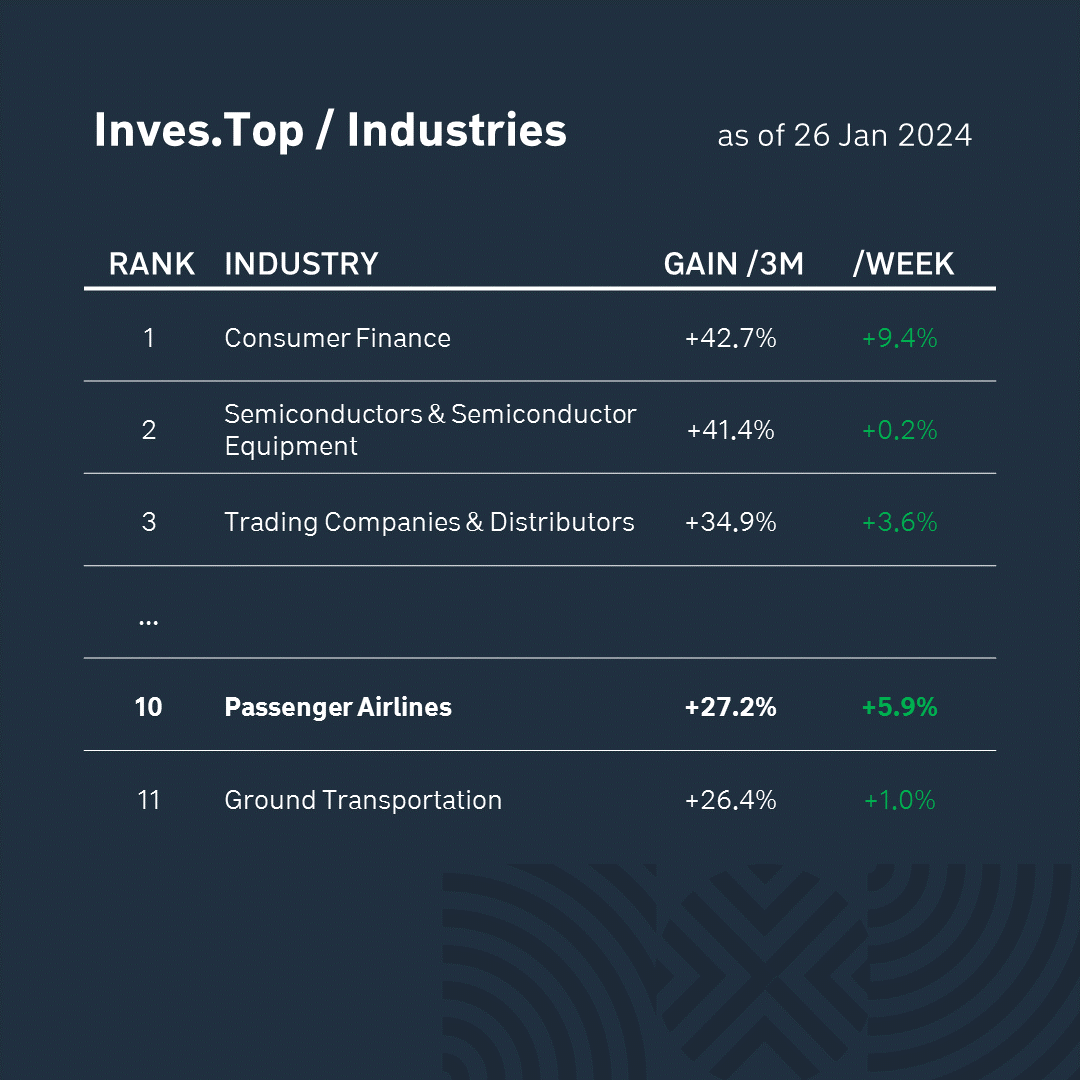

As we noted in the last week’s issue, one of the leaders of growth in the S&P 500 index over the past three months has been the Passenger Airlines industry (+27%).

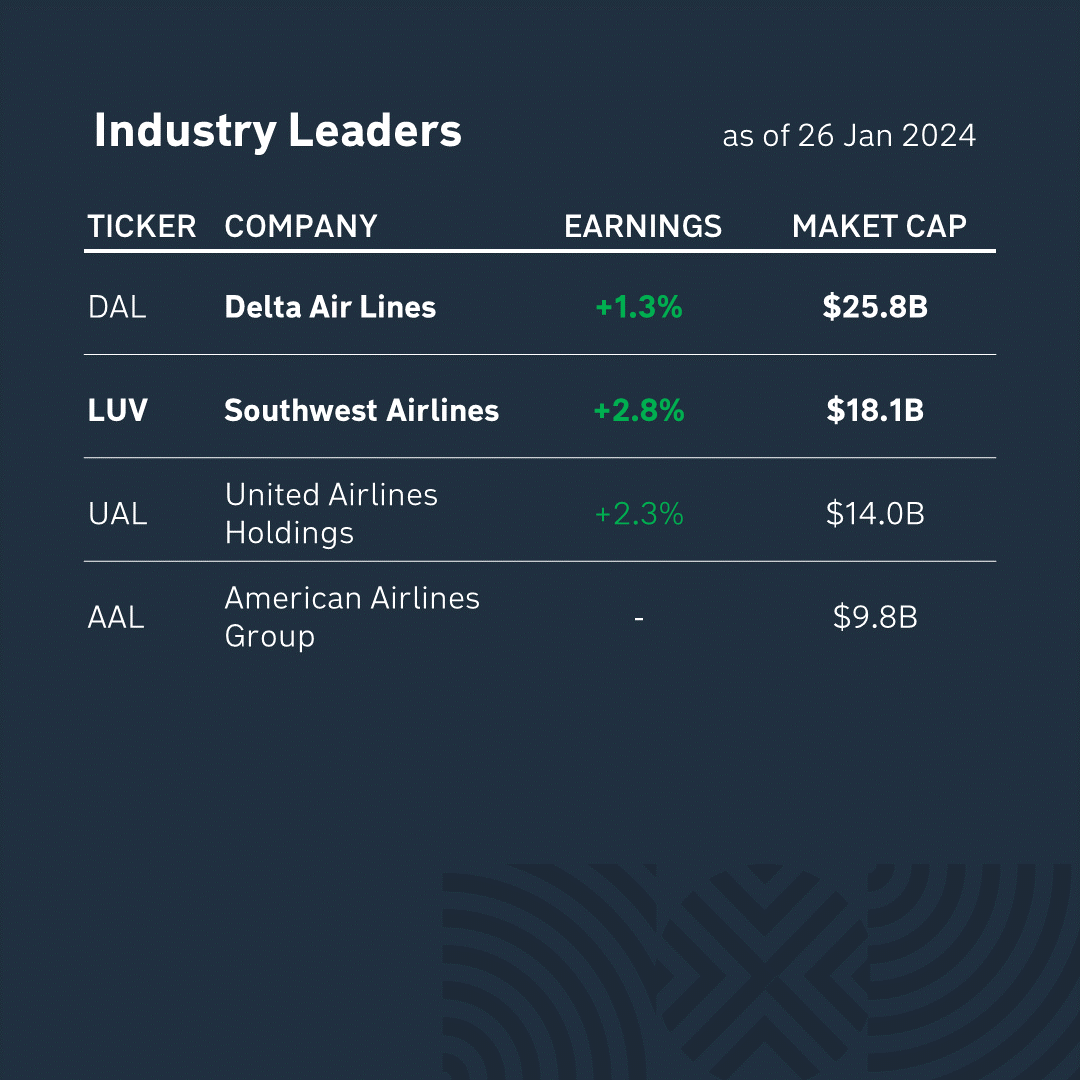

The largest companies in this industry (by market capitalization): Delta Air Lines ($25B), a leader in international transportation operating in 60 countries, and Southwest Airlines ($18B), the world’s largest low-cost airline by passenger numbers.

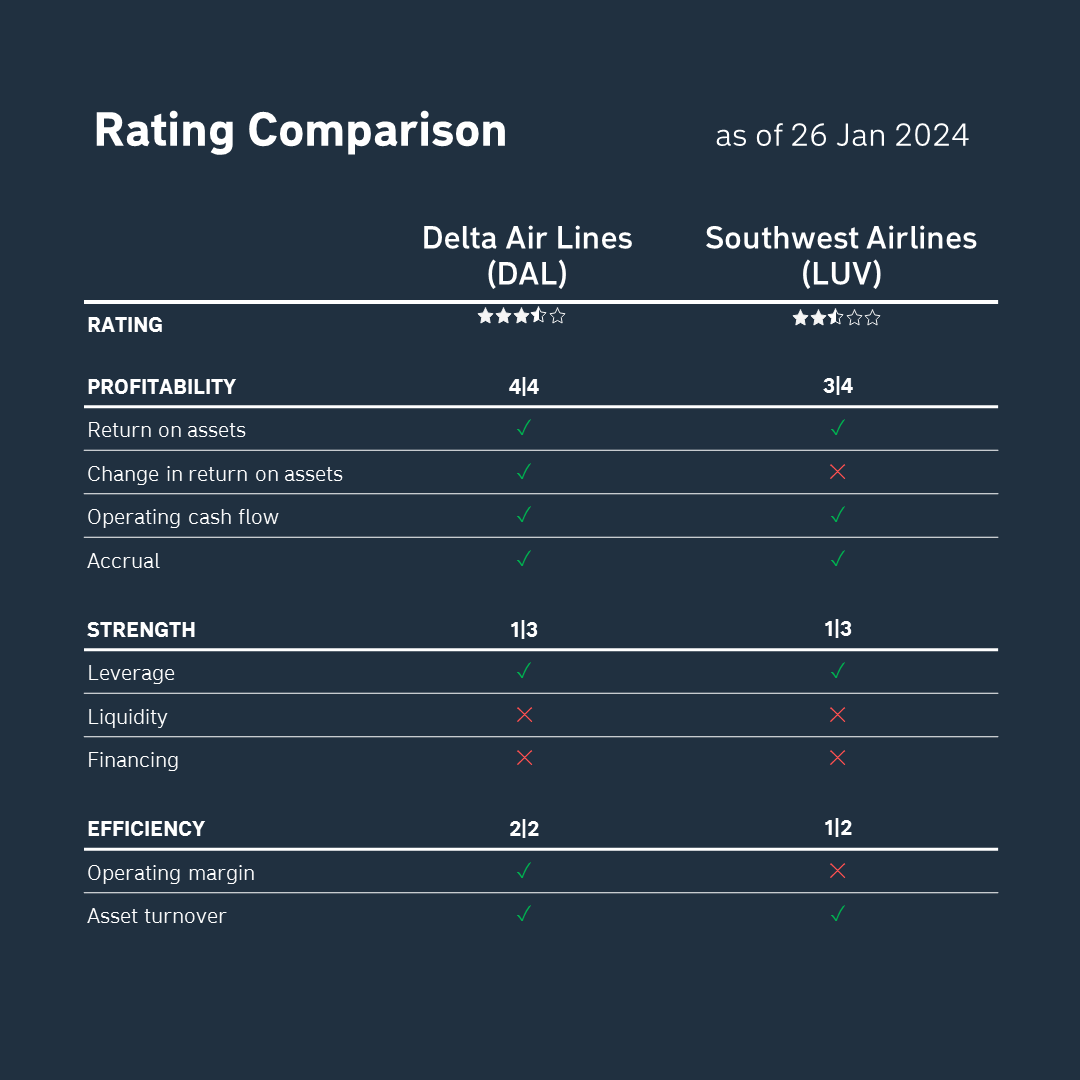

According to the latest quarterly reporting data, we analyzed each company’s profitability, strength, and efficiency criteria using the methodology of Stanford University professor Joseph Piotroski.

As you can see, in terms of fundamental data, both companies are currently showing quite strong results. Delta Air Lines outperforms Southwest Airlines in terms of profitability and efficiency. Therefore, it looks more attractive for medium- and long-term investments.

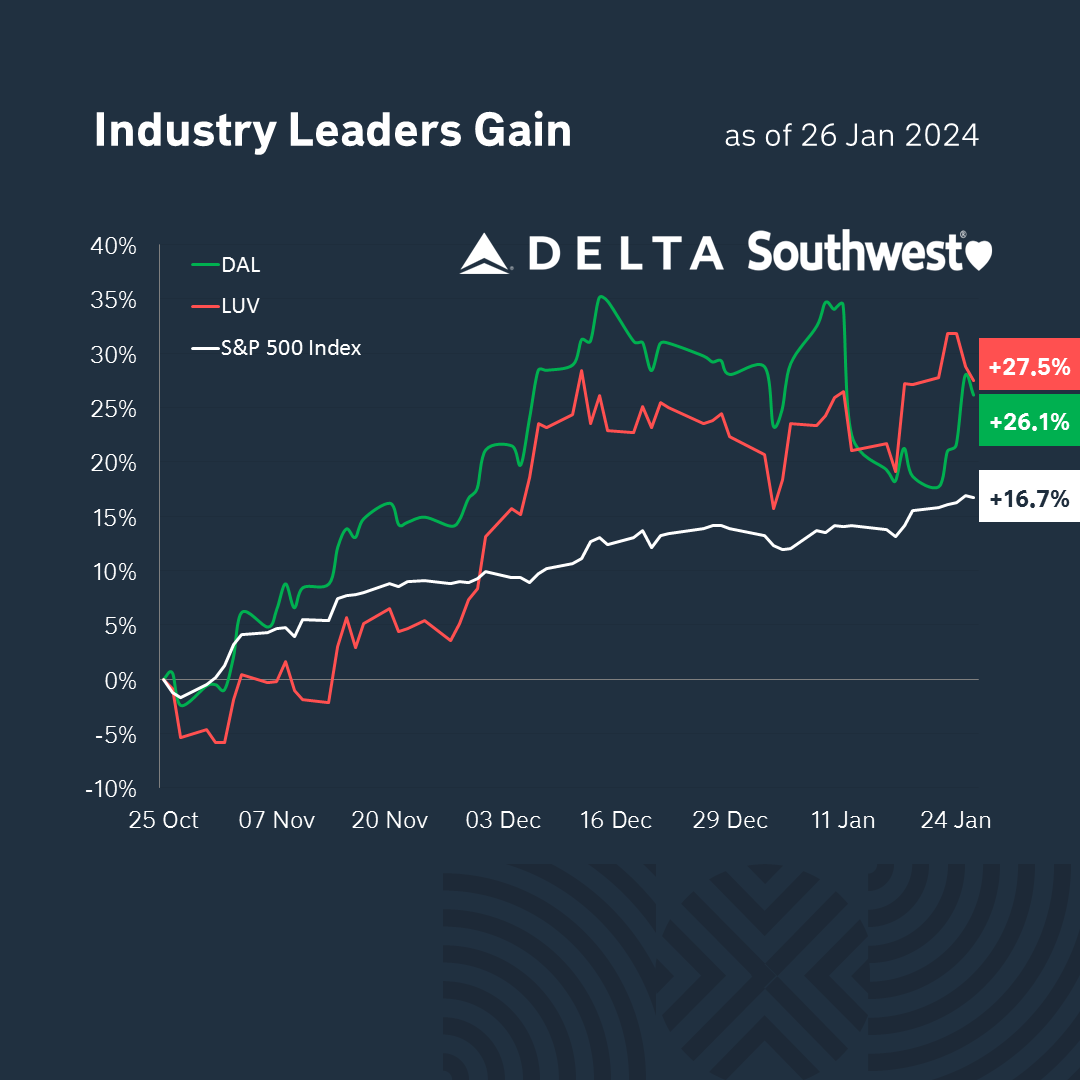

Over the past 3 months, Delta Air Lines shares have risen by +26% and Southwest Airlines by +27% (the S&P 500 index is up +16%). Both companies have shown almost the same profitability and outperformed the index.

So, the winner in today’s battle is Delta Air Lines (DAL). The company’s business looks healthier in terms of changes in return on assets and operating margin, and its shares are showing better dynamics.

* This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.