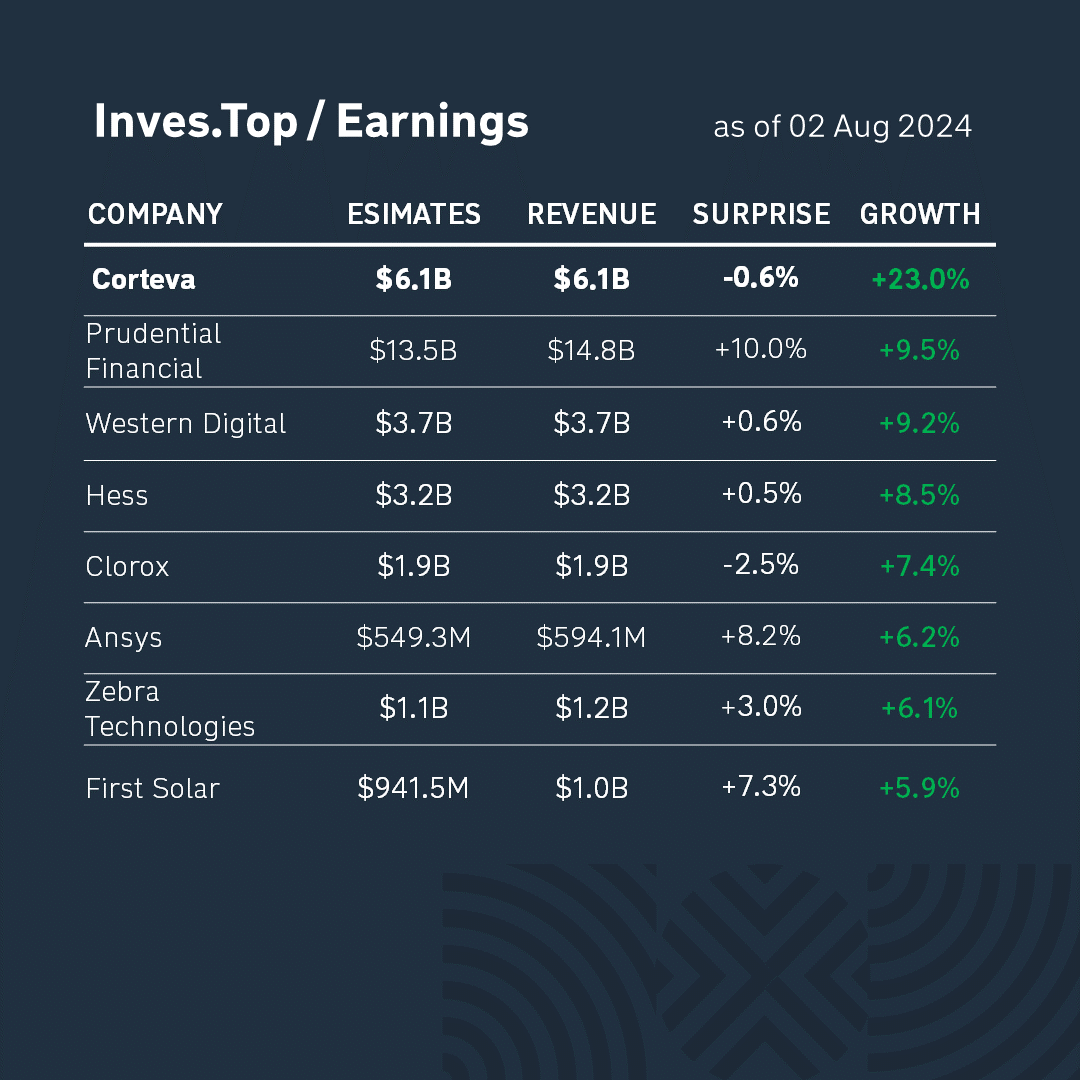

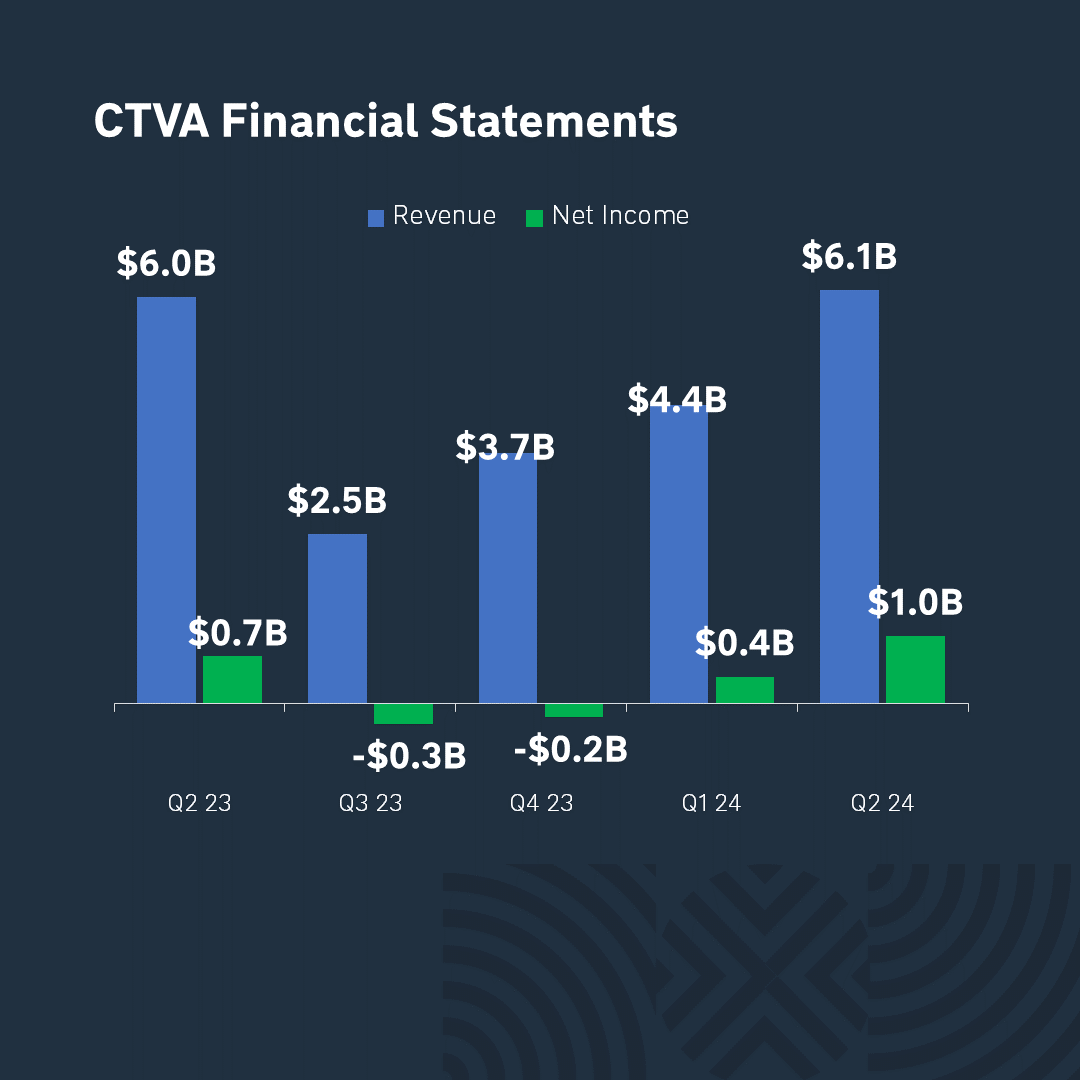

Today, we will consider Corteva. Its revenue is $6.1B. It grew by +23.0% compared to the corresponding value for the previous quarter, but did not exceed analysts’ expectations by -0.6%. Let’s analyze the company’s business in more detail.

Corteva is one of the world’s largest seed and crop protection companies, formed in 2019 through a spin-off from DowDuPont. Seeds account for about 60% of the company’s revenue and crop protection products for 40%.

Corteva’s revenues increased by +1.6% year-on-year. The company received permission to export its genetically modified products to China, which improved its market position. Corteva also paid royalties in full, namely $1.0B to its direct competitor Bayer, which contributed to the revenue growth.

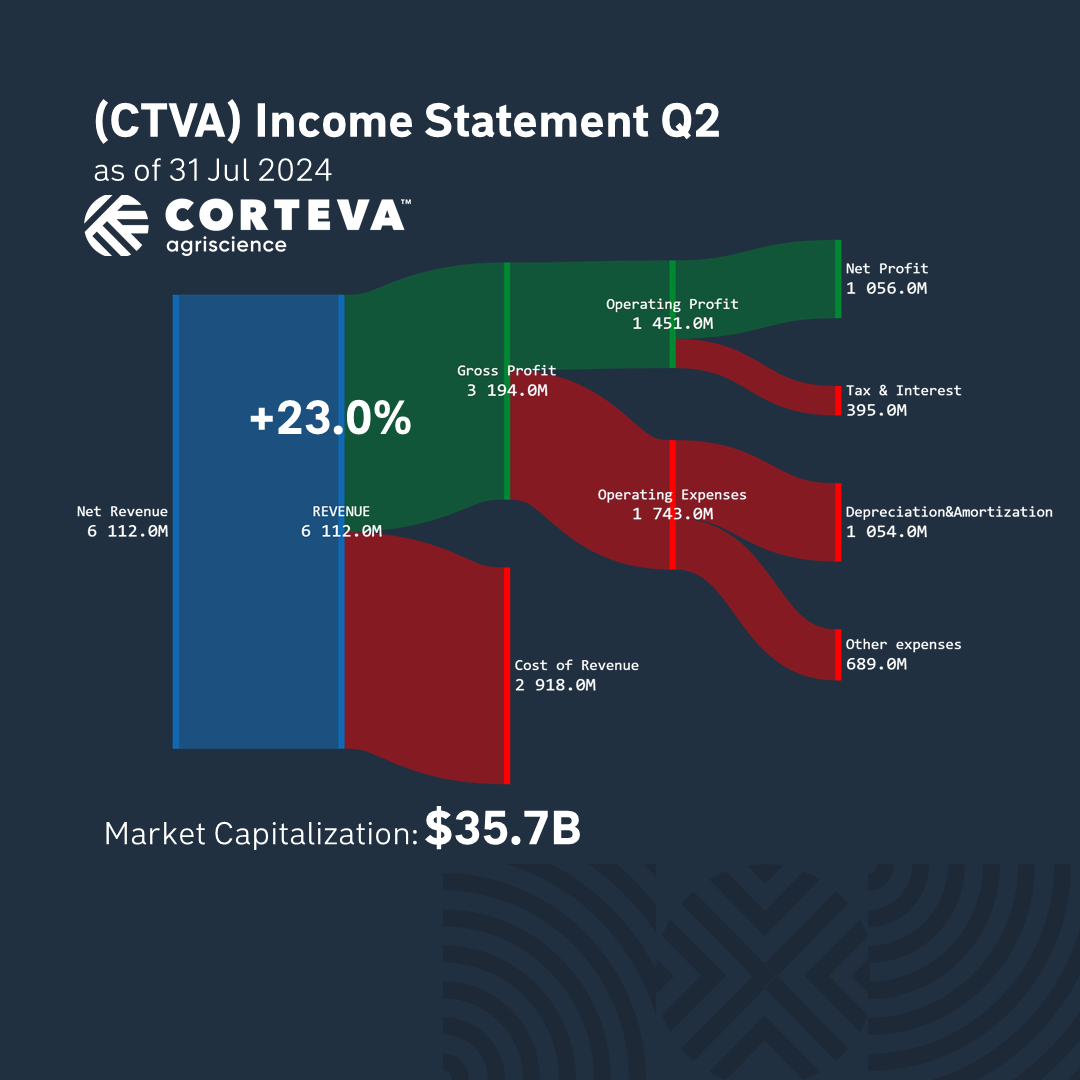

48% of the revenue structure is made up of manufacturing costs and 52% of gross profit. Over the past quarter, the company earned a profit of $1.0B. And its market capitalization is $35B.

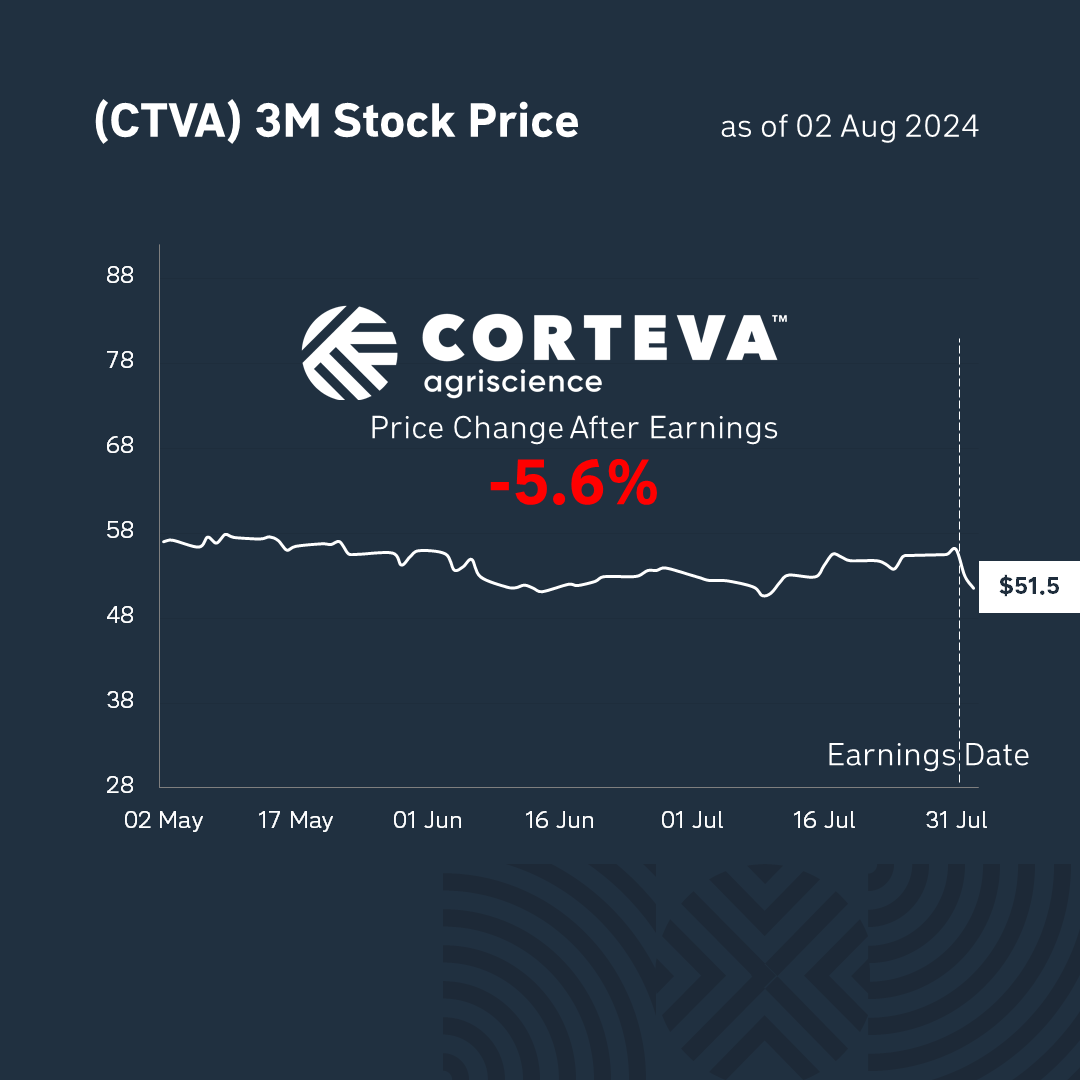

After the publication of the report, Corteva’s shares fell by -5.6% to $51 per share. In general, market participants are dissatisfied with the company’s current financial results and reacted negatively to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter