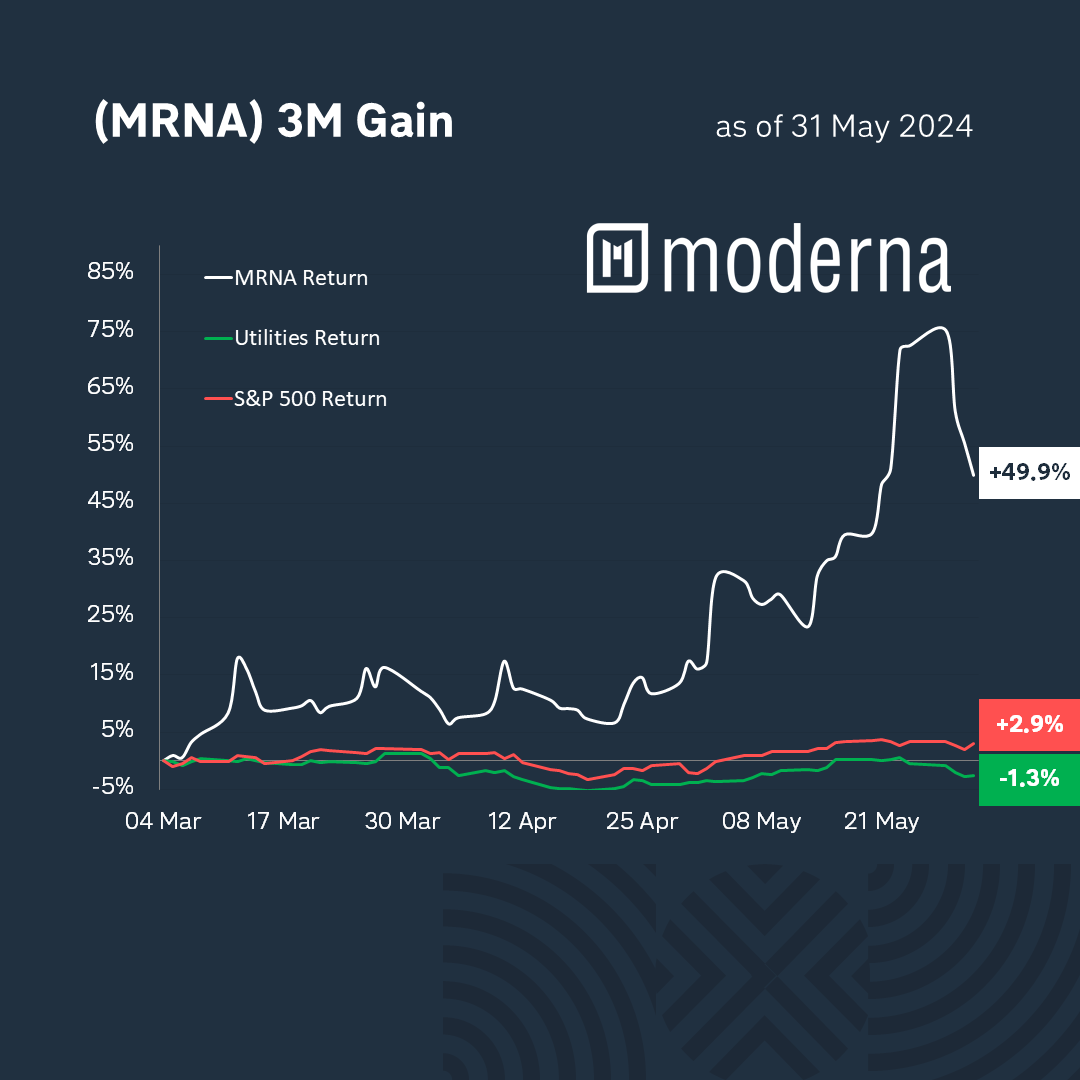

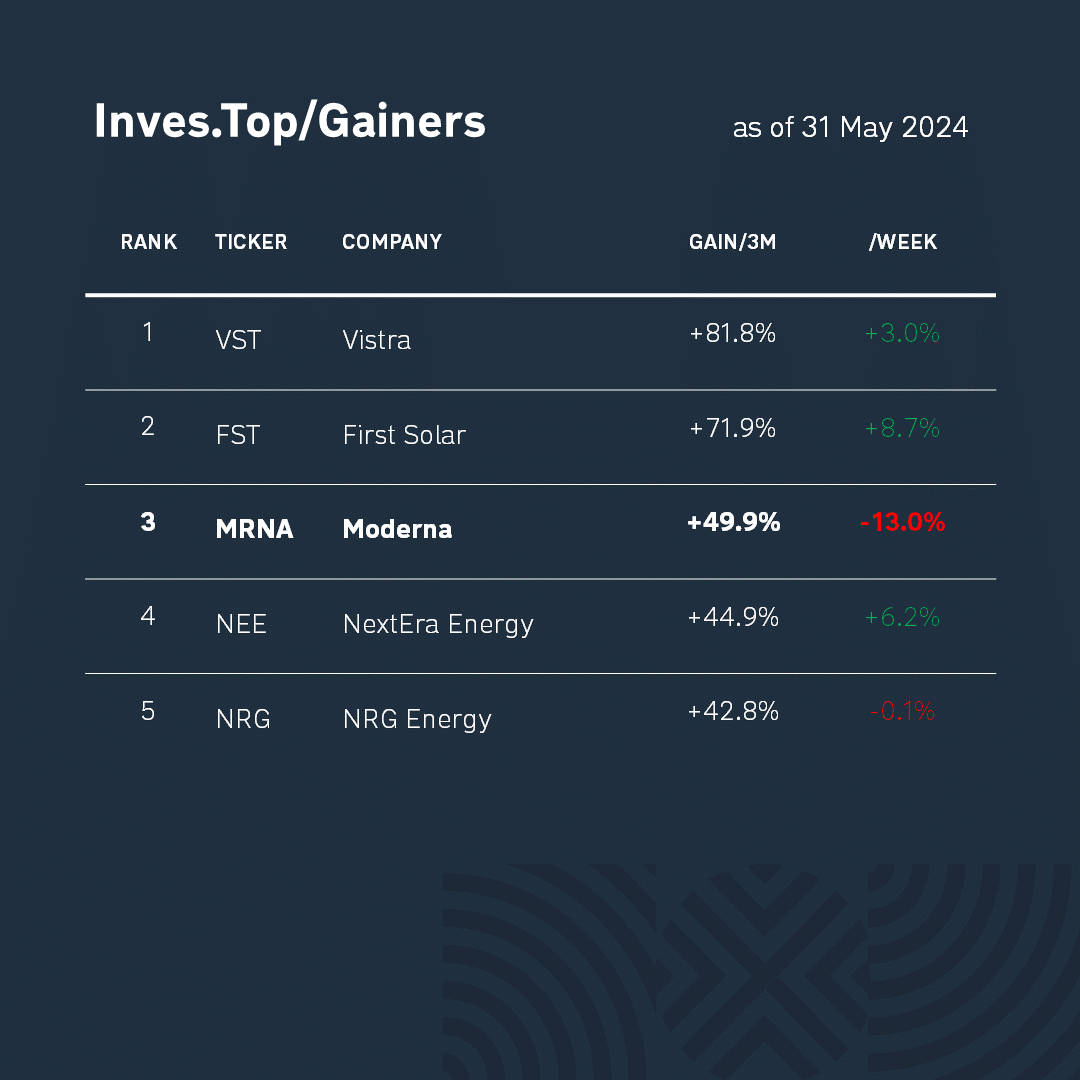

Today, we’ll talk about Moderna (MRNA), which has been one of the top growth stocks over the past 3 months.

Over the past three months, Moderna shares have risen by +62.9%. At the same time, the healthcare sector, to which the company belongs, grew by +19.6%, and the S&P 500 index by +4.6%. As you can see, Moderna’s shares show better returns than the sector average.

Moderna is a biotechnology company that specializes in the production of vaccines based on mRNA technology. The company’s product portfolio includes about 39 mRNA vaccine projects for infectious diseases, cardiovascular diseases, rare genetic diseases, and oncology.

The company operates in the biotechnology industry. It was founded in 2010, listed on the NASDAQ stock exchange in 2018, and in 2021 was included in the S&P 500 index. For the past 13 years, the company has been led by Stéphane Bancel and a team of experienced managers.

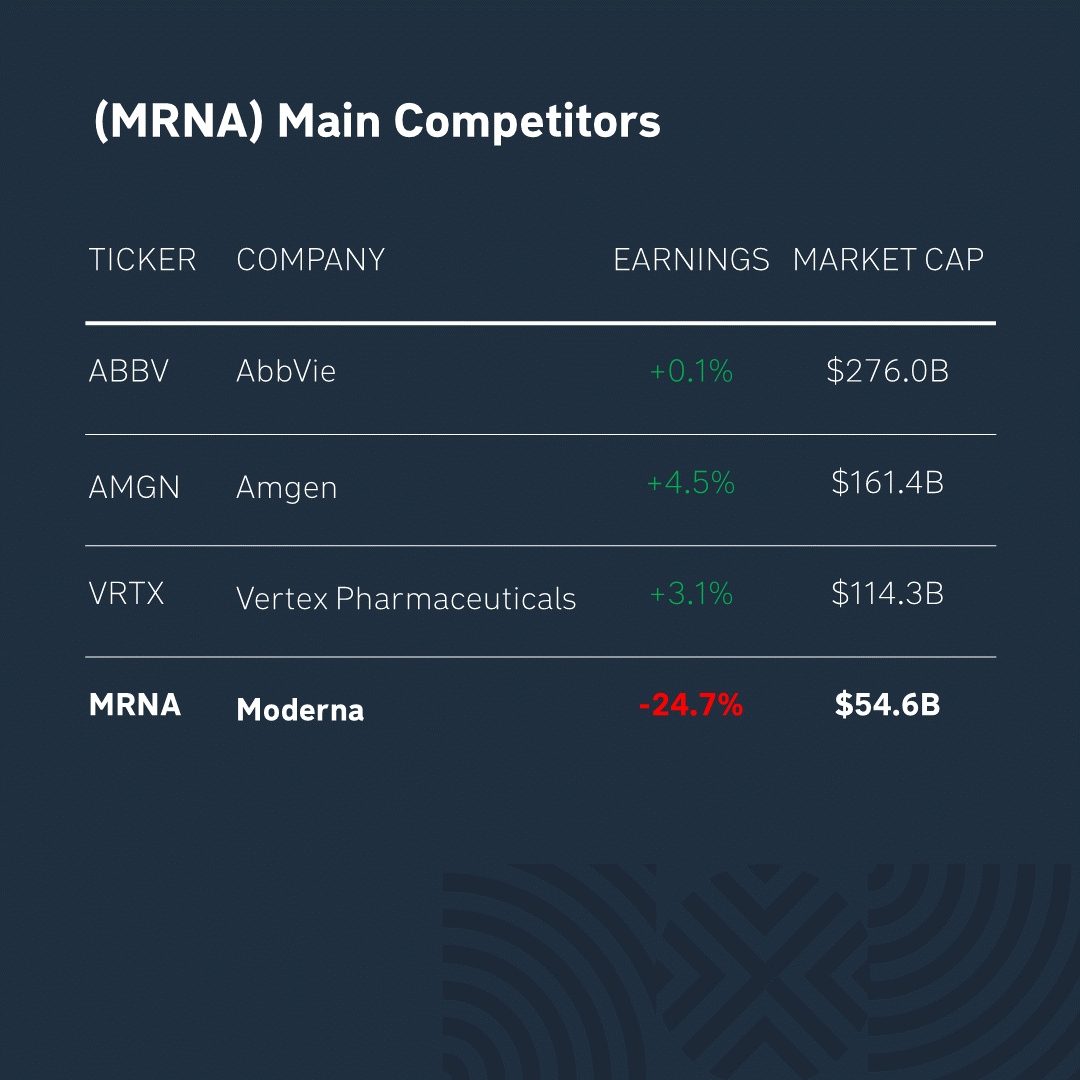

Moderna’s main competitors are Abbvie, Amgen, and Vertex Pharmaceuticals. As you can see from the table above, they are ahead of the company in terms of capitalization, but it has a number of competitive advantages.

Moderna’s strengths are based on its research activities. The company is developing not only vaccines against COVID-19, but also against other viruses, against the development of cancer cells, and therapy programs for rare diseases. One of the advanced projects in collaboration with Merck, the cancer vaccine mRNA-4157, is already in the process of approval. Moderna also has programs for secretory proteins that compete with traditional therapies, including recombinant proteins and antibodies. The market demand for such therapeutic proteins is estimated at $200B, which gives the company significant growth potential.

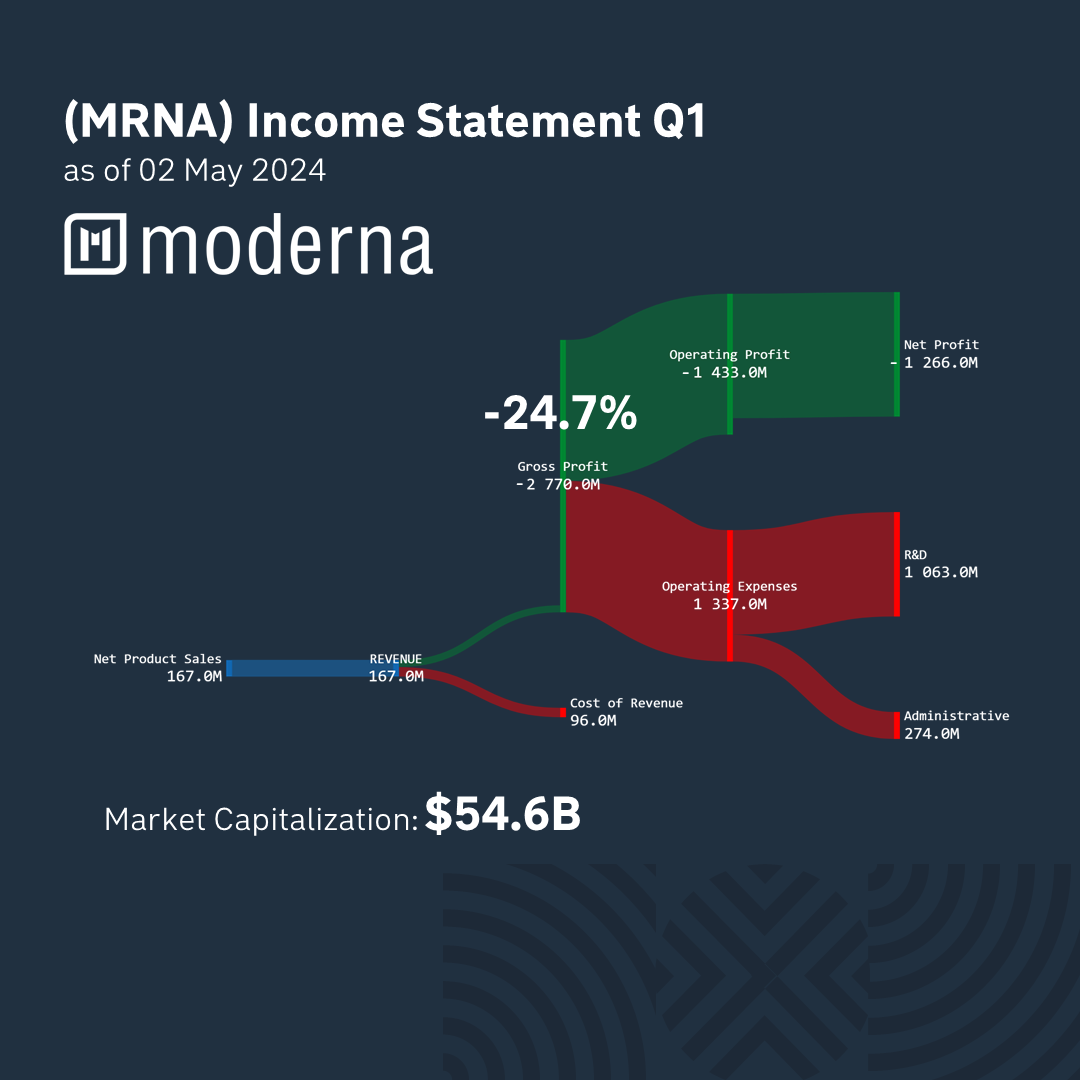

The latest report was published by Moderna on May 2. 41% of the revenue structure is made up of manufacturing costs. Over the past quarter, the company suffered a loss of $1.2B due to significant spending on new research and development. And its market capitalization is now $54.6B.

*This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.