Today we are going to talk about Axon Enterprise, whose shares has been in the top 5 growth leaders over the last 3 months.

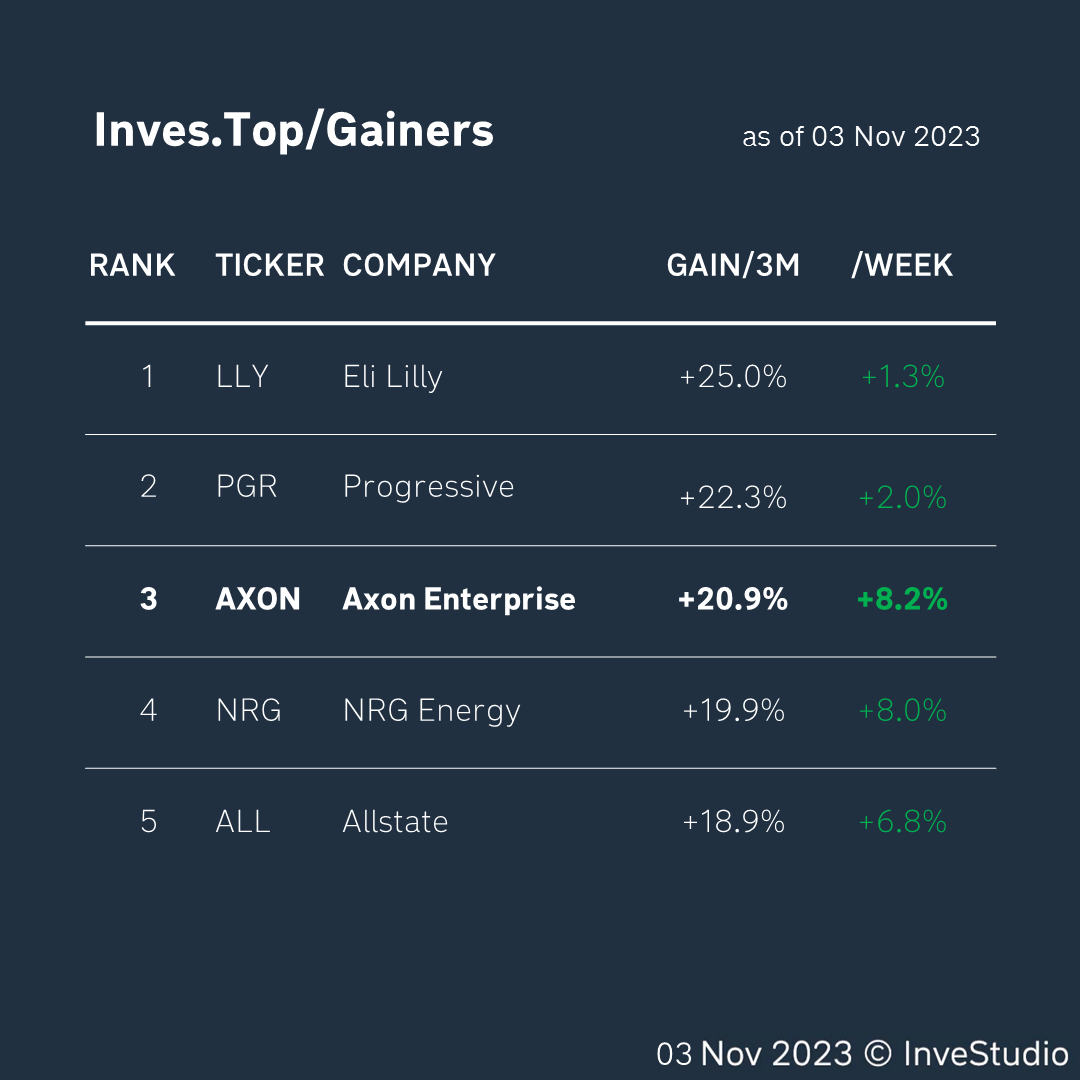

Axon Enterprise published its latest report for Q3 2023 on 7 November. Manufacturing costs make up 38% of the revenue structure, and gross revenues make up 62%. In the last quarter, the company made a profit of $59M. Market capitalization is now $16.3B.

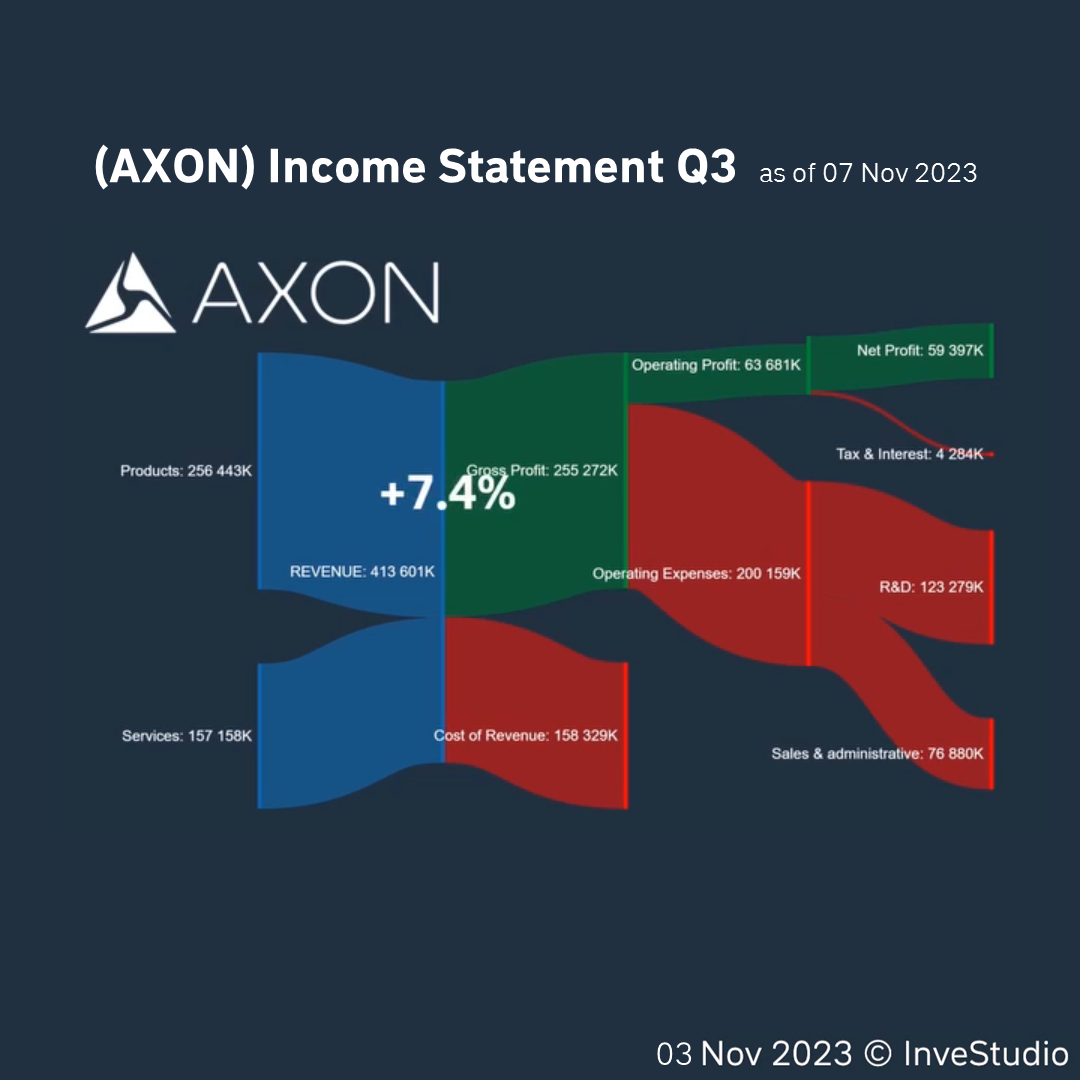

Axon Enterprise was the first company in the world to start mass selling TASER stun guns. Although the TASER was first patented by NASA employee Jack Cover in the early 1970s, it wasn’t until the 2000s that he and Axon Enterprise (then known as TASER International) finally managed to complete it and get the business up and running.

Axon Enterprise is in the aerospace and defense industry. It was founded in 1991. It was listed on the NASDAQ in 2011 and included in the S&P 500 Index in 2023. For the past 30 years, the company has been headed by Patrick Smith and a team of qualified managers.

Axon Enterprise’s main competitors are TransDigm Group, L3Harris and Teledyne Technologies. As you can see from the table above, they are ahead of Axon Enterprise in terms of capitalization, but the company has a number of competitive advantages.

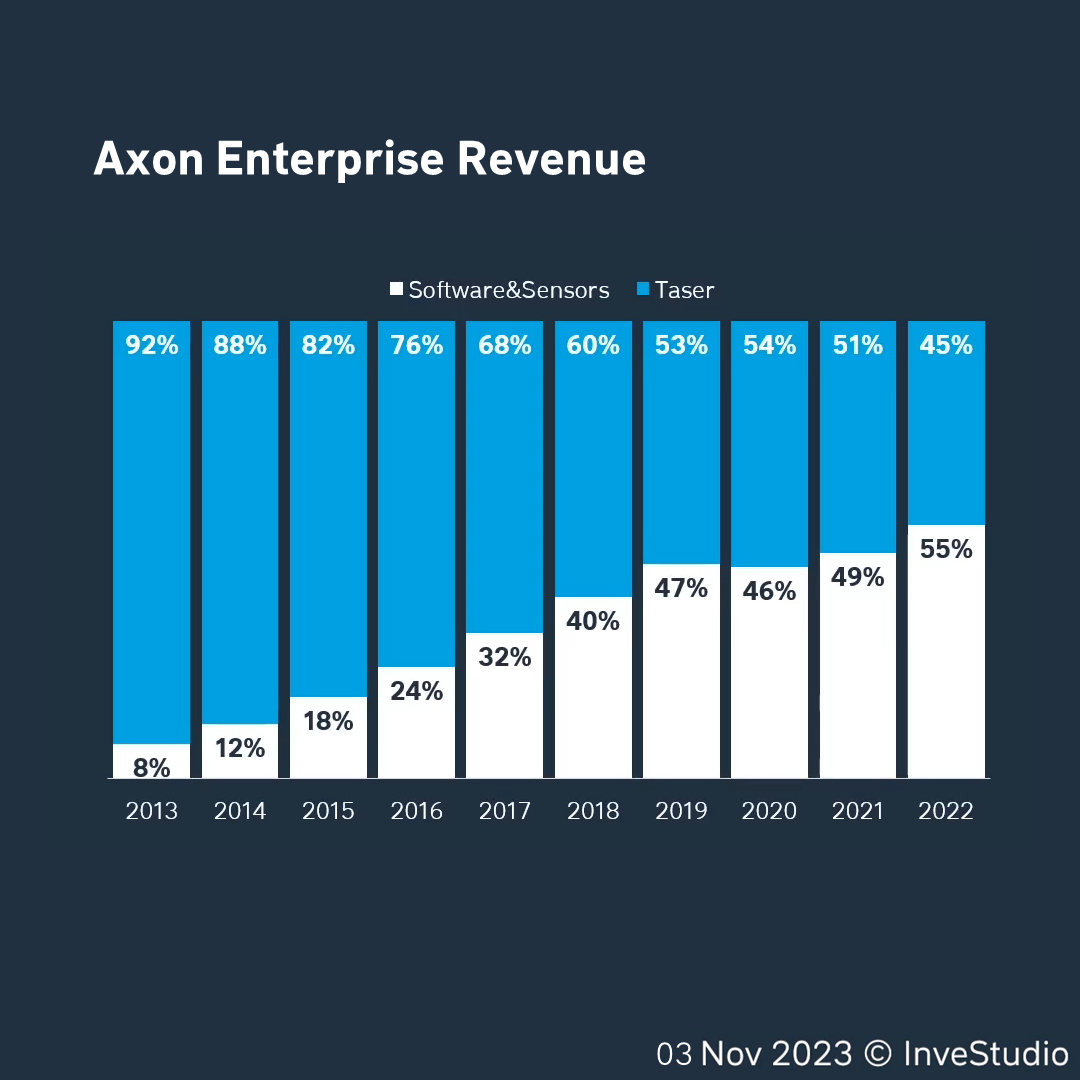

Axon’s strengths are based on the transformation of its business to a Software as a Service (SaaS) model. Over the past 10 years, the company has reduced the percentage of revenue generated from the sale of physical goods from 92% to 45%. At the same time, it has increased revenue from the sale of cloud software and other technology services from 8% to 55%. Unlike physical products such as stun guns, SaaS products can be upgraded without the customer having to buy a new product – just by upgrading the programme. In addition, a company can sell its software in a subscription format in any region, allowing it to scale geographically. This approach means that the core of the company’s revenue is stable and predictable.

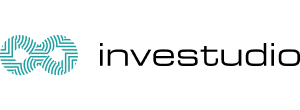

Over the last 3 months, Axon Enterprises stock has risen by +20.9%. At the same time, the industrials sector in which the company is a part has fallen -6.4% and the S&P 500 Index has fallen -3.5%. As you can see, even during periods of market correction, Axon Enterprise’s stock have shown more resilience than the sector average.