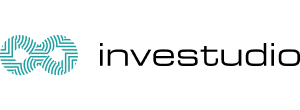

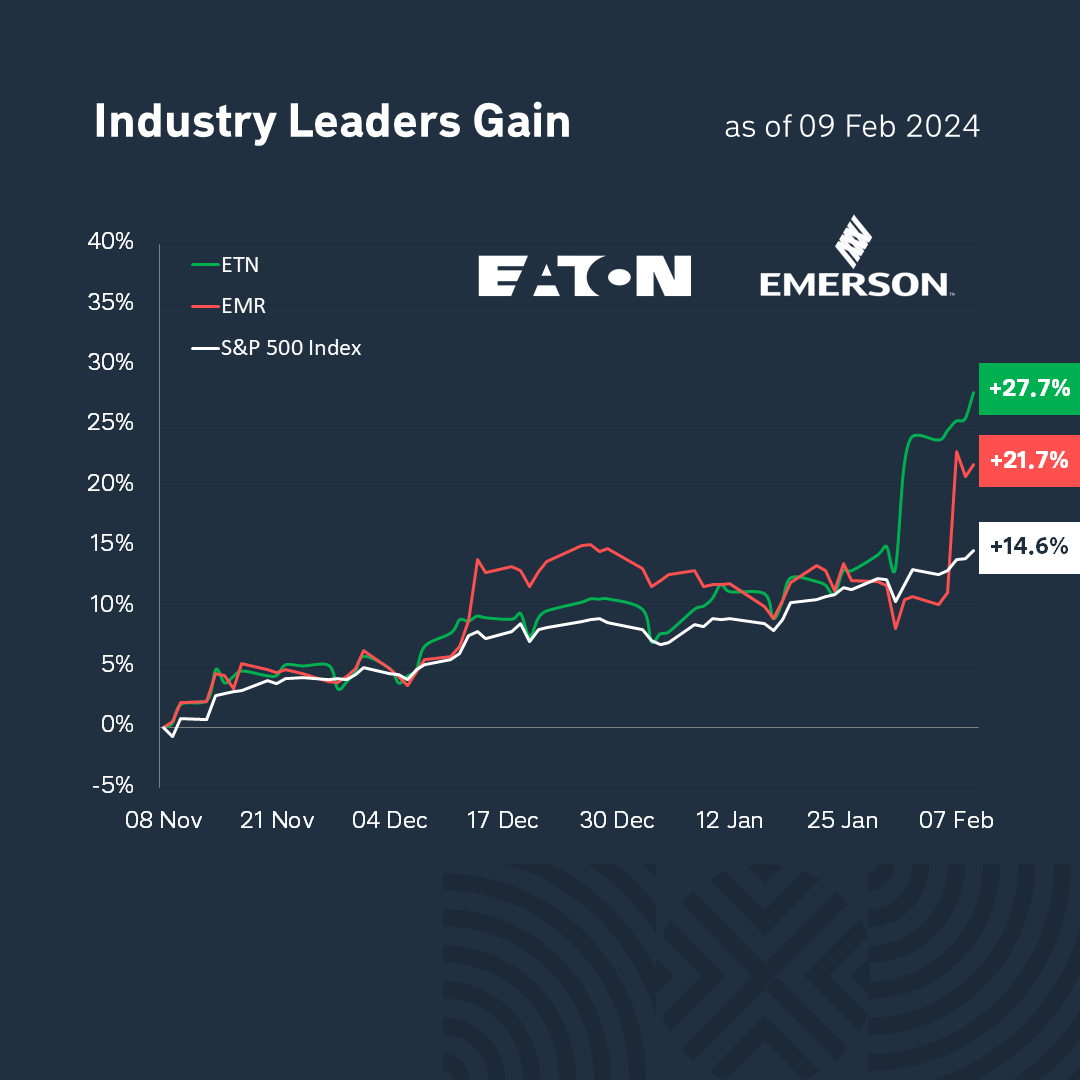

As we noted in the last week’s issue, one of the leaders of growth in the S&P 500 index has been the Electrical Equipment industry (+21%).

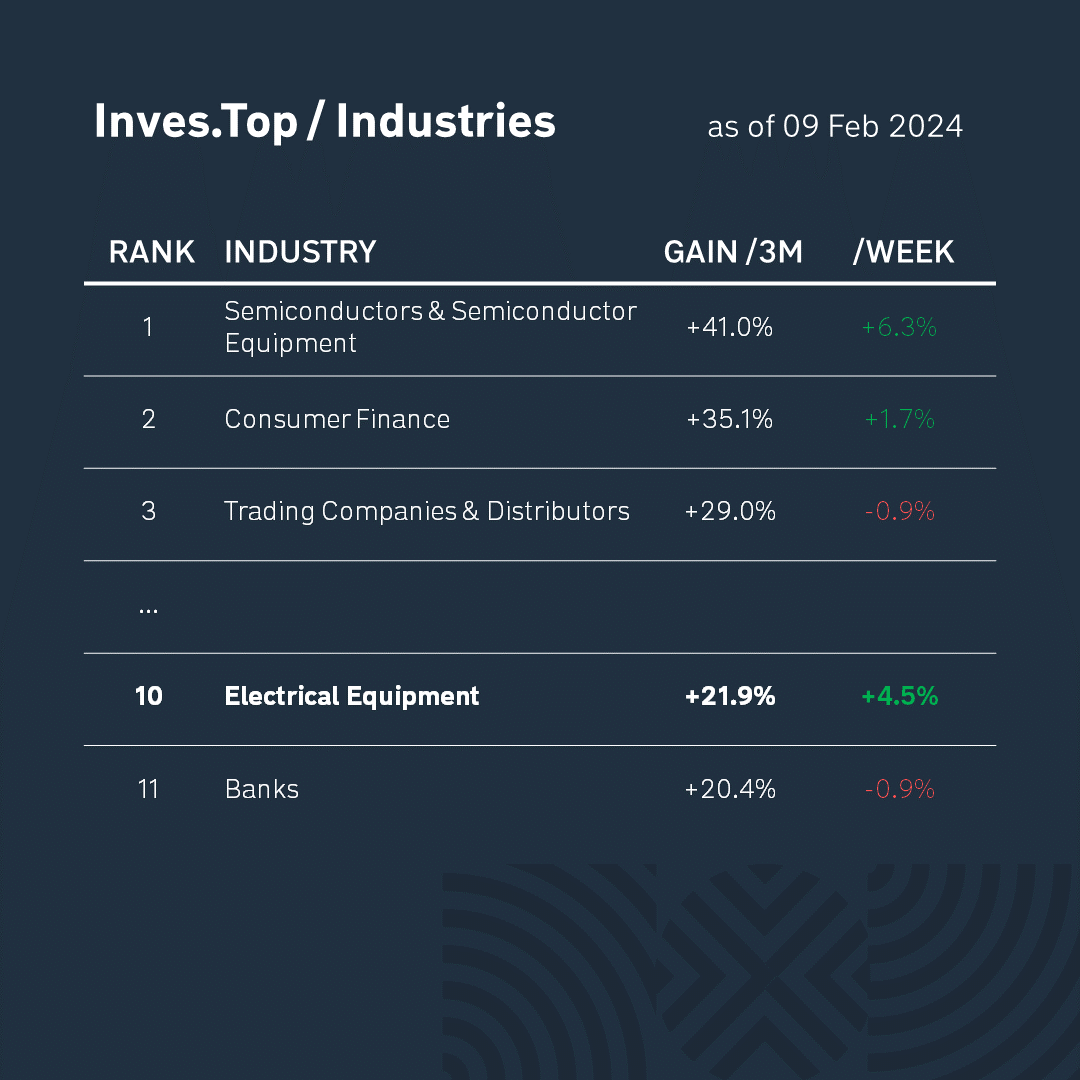

The largest (by market capitalization) companies in this industry: Eaton ($109.0B) and Emerson Electric ($58.5B). Both of them develop software and equipment for industrial sectors and utilities.

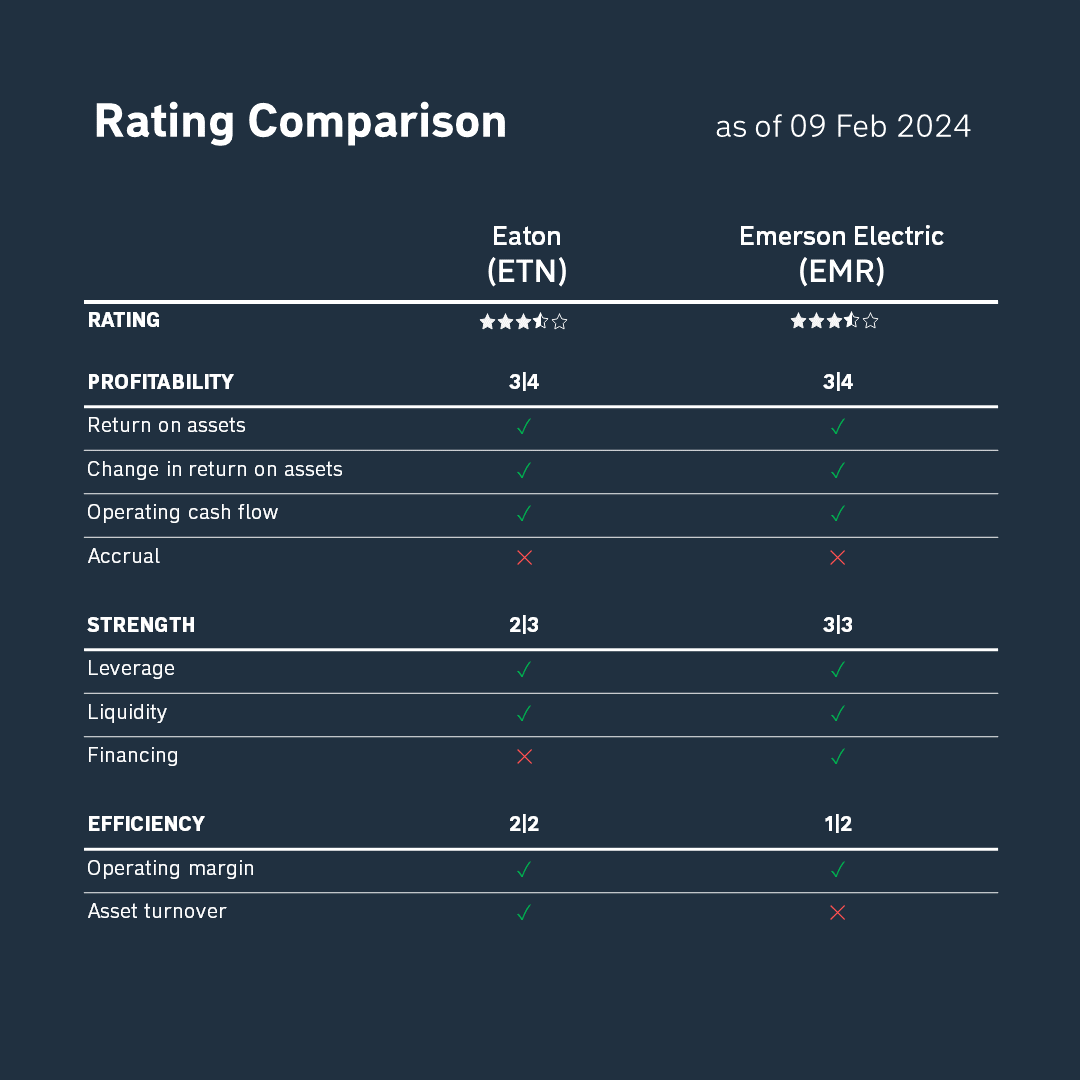

According to the latest quarterly reporting data, we analyzed each company’s profitability, strength, and efficiency criteria using the methodology of Stanford University professor Joseph Piotroski.

As you can see, in terms of fundamentals, both companies are performing quite strongly. Eaton outperforms Emerson Electric in terms of efficiency, and Emerson Electric outperforms in terms of sustainability. Both companies look attractive for medium- and long-term investments.

Over the past 3 months, Eaton stock has risen by +27% and Emerson Electric by +21% (the S&P 500 index is up +14%). Eaton has not only outperformed its closest competitor, but also demonstrated better results compared to the index.

So, there is no single winner in today’s battle. Eaton’s business looks healthier in terms of asset turnover, while Emerson Electric’s looks healthier in terms of financing.

* This is not an investment recommendation. It is up to each individual to decide which criteria to favor when making an investment decision, taking into account their goals and individual risk tolerance.