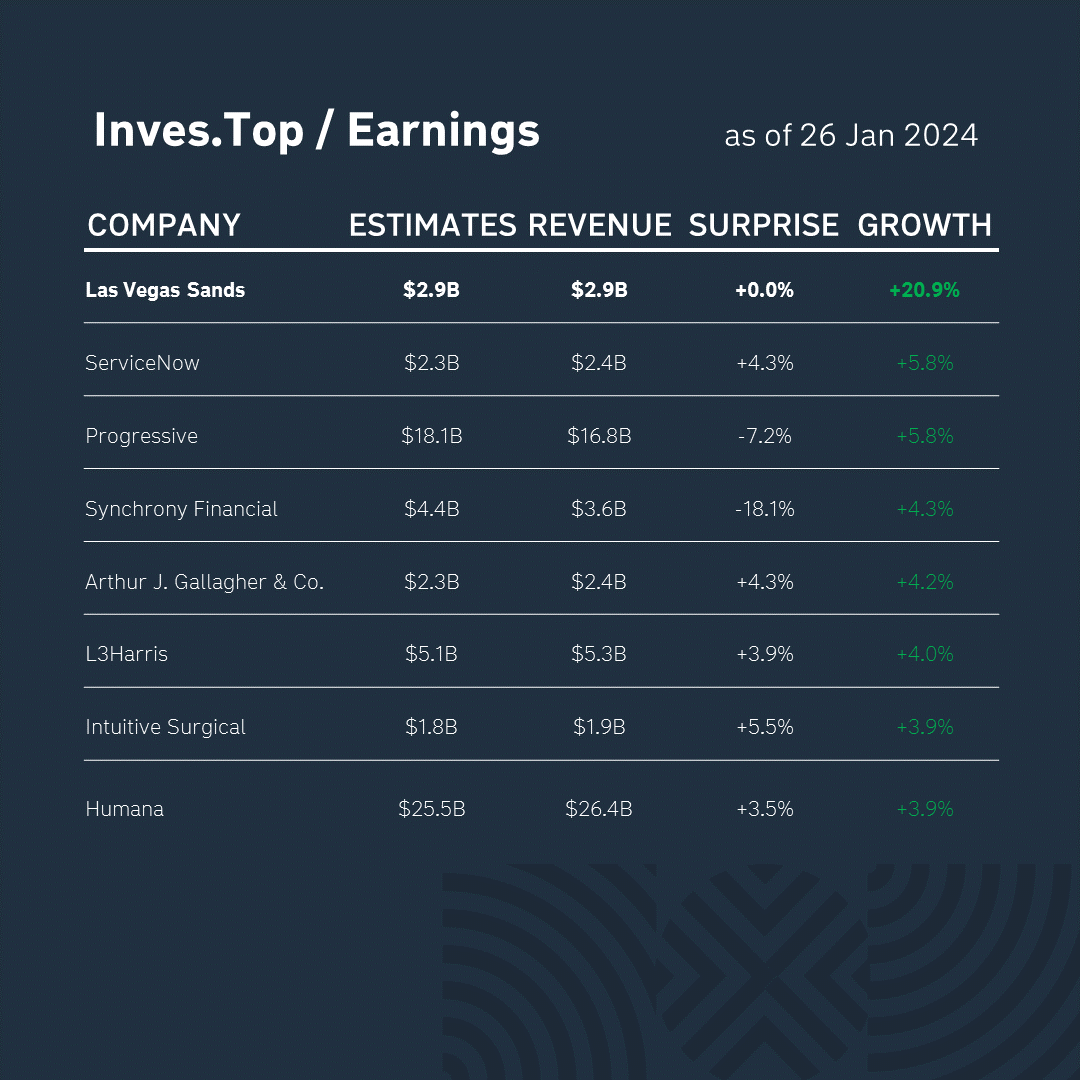

Over the past week, 73 companies from the S&P 500 index have already reported for the quarter ended December 31, 2023.

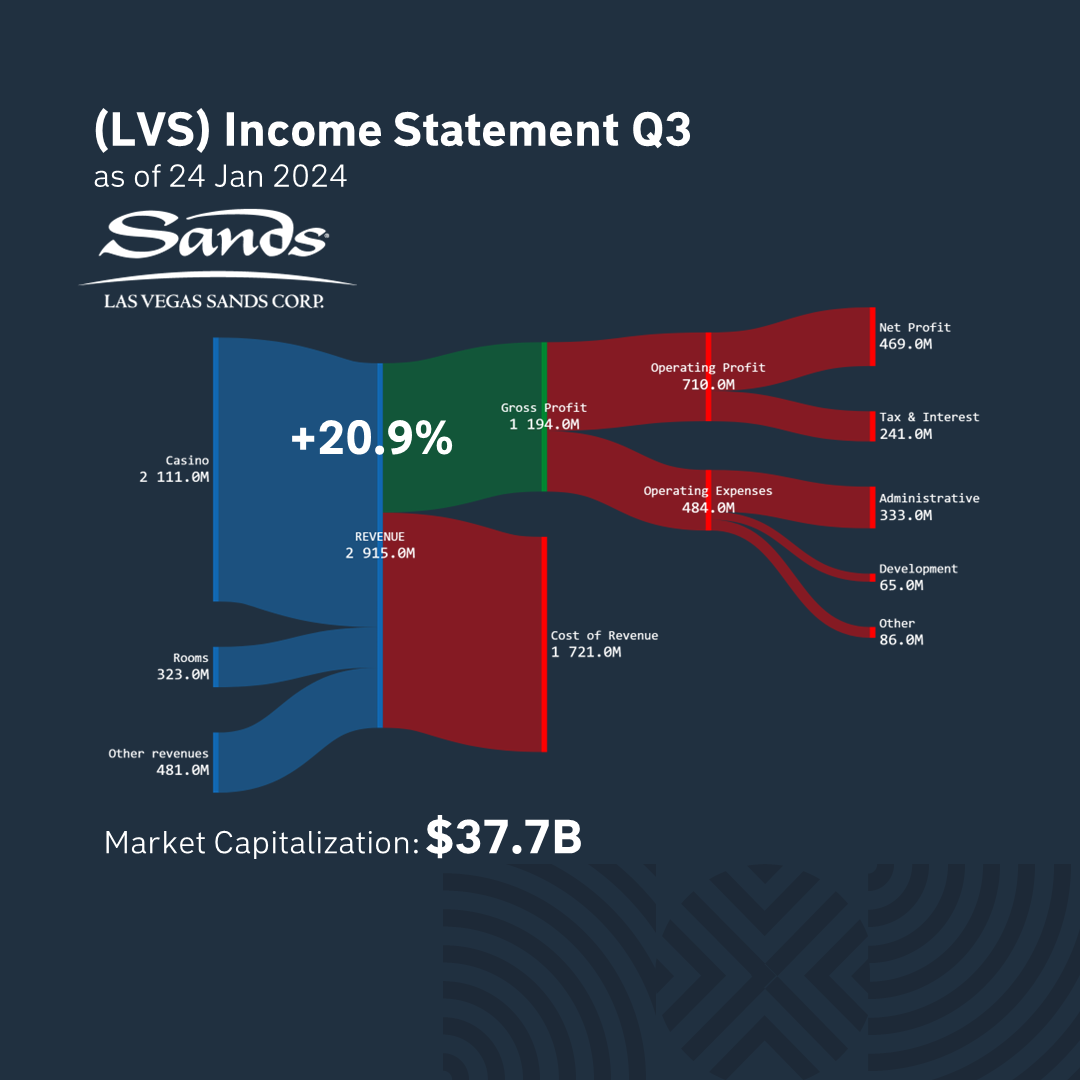

Las Vegas Sands demonstrated the best results with $2.9B in revenue. Its revenue grew by +20.9% compared to the previous quarter and confirmed analysts’ expectations. Let’s analyze the company’s business in more detail.

Las Vegas Sands is one of the world’s largest resort and casino companies, licensed in the United States, Singapore, and Macau. Las Vegas Sands offers integrated recreation complexes that include hotels, entertainment venues, restaurants, and conference halls. A systematic approach and the development of international branches allow the company to maintain a competitive position in the market.

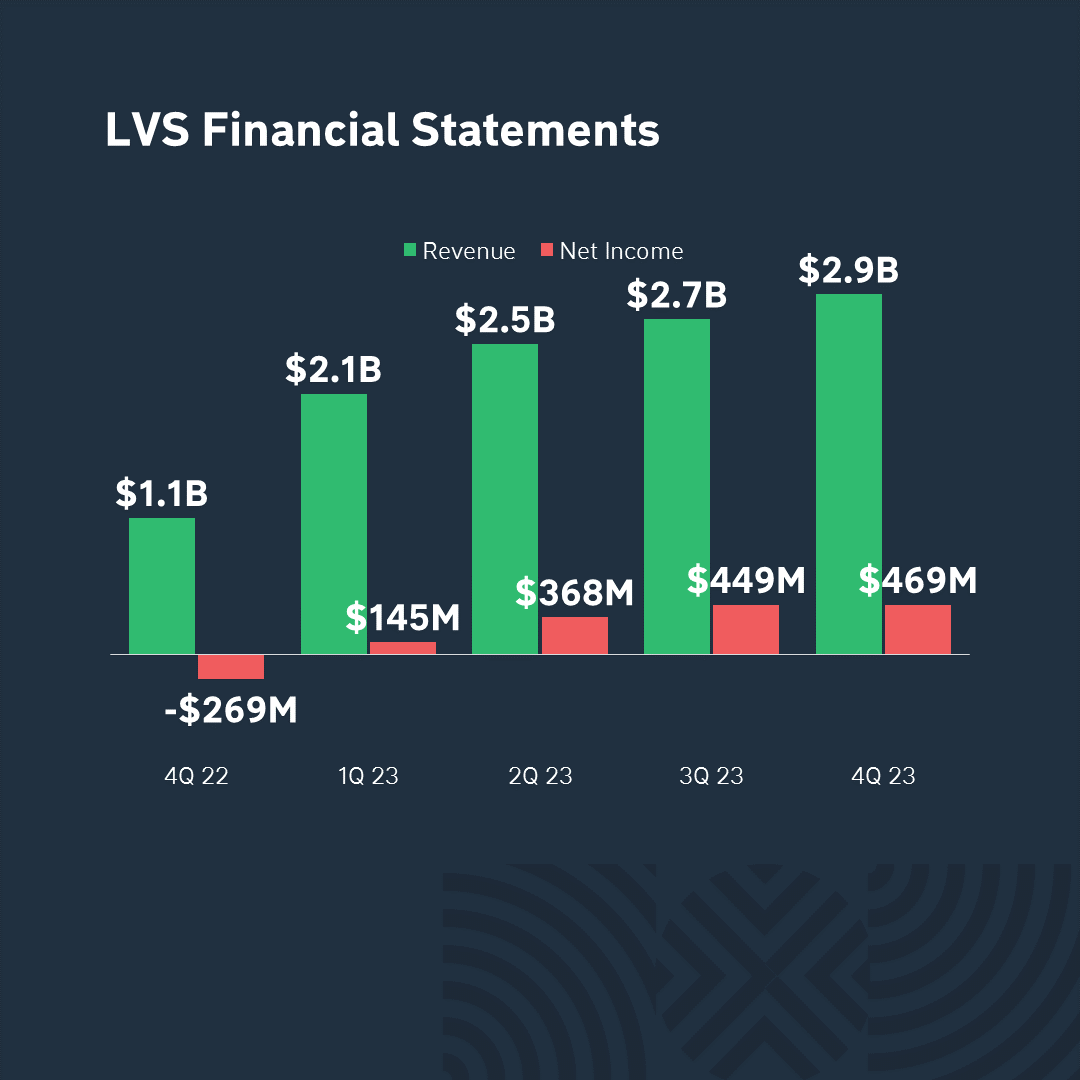

Las Vegas Sands’ revenue for Q4 2023 increased 2.5 times compared to Q4 2022. In addition, the company bought back its own shares from the market for $550M and increased its ownership stake in one of its largest projects, Sands China, by about $250M.

Manufacturing costs account for 59% of the revenue structure, and gross revenue for 41%. Over the past quarter, the company made a profit of $469M. And its market capitalization is now $37В.

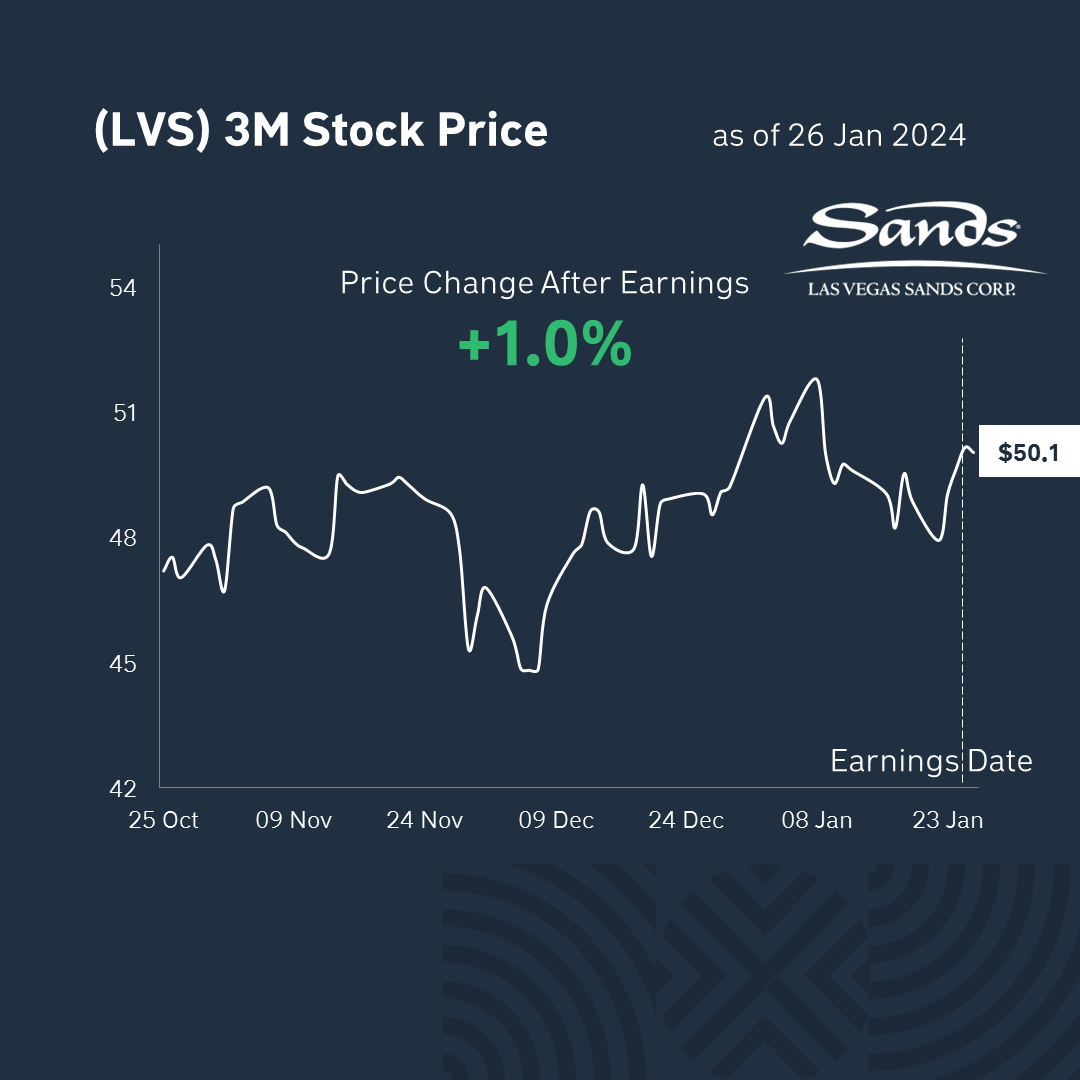

After the publication of the report, the stock of Las Vegas Sands rose by +1.0% to reach $50 per share. In general, market participants are satisfied with the company’s current financial results, but reacted cautiously to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter