The corporate reporting period has is going.

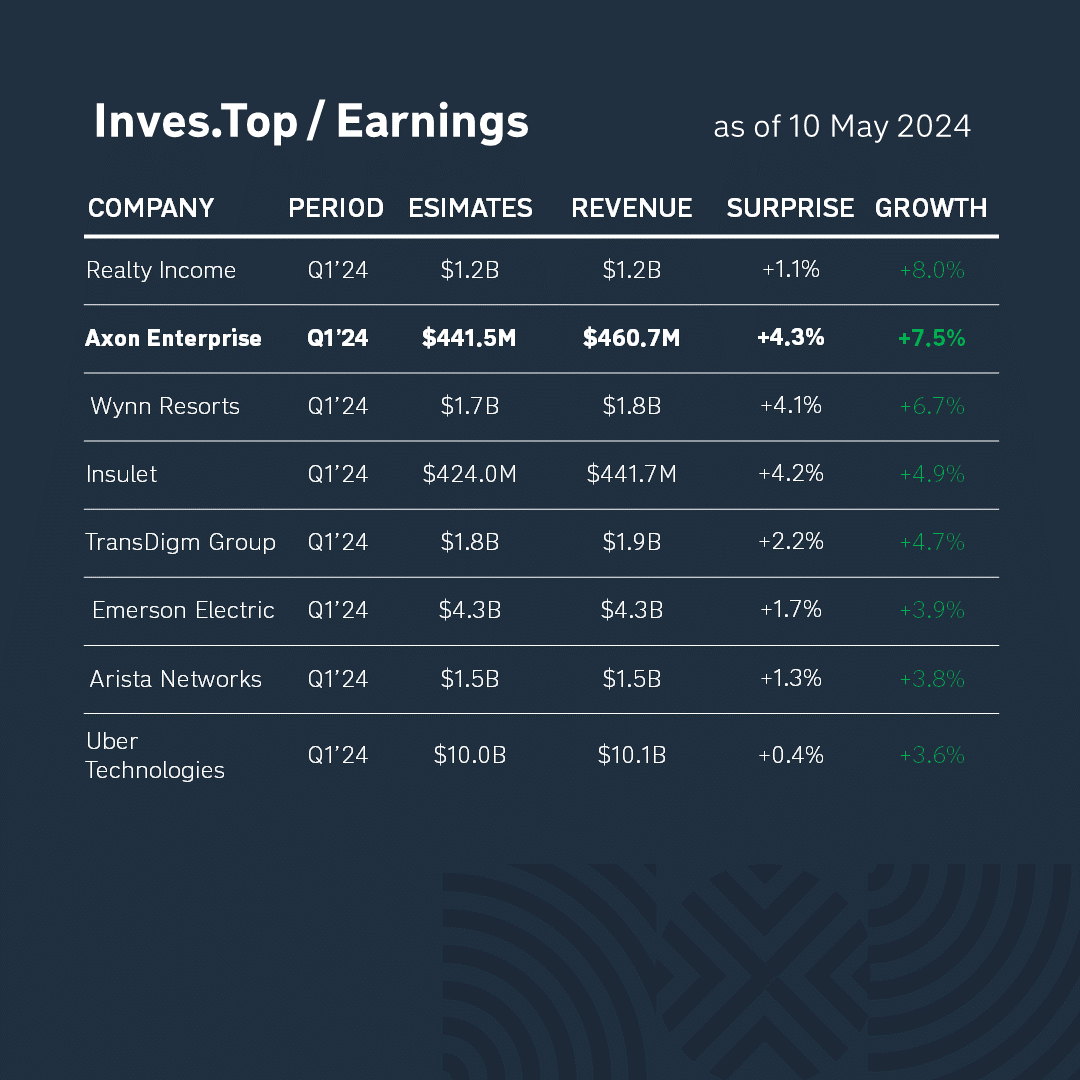

Last week, 57 companies from the S&P 500 index reported. You can see their results here: inves.top/earnings

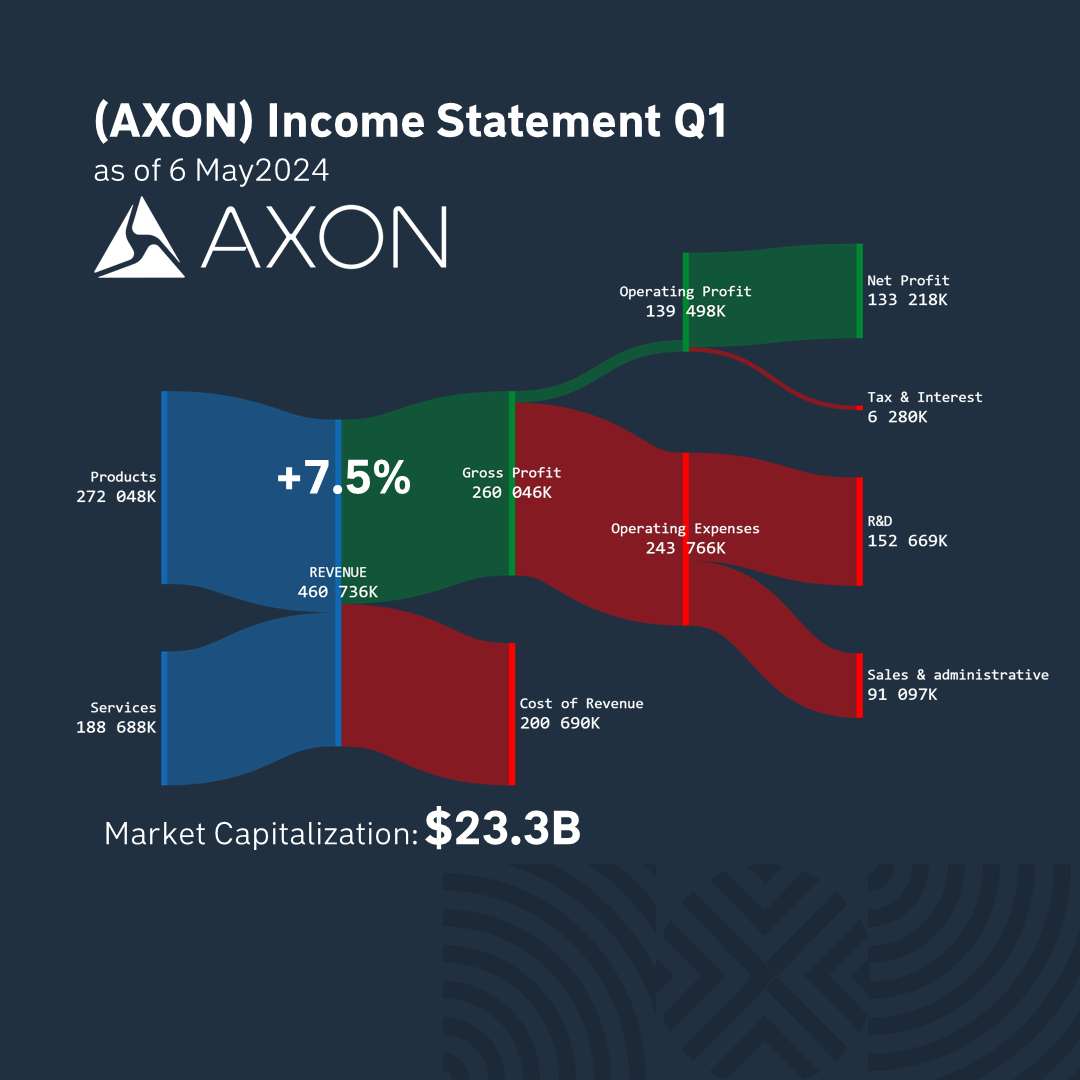

Today, let’s take a look at Axon Enterprise’s results. Its revenue amounted to $460.7M. It grew by +7.5% compared to the corresponding value for the previous quarter and exceeded analysts’ expectations by +4.3%. Let’s analyze the company’s business in more detail.

Axon Enterprise was the first company in the world to start mass sales of stun guns, namely the well-known TASER model. The company manufactures non-lethal weapons for law enforcement agencies and develops software for public safety services.

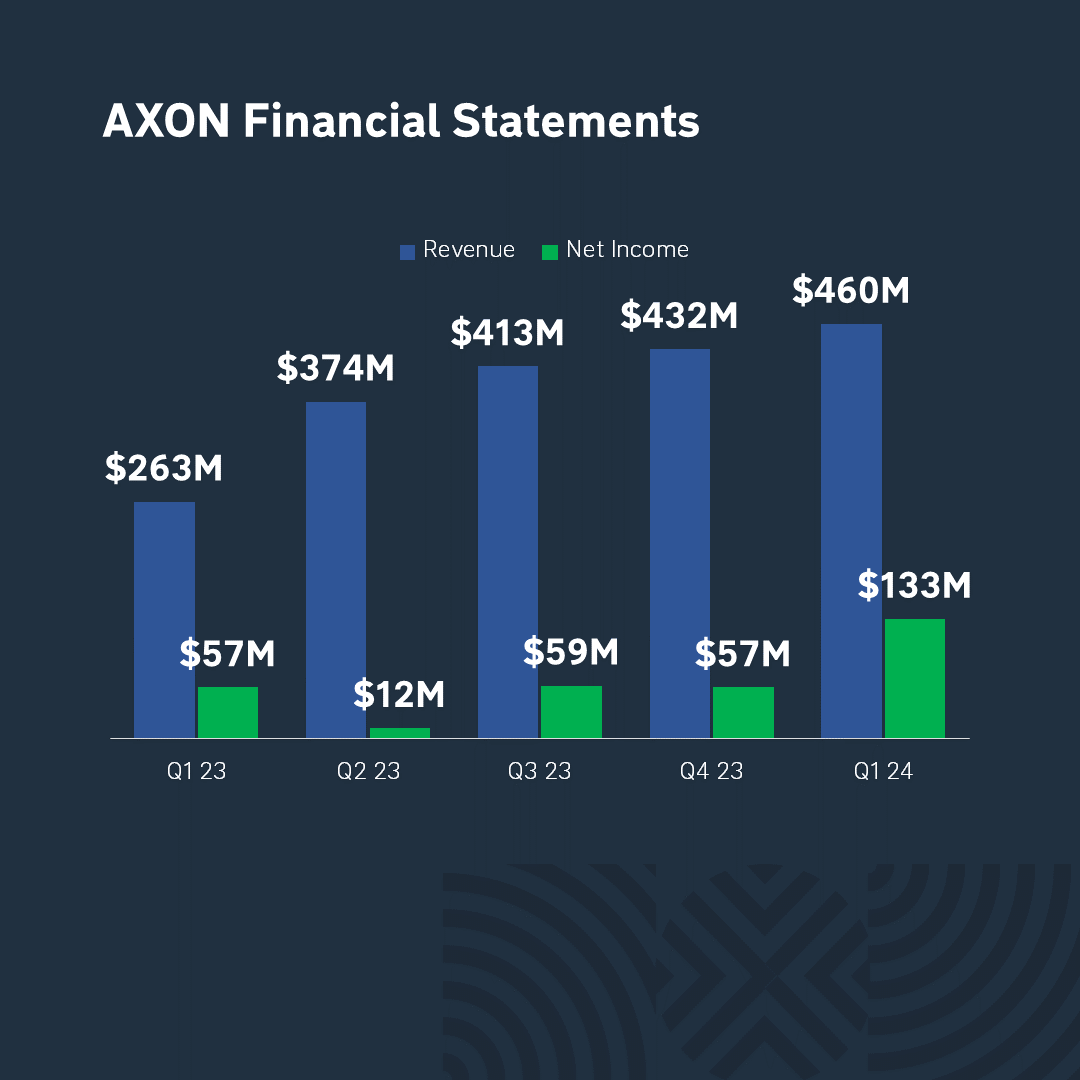

Axon Enterprise’s revenue for Q1’24 increased by +74.5% compared to Q1’23. The company increased its revenue by +51.5% QoQ in the main Axon Cloud & Services segment due to the growth in the number of users and the increase in additional features in the company’s platforms. The TASER segment grew by +33.1% QoQ, mainly due to the sale of cartridges and related devices.

43% of the revenue structure is accounted for by manufacturing costs and 57% by gross profit. The company earned a profit of $133M for the last quarter. The significant increase in profits is due to unrealized gains on the company’s investments. And its market capitalization is $23.3B.

After the publication of the report, Axon Enterprise stock rose by +2.8% to reach $303 per share. In general, market participants are satisfied with the company’s current financial results and reacted positively to the forecasts for the next quarter.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter