The corporate reporting period for Q3 2023 goes on. Over the past week, 75 companies from the S&P 500 Index have reported their third quarter results.

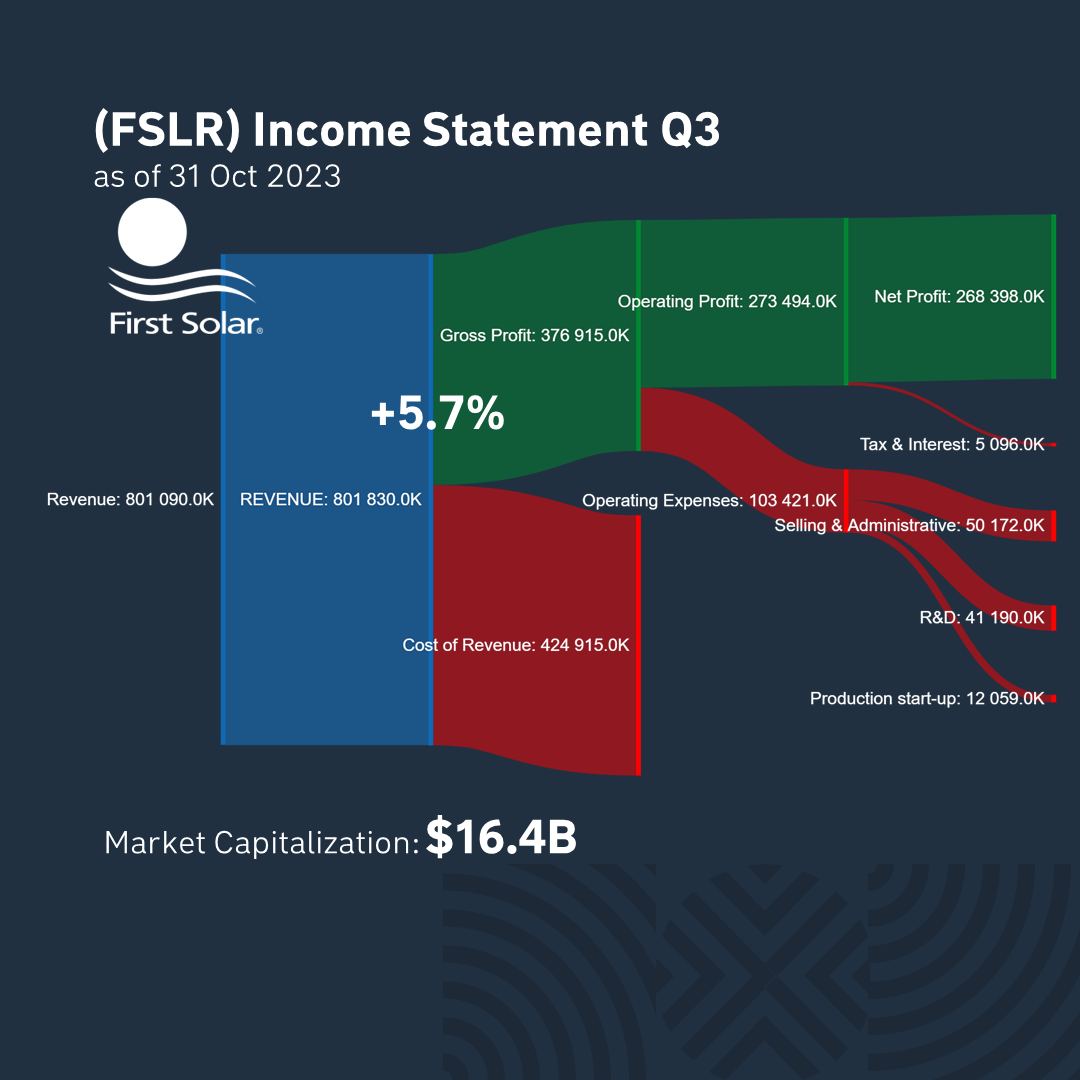

First Solar was one of the top five, with revenue up +5.7% to $801.0M. However, the company showed mixed results, as revenue was below analysts’ expectations by -11.0%. Let’s analyze First Solar’s business in more detail.

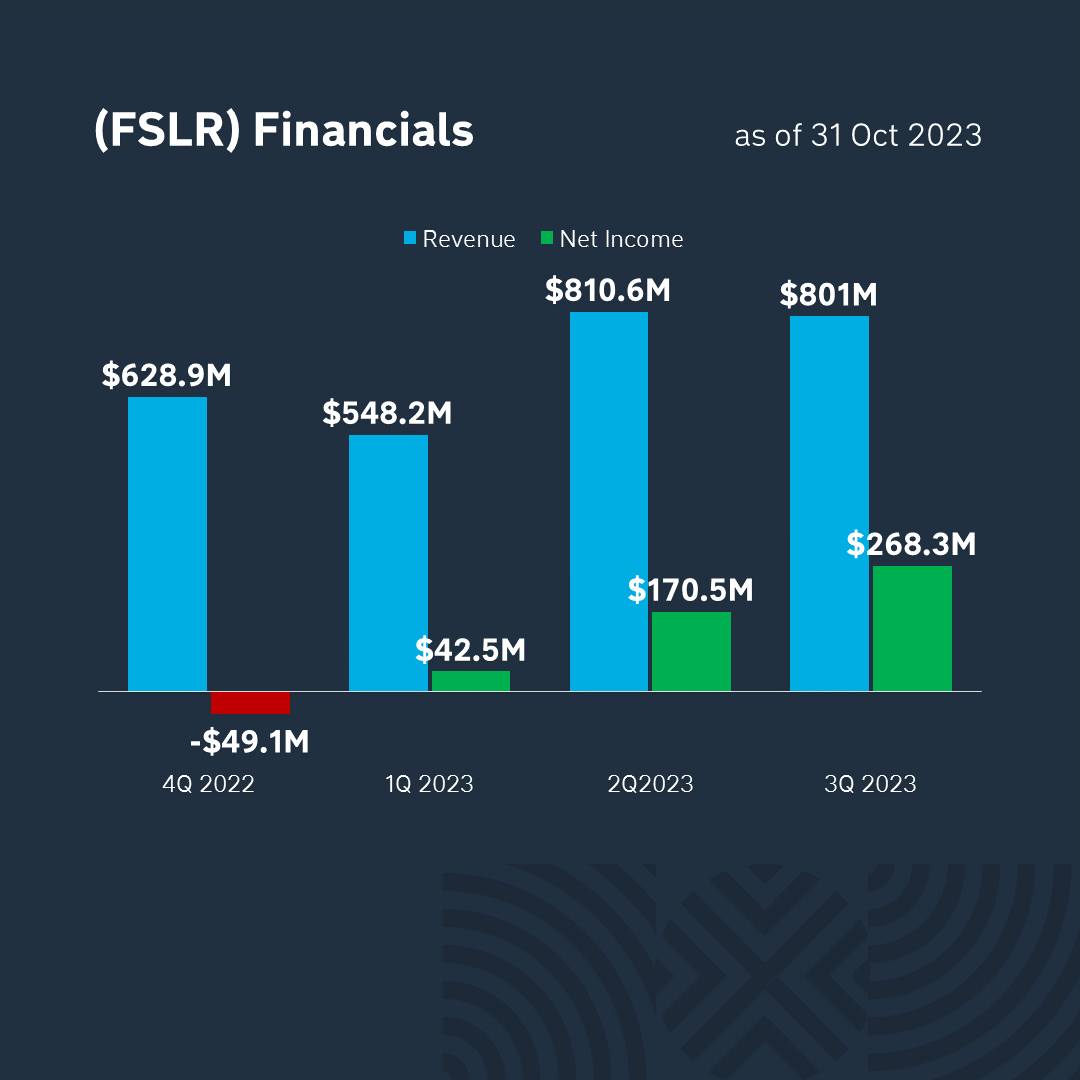

First Solar is an American manufacturer of solar panels. The company has its own unique thin-film semiconductor technology, which gives the business a good competitive advantage. First Solar is confidently occupying its niche in the alternative energy market, as evidenced by its financial results. For example, in 2022, the company posted a net loss of -$44.1M. At the same time, the total net income for 3 quarters of 2023 is already $481.5M.

Analysts expect that the subsidies provided by the US Inflation Reduction Act will stimulate the business of solar energy producers in the long term, and therefore the company is focused on growing demand and increasing capacity in the coming years. Currently, First Solar has a portfolio of projects with a total capacity of almost 82 GW, which is 5% more than in the previous quarter. Since the beginning of the year, demand for electricity has increased to 28 GW.

Manufacturing costs represent 53% of the revenue structure, and gross profit is 47%. Last quarter, the company made a profit of $268.3M. And its market capitalisation now stands at $16B.

After the report was published, First Solar shares rose by 4.4%.However, this reaction was driven by the fact that CEO Mark Widmar sees steady progress for long-term growth, including investments in production and infrastructure. And this makes sense, as we are on the verge of another cycle of interest rate cuts, which will be driven by cheaper loans for households and businesses. By the way, the downward trend over the past 3 months was largely due to the fact that the industry is very sensitive to high interest rates in the economy. Therefore, it was quite difficult to attract new investments and finance projects in such conditions, especially for small companies.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter