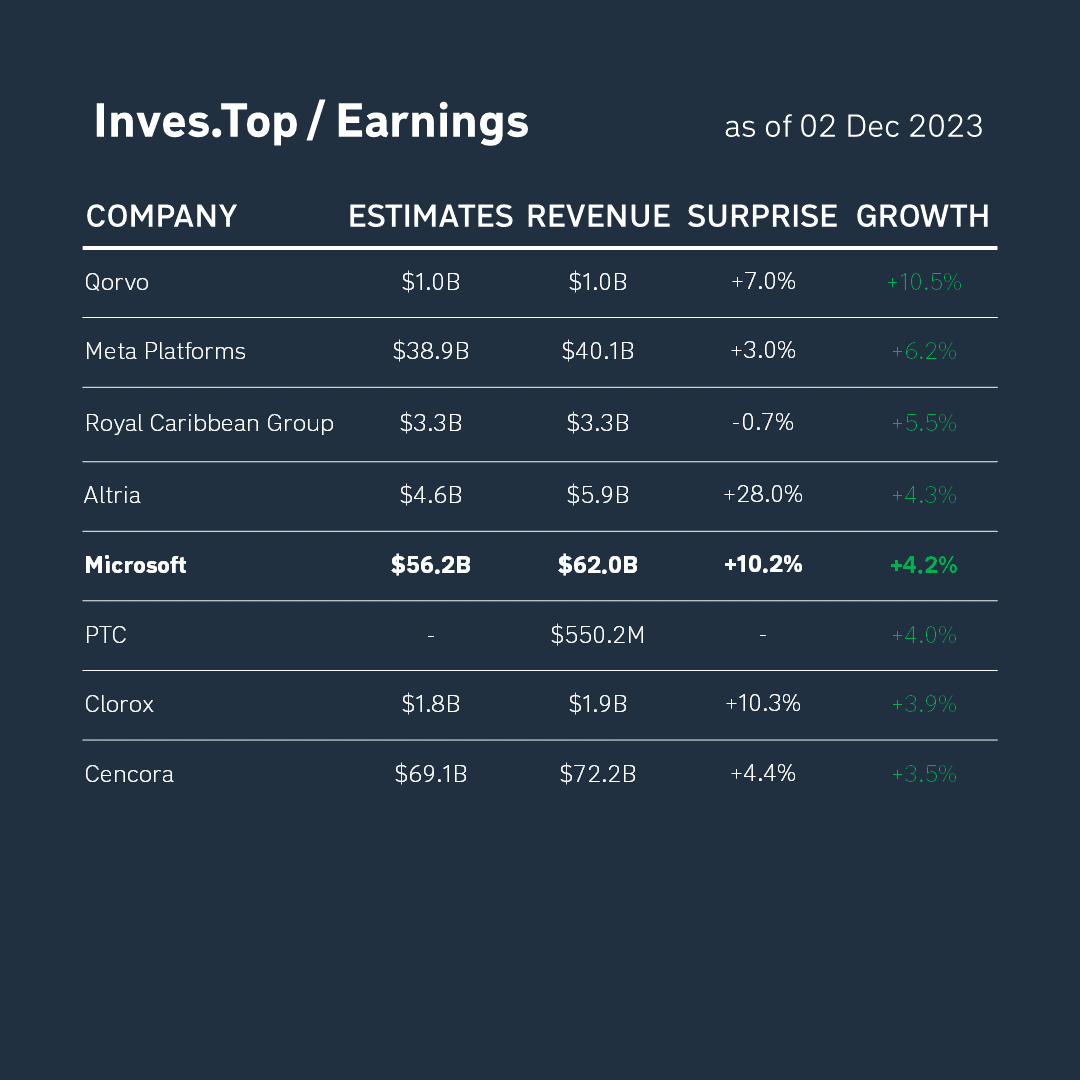

Today, we’re going to talk about Microsoft, which showed one of the best results among the companies that published financial statements last week.

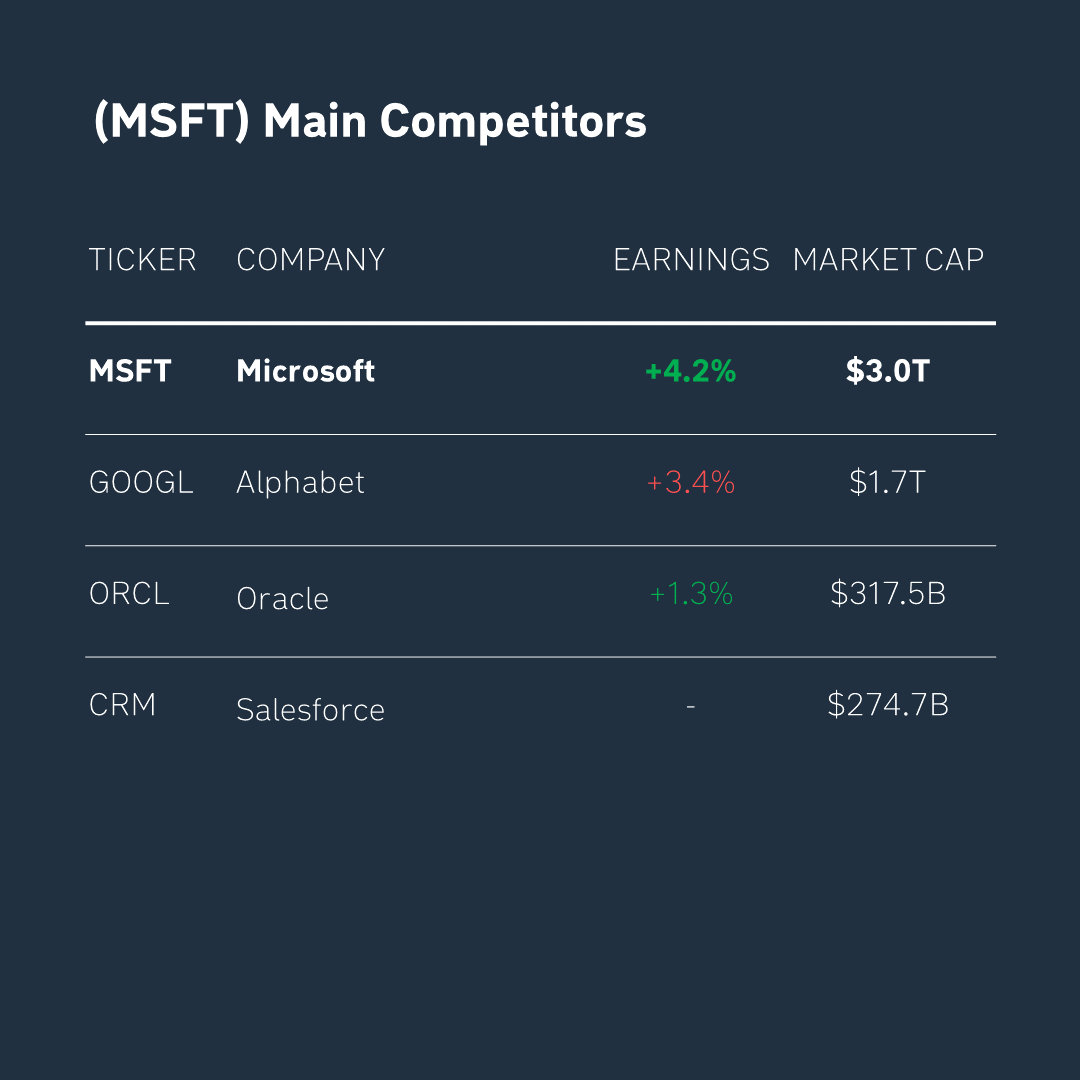

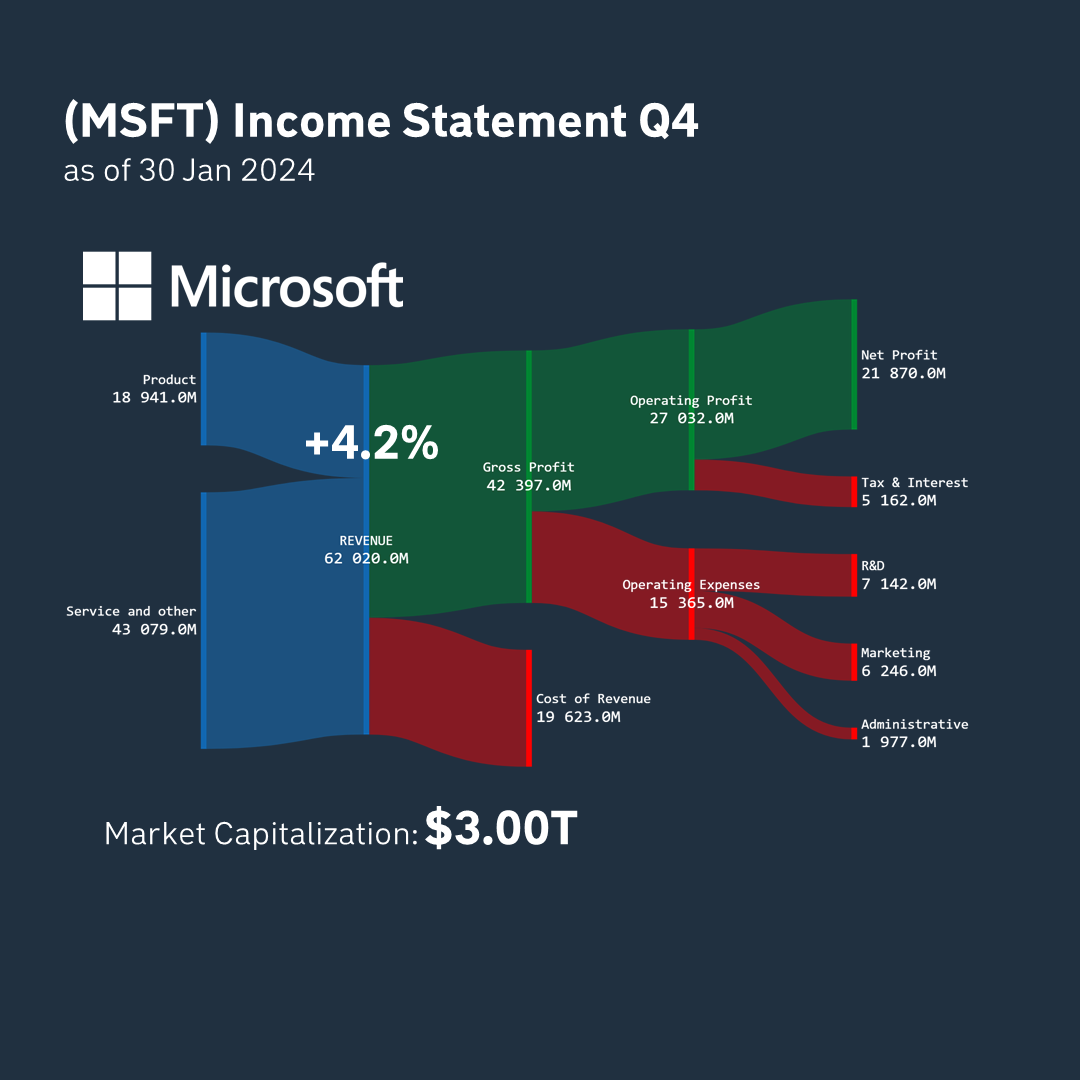

Microsoft published its latest report on January 30. 31% of the revenue structure is made up of manufacturing costs and 69% of gross revenue. Over the past quarter, the company made a profit of $21B. And its market capitalization is now $3T.

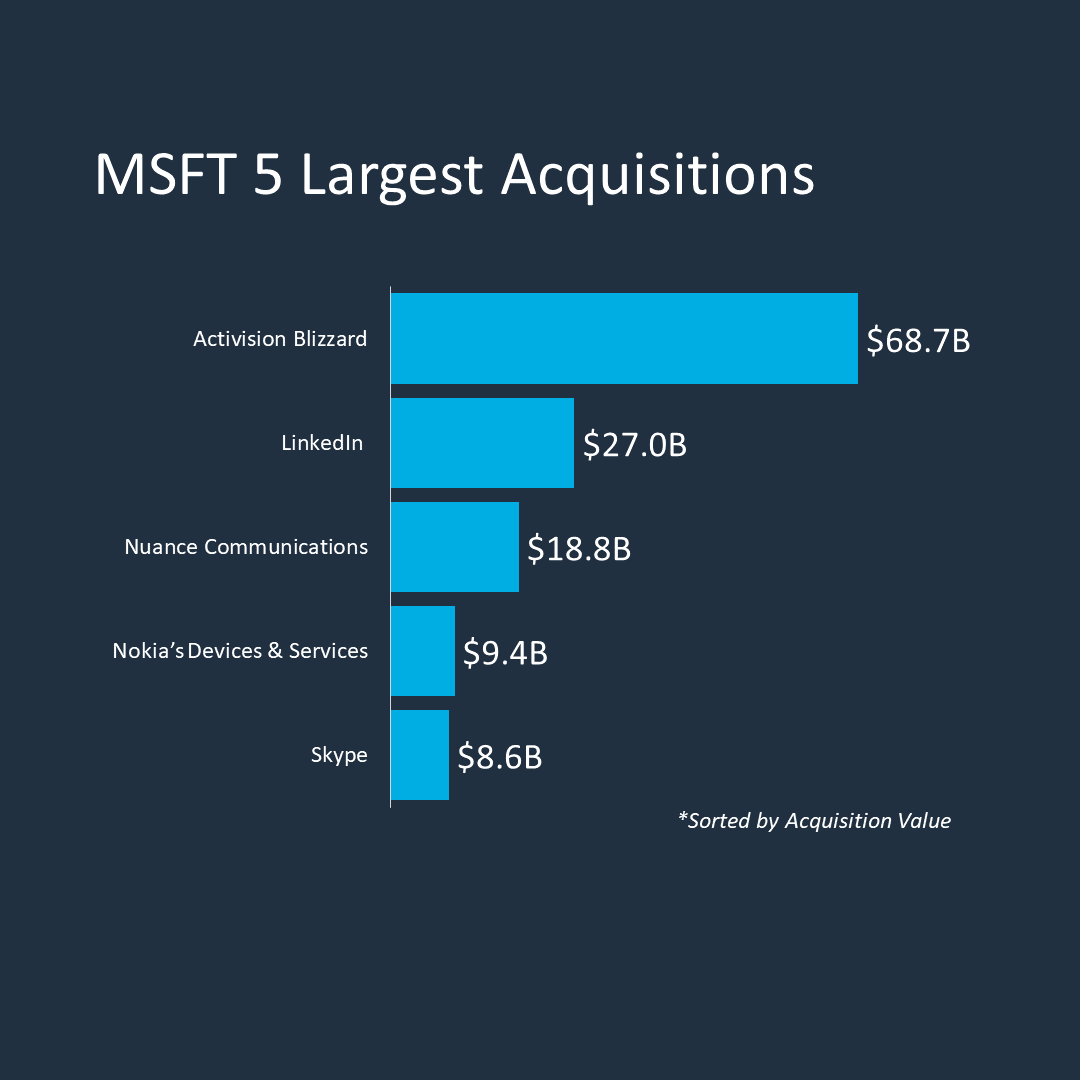

Microsoft is a global leader in software and cloud services. Over its 50-year history, in addition to its own developments, the company has made 225 acquisitions and has a stake in 64 other projects, including the ChatGPT developer and technology startup OpenAI.

The company operates in the software industry. It was founded in 1975. In 1986, it entered the NASDAQ stock exchange and in 1994 was included in the S&P 500 index. For the past 10 years, the company has been headed by Satya Nadella and a team of experienced managers.

Microsoft’s main competitors are Alphabet, Oracle, and Salesforce. As you can see from the table above, the company is ahead of its competitors in terms of capitalization, as it has a number of competitive advantages.

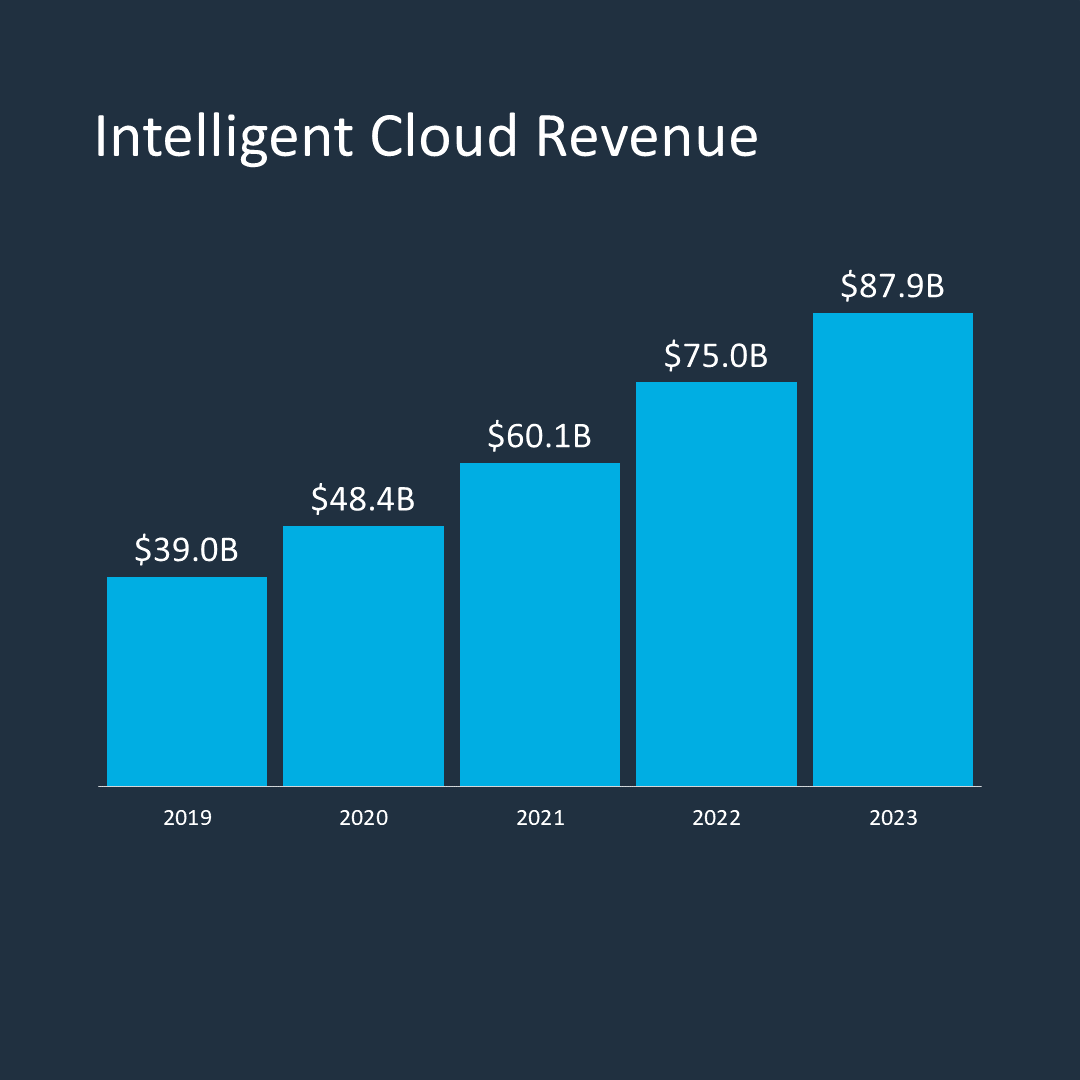

Today, Microsoft’s strengths are based on its dominant position in the cloud services market. The company’s main growth drivers in this segment are Azure, SQL server, and GitHub, and its clients include such well-known names as Visa, Honda Motor, KPMG, and Accenture. Over the past 5 years, revenue from cloud services has grown by an average of +22% annually. At the end of 2023, it amounted to $87B and is expected to reach $119B in 2025.

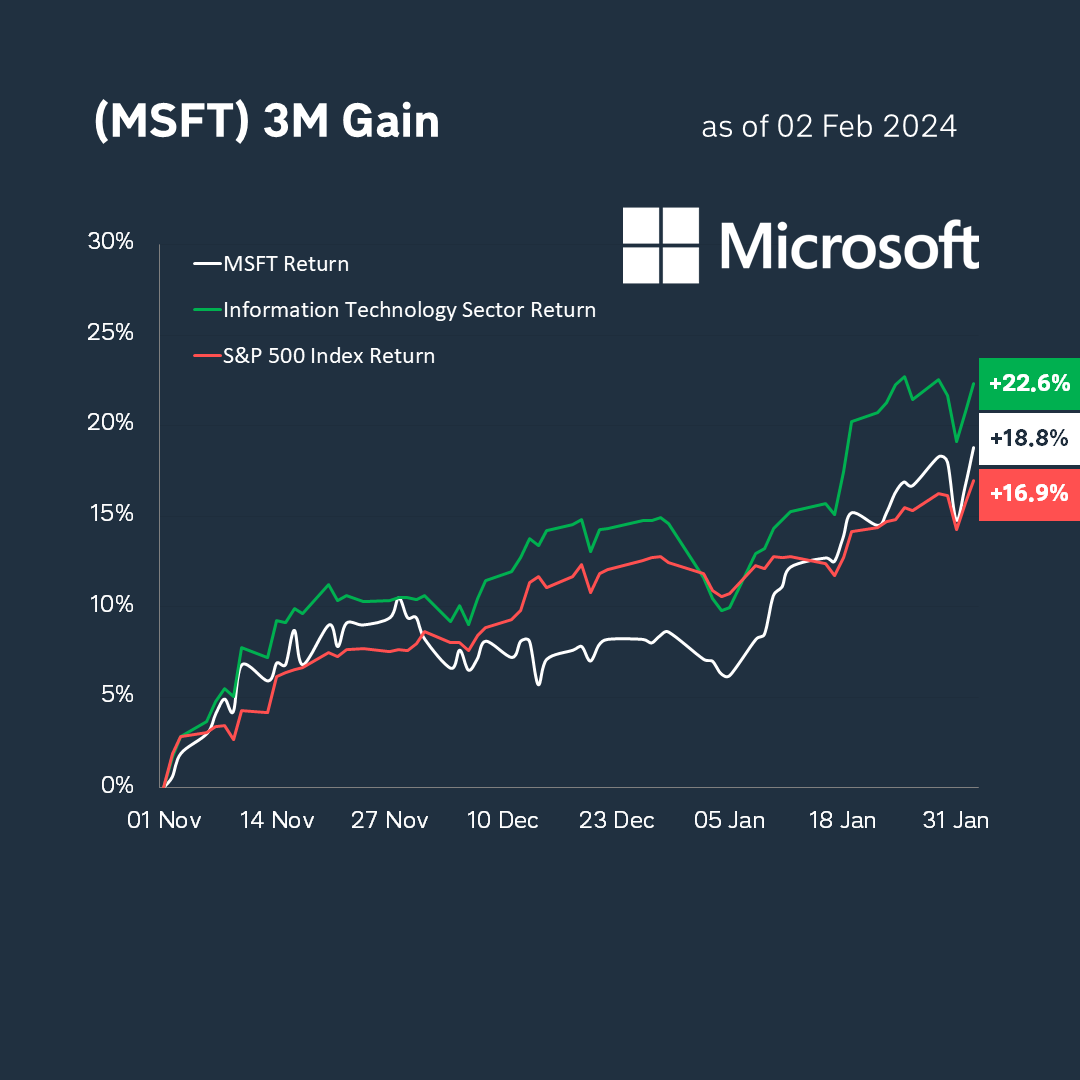

Over the past three months, Microsoft stock has risen by +18%. At the same time, the information technology sector, to which the company belongs, grew by +22%, and the S&P 500 index by +16%. As you can see, Microsoft shares show better dynamics than the index, but do not outperform the sector’s yield.