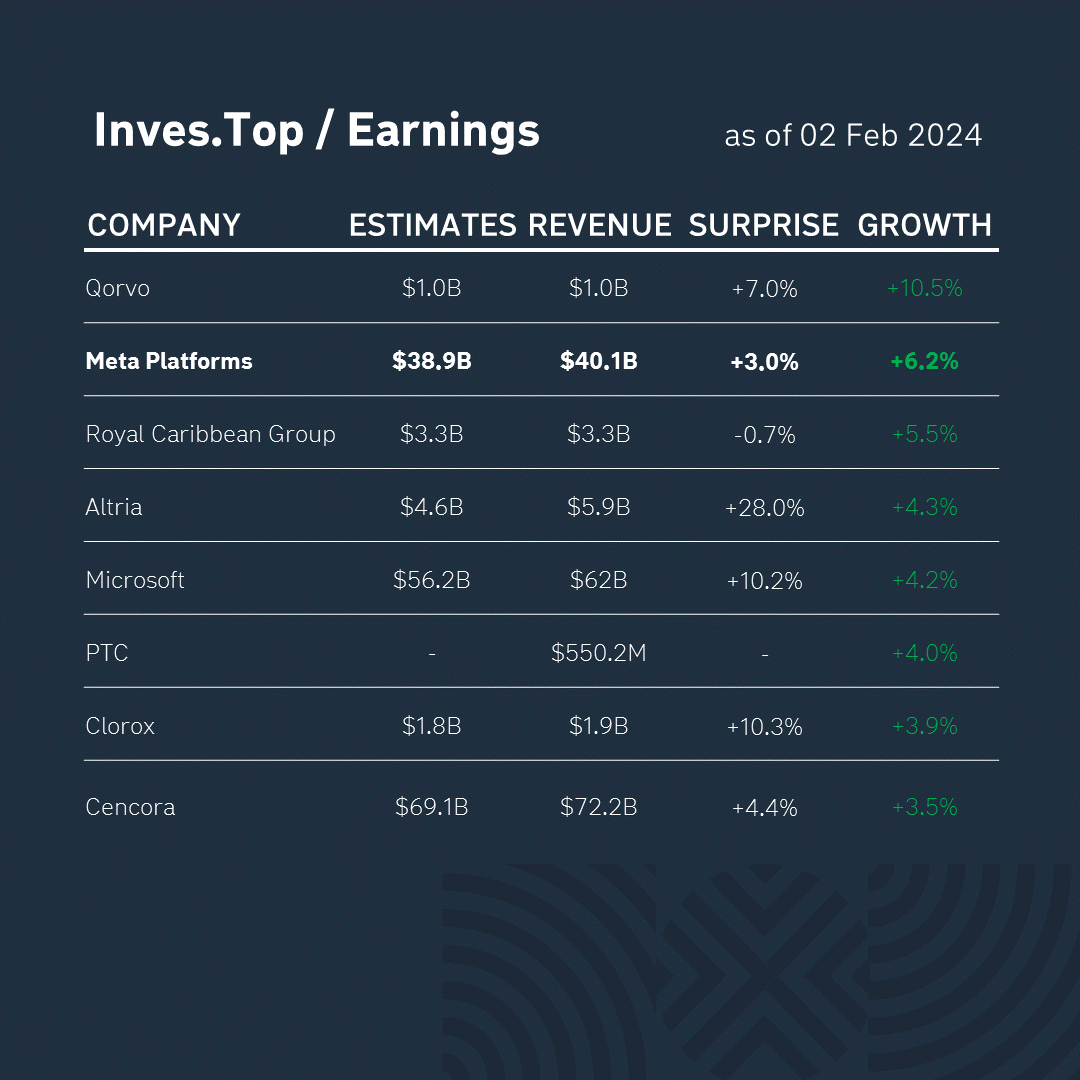

Over the past week, 102 companies from the S&P 500 index have already reported for the quarter ended December 31, 2023.

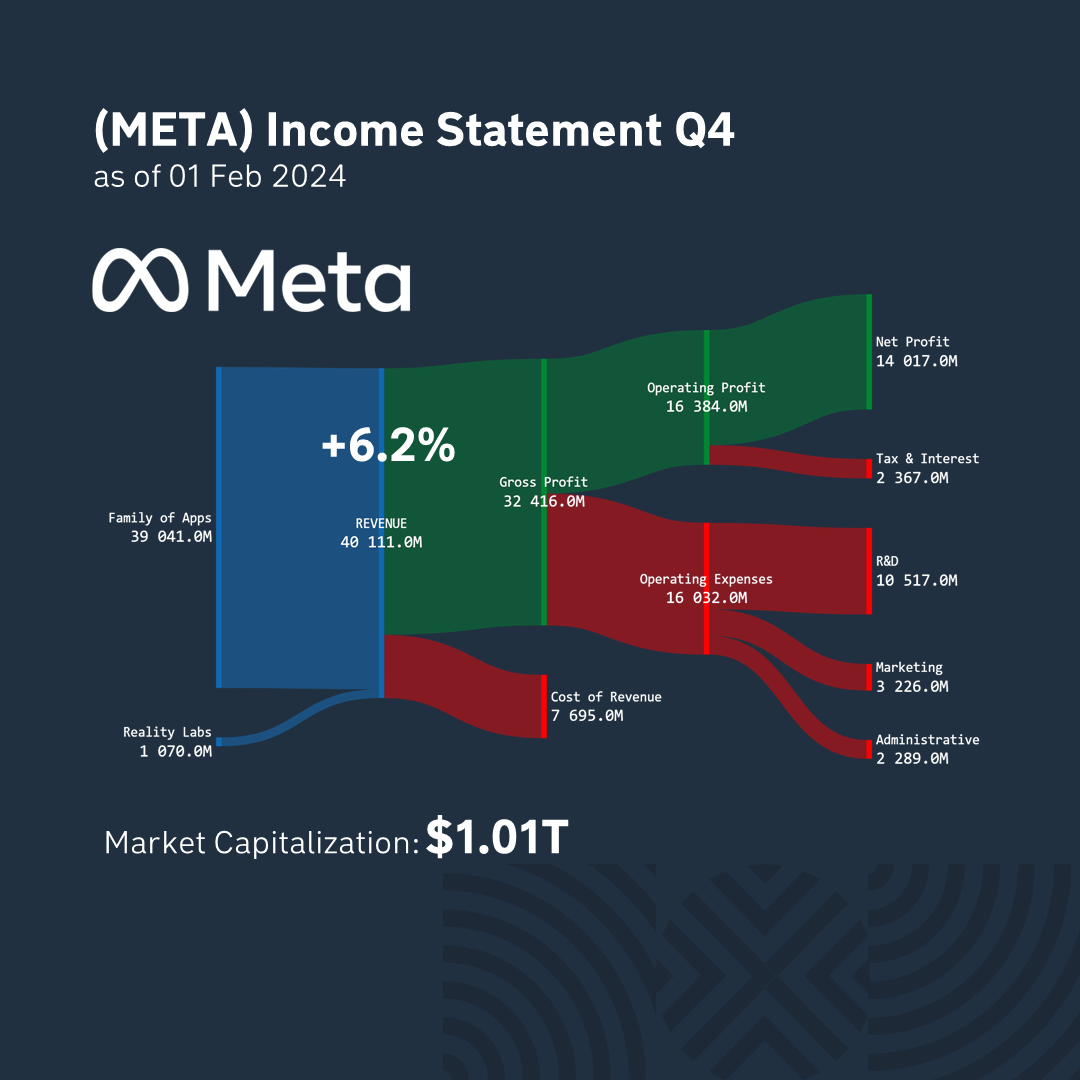

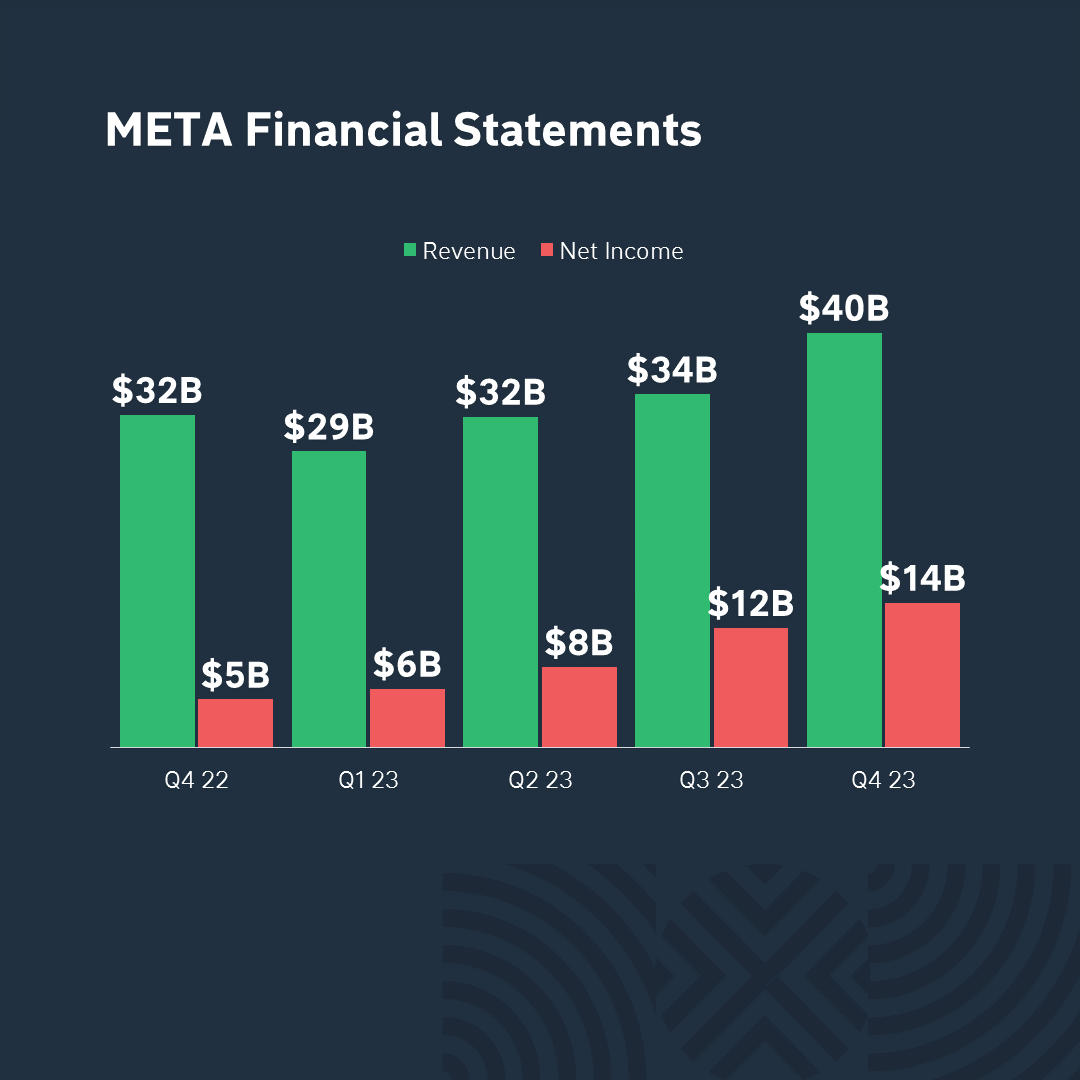

Meta Platforms showed the best results. Its revenue is $40.1B. It grew by +6.2% compared to the corresponding value for the previous quarter. Let’s analyze the company’s business in more detail.

Meta is the world’s largest social network with almost 4 billion active users. The company’s ecosystem consists mainly of Facebook, Instagram, Messenger, and WhatsApp applications. The company generates its main revenue from advertising (over 90%), of which over 45% comes from users in the US and Canada, and over 20% from Europe.

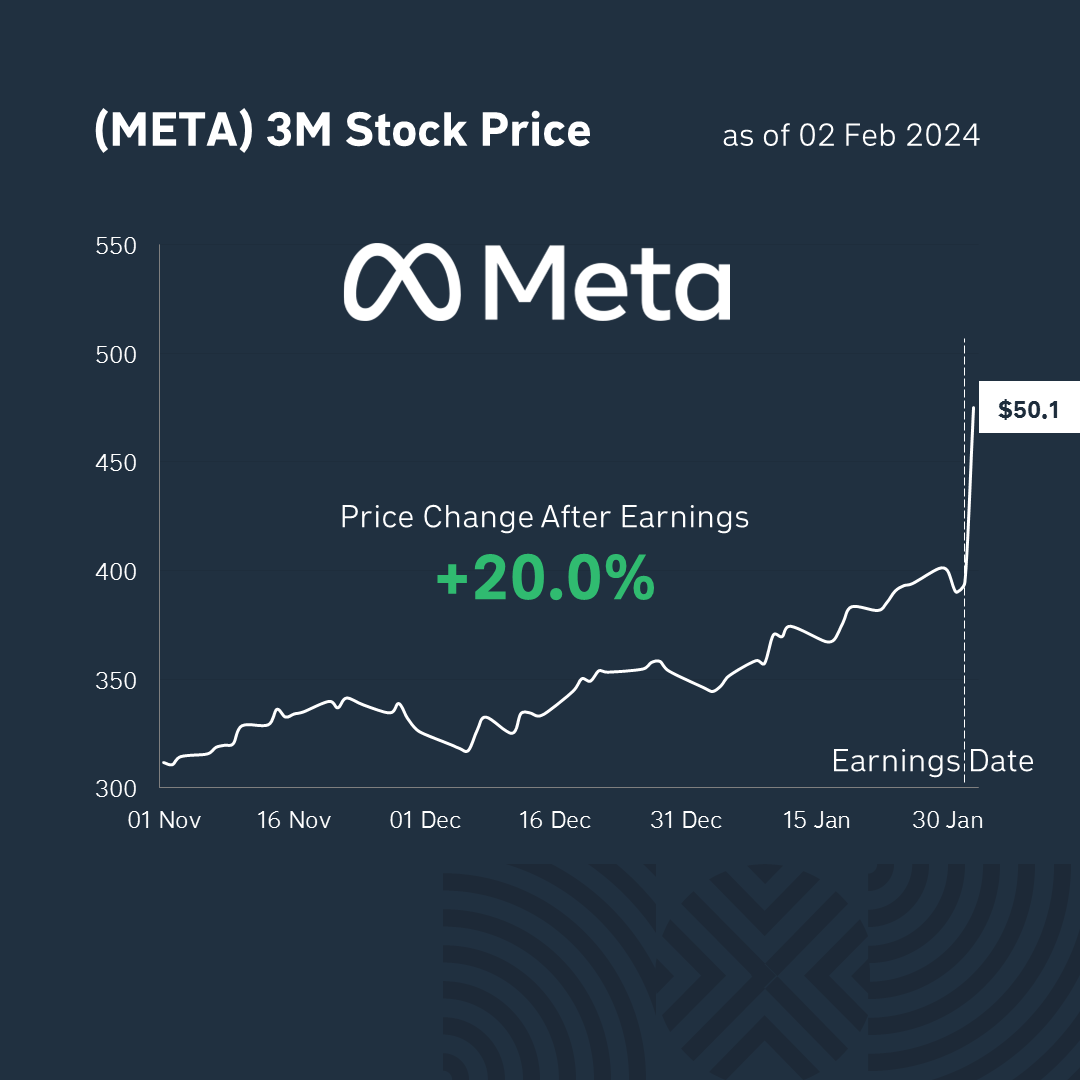

Meta Platforms’ revenue for Q4 2023 increased by 25% compared to Q4 2022, and the company’s net profit also more than tripled to $14B. In addition, the company announced a quarterly dividend of 50 cents per share for the first time, which led to an increase in the company’s shares by more than 14% immediately after the close of trading.

Manufacturing costs account for 19% of the revenue structure, and gross revenue for 81%. Over the past quarter, the company made a profit of $14B. And its market capitalization is now $1T.

Following the publication of the report, Meta Platforms’ shares rose by +20.0% to reach $475 per share. In general, market participants are satisfied with the company’s current financial results and reacted positively to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter