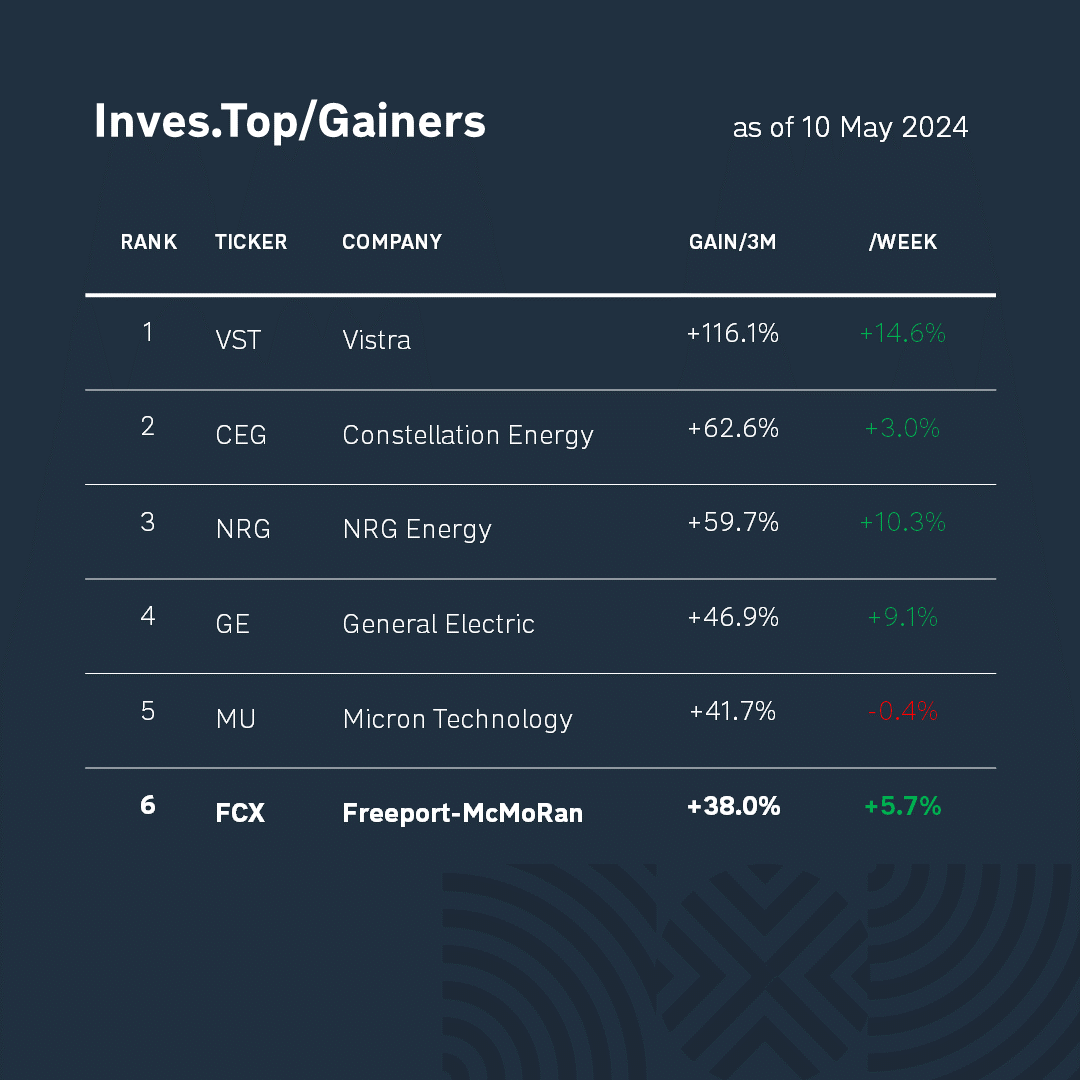

Today we will talk about Freeport-McMoRan (FCX), which has been one of the top growth stocks over the past 3 months.

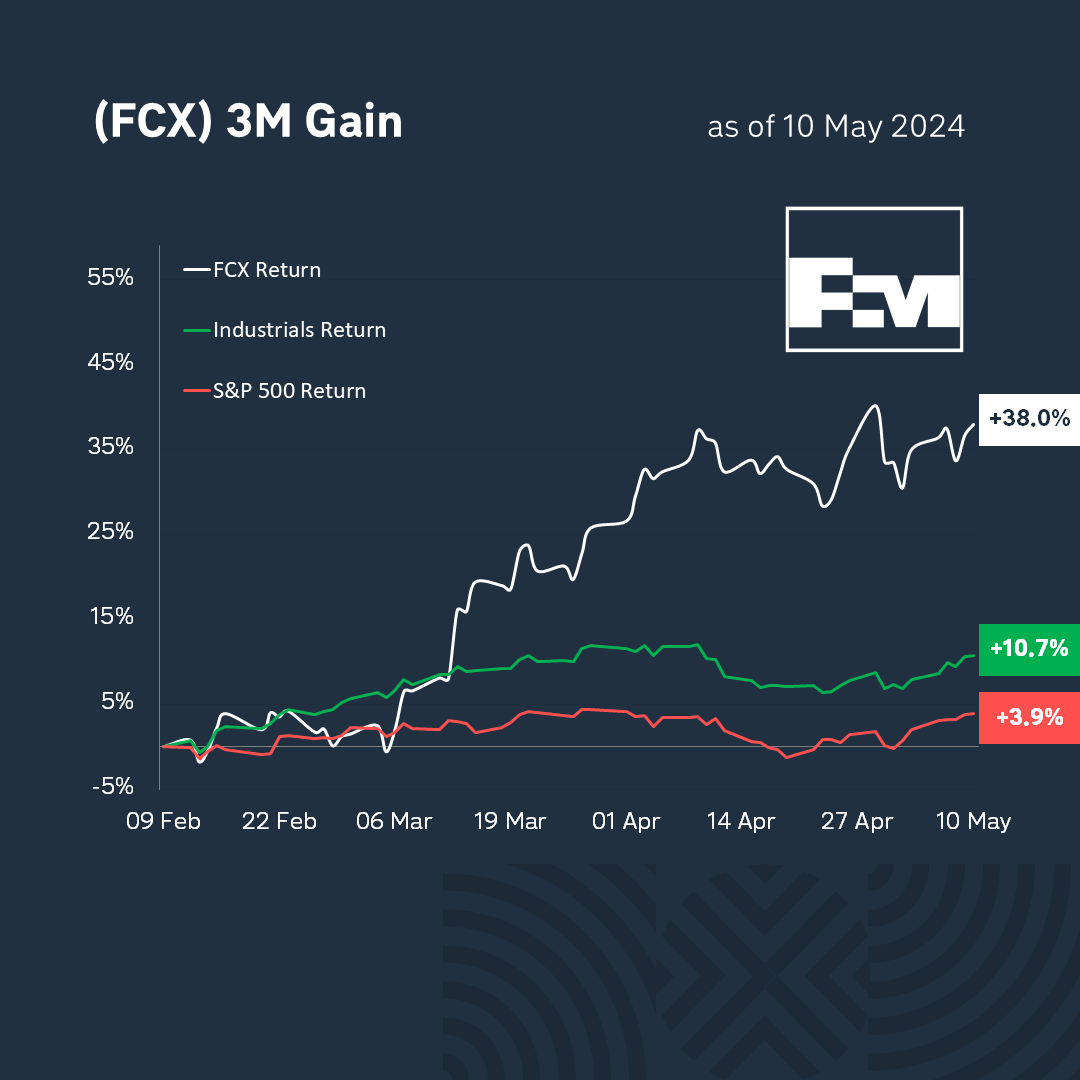

During the last three months, the stock of Freeport-McMoRan has risen by +38.0%. At the same time, the commodities sector, to which the company belongs, grew by +10.7%, and the S&P 500 index by +3.9%. As you can see, Freeport-McMoRan shares show better returns than the sector average.

Freeport-McMoRan is one of the largest copper mining companies with a share of more than 6% of the world’s volume. The company owns deposits in the world’s largest mineral resource regions and is also engaged in gold and molybdenum mining.

The company operates in the mining industry. It was founded in 1912. In 1995, it was listed on the NYSE and in 2011 was included in the S&P 500 index. For the past 20 years, the company has been led by Richard Adkerson and a team of experienced managers.

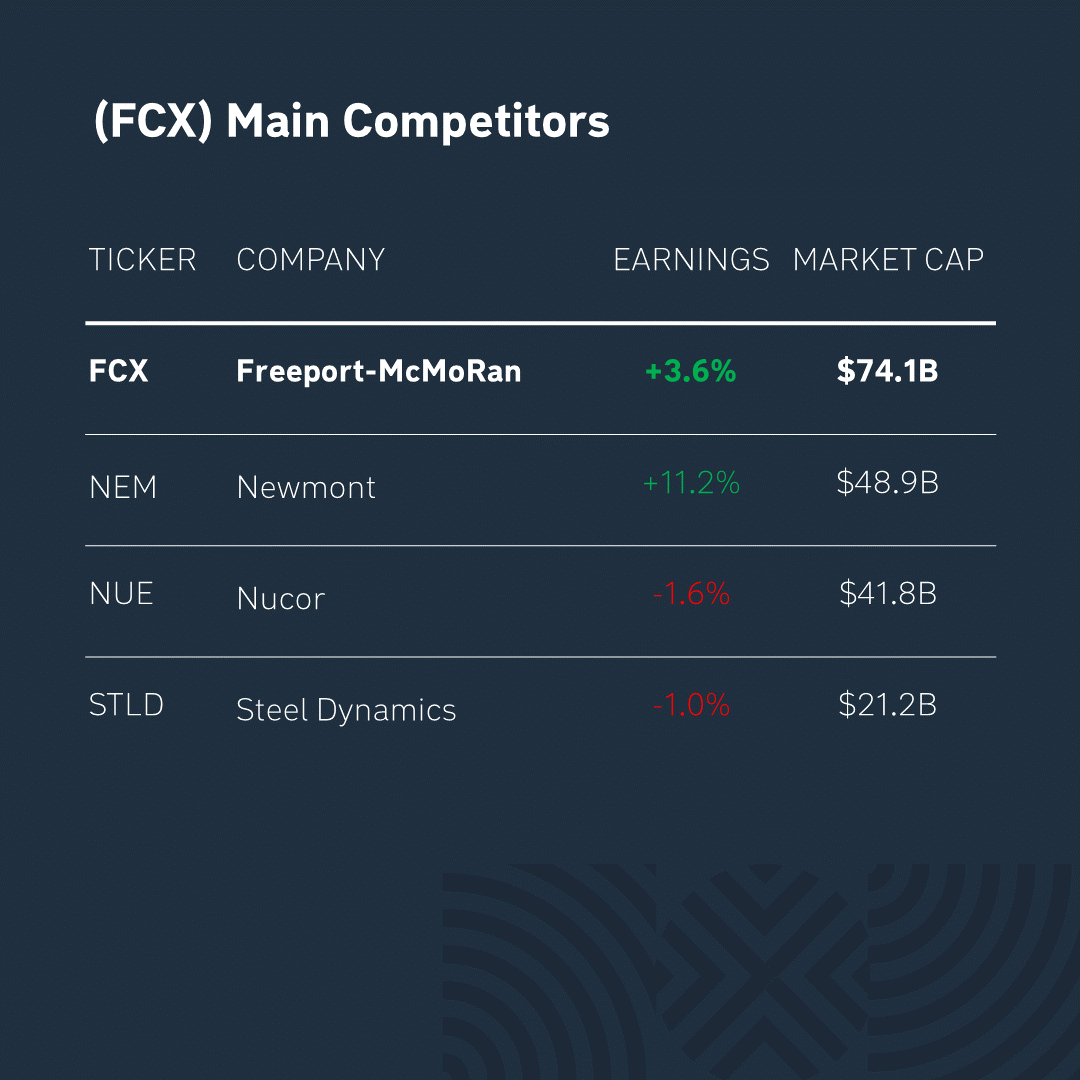

The main competitors of Freeport-McMoRan are Newmont, Nucor and Steel Dynamics. As can be seen from the table above, it is ahead of its competitors in terms of capitalization, as the company has a number of competitive advantages.

Freeport-McMoRan’s strengths are based on its market positioning. The company owns some of the world’s largest copper deposits. These include Grasberg in Indonesia and Cerro Verde in Peru. Overall, the copper segment generates about 75% of the company’s revenue, and it diversifies its activities through gold and molybdenum mining, which account for 18% and 7%, respectively. Freeport-McMoRan’s business performance has been highly appreciated by rating agencies, with S&P Global Ratings upgrading Freeport-McMoRan’s ratings from BB+ to BBB- on Monday.

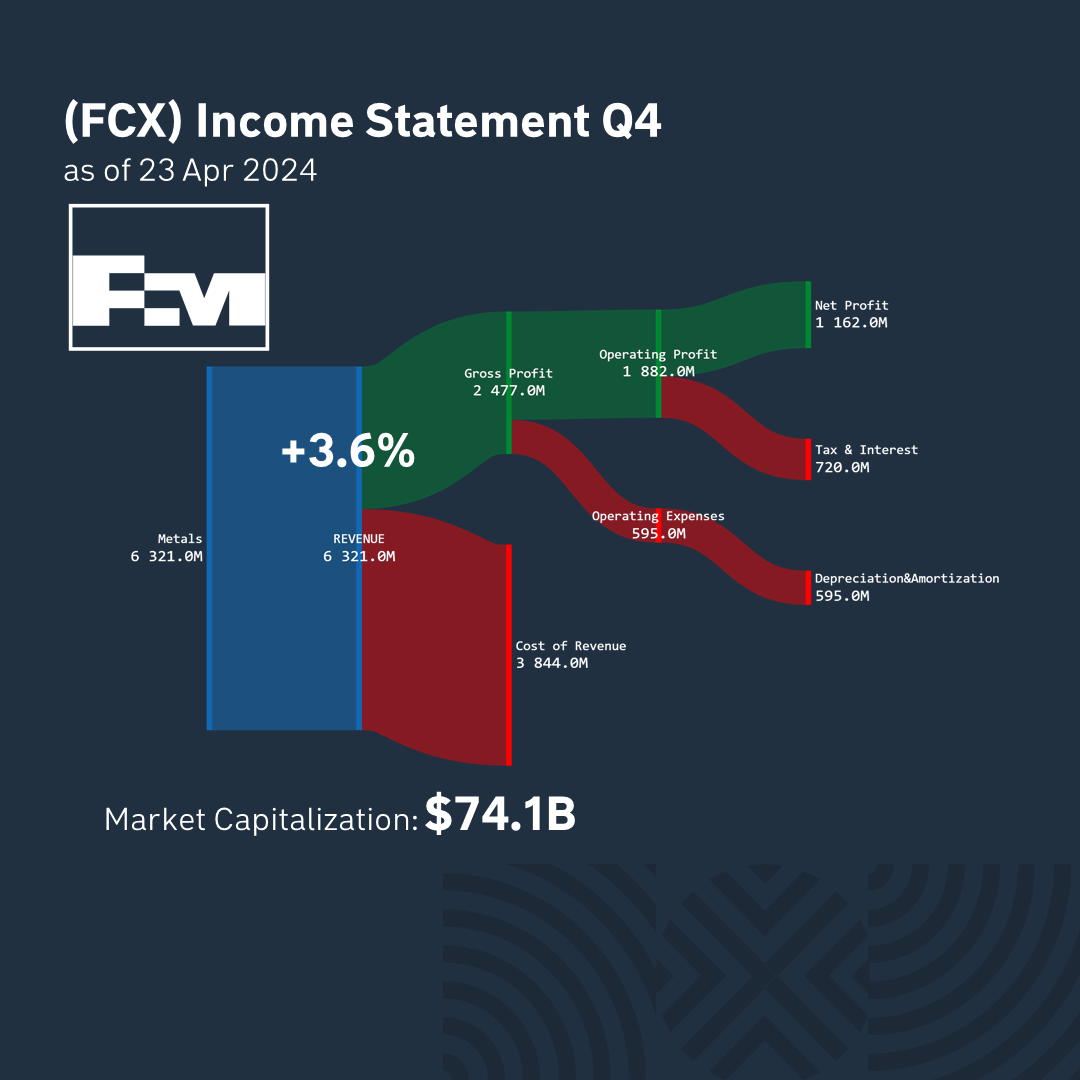

The last report was published by Freeport-McMoRan on April 23. 61% of the revenue structure is made up of production costs and 39% of gross profit. Over the past quarter, the company earned a profit of $1.1B. And its market capitalization now stands at $74B.

*This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.