This week, market participants – gamblers, traders, and investors – had three things to do: wait for the Labor Market Report, which is always published on the Friday before the opening of trading, enjoy the rise of Nvidia, and have fun watching the situation around GameStop. And now, let’s take things one step at a time..This is a quick review from Ivan Kompan, Edinburgh Business School analyst.

Nvidia is a dream company! Five years ago, it was known only to specialists, and now its value has increased fortyfold. Since the beginning of the year, Nvidia’s capitalization has increased by 143% or $1.8 trillion, which is equal to three Teslas or one Amazon. Everyone believes that artificial intelligence will change the world, and Nvidia, as a leading chipmaker, plays a key role. Nvidia has become the second most valuable company in the world with a capitalization of almost $3 trillion. However, in order to justify this price, all the most optimistic forecasts must come true. Some investors are betting on a decline, with a total of $34 billion in such bets. Time will tell who is right.

GameStop is a symbol of meme stocks turned into a casino thanks to trader Keith Gill, known as Roaring Kitty. This movement began in 2021 and has become an example of how retail investors, social media, and a lot of money can turn a stock market into a giant casino. This week, after Hill’s return, GameStop shares ranged from $26 to $65, and DeepFuckingValue almost became a billionaire. Those who bet on the downside lost up to two billion dollars. This game is ongoing, fueled by human nature and modern technology. If you want to participate, there is an opportunity, but I would advise you to stay away.

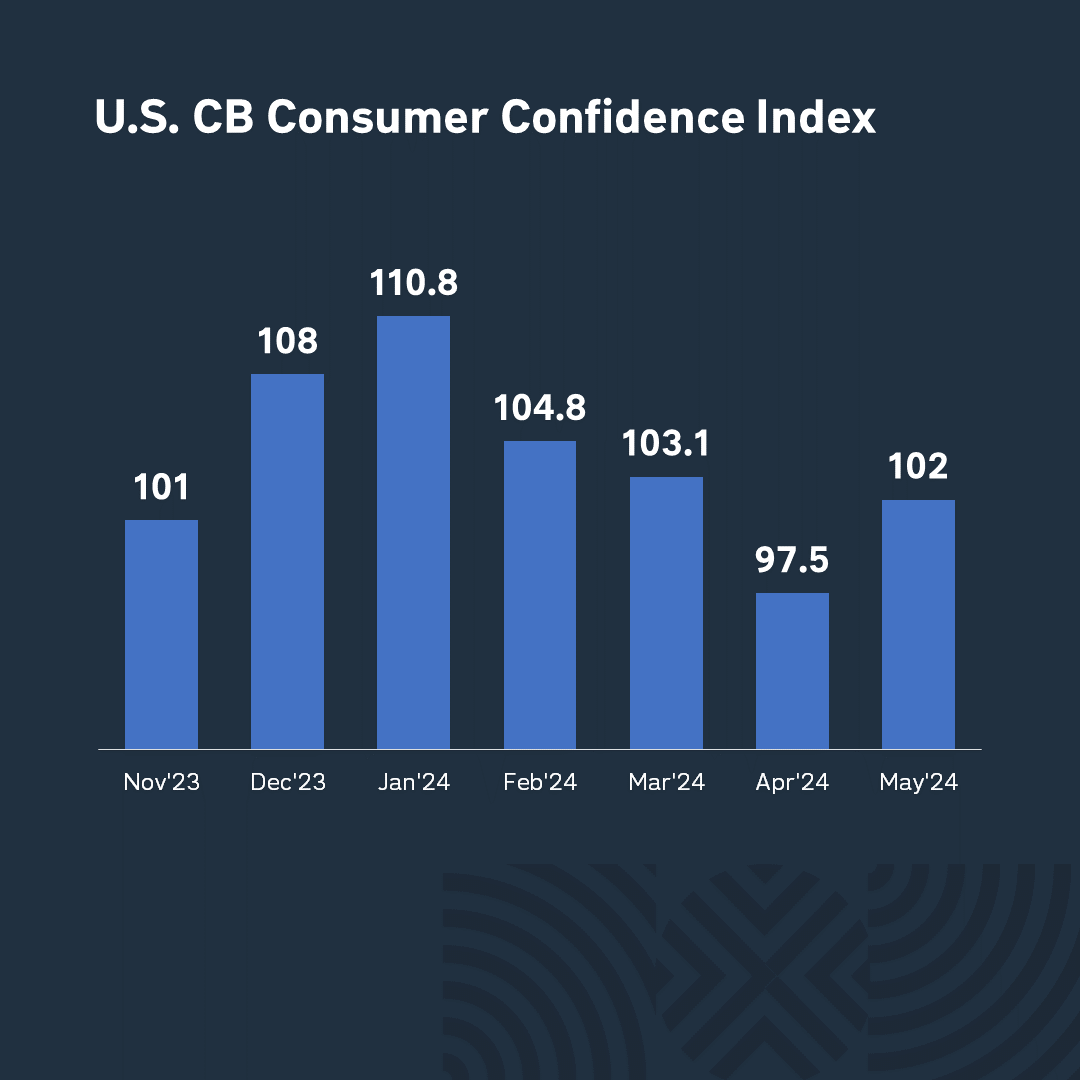

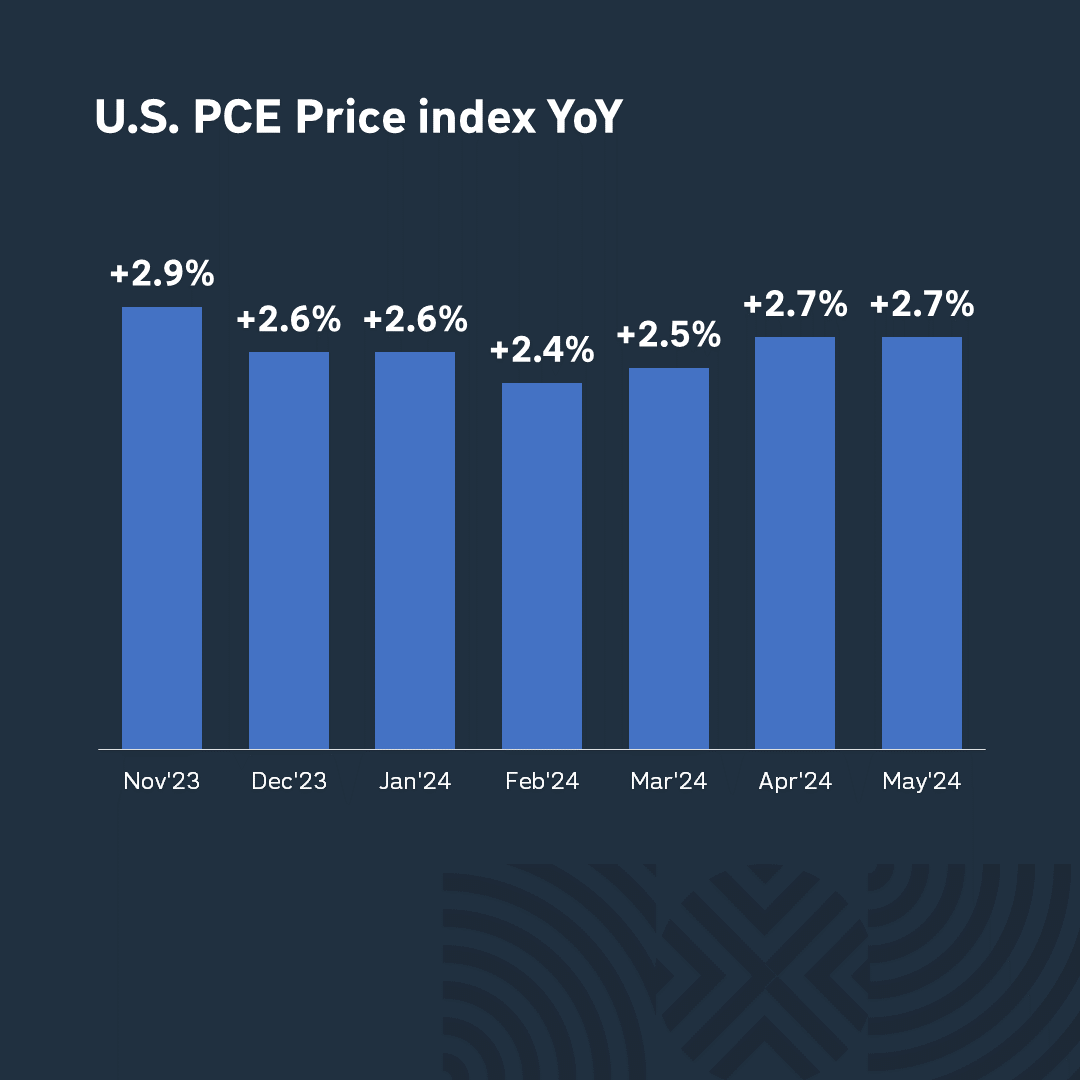

For dessert on Friday, investors received the May Labor Market Report. It is important for determining the Fed’s monetary policy and the fate of interest rates. The report turned out to be optimistic: instead of the forecasted 185 thousand jobs, the US labor market added 272 thousand, which is more than the 165 thousand in April. The unemployment rate rose to 4% (from 3.9% in April), and hourly wages increased by 4.1% year-on-year, which is higher than the expected 3.9%. Inflation remains a concern, and monetary policy liberalization is postponed.

*And finally, we would like to remind you that the information you have just listened to is not an investment advisory. Remember – investments in the stock market are always tied up with financial risks. So be careful and cautious.