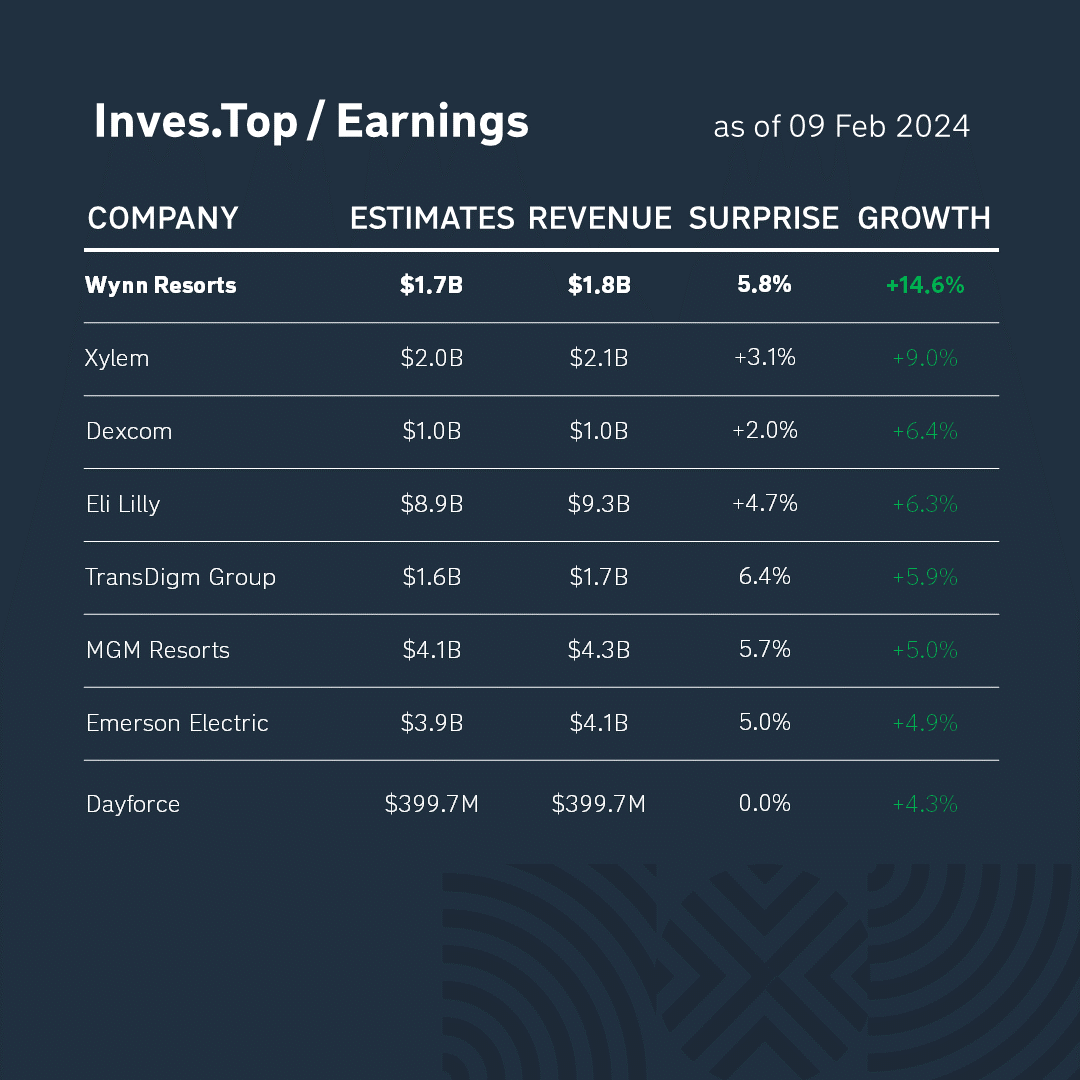

Over the past week, 107 companies from the S&P 500 index have already reported for the quarter ended December 31, 2023.

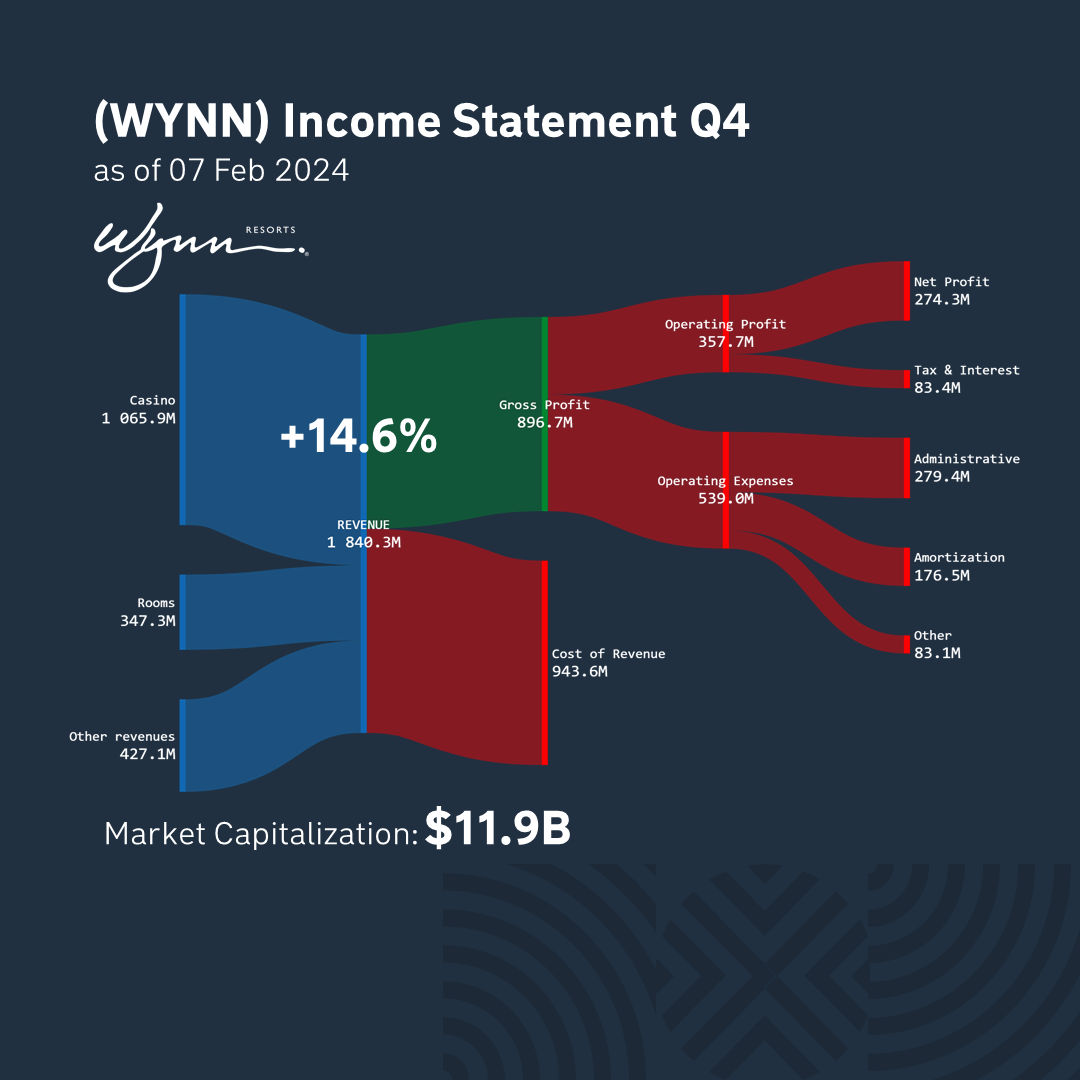

Wynn Resorts showed the best results. Its revenue amounted to $1.8B. It increased by +8.5% compared to the corresponding value for the previous quarter. Let’s analyze the company’s business in more detail.

Wynn Resorts owns casinos and resorts in Macau and Las Vegas. Besides, a separate division Wynn Interactive provides online casino and sports betting services. In 2028, Wynn Resorts plans to complete another development project in Macau.

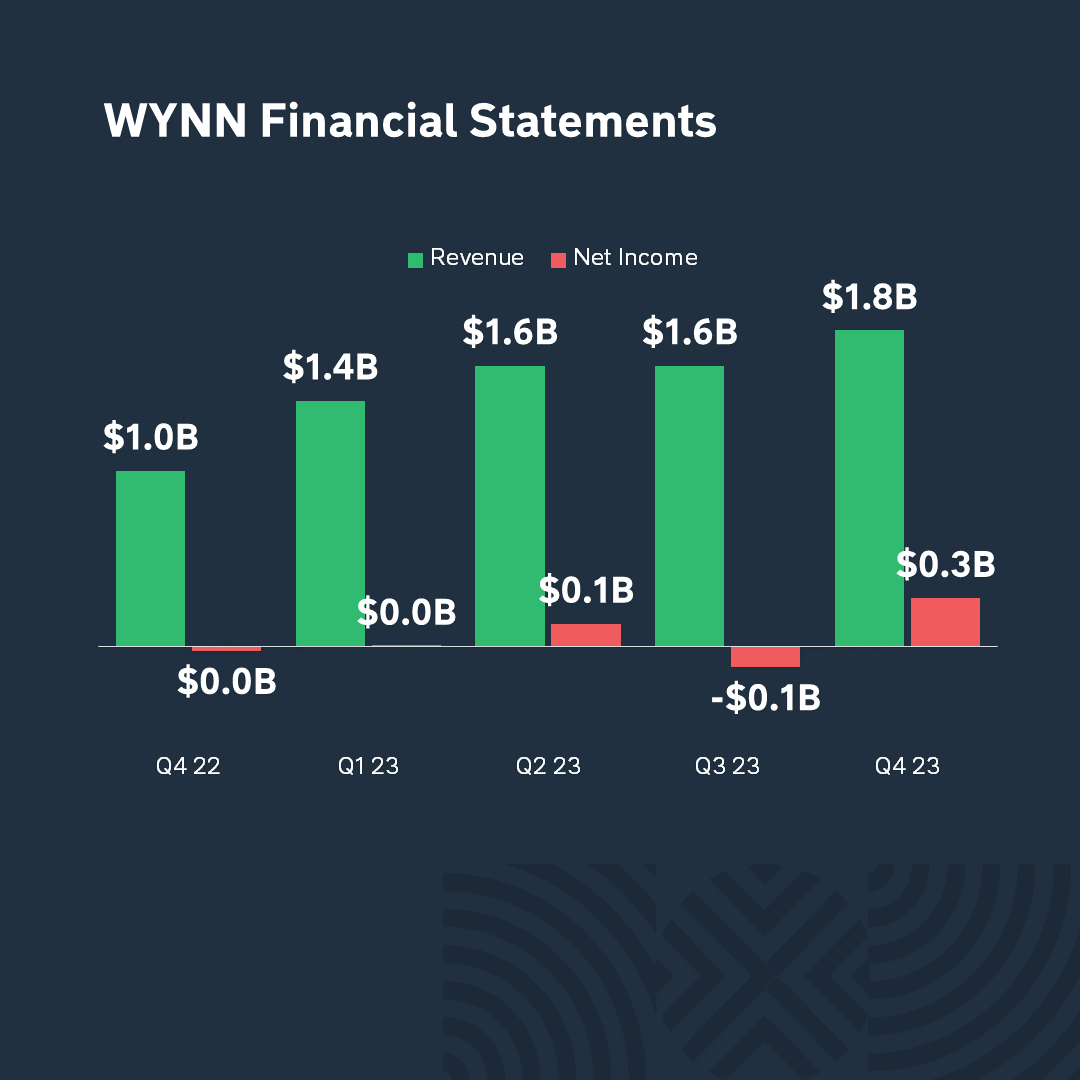

Wynn Resorts’ revenue for Q4 2023 increased by 80% compared to Q4 2022. Also, during this period, the company received additional income due to the abolition of tax penalties in the amount of $499M. In addition, the company bought back its own shares from the market in the amount of $139M.

Manufacturing costs account for 51% of the revenue structure, and gross revenue for 49%. Over the past quarter, the company earned a profit of $274M. Its market capitalization is $11B.

After the publication of the report, Wynn Resorts stock raised by +6.2% and reached $105 per share. Market participants are satisfied with the company’s strong financial results and reacted positively to the company’s development prospects.

*surprise – % ratio between actual and expected revenue

**growth – % ratio of the amount of revenue for the last 4 quarters compared to this value calculated for the previous quarter